With a market size of $570 billion and annual revenues of $333.4 billion, the menswear category is expected to grow at a constant rate of 2-3 percent a year, according to a new report by Fashionbi.

As size and revenues for the market has increased, so has consumer spending, with menswear seeing an 18 percent jump in purchases over the last five years. While far from a new market segment, menswear has seen a type of resurgence as men of all demographics have begun to embrace style and trends.

"The growing fashion-conscious men consumers, their tendency to spend on more high-end durable and functional fashion items and the upcoming men influencers that have highly impacted their fellow men audience - these all factors paved way for increased sales in the menswear segment," said Ambika Zutshi, CEO of Fashionbi, Milan.

"Besides, as presented in Fashionbi's latest research on menswear industry, there have emerged some phenomena that have also contributed to the growth; namely: gender fluidity, YUMMIES (young urban male), same-sex marriage legality and the break-through of performance-wear items," she said.

Menswear mania

Recently, fashion trends have leaned toward gender-neutral styles. But, instead of all brands pushing unisex offerings and taking this stylistic approach, menswear labels have seen a noted growth as their brands already offer pieces that can be considered gender-neutral.

Fashionbi’s “Menswear Industry Market Research” report found that as fashion goes genderless, menswear has overtaken women’s wear in terms of global growth. Menswear, for example, grew by 1.9 percent to $29 billion in 2015, while women’s wear saw a 1.6 percent increase in growth.

Consumer spending and fashion brands expanding into the menswear category demonstrate the staying power of men’s apparel and accessories.

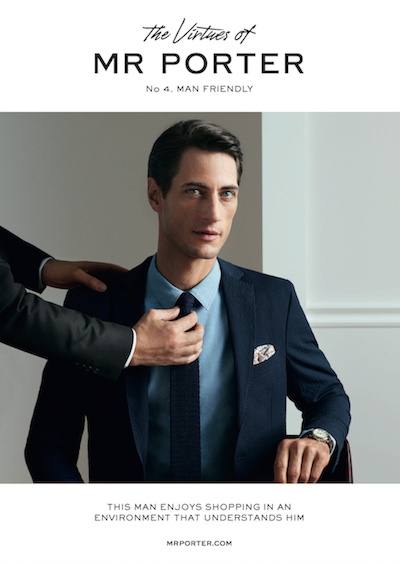

Online players have also leveraged the popularity of menswear, with Mr Porter seeing a 94 percent increase in sales since launched in 2011. Mr Porter’s sister retailer, Net-A-Porter, which only sells women’s apparel and accessories, in comparison, has grown at a rate of 75 percent in the same time frame.

Mr Porter Virtues advertisement

Also, it has been within these last few years that men have begun to bother with fashion. Of course, the market always catered to their needs with formal and casual wear as well as footwear and accessories, but recently there has been an increase in the number of informed, passionate and trend-conscious male consumers.

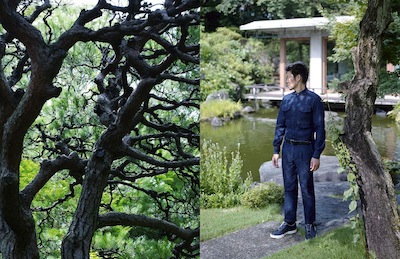

This type of consumer has become increasing visible in emerging markets such as Japan, China and South Korea. In these markets, being fashionably aware is on the rise, presenting opportunity for menswear brands to grow and have a formable impact.

"Asian markets have been quite ignored when it came to promoting mens fashion," Ms. Zutshi said. "Asian men have never been named Dandy and hence perhaps the brands didn't bother to make much efforts in such 'absent' customer segment markets.

Zegna's Made in Japan

"However, statistics show that Asian men are growing in every sense - in terms of personality, income/social status, fashion-consciousness and knowledge of the available goods," she said. "Asian men influencers and celebrities are being seen in the front rows guests in Milan and Paris fashion weeks sitting next to who's who.

"They take-over brand's Instagram, Snapchat and Weibo accounts - which is brand-efforts at appealing to the Asian consumers as they sensed this unexplored potential there."

Young urban professional men, or “YUMMIES,” categorized by being “status-hungry,” affluent and late-to-marry, have also grown in prevalence. Fashionbi explains in its report that the YUMMIES consumer segment has taken off due to omnichannel retail, which has assisted in ensuring consumers are well-informed through digital and social media pushes.

Tom Hiddleston for Gucci tailoring, cruise 2016

Similarly, same-sex, double-income, no kids or “DINKs” in the United States have a much higher disposable income than heterosexual DINK couples. Same-sex DINKs have an average household income of $103,980 whereas heterosexual DINKs see an average HHI of $62,857.

Likewise, as same-sex marriage becomes legal throughout the U.S., parts of the European Union and other strong markets, the LGBT community will boost the economy. For example, when the United Kingdom legalized civil partnerships in 2006, lesbian and gay marriages generated $209 million for the U.K.’s economy.

Performance preferences

The overall menswear market can thank consumers’ embrace of digital and ecommerce for its growth. Fashionbi found that over the last three years, ecommerce has increased 127 percent.

For instance, Mr Porter is bringing its editorialized commerce to a new channel with the launch of an Apple TV application devoted to its video content.

The brand’s Apple TV app connects to user’s mobile devices, enabling them to shop the looks seen on screen as they watch. While other luxury labels have emerged on Apple TV, this first-of-its-kind shoppable app represents a new concept in luxury retail (see story).

In addition to YUMMIES and DINKs, the menswear market has also been influenced by performance wear. As athleisure responded to consumers' demand for comfort and utilitarian fashions, performance wear has answered consumer interest in functional, well-designed pieces that fit within an active lifestyle.

For menswear this trend has been huge, with brands designing semi-tailored clothing that has taken cues from athleisure such as washability and wrinkle resistance.

Italian menswear brand Ermenegildo Zegna blended the performance of its Zegna Sport line with the fine tailoring of the Z Zegna Collection.

At launch in February 2015, Zegna explained that the pieces were designed around “the idea of 24:7 living” with technically inspired details seen on Zegna Sport now on tailored garments. Also, the clothing is dedicated to “urban trendsetters that blend seamlessly formal men’s suit[s] with sneakers, bringing tailoring and sportswear together in fresh harmony” (see story).

Social media promotions of menswear brand's shopping apps, performance wear and lifestyle has helped bring forth awareness for the category.

"Men have always been active social media users - they were just not engaging emotionally as yet like their female counterparts," Ms. Zutshi said. "This was also due to the fact that they had very insignificant of content given by the brands to engage with.

"However, the success of brands like Jack & Jones and Boggi prove that if the brands start to create precise content to cater to this segment of consumer, they see a direct co-relation between increased user-engagement from their men audience and increased sales in their mens products/lines," she said.

"Social media is a crucial tool today to appeal to the fashion-hungry consumer composing of both adult and millennials, who is there to get more information about the brand and just be given a special simulation toward purchasing, really."

{"ct":"rtSP+XYb7UxZaAegIMZyj17aV7YWWe6PxRdlGJTlkSpegXajRwfi9HzxQ3d76czpXbFiFZBV3ATfZHIvJ3BUKlZkY4DYXWIUsln87go2pB7BLAhXxixL3R41nEziU\/CxeWSNVs+eWwThEESeg9oH+gKZEvIboGHx2oaHBfVKGSSUQqZU1lbF5L9V3Ac\/0oeSonrf+8MhclZQ8Hj06vdcq0F242xn\/81qXAi+bYq69zPvRqVMBhaMUv\/TrOTkOYpz9UxFvaG0KAoulhGRZxSCdq1RLHekgwYFvirQ2mKq+51\/YMEdLV\/cL8yvAvFBdrot5oFO6+X9ji1j6FWTrVgQe2h\/Zy2S+TVW6nTg6A6+8IxXZ1oLVbhKJnbPPHCbxAfQdZZ4zkYBleSaCF1GCh4GPd1O++SKf9nWjCnL9dw3bu3\/IiQ1ZcgLVtvGXAdY6IedWip3hfvmUnuvnJIFeHCukYyqkBeP1UWfkOW7DDyD5Wvf9P+h3cBUISOEG1a+g5Yj5keOEX56gxeWdae1R3iW+Squt0eSMY22PK3bjGSCkMiV2XSjU7e+Cw0Shj0LWtLukfPHYRD3vIEP0I2O7fbVZRNH9NqioOWKtyWnOkEbNDoxc5cDzi7iDqc8uij89t5oiboxw02NPEuKAZQqYYmF95bPL0PnnwmFkCzZ9pBM\/DSnoac2zhS+7ga45717iv4J6zz+tyhdrtcZ66JuQFD3lPcO+TQHxmCSA97SDcRkDE2TLqz88PNDw8Lc0pcRUCv2D8NqCUGiqw9T0BScH34zLA4FhD31nYvPXZ0uuQlx1QdpNrleAAed3xYouK4cgm7ewIuG\/7KUQWd32TgG5U6QIRN78CXMXqVpFeT1WlivYa67OekdS63w7JanJZZih8l7tYjUsmN3s+23zD0e9NmZXyf1eLJ01hsqZR7RhWXQk9eZNmOaPkv6+PNNYLwFqmuTFMszcd11LmgGR9jbV3GqpMTwVZYnPYhKLE\/TFcf47xabpo5f6B\/RUU7\/\/WoMMf9io47k5lsBNwM7FcYZQlWSFsTv4aXLfTnt8YgN2+WzLuY9qtax\/aPTkLVn5jT1Mej4\/xPnXIinw9HtPeMFCqDOaAGeYKkQcbtiA+jAHhqvY5Dn0bno37RaaG59+EU6Z2QOoYNBBfqs8s5XiG\/+eF\/VFVxzW0W2tqSw7l3PIJColwLqWyTCtp+d66PJeCs03oUn8\/cihEQJn38505Y1DQWe7viZ+1h98+iGplXhSLRLDoFCerAXoCM\/ar308mG1uRvG4XfXMoj35zqB5QEzCbhSxhLVR3YCbhZNTq+8Pmkb+T9ZoyB3giNdJ7w3SNBYvKr9fDj3A7u9DR2Yj0nFRBd0fHj4cSHZWWgZ65dpG75U5VFUHDxKfZkIHIqX3T6DjnOq3QLMFBtuHLhonvGK\/h1KfLZDGLYR9t0pTCkzvmyVnIjmt0d+jKBtWIjoIL8+YJNtg1F4UdgOL9zZLbKNuGNrGAak\/oyilRrqLr3EBbLNPnUmjO6LODt65u7Jq81tdcvKaNPSDwPhJIqSOiqCFh\/dzErgvRg13JE94oeTi6I\/xwPb20x5mpRbjAIacZxkE7l5MYql5AH1\/CZj1o09Lc\/m+Ii7q4VIVZ8zBN3LxY8Ozh2lSRACCarD9Bl+ka0ssqUUidBGTpK1uJtNUKman2UBzb3kK1ne3o6eq2w\/uq0tA4vuATdfW0lbqQaXaR283vStUaQdEq76nYNOWNbnr5q4hQfDUzPkIMMHNZMysoACQNC+KyR1NnhG1Z2oHwMP86JWUQJ\/qIeB8p6eF70B5mBQ75+snmwXZ3i9cbjCPiPJCXJTnrezd74id5B8kPrO2tBTezvAWRi++KwMq0I2VPnJRbCtu4rAbckoY25Iitf6c8I8auMF+HCVCQtTpCLgujM4sESS\/\/q5aDyArdj6kP0CmItADVPO8d203+zkyrgwJR7edASJVVFHfAlT3GexNDY1A3JdypelrgMrfoYXyoLOdIJ4LD4gcPQAbU1bpDDaFt9hFXUvGY7ri\/3VF\/ew5beU82t4\/jSzXDDcUkp0JhuTs3j4iixrSPqsX6aYEVwSdZ\/jDy9kBxSQqQxdmNLD6yomyqhVLv1oGvuX24gG\/eshUwKlqjYFCNG6Itc7e1mpdHYNQMpqCT5cRMCt39w2STJeuqFkR31vzufJE46FzZJ1aQvQ6xS2a3Jye4XzUgbtZZxCgHf+9h2Mimmi0xR2HIgcsUR0feXWCweG+MSw86hJjBx9zYkwPlGgtIrdauzXTJuD9nvskMvGz9jVEqUN5con\/OBPg1dsS+O4LMegmYtj8Q6I2vAJhUizpmL1nwVSsPUdEVxJFKxZFPjE0F+PH+2lHQ+viWQDH6T8HGJqSFLAQNpSkHrtAWp2J+JhBbhWst\/HK7xmRxj2xaXcMYE0ZvJhSRYNKxfYwIfecw2TzvD4jREv2k6fJiV5VZf5ep98J\/b4oZuRATX8I8AM8\/bSDbjuGiDpFOesDOD0xkzq1vsYnEdm6a1iTns5Df5iHsDAnAaLrWKf5x4MmrTfVRoTl4B5M5eOzjxcTQp1nak5DWCt29uG4\/udj5b9Rep4z3wbL\/zPm3c8p\/blkovhewB+H2e0oMZAgm8tGx9kHO6vP4w77OBnqpTlAp5Z4XarBktSe4Z02G690SJl8TGkihVH5oG5LZPYWVw8Ksc8gXKq+bGMQ1GHuMAf2V9P5c3M1V1voUuKmWraILeSI4BXGQXdu051j\/MPRegrUATJw7X3xr9wfEMIcqMseJtp3edcG4WKpF129wKVsuMjiUTWdwMQebIzPk6JHNg4a2py2rELqQVd\/L2Jo7Vsa0sYCNzwPYvcoyC1w7FAGgckwL7m4NwaMFYuzg3lHAz+D69Ia3TnvYVcRqQpKOfRgSPNsQlPjGuXL+239b0ccPZ2JC5UORIBmE2CfaHsVjbCCZH6hWmTnzGobcJQigyHSni30FPJBFspwphUZPkKx6V0dZJB9XqHXwmk4UHeAKDBJIlStCpH9Rb6lOR9VFsj+2qwOvstokZtf7xJq6JH6\/b6bvCxfxsjFW32kQhA281YvG0VRgIPt0\/frUYnrZmZx+a5yVFsJecikAfwwBoPQfFK5jjX\/90Ogp+NpLvKawKEDXcENpYlN7YZEJLUNrfYKlyuCqx6fxuuRmGgVa9s7\/RL76AufnKKTpledwo2VJTVLb5HAVfbSS41gqYXwPQm0MRLihPSC8kGOgyVizzBpJEaYxUABkQIfvOvZ6II3RyQnYdJSc9H1sgsRmMl1jpwRfWgWWXCuzxN+5sbymzKDwOBaKroPtYweDsp1PDUmvCcNjMPk1hF\/YlM0cnxsRyyo660xKyYbf2zb6gypUVZ1LapJcF5xDZ1VxwIlB\/VC09K4W7qEyLO\/PlgjzVeo4aHRntE3Vdo12YwMXho1F2c2w+\/1N8pTdwFqyK\/hiuFEeUVDdK71Qdh3jqo98s6k0\/4M66GREKzmWt9fTD9ukJJ+g5Oimvg5zPFZ6T61LfIBvcM\/hnWqaW0d+p+FQryg0vn3pQH\/q9aNgtUisyxKX7ZBYIt0G4rWJX2UYmVl5tk0iHkjrKcdSGbkhwFw1L30PEuDimoHXLaE4PoyD9wEPUYY9uTrcR9Eg4B+eHAA9qiPvvWV+FNc4psZ1gKwG\/AvKl0MAJT2Wcjta39wrO8hxAKttfcRPK0MQmSpj045y6JxSlOiAaVK6VKI0fuPREvEBYm4cKPp9QplrWaU6JapudSzRTCVjIV6jw5ziRrP8cuOHqRlO4JhEwsdXvuf6ktzg6eFC\/SALlDp6PBhMFrFA40pqv\/bh75xi6f9fUurKz1+6Y1W0sSpq+Epv7W8Wt\/vQUwO1iapyhjaQ86YkpQz6j4\/kTgIUcoO5IbcVDthn+Y1lyrL2xFcj7HlxwLJt5gcbKeCgfzzadTvTPjJSEnyBhCUiHQcX9C4OlZcaKTBliCg4V2F+qIGhLM5zZIsQxRfHIv42gJqJ76vpwO\/pMFaQV3oTXIk\/fUhC7Ajm3ApJbzlKk6LH\/M6NiCBQBbT3E6xiK\/3XdfWk16KUUzHwCPknoWfyxe86C6Ba7W7UDSSRM2v85HGnorgXQON8JYg8rtl+XpUlG2VrJnkdKgKGZ1Zdnsnu1g35AAXSGjMv+1qDFeXxU5zseRsJcf0Q\/zN6ot\/U1+T\/8i0rv48eSBMhY2TVA91TxDXpd0M01iR0Crl3kn5QorHFLa8u8KoRR0No5CS64r+dfdo+9hrZA80\/0321094Xq4wapPBLM2D8z6\/9wbkGfB1w0QllfRdP6IWqxWZOkz3JnLh49AEp0AmlD0xs\/2TPQyKvBak6N2ajNS4uWnikLaebH6lygVqWEHmWSELyetn7+Ik+K1sQgidMX68GCA3baaT685oQtZqT9NaFRpmhmCwhCCe9O1pZLVoVwVsCITmXuFOZbtwongV0LUDA3lj+qopGYMrSv\/d\/fHpK49\/dVthQcb9VGGo0J5xCM69FiiqOkLqt3EvQH5eUlCdDpUUeg0tt4rrPyz2LM2eMhoBGWKPRxi+xcS6o8ekPt+FVq0+oZ0jn\/oUixWne8AL2MCuKvudWCGn+ZEXMJNPe7owaFlW9bTcRzK7wdu50lonDr5VstY4CAuh2irAztL\/amc79nu9rddY7uJ53pdCCe7zoQs+k0IW7otPQKhSHCKqzC0yBZ6+jLf2RjOaEEQ36qYIsS1iJmygHZBkm\/BMncvGufwAqNSgTIWDqdT+92EJll9dFDA1vWQ+QwEwbugv8WKKKcxXQehh1gzBusQ6tuKk4fFKPr5J+9IrELgrC8GGDiq5SkXPRL7reYcpkWRbGvVsRPKmWBUky4BizWj\/qyalsI18+4QcgsCPplpj3L56jA7vbbMvm6lsBwX5d1vz5FdxpFSGz+ll7uVekG1arfuHY4YAwO1rwpPVvsl0XKn+Bd2iS98w4uSEqFa2udvOCixx7Biy2lydl3IXXT+nyFupNOa8zmfFc9eVuLob1jQPu8WD2KjiY2MBXOXD5oW5lqNPoR6+aR33OhXxPRRAYIgZFluDKyDzxDC990Mpc5wIOVL5Ome1xpx0+orFcTx2MG+faQ0bBPt140J+HW\/2Uv5SJfDETbow5F4Qo67bwH0rNLzIbuUmtOZhM2m7k6fALqxZEajBq\/4bhfpqOxD50HseWkuLsk624d01wT3Ve3LQcVycGocEr63yEt2dlXYA2pqe+j31o\/KrJlpax0eiVc4WkhGkp4Jme7tbJWSrWBnO\/pGjHfNj2\/rgSbweYL9eVYhRD7q1+alcLQVWKEbJxAwS4NHoAFRItl2FK+STUORZXXDfwCw+gYJofqRk2unvU0+mCw17l9iQQCrCs0N5qH4eeLuxEc+Ss\/ivrhFE+atRF0D626sHSRl23T01M09ODUzpsBWw5X50BPx9YhvnYS7IA+BjZntOohawL1tOXcaDpY1f34Df58M0FzItuJo8GEkyDY8BxpF+P4KjOFyr6jNIc2Z5y4zH7WIKcjLJ59NupeB23duZZAQF89lLsgYoyQwQX+ZOJmYyeOf1one5P2OK9nHyS4OSolug0+z7EHiW+k2sOO759MiVv2Px3w9aDhq3ocaKYxXRtdLA6lJ6GRzCY1Lv4cQbzPsg3jTsmzy7Ha2RQ\/iZa2nDKtX0X8SnS1gS9WLGkxoHRm5HDhzoYU9eX0tlqSgwqNlXcznnEYMhpx69i2g+Ko8bs7HAtHV5HnD1gFrdlZHejYmi5llqBL8j93UBQO4eBBrL0XwMaU5E0PECIw1mOtLghTY9QrUw4SPYx6EB70Bp+cPacij3ue0AikOfsuTbEHfdh+ls8noPSw3KQKmHrByaN3F0yvDZ+8SCSm8\/SwV3WVHpiVFX86p52MXRes8DQ5gad9EGPxFLv7LETxGOrTs8wOlKxoYbAGOHHMNcizmmVyEt5aUKJg2RIlPo0rDE5CjXAZwXQmI76fftlvyE8NwVAhHGu88eRj0jL7iE6KfCjZygWhOm9MjvusOf7Fsswgyjf\/DHS8tj06L2PMNlDU2pCSMMDLy5CkOSg6jTtdUmKkd\/WhA1fZ2M9J5vMQefrWTH1ep1O5bWA\/+N05RLSZd+2TXN\/GLFng5o9BgpCGdSsmDNc4gJhpBb\/kY0Qm\/uZ2O9KLmqMDnGJlj1zM8e6ynJBzdqfQmD4wYxQovxlpLfm6FaWyGynHOI9LJx59YUjj7ZA4CrUl2kIrcDsb9U7umr2HXuaYzJnHAOokCRp1LofXogfszDtKY7sQM8AEXSJxI2+\/4c6C\/V2ckiS6RQu81DwGepll0lyJxRog\/Uld6v1wKgNZwQsxWBJKX6RZqxIisyTUmKVBARv9c\/UMWiQdrtR5TgrNN9b04HlckB\/Mj4Cr190A1CbQjr0DC3563iI3THnfcXhysHHsv8jBKnCyL7nRPNYRccRjCtI\/ZOdRT5bvfK3ZmSpHqQJPWJkTrWFzxHTj+Unwir8kSNAoy9OsExuReAYtJOiDDDhVxOXomE8suasXnL8IexeXUCb4aBq4SQBVdXphpbTmtQNxcZq2pUKSkWAanxHlmYSXb3J95pYNqNmCrZnSEHoEZjgmS6FaHlOcuRq4lTxA3a2gpuL8e2SMxYJD4skz6LCwSLYL8plOZxdC2LvYBcxy51Fn7s5t8oHxjoBvGQDG9uOFF68deHVTx57dt+mrkeMna5ZGRC6v9q\/53WoTRHSCHlM\/wLPuwIqeGdGWJ62hjAy7pY6BMX6syUUVdF06SnJXWS1N\/iRwoXOHR2Szqe+Hmc5HkfydxOhj\/GXbSJF+wckMn2bLgsn9UvKX1V5yFqB2w+DqV\/pSD+1nT3bBpOGSReaiisw06\/z8SmaA3WfRp9iw6B9Y1OLAYc3qOSsb5uFGhBBIcuh47zqRLxTqT7LjuVSj0vkLW8jLMA7sFPM4DWn0lHS7H1DADFCsM14fcOkOlMAOAF+Wfqs50viWc+NLlgfVygOpT36bNNdad3NVTlz15PqVNnm2OvFi4hP5ZaWch8cb\/k+O\/B+J9YB49hmZoutxQAQK21ZY6oOQBC14xlhR5vaDT3jKkFA\/+Su8qvQ7JPDFNlanW7GA\/0Mrnu4ONdoG1ixMHUIw7FA5yiR77Hicr4m4gfPCCw\/lngHD5dUp72NBtxfX0v9byXC+x3J74q6ahqLdg0\/6LqsmdxTrJaQdWgtukszm\/xcJ24k15Lfj7nCxvhfNBmyVwQOVJ4ZPKhX7hx5cNOxfh4zvchEsPEankpShJXLDYmieh8KTV6PR5wGZ6jvTIJLUR82KeE50jZIj\/rEccqKlqVjE6Q6auG\/yRR98\/l5RmoT+Fos55A7BECj77jyaB+NstDvnqz4BQLg6jxiMrDZb\/887u4mucjcGKdPLhs5U9ohcCfVksLoE9txLF1VKfG9mDtN1ySysDHb+Gqc2o8s+DM87KYCt17VsaK7P0Mf2aPw3KQHGp+HKecdtdxv18Qac4L3AK0VLOyQtcZataNmWSKt7cjrVGnPlxFbLbQm3TYKn9So\/otFn0iLs9vIz0T5k092tuciBWLRIUAaz4wE1Uc3oa9ravIyy\/umXBKcZsQbIspZk5q6Q\/47pS+32IU1nx\/FPzrGkb1DuN1X4bvruc4W5Y573hYBPP30+IB8ucJEz4CdrFEJaPPl9OCkDvjLBIC8XO5PsEngS8au9jxek86G0kOE0190N4yKSYvD2sTr+nQUGIYLP+Lnmx9OXhDLg7cje2rZkfc7XG+fagmt\/Q+0PWLePyf3Tmh3LNRRpSvfZC3JVY+AwbnMtHRO\/jlB2KFeVdwIFScspJulqT9F92CGR\/IgssSNSb+r2a3ICiXcUaqwo5ey9ezIJSmDawTFbRfFv4aFnwdvzlj4CUwtSUdhke18K+znvDD\/NcEiZwx2xOTcIQgd6SKCMY2KJFxdjh+5vH9mKtayH3MybCZI2n7Pw3ASpncFyIIzg14xVpCUPvB4jJtMBoZa2Aaib5Zz8d49NaTWqRGWncumMLihvgZq+ypjkaGfCIw6UjeYDGrJ87C+PuDn673mmKtOxH7g4eaxnaCgE2Zl5VD+fDZ39Gc36pwpwP4eNgGc8ejTeJymhF69GEFgb+DVNtaXK8N2bihFq8mJ2R+OOYDB4B65Hr5SHPDKNMH+fq2UV\/WmhiMI6jzo25vlTlefUjOOLnh2BzDt3\/Uspvsuhd1iP\/gRrosJSlI1F8YOCxt5abR4lhhDiXHtLc7vU6CfU4tsKXHACjduMxMhG\/\/aO+fgZ+tr2GumJxdlHvQ++nO4z5oeJUC63cBYWvwm19yu9wx8AZwK4U8y591pMgkStUYoIiok+m9bVXOuiASsT91IQIwiuCKxhURoypqgUWRF4JiyKkPpUKF3e7VbBOy9RVyXEEUlyIBzlQDEjiIxc6ke7DPLERzf52DdJg2s1l1jye\/H5io6UIjTAfdImwB24KfUDvZjsTa1AicBiYZfg7SXeUDj770jVt8RJdIzNIw0fKqlndXtJ7id4hduzkde9XtURv8cFcFtRKjZSFw8YWPadixmz0DxdhgeuKpWbqMhEH3TO1r4OB9QV76\/5XtOgA8AURb0N14GHRDm2Ipvwch9zhI8iuqPdVeY1QOuhqhNEv\/RfQwQUr6E4gfJPucXQZYk21vUfoc5c1glMM0EobAYO5xeoPHB1Y5NW8dX4vbW0NzmwzSa1VBQnGY5weuKJD+M5VdVTA94hJIoRq9xqAsUGuOQa2JvF12KG\/evZX6yoifASNfVoMo\/M929MY34JI42z0CDtwqf7XtUjf8BLONKhtUoSTVCFRiShpghp1mFhy6ZpaYfPfAVEAjB3stiUkZXJYFiwlE17rQGx2lz0jUaBZi+d3+4TKuqLYBGGwl+bd1inuNiSOdpFGGcUOHMJIcUXGR3SrKyTEN+0IOhRb8RDiGVaTxgGgS2UN\/WYBi3u2FrOmXLGDCcEtJzrr7Dz++DYbp1CLwNTiMnxYJbIRvBoxOYz3pZUp9uyt+uzUTTaotkEzmqUaSZHMktqwvIJYfDXOwXtDwx8bKfZ8+23pAnl1nbN3C1W4K1A76PPaMQppWNlaAJfqSqvdn\/p1ed6IU6sl9u0UOGBt\/xWbc2MgkgVA0XeIa8QJDVKROxo1gmhJpwpd2Yx7agwV33QehDFbhv8nuiSEtGiocyzPrgs0RwnUkJKH64C7EUc9xKELqfUUifTpGZmTeBBpo5Q96nmHmXX5DPerUdFpmlxQimP5eRAsW6HFSbjI2b3Qav9IbCqQxUsFmDmmA\/wFuGcXKDvvtQuovo6l+afoY2e430Gre7oI4cR9zbbopGnBgl4LpK9R23Q2Vv6DZv4WpYOoJ7CwkRSnQeUds35+iwqfo0HOawLBFPHFi9Mub8NJFw0UsYYban4ol0ICV8W\/JS18DCh+T4AP18j9SMEurcAjurKkbERhsv7XmrY2ZUoNTbssGMWj8w6mA0un6zMm2fRHbEEevAvFAxbGmW9WnhoDTUyRCIyHvq+CqcuL2pfyRvSVEejGckj5uLXTZPf0c303T7WB6PI8GvUhLyNztgHV\/sEuHLmUV33tcT1Yb0CLryV8fE1IVQ3jCjlnt99bRTP+ns3gsnEREkRHGCEdOGnALzO7Ar6y9vDCqtmKpASp3zmHX+e1+BPYvvMJcOex75ZrPiRbFr4678vW7ava8Z50OQaB0K\/E\/Npb7KLHpDZHFs\/p1i+pxhNfOjUzKz0ruglEr8tcqA5+OP1aqE91ITDs11hUpTuzHr8dX4cNy9ahoga1OJql1WITGVvkP\/kDXq2OXvO44S\/QPKrIfyi43A9q5KwTmrFzobiXppuT2w6mdr6VSpcv0LrbpxRWBSE4SUAs86QfxphT7FW9AZT4IXl7Lflo8r56R7olHDg2jPujKoZuY68HbZrBT\/DugEwa869d37M+GH\/\/bXZ+cRLRRr5R\/rEo4vTQ2gW6IslmLmfkOrvXm7VL554t6418cVMI8mfzpKkGntExZ1PXWjYzYXbBwzq0ivxPL6pLDIuNe\/B5h4hz2rTUU9CghrtMV92M+mBqBXpCRqTnMfJ\/xalyqOXCiaV7ZqHJS0QzoPb1njJl3Fk7z6EUzLmYv+DHRzG4otQBHedSmOIPgfNpRkaT6GzwFd5KlX+vrzjSEiYNSBrbNOb7eUHOVo6IyeIfhrvddcCjZA0CQMFvywtQQAuhAhPLNver+t1GCA2V3oZgX\/Ma9A1GN1++nOYgkUSEnQMh3EKqJpd7XNO14I\/lfiVXQfS5F7c\/REgmDdczbvht48AF21JjxuB\/4Pshzq4c7goz\/s46\/NM6xThBHF5XiSOg6aX\/BVobwotucC2675enmCMou0JAvK16RDojMGRtcLnNCmclzqDxiKP2k0P0SXrpH2DnqDJDQZAzdgvw1tch4edkNnXRVH4ge77\/sy9veu1n2J3W3QsCCrKD1uo5GxKGzDpEj3yHCt133BSX\/xOY7VSWQuLdGWA6RrRLTRLx6HTIKAVoS7rvVV16\/210irTrgyxHY41z137KqcqtjnSmBkL0eP\/V6\/LV0Q4HMoguI83LuwBuo+iBxzqlPHS6vNW43n5IQATxVCrUdU6kd8CW28vlHMYUnultSB5q4jxvOH2rGFijdeReAbbxTyx9IV0IA1zQLhddcrpzib7AGCQuIokDVyl9Yd5sezHKwZteb5NyhC\/aln7c8DD3J9VQj2HiNFEWXH8iFx\/MXSI+qokyYVBwhY3gfn6RumgW\/+Sn14pjFW03hw8PwMq0v8OMqGL9lNVaDhGEqXh9Vly+0qSHmPolI3o39JktoCbSyV8AQhBsV8eG11EwWuRPN8xLL739zPOLas4I5BIwF4Eej1rEt4HXNxKkDopHFmpSFlcYXu9RBf2Ua\/NGgAFgTbtxigfGlwyq\/vmjfc9BDrZrFVwPbNFNJfOOwiJAmjbXuGFNUsRTqZKNaAk8wjwU3YflO5kWfdZqi2zFevn3RPIRInrwiL9cTwleN9j0lnTE4BfdP+pxzn2DtXDwRUqhEMY4XV8hf4XZM9WZL9aQiE+dUyEYJI6SlHNyz0YH2e1QvxhAgOv0JCL0EiR44igiMGZU9neut65PW5PAuNvPac1LI0ShbMAlsASYW7N9hgV+2Q0GQijo6wY1aqSLZg43aV\/SwqvruRb2Lu4dNB9lSOL0Njr7WsfXC33T\/2qfSOIx857r\/8JW5PO\/KhX0lPRg4EHsRHJuc2oENTMbTafcYxhQemtycGfMB+9YKgf6I1eobpUrzZeqaroMFtKjdm3gO37WpTMqSecddMbY18BAPf+UV5mb+MSYcpMAlQo0QfNc9RawMgccC6wSLkOuZRAbiHoMy3w3+01e1\/qVyZSbzOUpWnfbsr5N049uvgJFQQEX5rFGemB9v8rzbA3FZvs1hXFXrCcm\/0NiPDd3h9\/dekxg2\/xT9mvjak4lzQKD\/pSK81xbXFPsXHBuvHxPa3kTSQmnMSDtcperAkeCJsXQcJ8T0zD3wMffHEdX3Xer97i+U06UgxhnoPNEpnp5XGPCInh\/jh7y85geAF35gl1Ow1hDCItk4Xoe91dvfOOcjxBaoNk\/5SmhzHzXpgB2ujVdIcF1oVRr+Bk\/4Ojev4KcXLqnLyn6OBvXtiC3RUos+\/Yl8iqHaEi\/3R6nTYXUNjWnVq8pT1r\/pH1l5V6R2EC40xtbXIYYU+RrTOaBtBmmf4YpAgdK7PUb2iYYqFnF1xVzBTWcaUTuj4ol9wrTlmTnDU4S4DIgMZFDCPdxeSyimxdAnfilFsscy42Z49EkmxmgFppVvRrrE3AplpkF+KixAUKa3AolpxzIeQXKKPAoWgbdygpxbNbeCOyVP7cGoKkiogYs1lxV5PJQSLpIfogOXtoohX7DOIlmFg01eCQFcv0k8rnzQLcIueqtECgYomZ7WZP\/A5DH3q9eTqplvVqW8Q1WB1v96ue6AT8agxxMtzaNDEvVCUDOWqW0dAzf7wYw2p478BK74AMpANzjO1sFpjSt2NLEOelUjNnnwhXxMDIoGURWWYQPaS\/0pQPMPYXSqQyIk+KDwYMklJLTiaHBH+ZcjxZ+BjsrFjDVHN\/n6fx6jrP0zegf+w3Kmv6UgcknoPKBWFCLEDDsos0z7mHwjpXiLt2hRetBZQR8k1ykampY02Pr05PRBCdiG\/963IwPrWfS81hcFCQJQNgCbbgdh8f20mNVlTC4dOcWxPhMQEfEI3H\/\/FLkpLdmG3wymX\/kg+xi8Jibz9k209se7z3tUlpiOajxn4HcUEg+SXhulSKA93ISGPdulnofhgbg0TQq8A1jhLDcHgvgYCYmyXoKTjmnets138zDSjTa0jSmg3TQZNQO6wMwnQ2zU4QjVjHGsPBn2O2HFmph7dacNZaFnU5RzgFKdhuuhc9vBW2jaA2G\/550yRQBKusBNA11e1tUsmVqaNXvPk0HwzHIfhyqMFy+mEkrexikjtHMIxmwPXIAeGsT6Bm8VLPiG1QeysdLePkrhEJyj8XDxzZp9oTYudl8YtAOBamPEApcld2Lel8\/n\/gFMuHt0bAeoflwCaYbjzI4IATNll8y8EfiwaQmOs4cdc3iF9rsE8tjCJH1DbxCBEiO7gdjIhd8tU5HOBfd81ctBA==","iv":"8e71e22ac959d0701ee1768e79ae939d","s":"07f31aa3c843b6cd"}

Ermenegildo Zegna, fall/winter 2016

Ermenegildo Zegna, fall/winter 2016