As digital channels become increasingly important for retailers’ businesses, cyber security has jumped to the top of industry insiders’ lists of concerns.

A report from BDO finds that 100 percent of retailers cite privacy concerns from a security breach as a worry, up from 55 percent in 2011. With highly publicized cases of hackers successfully sticking their hands in retailers’ client data, the possibility of a potential break in security seems more realistic.

"The number of cyber incidents are on the rise across industries, but the retail industry has been particularly hard hit," said Doug Hart, partner in the consumer business practice at BDO.

"Retailers are in a particularly precarious position because they not only have to protect their sensitive data but their consumers' personal information as well," he said. "The industry has been victim to some of the most high-profile—and most expensive—data breaches to date.

"Retailers also face a growing regulatory and compliance burden. On the one hand, retailers are increasingly penalized for failure to adequately protect customer data—one of the few instances where the victim is blamed for the crime committed against them. Regulators, including legislators and the executive branch, have their eye on cyber, and retailers will inevitably wind up in the cross-hairs.

"There’s also been a heightened focus on the issue of consent when it comes to sharing consumer data with the passage of the General Data Protection Regulation in the EU and controversy surrounding data encryption."

The 10th BDO Retail Riskfactor Report analyzes and ranks the risk factors mentioned in the most recent 10-K filings for the 100 largest publicly traded retailers based in the U.S.

Risky business

Tied for first place with cyber security is the general economic climate. This has been mentioned by all respondents for the past three years.

However, compared to 2015, with its stock market volatility, retailers seem more optimistic in general. When asked about specific economic factors, including energy and oil prices, unemployment rates and interest rates, these concerns weigh less on retailers in 2016.

However, within the United States, retail sales are not measuring up to economist and industry forecasts, with lackluster sales. Despite consumer confidence being up, spending is lukewarm, giving 87 percent of retailers concerns about expenditures.

Back in 2007, expanding the retail network was at the top of retailers’ minds. However, as spending declined in 2008 and 2009, retailers regrouped.

For one, Bloomingdale’s worked to achieve a slimmer, more efficient space when it renovated its Stanford Shopping Center store.

The location in Palo Alto, CA became the smallest full-line Bloomingdale’s in the brand’s portfolio and set the template for future expansion. As technology continues to transform the shopping experience, many brands are finding that they can do more with less (see story).

Bloomingdale's Palo Alto store

The physical store presence is changing with the increase in online channels, making the risks surrounding owning or leading real estate a concern for more than half of those surveyed. Some retailers are therefore reconfiguring their stores, shrinking the square footage to make them more cost effective.

Compared to the 27 percent that said that competition for prime real estate was a worry last year, 46 percent cite concerns for commercial lease competition this year.

"We’ve seen an accelerated decline in mall traffic since the second half of 2015," Mr. Hart said. "Brick-and-mortar will continue to be tested, particularly in traditional mall locations, and specifically for stores that are not in 'A' locations.

"Having said that, there are plenty of opportunities for retailers to see growth on alternative channels such as online, mobile, social media and more," he said. "Overall, our most recent CFO survey projected roughly a 3 percent increase in sales for 2016, so there still appears to be opportunities for growth apart from traditional mall foot traffic."

Dior store at South Coast Plaza

Brands are also likely to see more competition for another resource: personnel. With a better employment rate, qualified store employees and distribution center workers may look elsewhere for jobs in search of better wages.

Labor issues in general rank ninth on the list, with 91 percent saying they are concerned about issues like staffing and health coverage. Seventy-three percent consider attracting and retaining management staff a risk.

Digital doubts

As brands increase their digital presences, IT and technology systems have become a more widespread concern, cited by 93 percent today compared to half of the respondents in 2007. Similarly, changing Internet trends and obstacles to a brand’s ecommerce efforts are mentioned by 57 percent today, compared to just 28 percent in 2013.

Among ecommerce concerns are the rise in costs to ship packages, as carriers including USPS and UPS raise their rates and pure players such as Amazon make expedited shipping a mandatory cost of doing business. Even with alternative solutions, including click and collect and using stores as fulfillment centers, shipping is costing more for retailers.

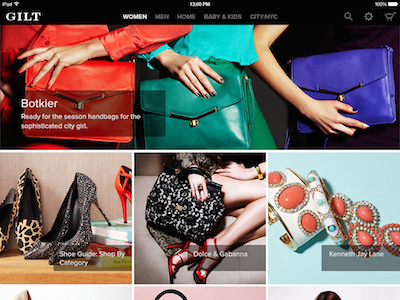

With competition heating up, retailers are merging and acquiring other businesses to boost their capabilities. For instance, Saks bought Gilt Groupe and Net-A-Porter and Yoox joined forces as a luxury ecommerce powerhouse. All of these moves made competition a top concern for 98 percent of retailers.

Gilt's mobile platform

Cyber security has been a fast growing concern, and for good cause. BDO cites research from Ponemon, which found that retailers are attacked roughly eight times a year or more.

Luxury brands are not immune to cyber attacks, with Neiman Marcus falling victim to a credit card security breach around the 2013 holiday season (see story).

Retailers have invested in software and have established plans to combat potential attacks, but increasingly sophisticated hackers keep them on their toes.

Another cause for concern is that retailers are now being charged with more responsibility for credit card security. U.S. creditors have made EMV compliance mandatory, requiring retailers to upgrade their POS systems to accept chip-enabled cards or face financial consequences for fraudulent purchases.

BDO stresses preparedness, saying that retailers should expect attacks and plan their responses ahead of time. This includes monitoring for intruders on their systems, training and running through scenarios with employees and sharing knowledge across the industry.

Certain concerns remain top-of-mind regardless of external factors. For instance, compliance with federal, state and/or local regulations has been in the top 10 since the beginning of the report.

For those seeking an international presence, complying with regulations and barring against currency issues is a global affair.

Retailers frequently focus on logistical concerns when expanding their ecommerce availability to a new market, but they should also be focused on tailoring their online shopping experience to the local preferences of consumers, according to a new report by Pitney Bowes.

Consumers are becoming more aware and inclined to purchase online from a retailer in another country, making it a missed opportunity if brands do not have a global ecommerce platform. From the ways in which consumers find products to their favored device for completing a transaction, many regional and cultural differences abound that need to be taken into consideration (see story).

"Shopping continues to shift from the mall and brick-and-mortar to various digital channels," Mr. Hart said. "Mobile commerce in particular has taken off, as consumers embrace the convenience of on-the-go shopping recommendations and purchasing capabilities.

"Luxury brands need to be adopting omnichannel approaches to business in order to stay relevant," he said. "Opportunity is ripe for luxury brands to capitalize on consumer behaviors on mobile platforms and social media.

"In our RiskFactor Report, more than 50 percent of companies cited risks related to owning and leasing real estate as a risk. With the new lease accounting standard going into effect, we're going to see many retailers take a fresh look at their real estate strategies."

{"ct":"oiWNTx7euyK\/3mgE4NvLgDzMRUvi5Jhm9kEQFddLPQiHsVq2f5+dbF8bv1r1ufT9gzzaa0+r2pK5ptgT4QjvB6X1y8cWJFtCn4lWK43GdDcYoVxiWpUny5rmT+JaTm+qm3qv6YwBXYxd0Xzp8UQus7pV9kM\/ubRoC\/CwGfcw0RlNbLYJqbDwFA+VRyMgmVl7UxFHE8GKceSdkOoZKhjTtKHZaDImOHOYIg9XemDyexk9K4qBQy7KOtRFtqAVGbZMSY2hKCosK9UJ5Uq9klPuVxuym690f6me00hMeDeDa+ocJE3V6NbuRlPyGQb4l43j8cnxnuGrjfFlBzgToQeZAAYZiDenGiFqe25i3klb6Iqijr1olnH7dPA7QZruS59A7mmrBTtBN9iI4A9fqymUDzxn5fa\/HYZrN2LYAt873nI36WjT1Wc1GuKMncDSzTdU8qehUDjSMRIz+qIJxO8\/7ZdkRwrQHOTyR6kt71hjem\/iEh3Wjct81M\/0LX4XvDZdh1xJXgIlZvAZ8RsloX1rubcfuA3Oc4iuVn6m9dqA5zoNoFUq4PSBQBfaK4nJos2T2PyqAxOwUDjNCxlsiQdoi+QhSDCeRGNCBFfVV0K9lqqvr8wDlWuw6HoidbjJn\/YAgHOqNCH9Rp9tzhXRWTkwEIIgoX13J5k4LGm4mMNydaomAt3b5RTlUgFixV3pdexWXrzNGQNyyVURf+po\/8rlfm3Zzi1DmCCeZoaZkodY+dbXAZ7+BNO3z3Hik8+wtkWgzV9OroiUYZBwwWzkJJ7JmMf0\/KGxUnAUZDR+WmosF\/\/IjOlxZtV0L9SxCeJeBzExjedOfPb28DylVhGWmMvuREO9WSr9EZn0WKibxje5bLfw+r2ZzbeA6I3EorUR6hFzaQ5Qc0O+5iR+TBQYracaRKojjLwWEdlT458TxgHbY8PHUVhGmY96+osGzFDyJ6590Cn3d\/zKqdNqlxKV5EamrNBIK7jw5zEQXbpz+oyusvMsoYE9wLCM9FSmtNS371\/\/JRRzgfxyhdDgcSfLWhuUvoGS9VoPZ\/VujKTM27QRGYKyKRQWPzI6rICcSVUvXI6YqvTMvSfU8LtqOPHMrZ6J1XCr4+TNUDV3HVOWPCmygCHzKtdCYx3k1b58VwNoUcUjIBQng9Te4NwyuEot9dbpT05O14aOm1ErGQ7JkfVQfTQq9CgmspjB0JW1XTLwAzGQF9uuVGjWRFj3mn9y6GtX+3z7E9nyo5X09ukSd\/08QuAF1s7d57nFTotOT6ROCKw6IvPZjLXgzfanyDuB9qIjdluicWmF9o4kBq8dii2dfsSbAOAbSu1XxRadhMv3mxKaG\/hnFAZJzQgBAe6dyg2TH2dXQKC+iX3efQl1BHPqMhg1lNLrodY9nDRWfqV6cnO749lKtCcx5OArUmxcsygRWX+ubE74sltMu1vFpYk4p3jGn5Hj+62uM49z3izYvIwAKHlj5abL8PNSlGz9F7+IWfPOlpUq31VPjbDEbeAVZtIcke0YnOoiWq\/gHhg9oq+q2E9VDEPcO19LyYNp9\/cntDLTJqCf28NWeVNSjkAeKBUuY7Rr4qo3NhBGMOLL35QFX9iWW27oYYONi1JtDkr9DCBg42ASMx3Cbsx3a5oD4+JFwHYughUgouNrtosYJMKmfoUD95mXbbrKMa0fn6vrFgK9Y4KBZG6MlhtcHsJIrq6kx6nAHtvg5YbCFg+fsSHqmF65qsCJIKWwkVDGCRW9RSM6AWGfRgg2OMV8R1svOZqYnKYj3Kov1bra6dN1Najwn74TxBoyCdaHpC9MNkgBvyYjPCJt0RVZB3Xpln7kttnfj+5mnY0so1DN11tBe9egC28DUHugLiBDMnOGbUz5hbSNj\/rhct8CPaqrG3K\/lNxqjc+N4XiVq1nTU9h2QKueapdNP+cBcyNwsqJne9eEQdAOG5h89QnsaVHEKqM1ikjxm65LbFGrLJDLjTbb8Coqj\/u90GPAWc03s52oRdABLCd9rFsNnI2ujisKKN71gxwM3tRwuYBtW95jZX4+yHEsDwkV6o+Sifk805z5BYMfQsYqjkxilVDhs2OapxpBXfoUAzMrRVV712J4DGJsFBuLCYMy2DIIcfHCEV6aHqROji93NrCpzsx\/LYjGCA1DHeib3r+b0BwM6hKYeCVJC+Rk\/7W+s5lCX3ySeLNwxN\/opOGMbLyWRv9C4Za+K23fU5dgA3t7D8g97pj5V8FbvY2blR\/yiOXq0j3N+PXqG70SJ6gm5bZBMN0y9WktHSMcvAoohXUZas4oYWBZXOafnWkoUMmxDlD2HHCIJ\/u7FKBFuLegb+Wa\/Sih7cbL62yXHRPuKy9FL\/I+bqrjc2Cnyg8VRnQUp2aYu7WHIzytNPcZG2COGM4Un4dki3nxBMZzUDEirbNkzKZTzg5eBe0bGXFiNky\/iKtp6w\/9blJNOKk2\/t0jyYi2tKo4Rn3G910QyOrlNT0B7g6PwqNaeKhlM62AGQPhM33kxqgKBwNyAZdlv\/Luo6j9IPecJBQALakEglINWHdianF3YQnuvAzG17n3uwKrZxDu+hAA8SsTYtDQ5znZ0NpXNIAvRLOAihHEdHdZHRzalBk5H\/FA\/s8UMFaaxTfGWju+A0Ur+FGTqEH26mrMlTswCWc4AlLa2DjWB6zMBRqeOPtd+1kZVwcTFslyM5osifG+5A4Pv6ZO+O40kIQJ1X5\/3j2tNWEUyn4YIUcER9NNJ6bvgWhWLC6DPL0FjmfgAzPPSNvMlMFq7MtSjISKzSCffxjwFnx1uR7o0n4Vwh9Vgj\/fcKZDJjFjUAstnd66lzI6hoVqGZ1ZgkOfqL\/is66kSlajoobs68GMPzunAQjcxM2KZNPFtm0zfc9mpbHyqfBjPD5syF\/YAheUi5gJsgZU7Unax91cdBCjRfKwbCS0TqVzW1KgyRnuG+Ik77+zpBercG2DXJN8XurjlRE0NwhVzKg1Nzm+tJg8FLUU1OnR9ZoQDOXAxcjKf1Cjd9CQ7KXAqbbdP0WswE9XCEvcMmDJG862x6Czry+7LwWkAzuTDu0lShhEFmXWrZ1zQ87XhSoe1UEgr9BUyJM1+\/FwoVSbg56XIMq74VNueOCcxw0Hgr2Xm92aZzKmstnTrH8lT27gtuG+g6w9RHL60mV6wxrHybZ\/dgsaCn21eYqq1jfes3N14BGHinR8ZwH+8S2W3zcWBqGwlrNsyV51gsqy0FKwCiMCnJGEKXn+F0FZb+PLcsxlD6NiC5Zzf5KnUbeMxtfSu7q0Sq6+M9YKjxMT8zQkzVWeCqf7GEobzZeM67tvS\/uOaZYDcW8o1Mc1Gk40i3wGhEQNSDkk2V8xH+xMLrWAAYxWXarq0SeCmw80gILRLELSe08zsg917nIOow7x49MlbY2+BatHsiGzrqhV30Iq7AsVqyAyO6RF1A98fJ\/cJ\/hdoZMMUXFX9Yq+G\/u+T+QOf4zeYmz8qhX8NsD3TgvV+4fVz8+ddHke0ubMuCMqkUZ9wv56IYHO0r5EtaHYquZ+brL0WI6UGwqVAuLYpwcBE8HUZyfyCEbaGkSi\/+XstDkd5PiAfkL0jYiJW6\/kFNVEwzPutfyP+KtG4Wpc9pFIAHDqg\/hSySQAtmd6UkJcMOMTP+vJy9HwvrbnXMgmkgqlVrg0MzBPuwMP\/iagVnM7QhcU3dPDxEO7apRJob+62VIvwXJzt0iBQBQmkClxG9dcwbYp2XA+NCTFyOkc+vGjwp9rH8LEOAJqLhf2F9GrF1N0N0qCVPkI8\/LxMr6PMIKcMRcw4KJ+sDT22TmrBOqrJ5D0BeZcojHtECshWIOkCxg4Ti2AXYtQypN34kSFsFS9axT5H0rW05PeZGOf8RuOgs2vcCwXDQLqUZEc4SnB4kIvoPgVWrIVlJ5IXuTmTgAWrHhjWzh+2P1\/ueDr+oe43yUQR3TO4\/eJZ1gmsVx1u+6GrIr7WrIUu5ZhPgCBcui3qfxI9VGqlEYZHNLaihIE49Bt0W6unS4iRe+GLKRR+JoPk1JOSKcbQ5fWFnasYTKupQ0ADs9SfGVtdrBm\/\/SWvRwuahqPuOSSMqzlfVdCoDucerIa6d\/U9XMknk2CGo5BhKgr8kbMg+oM6k1KQY2f8syoXsGjhVCC896mCa6wmaTr1hzjFypGdfZa909MBhSisKimxErOah59oRdMrElaWtkr33ZJHj2blmap10R7n8DYP8SAxW8GjEHfgIlgmvfKis277aThR1tnv0O6v+YYk9GdVZsYop8SDGPA4JT5dmyPG7f4Yryfi60kCXBk6P3Y3H1U7CDSgfI2mcmSzZKldyAEcK+DazlLG6d0pp7CRIpctiTLHqurfDLaHDArZ0bgfw6foN6owbODcjguyZGxz8pbLi8OBLNBm+rtVKMGX6ap02S9hWCYMSZL4ZWb4NuqlVq9RCZyZGmmj4dS5RvJiyLVbze+h9Kq4GjGUdv1Nd21xVHKacYtwK4yK1Vci0hCllEMPqDXcirP5r7mSg6uKBQSFoJLmx\/gEtZhxP9mrrXzAnMTH5vMt0LM9Q5b\/IyRMVlrdUtJmdeosWAGKAqUfDYlvXzRfETbYG0K8NhpsjwIr0nZe\/HhPSkNg9dQ\/hOFFTKbj7BKFQ9YYeXmkdzdy0xCL56J6LtqwsXlt\/gllGN60HOHTs15wFIPm3T49LZC1mSJ2t1MfrejXFWIU9\/507abu3LPFXQn5yMkd4gL4RxaO8ivwadHRywvnhinpthkSrH8303mv2F5atWVPaBdYMI6H3hF2Y2yvVSeSIHw++RQHPaKRrT4QRtDGOqq93RHaUSd7gzX\/hkUA+3wDJBfFPkQYZRAIJY+bCAZYlmNvO274Sjl69eO4E80y8fG37aPlikNEAZ\/nbQA\/m5aga3kLVDkW9TPVIIU6y1ZpKBay\/N0gklo5VLamHC4BmxQOqu2esG3pENud1Hk8PldkACoOKkFIYlP8xpuWaacE08MFQ0HEvJa9y7uA4Tnc8K2uyQ349HDLW61nbfzbguM8zPhlYvELz45PC5IbvnbopuzUEPWQD0zBR59FcPw0vz9lL+Zy5zxpxikdO3cvQLT6qb84DhkJnq3b8Hd1sPRkkMW1caFjkWLWFdFCnfHqZs37oKJdk1vMCfUI\/rybDBlnZ+gI1xM68+seMovHB3VhKMj0sX4OurM8Qh4ZMWmfnijevO4FKIX7cLfKPAF\/CXbnUB\/OrrOIeOlXVy+XzltEkwXY4EWTrBUOrbGA4TaA5aJm+ffSgwSLTpUObXTzOYDBP8kCl4tyGy2aLJW+oaByecFbjssGp1++MOpmy173LM7Y+KnRHKgMVGw1+Oczljkl3xn8yK3nQs+L4Ec\/fShFfnmihrc\/8mJQ1jOAYCS1dps0YLP4pFKMuaNkxcpgkPWQtnJVeZnKu2cEROAwvSaur\/uXNMAhDd4nTVxfYSM4Bg5kslOCt1jbONkZHVJ4Lc7+88dpF90tMAARlf8pYzS+So4rFng8d4rQmst1XE+WByjHnn7gU98SEc6ls9rx+\/A31fPQ\/zjNaWPL6af8TimmmnTBBnBmjJ3vAaHxDAQTIBx3DTzfgA4APBsW3gohayJ6SVlMW8sqc4CobdZ5cpSOV3w8CbsVjmkSyeh6XGlmv3zq75qQipHQbbd9MuXoctECaaq0CN1h9w9+EU8wUpPJzZhxpBEldFJT02AfK2PtsLrCwTE9DsG7qJxzn0Kqpk26Po\/NNLuuASsgO4qtn6pIFqq7ThkwJhOoZdd7TGiWMi6NgD4rVoHJGW5dwArX8+s19M6QN4ODwxLDeNIv5a3Nb218KLb\/SmcosElGPmSB7YG8cZpDGLbm5+kzKAl54+FmwvJ1EOuMo2fMOunKSO+hK2YB77G\/fH\/a9zzhEbCQ\/H0Tcls7Zyf0vFTUKdchp4oRYFjsoNjPORnwiu+O9C5stJdQwoj9RombWGCDRJ\/fxl01wlh4VYUt8iSHjkNoWtbCjNOITGFGe3CDjpzVhHNohZyvfFOYDyR7b2ssSX\/Pm8UcAIijacByAcAetJDJt5\/W57QmUUoUlRnZ6SkNM41\/MuJaR8Ej+z2034fzyR4tL33EgrSs0PjdrxSzFYjDbCvzi2+WfTdp+D9NspfIHZZVKyJQoHrs1woAAaj548tTzNVNQ5SDhre86TMtLJs3PGJ1D+khS07+lbGmpkVafVXI52N9VFhWVkOUhXPyBeqkT26SQGUGOQYvGBAdfKVcWoQm\/dIjV7mxTJyfMGlLmr+uyrK4bskwq1J5MJXS57pn0moEkX5YHyMEfDRj1aPy0BTc+KcE4j08dl6chq9HBiKwfCtD08A5LFpCVQAOlN28S9CiNCop5+GFQNNK7j95nd2KgfDt4QCkxrqSaQW+IyAIuSxBE4qySIvTWWK1xq1AnzYl4rm5+P4HsekmfYfv1F+qQOp4WdDzpEqUJhT199w+F6IW6hsPS7HmBNTOAgD6BFdQq7fVkiVWod+qgLecDk3DwHk3NZWx3fAqsi\/3K4BWnXwr2ZqyWz4VAayblmVebnOUY+rWkfTm+t1WbcHWbgJHEII++iBEcuwr8N4okW6ZnTE6XdpEjdeXyEsLSGGu5epJJ9wxjMBAsKfLiO4t7ZOnhWdLixsR0T5ZiVaSLugUS\/j3T5FB+x4NH0GhLj7tV2d34zFXkIEfTRg4F3aT3UR2Hd0VzVPx0wXkL0oZunJbBZJI7fcdfS2NP4VYFnss5Xeobt9gOiary8rR3ZcArlMHoh1FE7\/l7BoeRIWosucVBHzs2hLv7y1qgBqJ8Jr\/a9eITwSRXVspaB37cPoMzDCkKeryOwyl\/pbRYN+ZvG4XowAKhWa3TkhnQCzYOx48BgE+jme4XgUj026Q9h5ge0jFSeTWSDWyXSRFyzJo3DSTkXXjhfS2PmJ5nFDO0lJ7N8LaUMfTV+xV\/ZnQTPPltREbRRhcEujacuu\/EeB3rl872bsFRY9Ds3G1XPJTqGNvGJX7CNHMydxSgw3kfgQGpLxNWCkJtyUICeaGgKVJMEw1cldQlrf1Sq4Kb2eZax\/JE\/V3wxxjaFSS4YcEAtmIwAOmKxUNECpffbFCdUQJFtgGqoR1AB7OWsJgv9quR+17NU14HiWkzUXGGAxZJfNKj\/PUuldPi57XZZC0tC+DwciX4DGlXTV9NU5wD0ZFtZvl6ff6sAUmUGMZLKGFAcpSWILMNyXDOfjswaWb3WJcAIj2HokHWXrFl3rxoG40Mw\/zfXOIYRtLyy6YGr5JdrM\/kK8\/4sy9pfLTxYj5IBvTpdPxg2lNF9IHMXjWX7\/9GKbrz84hgB+OeVH2\/wdwWGJZhj05UM+28wDCiBRNRYI1VmyUEh1yxqp0naYf9YDV4kAncLj6i0AO5tK+cheZKSGKVVqaVfT3ZfshlCyR5E+YMeEMesuiZ8ogzLSx7znd4vKdc11S0jjjH7ZWtUOsKO7CynaIqY246IytotNndr4OTx7dokKl\/taZ0PYPYp58VOHKCAEsYkQitnO37Z56vFQUAbWzg5ADHF1lpuKEPf6cpBCvhHDmsNVHEQ4qZpJgvNoxds7QEdB0LRk9lH\/s1Uh9\/kvfYhXicycEDxVmFoV7lMmN\/DA1bmmo\/mdvcTcIpB3miEu7jYHXSf9w3XDuTH+9Z3Avqqdv\/c9VADNw9CCs\/hjUZz85t27EZ4zM1H4whJ9rcBtteC52AEp8XLtFjzi\/F9JdIB8jbyvxoYhKAR2L7\/iqApAtLKIm18g1XNjjbCcOInyrQNdKiFBOJ8i5QTA82tYTTvM8ejajJGQJlFWAqq181OzpOkbn9FrUX1JYYqXVPqrOyw2noms83yIXhAjcYoyeJjUGYWG7KwLxeO\/H1NdhRaxAFcGQ+BgDU1OFrJZtZFvIA80RVGOeCnmVZF101KnX0UF\/8bukpu+Ut\/FqdFTbhZ3RjiZX3Pvcb80t2yBpS4z\/uGbRlNQh5u5sECatdsZjutlvrgs0IFb7Bqa2dOKWNwzpSQd\/H0NdQUtvYCbBTWzLKXQf4F5S4EeTZMrI1MZ+9zoHTGCfT82jb84Hz6It8E+EERfpMJAA59+xD+CihotA8zNluMcV9wPl2EBBgNqSNQuyhZ2iunhpSDkGYhtyq4IcSmbZuwLKLmsHkysvXgRtfnIwm+xkpiE2re+4a5hueCff7dP52aKJVEksUWf+dEFmSPt4R797il5SyrcJ0LjlRTplrT3Z5fshpmeG8QkCqWE9mwo3sQofrZkQ5UYcynlspu3l6BYdikcqUSp8mjpeZQzDKVflxa2HjtJ8DfTTPRkfFSklC+M5Gbg6r2NvPZNpzlkCkqbqIjx1ZE8d\/vbUDpub97FiHYQFisqkDoYh3geUzxRyW92pfgjfMfPK07Q3WNWXDs4XCnspoZOOLKwreoyUcEH1l9Q7tI7SiZ+1Dp7wbhONxfUseHq7yJ+yAc1aT2254cTSu9dXt8ROKneWdYIxC9\/3c4Obg3Rtj1RVtLqbWxJgk7gZmM6ypFoGdFs1O220S5a5YHlywVKlVJHIt40xPmbMsemqiUPPGxaYFFtYQ\/td+Ze3TS5caeAsnEHNda4XoJunXolWhbcUXwtycSkmfvERwz8gRJY5+R4PGX\/4h7Me23DGE6YUq8bPfQjAZAyNGapzMkYtEihSWFmMdWctePfDTfq2YRtBz+D4umVDRrUl+mKtd9lfctACZmvTrGNxonLi97MK41npsODDidqNu+He+VBMtt11xAKoJ7y\/6\/zmvPbmkvUgG4ljqnR1yZOE4hcbJhPNjUy7d\/pzs6LCcPIr3e3lMOXewc7C0LkchJpBxT5ekXPc6AuylQ8+OaVayrF4DYr2nmDiJ+2EHqsGau6PXorR9JgtYwU2v73JMwmFQJM26y2M9dT+4eq6M3yjO8xscLret1S5QjWNVYFWJy6qy6aTMv1oMUC5VW8Z3WrqP\/xOtjMOqMxChd9UyxEH21URJfQdZl+F0mw69JzLUeSMKM1oD6eYVBzoL3SN8gPq9zqsGN5gbfmplgqxN\/csksw34u654jc\/9J07j6UcNU6O7oeghOnfXejZJxCqQTHIEo5DTm0WGRXfam12zJzRGl4UMfGwWJEdmgr84UY622D5UOG0iJd\/tOUmJUzwNW0l4fCUGDFjWeT7ycWFCYOjG4\/aelcuuG6hRWCNx60lM3txjeYAkJ7S0BRDG5H0y+\/tklU+1GMBPBxpMWxgM0UeUCrzq0JJzZaFrEERktInqGhdnouMXc3FbA4VmZ3QT+UOsPbtLo3iTwHK7YAEnAtPCQQePyWmWmoGYHn3K6JcOmtpB9tM3qA9MabbzxhH4vbJm7nV1N0f3UqT4u6qRY9l0GBvbW3ZxXASEtOTC5Am\/ceSVX3WFZJYyguz1gPg8Y+Z\/VTC13xZ3z532Tonh5sP6e354LbU3HbtrBZ2CURPZEP01ogIrnhD+kXBAuq1bafyyLYB+MipOGEgJYFXd1NTsvNCzgAV8jwoFbCBvDIRdKE+gMoSIvWNT7no6\/4q0nLkXikAIdYgclFLbkPP\/DKeX6Tbh5QnBjiuVinxq854XAA1kWiqrXLdLv9hIxP3YNG6g3XsaMH55d19dY8itmOIvZwmvBXatdpvedLmoC1u4XOQ7hfhaJWYOmSAYFxhBzK4ScHvF26+TIQgmkiXZZyXfyanMvuFVBtCVEaGPzdc8GHhAUBP2PHXPE7eJTRrflOtBjaDWaR4NhJ+t4JFtBfhh4S\/hlh3JWPaSxAlvFHnVUuF0YoRCVsAN\/6tHwNvMLNYua65NW8IpQ8n943gnjlRN809y7erI1qeIyiMkM4QhAgFbeJkh3IzYwxzUNgvhl1QWQ70FctC3v2z1TVv6qvbsMfitHQt0BuTk1ToaEDzRXzxhyyLvgaZ0miOSzYK9m5jAIIORW5wmFeGNdyLNzgK7El7RFJGErk4G66p91OI\/MHaq1\/kF+Jea4PwjE\/kVLyC1vtXekPLW1pkmcC2FsRjukd0URk\/0P6arwlQQr9069gbSoTRVHDlRut1AC89g\/s5nZz8cSnJ+BBfLjWujMTGjGvRNi\/u+QTOzJ6D6ZxK4wlpVoumN0xEyMEyb9tru15R18cXV1Xe3eN+pHRkmeH7ncTsrXKyRsRvKoK3PhJI9P4fJTu5Xl9gLKYRewiOFf9ZROURhq9SG3gwwRzLwgNiWYIBLAvRSfANCEhnDw9QGUBGwYeAjG67A8vFLG3fqhKiM0SagqJs\/4uqiR6ORoVf1Z1IiqihTOixJaFYIaZ0gvyS+DX8G2EE5F2MeuQIZC6gLvk4FXoWnMupQMA+jQ9NZnxbNSM709T+RMSDF1UHyj27BT07RWlZ+KONhFsx9Iyze463cQbc4e\/DjSUchr+pktyDuJ0lardoXd8Hq5A4UBIy24TU+yVjC2Ca8jVyLgQopBz\/8aLJHPB+QJhDtNGyy4yR7Xrv5DBBNWSv3ZZaWHQRQyq6kX\/+LLQoZRYqYn4nfaM8xX8mUTp+cZwdq9LT3VgHwya\/hKM7dNn1KPtVDRDSW57JAN1tRH99OT7XSlVUjNG4eRzwWO8Z0N3qro6la6\/We8nIWg1QMY+v70piCl+1+smY29wvOhoc\/KID6PAbqB3QxIa+NXbRg630ksPQRHXraIG5xxLp0e4rWQQ+5K5tMae4kcooq8PrFkUX4P++VxdsQ\/LMx3ca9CkE229uJj7q55SdMj6bXUOFefy74Bb8dWxEpTgpJhrNeeSKnQcp4b97myCcUDSDI8JbxQdzkVJq6I7wqfq7b1oyYv9r14KS1kqbeP0DRjXSyRduUjryX6aKV3tEe5feAMW1u3MQq36h\/7On2RyQG7BmyeZOg89VSC1FwDP0A+PPpdtvZwImCgJ\/NBFe8EJb2efP9EXDfW3ucMEnEcDhaDMJmoZOAYDKWb1O3rHtr\/HMSkA365HV7m1GuackHRLGQtMUPe4O6xFj\/aUCuLlkRNRMedyygIY9Fk8lVZH116bNJH0\/hNgdjzhtGNWwHDCDShl83WrsM9HCRNaQ2Cq6yQCfXQlNX+2VseqQneug4UaWYvmeq5tPdvJ1ALxSH4VBr3\/9vagxDufpYZQgok08nKLLjv73OBW3WxtELcRRiILLBPl7v7PirEiWXZavtokoExQ5fgC2erDHJ3cKRt6adX79I9ULd0VKkgBrv4arF+zu2WK+g0hzdhLLb10OSWRYWyEBF3g9u\/ckGJbWaklJ47PNNPAm96B0aH9uH0K5i12LYqDkEyp1lN9k+UZV4zMEboC04npUwYITpaQXmSDnuTWTipi24wE5wqZHOk26r176bHTsYQRYSk9Z+NDG675UOW5+60HQKjvFgfau0mO3H3MPSf5C7relOk3lDbZAZlCMGZmNlT+6DfMarSovu6vTHICDQRzVPwEDH\/weWS03z\/pQrjhESWuEZNqT+o4gHkJv2t3dcRmMChx5gIV1EC9mPKAvZs5BEUKiJL57JB73qIPXk2BZENNeqqVbOjvqTE28awYS1NvmLV7pshUouE\/NtBS\/kb\/yRi4pUNDmL9q3fJ6PAduwlBMyLDZp27uwC4VnkRTwS\/E7mgAZcML5NyiVEjEM8rrNESKwmc1NYfYyX50PWx7pCn996URfIj0P59E+Une0gTkLXlso5GCD\/QJVTwp2ZmiDlZeXzjkXt7xIMmu26RF3sCrfi5ZV4DVuTYumXWffEJ+hqiNLPdOINrTriqJ2qlpaclLvjLwVN1v0I5Rq6ImsktE39Pq6unK3RisCAAhFNpidn9gatHCYB2eGZoYFB80t8a7erI7DdT0diBSDURqIx08v3AiP6rATPxWwnvRzAvpAi9EGdYOyuxFCOcJF6uLZoMzJgLgL\/lDFu23LDyRC0VDhi6+rnOavg54ZEhngHJLc+xeTRPFH0OtjRbVHc0VgR4OF8CTnndRFUyli\/qh8CH8pspUMEqwBBIGysGa1AWtktsjAm4IKIYGyIgUrluI0iMVY227P2a0uz0Yo+Be4r78PLzwKz3dUa1MKPMJjcI32cJSwUtCK+OXzSJGNPgJ8gcOmwGiU83RTFehMkC4h6KQk4V0GJZaeMHu9lpj9Y6zGzuFnEdcI1Wvf0LboFz7mj0t\/lvi2I67gl39CT3zY9YVvbmaqs4mYxyQqK9GJC5VnMCoZsWtl4BDQnR6omxXtmo2f7tex+YNsw2OWwJm6FQ5QrPY2O6Pss0WAVQ3RvdqTneDsBTCOvH1MUjABcf3ZX88EgZkXpA3eLLE7ewBgJ+MkFseQ4G9n3w\/kGdQIjCkqwm5La0pnrlzYA\/8uf77prs+nZxdDbjI1E51xF1ZFOtImfFbehffjzkq7BDwVdn7ueosKQqTxHWn3L+Y1fOjn+AXHJKmnKyyP5dc3JULJUb4\/9UdEiXCi9KLOu3mI9wD1x4Ee7PpmGIKDamKbX0q9iscwFrDYgyVd+HxthhvzKyp8wlj1F6A07eUDOxJUgAUazbowo\/JV0bl\/qyG7EHoc2EDVzOtqc52LRMNE9\/bjxUXDJRAu72oI2RbmWb+Xg8+PCetTMsZxwtQbQ5OhbKcUVCl12VI\/LECCYmIllIw4JV8eilwLr0dJ+UCADCOo3FueqjAMAFKMezvBjuU8aupGq3h9R5ttDx+1HWE3g2qBAjDd7aeSN3fehQUVqvmWz2Qu\/IfGI1b6\/muqVFTOd4trW3zZuXqSKn6MaElFmYX7Y2mvPevhNG18OrOCk4JCk7Qgcl6ri6dzxQ1Nb6WQguqsteYUJpga5kH2036AYMsoK1VoiaOK+Fr2ZdeFgesTJ9br57KGeq5W02sWCVRrQMgmb2p3udo9tYC2RksZPcuaGwh1fcrwn3MvqRTM2hj0iLgBfDotLXZjVC8TBkAqj6NG9Mlmckdep8XCg+jzBf3D4IWFssI2tHUVUFeA87BpBJbKXZ756a4\/TiTdDT1Jp4HGJd9wf8i6VZdAPv7Zy2COTdX4lsJhJistGsmfycjXJUaKqtY4xcKWfgALq3q\/8ZbvxfDBCoP\/s\/\/UOwOcNZw1pxkeRqkmpmdrpQYgHDAzPf8ZlDtzR6zHnEAwPmTRCVkQiNtcFo9cck0ZvlGcEZns6\/glw0b0EBrrNeCdGzwx\/udw6EXufp2Jxtl+o+QSdW4I1Vfji28RbFw1ztEq\/i1s4s\/asNyI5NQ\/ymj7AMGYKLZPCTVsAK2arRWfdioqmAFUOJWBdljpHp4m2HIxAYQMyjAL\/YuSSeBXViYA8DEsT32UgJZ8Pq3aQab2Eu7Aqyz05YL2IjBPHg6sY7TcldLGs4SEi3VTXuqrRhbtoPBR9izyQ\/6\/MUopGR2lkvtWrT5FPiDHtXduzJGDVnIeetZ8o16U2HHC7L426FkFUKQnbzG5fyP3FYvv9GTOdL2Ky6DvEbHTh4b9bYDPpvPF+b4xSOBhes0Gl9o+TF2ci58\/uamLWjcFz3vBKihFfM2lKthHy0GSRgHtLHXNSaiLWcFWH4ZH912h3JKTghx4QhGnsFBnTJntEs1n0sjkgUw9FCi3XEhuWVFahZqVPbaQmz9wEDTtUpkVxJf6LUN0iLMHGYhwwGhL2bUKqrDndnMEcjsOgFA6itL20f1WMZPTgiuhYxZwNYgI2Twx2v\/AtUkjkznEcHIgmoGiZXrcOxRUsR\/SpQn4QS1rEXwPKUcxwtwta\/g5mIWps\/aDG61SmCQ04xfU\/HtxFvbGlHZCE7Em3wDBYzxL+pHKwMSCxZqTUlOIm5TmUZatR0E3OAoHr9fmv8BZXMFH1NdLEINAXIs7M0qiHnl870qaLGSByt4B7V7QtfmumwGWXZoZq0AwLZhsJ6suL7vHroVC37YxiKQfI0qKKR2z5YO\/78stYMYouh6VTdJo8r8IxyYXowXbwNMp\/xOwSu6jQdM7I89c5J6UVwe+qBddHobOi67zuBZEx9Vl8or+UlyufF66CEwH5RLgxAozjCvtUqxNS6zITpNAPx\/sDL3RkDA9pVJuIIxOoo+4GN8\/In7PloZoUzm7bpkYRP46i0S1XLJupNOgaMSp4Uhs2aDzYCEiPUoXAdZt4IM6NqSW+taTvNFOmYT+XtJpf4Uya4ak5p2fKIyYZGYcCEhjPwMCqIHc7ELfOZHR8uZTe9UfadY\/\/6dkM5RpTa3DlvVvfgSqOZfEFvflJjiLaJ+fGymCQp5zim2","iv":"20e7bff7ec9dbfe7e71be4973f52fa6f","s":"40d05f721a68a209"}

Image courtesy of Bloomingdale's

Image courtesy of Bloomingdale's