- About

- Subscribe Now

- New York,

May 13, 2015

In Singapore, shopping is a "sport"

In Singapore, shopping is a "sport"

According to a new report by Borderfree, Singaporean consumers will spend upwards of $4.4 billion on retail ecommerce this year.

The “2015 Borderfree Index: Singapore Country Report” highlights the modern city-state’s unique consumer climate due to the country’s "financial strength, personal wealth and unapologetic luxury." Singapore, a former British colony and currently celebrating the 50-year anniversary of its independence from Malaysia, has the highest disposable income of any country in Asia, making the country’s current “wealth boom” a driver of luxury goods consumption.

"Singaporeans are the wealthiest consumers in all of Asia – which means they not only have a taste for luxury, they can afford it," said Jonathan Kapplow, chief marketing officer at Borderfree. "The majority of the population is ethnically Chinese; however, the high level of inbound tourism and expats from Western countries give Singapore a distinctly cosmopolitan flair and familiarity with Western brands.

"English language proficiency is also high, as English is one of the four official languages of Singapore, so some of the traditional cultural and language barriers that make breaking into Asian markets difficult for retailers do not apply," he said.

Borderfree’s Singapore Country Report, and others in the series, gives an indication of a market’s cross-border ecommerce attractiveness. Countries are ranked across five dimensions critical for cross-border ecommerce success such as consumer appetite for purchasing cross-border, household income and purchasing power, ecommerce infrastructure, import friendliness and ease and forecasted market growth and performance trends.

Country reports have been conducted for Australia, Canada, China, Hong Kong, India, Russia, South Korea, the United Kingdom and United States.

The sport of shopping

Singapore has a population of 5.4 million made up of a mix of predominantly ethnic Chinese, as well as Malays and Indians. The population also includes approximately 400,000 highly skilled expats from Western countries who work or study in Singapore.

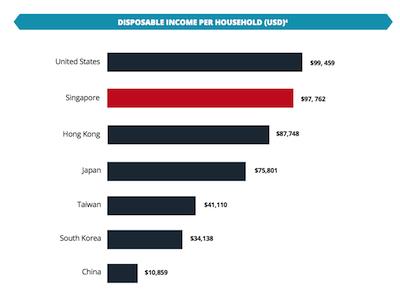

Beyond its large population given the country’s small size, Singapore has a robust economy that is characterized by open trade and regulatory efficiencies. This, along with a strong Singapore dollar and low unemployment, has resulted in Singaporean consumers having the highest disposable income per household in Asia, with an average of $97,762.

Of the seven countries profiled by Borderfree for the Country Report, Singapore’s disposable income is only trumped by the United States’ $99,459 in flexible funds.

Infographic from Borderfree's Singapore Country Report

The country also boasts some of the best shopping in the Asian market, drawing both local consumers and tourists to its retail districts. Because of this, Singaporean consumers are well-versed in Western brands and more receptive to labels and retailers entering the local marketplace.

In Singapore, shopping is considered a “national sport” and the emergence of high-speed Internet access and mobile commerce has furthered Singaporean consumers’ access to online retail.

Also, consumer familiarity with English -- one of the country’s four official languages -- has eased ecommerce relations. Thus, brands do not need to worry about localizing marketing communications to the same degree as elsewhere in Asia.

These three factors have resulted in consumers spending more than 50 percent of their online dollars across borders. Typically, consumers in Singapore shop across borders in markets such as the U.S., South Korea, Japan, Europe and China.

Although most goods are imported duty-free, items valued at more than $320 are subjected to a 7 percent Goods & Service Tax. On average, the value of a typical order is $223, with the most pricy expenses being dresses and footwear at $144 and $102, respectively.

Infographic from Borderfree's Singapore Country Report

Even though only 2 percent of the world’s apparel market is held by Singapore, the city-state generated $4.4 billion dollars in retail ecommerce in 2014, up from $1.6 billion in 2012.

Brand familiarity is also a strong suit for those aiming to enter the Singapore market. Popular bricks-and-mortar brands include Michael Kors, Tory Burch and Kate Spade, while ecommerce is topped by labels such as Valentino, Prada and Christian Louboutin.

Similar to elsewhere in the world, Singaporean consumers tend to shop online the most between the hours of 10 p.m. and midnight with order volumes equally distributed throughout the week, but increasingly slightly on Sundays.

Connected social shopping

Eighty-five percent of Singapore’s consumers are active on social media and more than half of users are younger than 35-years-old.

Whether shopping on tablets, with 42 percent penetration, or on smartphones, at a reach of 82 percent, Singaporean consumers aim to be connected to their preferred brands.

Infographic from Borderfree's Singapore Country Report

There are 7.2 billion individuals in the world and just more than 3 billion of them are active Internet users, according to research conducted by We Are Social. The growing number of individuals who are gaining better access to the Internet and mobile devices opens a world of potential consumers for brands (see story).

"Internet and smartphone penetration in Singapore is high, 87 percent and 82 percent respectively, and ecommerce traffic is split evenly between both mediums," Mr. Kapplow said. "Social media penetration is also very high, with Facebook as the most popular social media platform.

"On a basic level, luxury brands should make sure their websites are localized for the Singaporean consumer – including converting all prices to the Singapore dollar and only showing promotions specific to the market – and optimize the website for mobile," he said. "Knowing that Singaporeans are active on social media, luxury brands may want to consider targeting their promotions there to generate Web site traffic.

Also, due to Singapore’s high Internet speed of 8.4 MBPS and 87 percent penetration creating a penchant for ecommerce purchasing, Western luxury brands should prepare for high standards for customer service and efficiency in tracking purchases and fast delivery.

For instance, British apparel and accessories brand Mulberry, which has three boutiques in Singapore, launched an omnichannel service option that allows consumers to shop online and pick up items in-store later.

Creating an omnichannel service provides options for every type of consumer and allows the brand’s bespoke service to be translated even through its ecommerce pages. The “at your service” option will likely attract busy consumers who may still be interested in the in-store experience, but want to browse online (see story).

"Singaporean shoppers have very high standards for customer service and convenience, so brands should put a priority on delivering an excellent online customer experience and follow through on quality shipping and fast delivery," Mr. Kapplow said.

Final Take

Jen King, lead reporter on Luxury Daily, New York

Share your thoughts. Click here