Exclusivity and desirability go hand in hand for China’s wealthy, with the same brands ranked in the top five for both characteristics in a new study by Promise Consulting and BNP Exane.

Hermès takes home top prize for exclusivity, which measures the consistent quality of goods, the brand’s prestige, the valuation of the brand’s customers and its ability to justify a high price point. Chinese consumers are generally becoming more sophisticated luxury consumers, making for tougher competition between labels for their attention and affection.

"We’ve noticed in our other surveys that the most desirable brands maintain a higher exclusivity, because of their products’ upper quality, their unique savoir-faire and their devotion to elitist clients," said Philippe Jourdan, CEO of Promise Consulting. "Despite the ranking, Chanel and Hermès are rather close on both indicators.

"Chanel’s first position on desirability is the consecration of its very coherent strategy, both on ready-to-wear, handbags, luxury shoes, fragrances and jewelry," he said. "The refinement of the haute couture collections, the success of the cruises and ready-to-wear collections, the tribute to arts and crafts, including the 2010 Paris-Shanghai collection, contribute to an irresistible ascension for the brand with the 2 Cs, strengthened by successful cultural and artistic manifestations: Chanel Culture in Shanghai, Beijing, then Guangzhou, and The Little Black Jacket, in Beijing and then Shanghai, etc.

"Concerning Hermès, its leadership on exclusivity is explained by its permanent investments in China, as symbolized by the implementation of a flagship in Shanghai in 2014 and the launch of the Chinese brand Shang Xia. Besides, Hermès’ brand image and the conception of its products meet the needs of the Chinese clients, who are searching for products that are less visible, branded more discreetly, that reflect an authentic savoir-faire and upper quality.

"Those brands may take advantage of the situation."

Promise Consulting and BNP Exane’s “Exclusivity and Desirability Barometer” surveyed 600 women among the top 3 percent of households in China in September 2015, asking them about the 30 brands across ready-to-wear, footwear, leather goods and accessories which have made the most investments in communication in the market. This is a follow-up to a survey of French women conducted in May 2015.

Ranking order

In exclusivity, Hermès indexes 162, placing it well above the average 100 of the top 15 brands. Aside from Prada, which placed fourth, the rest of the top five is dominated by French houses, with Louis Vuitton in second, Chanel following and Dior in fifth.

Hermès fall/winter 2014 shoe collection

Hermès has a healthy lead over Louis Vuitton and Chanel, which index at 145 and 144 respectively for exclusivity.

These same houses also ranked in desirability, albeit in a slightly different order. Here, Chanel takes the top position, with Hermès, Prada, Louis Vuitton and Dior following in order.

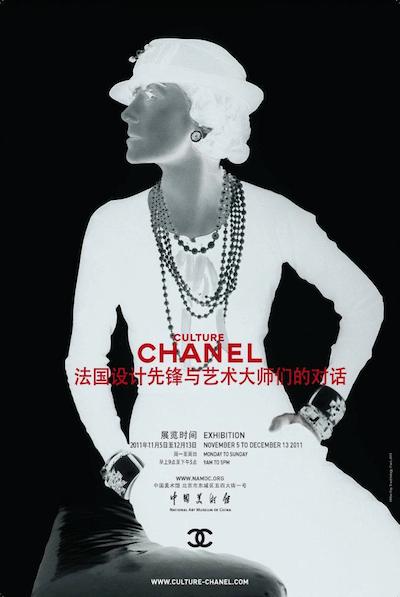

Promise Consulting partner Philippe Jourdan partially attributes Chinese consumers’ desire for Chanel to the brand’s exhibitions staged in the country. These included its multi-city Culture Chanel and Little Black Jacket expositions (see story).

Poster for Culture Chanel exhibit in Beijing

Surprisingly, some of the brands that have achieved the most awareness in China did not make it into the top five on other lists. Notably, Gucci and Burberry, which trail Chanel in second and third place for awareness, are not included in the top five for desirability or exclusivity.

Burberry almost makes the cut for desirability, coming in sixth, but places ninth for exclusivity.

"According to the results, preferences are driven by the following issues: the ability to maintain the balance between exclusivity and desirability and the ability to incorporate Chinese elements to products without over-customizing," Mr. Jourdan said.

"The success of Hermès also underlines the brand’s ability to be both exclusive and discreet."

Economic climate

Chinese luxury consumption has seen a number of roadblocks in the past couple of years, including recent stock market turbulence.

However, even with a faltering economy, Chinese consumption is projected to rise $2.3 trillion by 2020, according to new research by Boston Consulting Group and AliResearch Institute.

Households with disposable incomes of $24,000 or more will drive 81 percent of consumption growth through 2020, creating demand for high-end goods and services. With rising incomes, a younger generation gaining spending power and growing ecommerce expenditures, brands will need to adjust their strategies (see story).

As the government cracks down on corruption, purchases of lavish gifts have ebbed, allowing new leaders to emerge in place of more traditional players.

While overall spending in China is back up to where it was in 2013, spending on gifts has decreased 30 percent over the past two years, according to a report by Hurun.

Chinese consumers’ preferences when gifting have shifted, and Apple has displaced traditional luxury brands such as Hermès and Louis Vuitton as the top choice of brand for presents (see story).

"On the domestic market, the economic climate conducts the main luxury groups—LVMH, Kering and Richemont, for instance—to reconsider their price strategy and to dynamize their smallest brands.

"For instance, LVMH pushes Fendi, thanks to its successful Peekaboo collection, Céline and Loewe, those two targeting the youngest luxury buyers who are not concerned by the fight against corruption," he said. "Richemont pushes Lancel, as the brand capitalizes on its affordable prices to seduce the youngest, and Chloe, with strong communication towards its Drew handbag."

{"ct":"yeTW1puEExbkpYDmleaWiM\/DpSyjDiya6HT7ouQ4ylwm3qL7J7gDGRv6DcpMtywFohDIt3eas\/6EEGNItRGrhd17EQkmgRwgXXcOT0hCBFGdhREUP5xJqRat38Z4tNfJ7SUfvDRtx3tpQfvp4H\/CzvAn0tjSQ581W400ZidKh7P6JMg1F1j3Myws787Xkd2jz8O\/WrNmt7hPcKO1pre+\/r9qwTwYormaSV9VrOV6EXvpH13pWRJEQpRqEi8PTqHWF7mIvIQPrxMPJ+dp45p4v3yGLHhnXHkFbnM6DEl8brffsmAI+TnbpcXcJBULXrgmfBxApwhY3sdzdSFe\/ALju3PbgPUH5idgvXJR+cJ4HllAc2\/c\/NQEu014kSYAz1Xe68L4zBgv6hAugq8jHGvqLhpJ5oRK1XPOWeQXq0ARAN3E93lPhIXYXIGwZ8IGLjrG6ICArwPNpjEEuVk3JRQL6sJQsK1XMal6ElQnNqvydLtpiIaY5ZmO0eNfB0zK5bDwYU7ATleUUvmW1upO0XlbuMWMHCgdfQQLbB3xwPwit243s7vAW83K+nQqZfufi5GY8s7sCtq1AV2HFfiCqMb7d63TQlhmSXYSk6BIdi11cue2TEownyuuc2EhZ8oosvpLcygCyHBLSQFvIqGwhzQ4RDqgGM7VCP9FtopqqCHd4NVKOfbvB4GgUW1WQvB0xh0TxIEx1FkD2FBZx1njH3BeLbQaZX29Qz6UYeA5em1x0BjsQYi3e\/espD5lONpWqIRkLDgPccZWIpROQsSWC1yeG5mnnpHoOqKwa06158gElLm8ZNnLcqO8PakhZgwuHbC4hfsz7BMJBi7Xqnr1xyszey\/z5mWo\/fx5kUbHF4jAYWUi2Yn1kKPY\/zeyQIUlvc9NhzsElvGdADCbkJ+20hU7tv0gdXmwBaQjJpI+Mnj870rEb1dAb0xD5ccMgjUhJqGQw4g7imh3L2D\/dFK9zSOfzrU\/rqTjNAihnVwa91oOtni0KSI9e5T9QYmJOs0\/nhpSRKRcHF0haOws5ww+brzIzcGufnqBWgqv5aqxGT+K\/n3Ga09IntmTWjRNUU6gbVnSSqRn1fuq2xyaSwMLnRcOYgSD5xlaYvZUT0HpjuII0k1My6PFjo0hwyVsh2vlHt2xDHD13krBj\/oleIH3rP9tNr947jiYUFs0p+vFbySVevi24lWcE07fQYZZqKqB4IG5yvFk\/tp377e55DIwp2MsDavY8UQI\/Kw+aPXs14Datp20EE9totXqDgCxFbdiGilYdPkh6NfIYlGspI5yJNyFhUA3V6bvPMSBjAMJM7T3aGXNzau+NC4T+u\/Vg3wd2UY0iSuez4KLepRUiIYDFuhruqgb\/zEsBS5D3pJFNB9TMZAtiBz3X0AEFJY70mC6Y5gZhtVkOthwCvDsVfwGpd+yBewCMGHuZCndtuwXxYo0UuOJHkdIAzLgDj2OtQDBRWZyXM0OJDnYTQ+VTiRbW9C8mK2JasyNFn\/ZShjzR6jNFz711+IvSHzFRvlezeszEdF2Eh3kcJtMFTZl9MNiM\/URaYubvMUQOlKTfBUEBmPgnQ9b0Ln12KB8pYl42J0fFNriKk39Vlcoy5cYZoL+CKaqEjZo\/GB85sHHSVFQGhm9PiRd\/oV+POlhiL+yHa9tYfYnMw5q\/fOgKAHo1qZ43pEOuCp3DIgIqHcMcEl4yWuJbn23rx9U2BtNpCdewjmQZBrv7D3Hc7FHOd77HTOXN8x7Ny8JE74TA253h0Eeyyu3BcjzK4uuk4QAiKJWiG7CZjuXt4utle5HT+PVvaEmxm+H+0TtLkF+z6THwUQH00htVjg4ZQJFSIw0jccACPw0hRt9Y+ZussiZB67fEM4r5MjRFrstXC81R5DE7MMpIP1b4lClt0en2wag6aQyTRFkXe38v4xZ1ZwaeF\/t9edMxDlLzaf3277N4ZaZz\/mFTc7KNKZ\/I1V9rznlBMH8E0zf52oHgjQze2xE9M0mGmH36CL4vHvRWEbUYb8dE3wYUGy8z6GqNGUrKx\/Xiylp9VXOjgswtmikjt1RLUUOktzI77yEW8wdG6zn9xr0BJdZxZglDhT1MWaKrYmrPdsiTWiwSUOyuK2BF3HRbMwAwylUIhrK\/e2Y6OOU\/ucxqOSYgaqyOSkyizslpANRjSYvRCILWyC\/7D5OldfohWglq7BSsNoLbrQfrjosyi7v6yLbjfR674lHQ5ZMdQZuzoDOrYoXzu3XdYXibzKj5zAT7NfAS0VtNdXxT7XWHOkW7PRphxJMCVPX56KPs1l09psgODxa8ixTkYkeGKk3YqDnXSfkkbj08a8kxPFw8cA5WeTN8UFf4BflbKPN2oYwtO8xcss3GMBrtn\/rHfrIAkV2IEuZNDRkWoSmu8h03VtK2x3GMxCr\/6kJK0BGVmUqFElEURVjwzCSaBJulrA3gHitaQQVC3MacUcZnFnrae1NPoY+f4JS8A5hsgOjcsq2q23tPPkPKjKlGChC7pMPBCdLXCM+nHMzbnTpDlBmJyHHVb\/jkGGA2tA9b1kdY7L0cGHngvT5Nvw6YzmFMTYCAyEeFPX9yOeAvmcN05ZioNaBptpH5xqQHFdZcjvLZy\/sOI9URL488CtHrMG0ihhtkkKF0GTPlD5mGzFD0isfyqcZ1LrdYFOXplI6RZe4I1nbJQHWn8oWT78U9ol7fHhC6GKHlbSU3zF1woPq\/vAHfOiEuq2F3wFFrsWcFdYCL912fsWu+Xoai+bPpcfEjU79algL6vEVby83+Pn5u04ir1vUr4\/PHY\/Q4k\/B77KcADotOX3vImxJIuE9359xRD3bFiv+hfVD61CUZ7rUU4fXuC6T2gXEM+8Z7z9zdKsciIA0j7fYE8fIFwxaLeRO71Cuf2Ihat+0rCQPA6ajbi6HajFkU31ZGZ5DeZ9KpT34dOt4o+NmoZsXrzqpLdXxlc7t+PX39NXniYMgbEbK9GnPORu9AVfU4iXUoiFU6JwlO1TbTDevvj7bZM5tKphy+wsK9M6WrGim9D1Qd5+6Rw\/IsfUnuND7IMs86K7gwtOky3jdtroD40n9c4lwp0ZpS2CrM5IYN85S1iYjKCTfRMR+8AfO+6cGFrn5rwByGSS2r4yP+Ax6B2CiDelIXp4GXFALvI7Hcs3Lq5IJektxbyDtYDL5kIFv9csqntG91eLYsQIrszVEQRNiD8psEHkZVXc1lJ7xxM5u3Y22Cwc3qsjpBzSeZt97XBnQTIwv9y0ALaEFFLLku2LIAaV73pW8bx0gl58UNzZN+9vJRQP91II6mgBzhKNH72CAid2Oe\/GaSDrfxqEr7Wi9FBsJFyS\/WbXlV9X3520c53hcsZ8+Jygsnx9rGTBxzwpMoPzIN26KU8MMPpC+eY2UdxVFpHfoyfhWlkTH2ct\/ZPpeZVve4Y\/HuTAET7lpu245LjDPes1gYBHEypjCSl2Dxj5X0MbSWah7MydJ5XATt\/3S1tRg12CojJ6ai7vOMWR0QopQUDc27IvSZyZx\/aGyFVA6RJuUcS0hhRB\/mhfUPMAjht2CSJ4e3dDG7Z2vC7sC6wHc189qBTAQkrjf9Kh3ru8ozkFZ8CbDe3d7I4Xnlh1XL\/opmpPFqvpbWvPubmC8OXLg8UrB7sxozysI3lI14BH4NkVydH6YLQnJ1Sjq011Bap3Pn117eqXPzjGnwESHC2hwJchAvOjhXTC\/J3WoWsA5P9f90e\/bSL6WIiJJB4FzpysZyZgfDDfpN6WSxNGkgEWzOvqlFjWml2Z9aiJbAavS4w\/pcM+tFv4a8ryrE6VSiCwFr8Q3wkiLYj4YyN0fIb7ardeUQJQyogyep\/vFfYMimbOkPgrkZskGmx6S5LiTsWsLvpCIeFSqUEZ1j5OkpLVebin2OG2XAYQtOM9LnQwzdSu8Bliq0tWiMXlr1iAHVGtNxjoJdOU35\/BiK2luQG\/WKID4qjmGaPqIkJigwebTuaGlmyN1qveXC9oz2MBvZFPT+dH8M4\/ieLNk4h\/+JOoBFzhaC2\/kBj3VswIPsT0cjSFoS2+h663qlUKoT79BhaYIyfIkzxat3ZHwklJ1Ps5\/nGwjxMAAoxlt5dRzga4PAuPYWd17NU7h7fxGTyBLTtBEJdd9ujSbDL964HqNNwUrMm55CAflRdS8hz7ciYVUZoWAHTVX18n8nTEsqaIyBuygLD17N\/5hBCxQvvFFBB3J0HlZGiAkaPtjxPluHIOrjxNLlEJdTpUTXDRygJHArY9ZNixKJxL\/met5jjlNv\/NK9U82gqijCWZAyIIStp1B6w0qZ22JxdjAhtAKc9CVrs1SW2Bmw0zQh4rcnMKdM4FPwoGQ9oAXgtpa9awcoEvzuHQLM7B0tKHZUoyF9qX+fS4gwPUBib4\/qyDmEsxoLidvMbjuuJH2fEEvowUATNx1CmwoUapUMvby2H\/G7tJHK3qmuIx4uBG6qAss4MDtijWO8\/iG50tIIlTjepsrfUOV6OUGDNmDxN9xqJiGrIeBidnay38bbGWDwcftyDTJwbOPI4F19TEGBkqxyJh1jvz5PXPAok7FCoaNiUfMmwq2Aycxq5JmzXRKVlbEGOealtTWuipr+BME6kRLqIrUXK+TdlycEY\/ImvIoTBYmSu24vsunn2hCVk5gxT9aHqAh72Kz5+N0BGRwgW2SRsoHUqOptvVS74RfC3OfF1Za4MHTwDS6EroQj0ymGPqlU3I2Eph1N6YP9S1+ELMxpHEnuVUpn8fQF34474jPCo3ZbnPytQ0+VKSbC6rwoa14u\/Uw22txY5vSUZ2RQo68iLmeBIuLNnWF0FE592FAzfL+LA4x+HMBwdzHa6HKeUhjEEHZITM3yLyJWdDB0GX69zemqMZoiLQhbD5hSAUXcYM8zLQrrSJw+0aLLPAKyP1o2uFtkKFdo+s+1gpgIyA1rJIRqw28VJH+M71VM65f3N39bBD3h51R6mtRvJkAMVxoVIQBAFItp0+3yvlq5I0nbhNwEKJ7QpzPu7WrZvpqmSmds6o7AF8mqugCugspoqpxNvUa2IswHeelM459UGywu\/nu4k595jrzwtVo2P9WZcUtqdOEc6EK9v5H8ccwV\/IilVQinEoINCnbzgw+DVHEHliLD\/cS2JrUhXJ1pPtXKAdKz279Ii2hQybo0rarNPlmZ9RWXA6GagR\/X04Ywp\/VxjItfvheix4ZUUvTbsM1xLTB4QLn3+O25bZ7JW6YVyGvl3g6xFr81bYREu3M3WwE5Mu08cybv8Xzo04By1obXMadXmenRy+BRNQnv0mNT6S5D9EqJDN9KjkWkjhLzkt9f7vyxySh1YF37p+p7KbYY7m1e0p+yY+KsCc0Y2AXLqXC3gGUN3rQvLc01cG8xS8+SUsScADVltebRg3FrH+bqLghpSALX8CPxGD4v9xfIJH2L3v8CWN+sym5Rt4oJIH75OtsUGgGKR0HVTEVJyVS11In2cY+kwcc4NYcChYo8TdZPSedS4bEhkJOvyDMA9IkCkE\/wzaUfqkeFB0gHMQIeZqxsl+bbESBf24Uksnlm72SIMjdgnDXhuyYjodPpaZsdeiiq25OZnQxo1Ib6Q9sbIyQqyTvs2KMRNcm2X6ZysZS1LXQs03IM19\/FkExCJ3Z5as45UcfJm6n9PrtEPYAS2dpajD1jzLkX4Y6kwKRFjZy2ANitWu5KJwM8Ohs0WC97xjEae3PhtE05a92lCvQV4GIxmzPaqKW8qRReP7cQjeeMNjQJliMWVoS8zy2sCCpXHPgXeXHCq0qHXVVDobw5kbxI67Pg5xHUDCDDbhwgAFx\/f7\/eRAyHoXYDtsI\/DJBhSgeMFxAIxQG65XXwBZe79WhWYwEDfgelxLCHyusPfW1muczXUmc85h0vuVx6x9OUQbFj2kzNtwXTYpQxljGGorF6SjNqljT3MpoXE7vdoZWNZ\/KZ2U8GcCgpjXuYWaHoup2LHMvx9lLph6PZdB18ivSkusDrXpuzODnFHsf3HAazVZigRiFI5L1QkoVH249sZR0Vj9847CFXbm7ihFPlcDGQx8H6X1CbmhJjRDCXVSzFBQMEsWfVaN0E4CFO3OGOzj3OpYYYX+pLaD3EErEg7BWqn2kW5+Oa6byC31ZZQng6LFMNTmxQ2+557I6k2XM\/bN4QN5MXvMOQtqQT9qjlyIraGPmFuXH7LrbE+wXPbxAGTZa4Rlet1lgyDUgHt5bLq4ooyyixmwKBHeQ+oG\/31SFBFl7mYQDWz7X3AW95zEB+N9jpiRpBCZCjaKC8mb4EQwgNuRKuwxGxhzN0ln4y563EkvoivIqogjPnJWPRekwf7TksAeBGSMxoyYy5FYXlLf7rGBa53r9b38rCUXo5AJu07rbfTsKsWa99tCdZq96CxtzlkzNnvLwauJ52vr2EcIZT1WTJM\/u01z4GBNmuj1xyGSbe4lZ5QJpTOSFQWNgFqseqVdeRne1mhk6tp8tfVUNH+QqyTUSwS4i20KN8+FOP5Flr60m3QTC4+p5srHKBLlcUQ6H0O54e8Q9xeB7E1MLrXKAdGQJ2jYsfKs8hS7EtdDeYd8Rzm8WnvEJHBGjcWasYXOZm9RaIbUgovQSj2exZTFlNVN\/dQtLeuPfsL8sLO1NXV1OPe\/lEohW0VN5i8QsFLiCm2B0JG\/TEaQKPSo10\/iqJ9vgUxsVp0D7yiXDGdvAMrBpxXFszYKzAAbFi6a3Y22to8OKRbkNET9Ywfvm6Qc3gaRyPoFy4ZoBsuHKG\/MBx8HwSjXXp91MSiYLE5Nk\/msrtKVQrG4s25tHY0TBuT2VySTpUpTlwKqYovA3zToB1ScYgzKvp7yEw4e59IToJy+yNQkvDF2nK068kulw+6OyuGW4vLMdeUlq\/vqZNMP7R0Yg3Alk+L3VKJIH67GobvCVS+axK8eGLUa5C1iueqwQxhmoUpX\/7gsp7xpL9te1duFuCz89vaOkWKN8j+eftMK5iddYfXprxAiqxTUa6a5HD90EOGDSfuNK3cRTFeccBUCtdNYP7uzXzXDODTFZ7MM5LSETuQKy5CMbUJcFW+dC8ZbHPHm0BZk1RgL8tT0rbXPNAJnt7jaFTu08XVjr91pSSIDL8lj0TKPqEfWQg2E1MwG3im3Rg4xflyiNvwXd6+h+Owov266fz8GKUAZs8BEw6lZIWF+F\/xLZ348GRGGdMLHrTj54zMWR1qqF6n8rpUJJDQhqZweagOtAc3Qtsi01GKckqx59ODNW+54cZrUVJCSvgbr4jDR4uffdDAc\/j7g8pGsre3XWK2X+ZbYGuxArxayV29vZRcZLPfjJeR9j5i3J\/EfMR3IzyzfXgjhj1Q1wGMmutTxV4TBSJp\/Qy0nSDARzYJq\/+urQaNxMHsvRcofY3UQD0KQv86KXmWf6xnWnpA+2YxntSfbJPtuV8Fd3D5vbnarkS+QQMZ81ghvmw7x1L3m7fKk+9SqzfYDbM5GyB4oe\/IGb1K5Lsd6j\/wOHNQaJdMuTXhgsK2cKefSXAGjhYn+IHAi0kgcqcGz7j0hxdN4tFw1JdXtRBjmL6aoNOJ+ymGzlCaq\/50WAia\/tQBZFzzpNLfgqRmou6g3ngj40BMoTp2NgH5CLdPfK1nceMmCRFCd5Vd6IRdrdw7dOfoXBHqHbG2VHUa1i6bTvjGqE9c8rky0jghoAd3j8OglsNpLx0dfSwpLzmV0qVmXb0jFhTdWPAHty2IWOErDhXxP60W\/wHLb4nlYcs6PlgsJC+BGjussNTvMYWroG9Sjh9txGAtDP+hN4Q6FNnVX6ARQ1aOTd8G4gGwDXKZoCwW8ztp+9j9IrDkO\/FYn8tIv59YtFFFQKjn2ZN21R1O8qwcBd07GKroHT32xYH+0WC6Obb1rVFU9VD1w68dGl5XkY0asoDFBUM+zbZB0iIjbbyRum532F72bMiI8myIStvGOs5oFi1UHyD8BCyXeWOhSnACOHw2MG3HZ3DE7GH5FGPq6RGaV1laJTsegoT1aFiEjXqoJAVcbvk5iqNqPsX+YIBDjXA46XHThvMT6MwxeKlUWo\/quB624DkbQfUxKivxDNj\/NgBil2usmVaGVAXuK\/tmxrCiCzY\/Lz2eZ9tV72JsjtMjXMRzd5zfXhE+F\/IbS43t1t6P+v7bmttfS+LoSXb31QYWsRWPTR6HQk8FLbVgvUUNDtF7jiBViFYBhWnqVRhhZzqmSe+qUikVcVHujpgoZJd5X77APXMAinbmjNR7jNyaEQMCxbSfFK13hDpcYd2KqT9YuohPCtk3bd82NrVBk8WIenEx0kgPe3cc1tfwEEDHdo4ku7sZLAbpZGeiSkmtpMolygOT0NQpAOnjiEY2UE+jNhviWZWOLGP7MADDFabub94rXAJ9oVSTWJhCDnIRYGOqqsKu6uV\/vMmzb9PdWVK6Yaa\/VnUTcT8wgZnOYNZyH6Lnzy1WvAUANLyZOgKgqIgzQR7AvsgFqhOF5VBhSyEwjtIrcaeF1MGjvGhywFLzHuj3hA1duLEt\/ROEDjrrsf+wE2fvkz0wncMCJ4ZlibN9FyUUIyvgXCD\/FvxjUzoWxcEsPecs9xuJRZcIF3zrFJkwBll\/wgwBd3+Yl16pLw1dja6OJRvC0kawfGo3fhXiYglQzZgIxD4aLoDRqZEG+kEibHIeKBh32Sdkvgjd7xsvBCTnEWHQSJDNOyHszHnk5d0ht3vtEiNEbGLZnTPT3Xhlk+m8dfF0NpnGkssdt9tdfHBRMTrIx+LJkKQ0fbG3mV4EBJ2\/BYdoWN2MkoAz6ai3JmykwTgTfVLj1n2jUkxv6PONi\/nVI3adJZl2nO+HSXTFKGlrVdnZsGq+c1qCMeM4s6rOhCnUMIKeRXvwgfF3QcLyiJu2rsOg4+lztg\/KkQmL9sNfnYKXAL+aYu9\/7Y1G7rJbRuCLHHTBjG703QgJyz\/+q\/0YSK\/TYD3lVcGmHUOg5StM+k1Mt3vDbsCLaZZ8rhwoA7Jh5a7ISkLgQ9wK+84fex743\/aSQHBlqj2A3F6WklteHahL7l4eqXLBO0apuPVkuIkAYBiukhSKkjgdPdj4iffeA6K7OBoBifi5vGKNzIKr7GLXIh9gjxCbDH18XD3ymxUo1RKCU7bLtD30LrmR\/yFYLXFVfYdBjTMRae8CcPknOV67w0wRbQaxSnjgTRDeubuyEfZ0Bzmx70tlnw0uRSSkEh5oG9rjzcYUDilpGtEQMTn0gFcdjFm7Aoc2xJ\/X68\/xV6HXKW3scJOkUzQG0SG+7FlOYYhs1MDPOwiIYapQG5rEzIbNqpPj1n4uWACsvetIsHSFm9ImoYbl6MpxRiwVnKGI1TNSIjptKN1ZeKJt36rCfTQ8ZuO7c3pKWf\/v7dN1O7vYblxRvWP8Lz7rcToZZyoxdaQLMUpYBuvAQ+M9vhF6177LPrjveD5sMo2X6QPTfup5W4qm5t0p6wnPL3VQkT+N4s\/q5NbKS8HtU0Blv93ZgNsnKZyWlzIUjyIdEiI64x2q\/mk2Ykwt96K\/kCILctV7bs44iT6ZOpj+mrwIamk\/pia6Rt40V+9RJ28qSu2vZYw5DY0hgJ5ec0HtdIw4+aj9Qjw1\/p02GMJPSKbXbxo7CXDJTamWeWlmt\/a0h0YX9lRJkzcZHKp8C+bTBYB0M56BbEiAwkYVZf\/o6bQAm9vjFmee6Z1jCTi9XDhpDI4oC710ni2ia9bjofWTNwXk6syBnCTPWFd0VAG0NUyrh9EeG\/uM363xLE+cDbEjqAPtA5GUuhk1TNQsafoJ0Cc5dpzeMlX1QApJNCNoriFE2pisU\/v+DlIHDzv3h8e4vTvmIWM6nzcZ0pzpoPDsvzm6l6qG\/tRHDEZg\/jX0DqsUCMBCMjd+35AbI8+jn\/3lJchYsFRZqL3nIhW3m8bb+9NT8SVsQ\/qIjPX3xNHMklTPzlUEW4DNgPtcDd+lacvLjcj0UiTb7GPa7R+LBz\/EwmXW1v7g7bJCCiTC4OvBeh27VVVj+41LpS8MOZ5cZYP+7LAzN3q1lB2PtCTVpsXi1sHNINg3J\/oim7JrmUxRo7LfUPGsS3lp3QBamKRLtt+TPHwVi+zf76mdMawxzNwu7UYy1Za5KsLQ==","iv":"71e1e587e7487b600857aaa0db1c6645","s":"101b2f371e2c8171"}