Even though the United Kingdom is undergoing an economic slowdown and complications from Brexit are troubling, the country may see a surprising result in tourism trends.

According to a new session from Euromonitor International, inbound arrivals in the U.K. may see a 7 million increase by 2021, despite political upheaval. While VisitBritain, the country's tourism bureau, originally estimated there would be 40 million inbound arrivals in 2021, Euromoniter believes that number could be as large as 45 million.

“Despite the economic slowdown, in a No Deal Brexit scenario for the U.K., due to further currency depreciation making the U.K. more affordable, inbound arrivals could increase by an overall 7 million to reach 45 million in total by 2021, far exceeding the 40 million arrivals target set by VisitBritain,” said Caroline Bremner, head of travel research at Euromonitor International, London.

“Travel and tourism demand is highly exposed to macroeconomic and geopolitical shocks, with Brexit no exception as the U.K. is expected to benefit from a Brexit bounce thanks to the pound’s depreciation,” she said.

Worldwide travel insights

Asia is on its way to overtaking Europe as the top destination by the year 2029. A balance of demographic growth as well as income is helping the region flourish with tourism potential beyond just a source market.

However, as of 2015, Western Europe has remained as the top most popular destination with about 450 million visits and Asia seeing almost 300 million trips. Behind that, Eastern Europe is third but dramatically behind with not even 200 million trips made.

While many people believe that Brexit was detrimental to the U.K., research is showing that in the coming years without the decision, GDP growth would slow and unemployment rates would increase.

European tourism and the luxury goods sector might also be impacted in an already tumultuous period now that the European Union is considering requiring a visa for travelers coming from the United States.

With so many luxury goods coming out of Europe, and buyers living in the U.S., the new visa requirement could affect more than just travel and hospitality brands. If the proposed visa requirement is voted into practice, retailers should consider strengthening their online capabilities (see more).

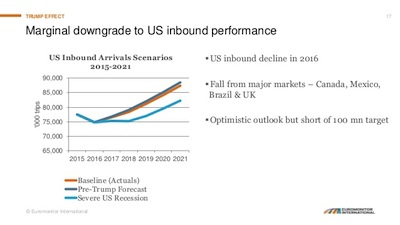

Chart courtesy of Euromonitor

For Mexico, if the current White House administration sees the United States withdrawing from NAFTA, the country's GDP would drop by to -1.3 percent in 2017 and -3.1 percent by 2018. This would be create a serious impact on travel between the U.S. and Mexico.

Travel and technology

As a whole, arrivals worldwide are continuing to grow and are unlikely to slow down, which is good for all markets.

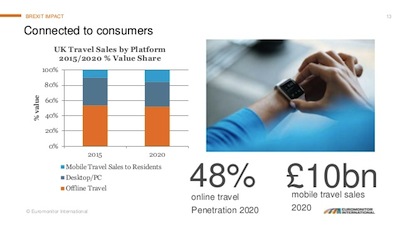

To capitalize on the interest in travel, hospitality brands should focus on increasing their technological offerings as more and more customers book trips through these platforms and also leverage technology while traveling.

Chart courtesy of Euromonitor

For instance, private aviation marketplace JetSmarter is extending its on-demand services with the launch of home rentals within its mobile application.

The service, which debuted Feb. 24, allows JetSmarter members to book a staffed home by the week. As JetSmarter looks to transition from a mobility provider to a lifestyle community, this addition to its app further rounds out its offerings (see more).

As booking becomes easier for consumers through technology, global tourism is likely to continue growing and consumers will continue to become interested in new markets.

“Asia offers enormous tourism potential, not just as a source market but also as a destination, overtaking Europe to be the largest visited region by 2029, thanks to a positive mix of demographic and income growth as key drivers,” Euromonitor's Ms. Bremner said.

“In the event of a Trump Trade War scenario with the U.S. withdrawing from NAFTA, Mexico’s GDP would be significantly reduced to -1.3 percent in 2017 and -3.1 percent in 2018, acting as a drag on Mexico-U.S. travel flows," she said. “Incremental spending in destination can be achieved by recalibrating the supply offer, by encouraging new models like short term rentals, as well as encouraging digital connectivity – a major catalyst to travel demand,.

“The Forecast Travel Mode simulates different scenarios to help identify new, resilient sources of demand, such as India’s positive combination of strong population growth with strong rising income per capita, to help destinations diversify and minimize risk.”

{"ct":"yvwTLCPm0rhKyyT6izyGSF8YN6BzMgNQnpFLtyFHEIcEfJujd169lRxm7DzJ5WltbOmrd3ZhANGHTXkxqO94SkaNmg+FV7UhqdNCP4Wrn2QIfm6opxQOiLk2ueHEZhwetS3guArQd1M864R9bAJGx33YeqFsOQ7FaO23EVkPF7TqVmJoX9G2Y+hjhbcPEZpLrpInJV5C8ufAbD5RgXT6BoDVcpR0RzYITwXiYDwj8TBGpgCjJdF0oEZFHfi\/S7ni+bPrTke659EE5UpfvJNKjlHQ4vcu\/kB5HYSvvJfgrsgg7xhXnqt+CWcvdy3QAIUAaJOlPkUYtmQSwt6lYKsWmFRRBFkDMKVWK7Pvvgagu+qKQjFlUIn3pGRwqZtrG5pOqxndQhCI+f0XlZFCi6wY5fQFNRV9EnDFvZO8O5VnuGX5\/mMs4l\/w2\/8E6X4UbymYPc3uTHL7vtmrGeay5kzelv0GWFIRjWI\/T69Cstp\/F3kH5yKECZPBuN0iNdhzb1vaUVQ+ZhXoFafwPCtNoDs0aCVJH6msWl01OLsnqAT5kDh7TupoNx87Jkc5\/fvxKttqYgGwM7CPW0bjYrDnbkrpEz+zyU6q0CifpAQvOjjSBz\/i1fOwOHr5iuwTkEjzyE7XfkFjjNkbzuFCv8Ocoqf7JNdJFAbNeyYE3DFDlAh0sbqtt49r58RS91P1srTltcN0BwLY7El01QHtbpZX6ULTGUhFO9XdS6Q6VG5IIGCMcoQ18xGC1qxDilJhdUglDa5cO\/eQeaG8gNtaeuI3OkgVZstqm4iK1ui1FNByRYR2eRb8BUprm+VdekhoIMGV0iVL1QcrSuuRsOxlCK46+ZiaauMtG5t6NkQcKoB\/Q\/K7r\/tLns0URcdtyKUKp8fLo2f0kpGzQSkrSNoSqD2n3dNk2DYl9ohNncXn6eBgImejdghZb1m7Of1KmtgmB+VQnic1h2kMCRNMp6jm0SO1QSzdwxyKafbjLWZKgy8WImPpCs6zkmA6HuPPxZpc4hPy0W6vJKCrbKUluxUalw12DpkacB6bw\/0Hee7+fVk2Cbas3ej86tf3kAMrxgZgEKafJM5awknCfJNOiuFalA9t2KhOohYcmFofqxcpMqrkDQhFaMY3XYq246nsVol2Cr6\/6rIBUuN2czb78i0qDzpFCrAfVYjRfHFn36myKb+e4k6Y9FreviAy+LlrgmBKOCQ\/zIOGOj+MwOkSbMzqOK0LNjkyrrB61dvnVov47GCRu289aOiP+nzGBiJWghIeEQ2lhXGf9XU8rauwy9QXvO5IbrojZ3ZLMGw\/zc8JeT+JFr51edVrlsauwHYmLxUK6q2riI45ZHbsFwNJ3SL8\/l94+DwrJa\/d2qVEw9C+j7XCUkMROTkPQ4J+PijR1HR5z4sIYPzoAskRX8uM\/uT\/vBR6Zlor\/sc93OYa3UzN9jYFCYIRg0YF1bPgllIV5pt1KmPnLdytsda4yDVVUmYHf6QGznrAA0mgV9H8JDNwPnqA4YyRKNssUfj0XGv5fg8W1m0gOdxFjQWU51WTqccWON+ffP5jnqUjFqW2ntHXGQ4MmmR5oTNqGmMLV6RZDu4PQ1oebvMgnnzOSQEGjgrawfxwZWgsFRhmAjbBKmq\/uKAmUW6ulwkxFs8wQf\/GTCgg\/QmhKV2X7rkJ7JosqTjPAVfmM39WATJ9xksf4bcdrb+TgJGlXxDydvGC3Rmc8fVAQClEclnhLG7xQgtOPFfEoDPshVDlonu1h3DDV6mDJiLkZOLldpueO4S\/nTir6bxSOv2vp+Rh7a0YSYgThRSk1XDOvwv7L912fOMO36wIGswO3LgZFMNeHrAJXcpEuA4lPRmxYXcNd2BIMqO3Kgpqiy7nAbwYesdOvasQTu\/hQXymN39IFoeamSgA4L3jBH2h72k\/A\/SnCD6bBVayygJ19Br9TchbrEfc3UAkZYmnCbKI2129TNIiniPt76Yjvg7prUe1U\/4QGoZiF4RhLj6FXgSEiSS6eKAuNIBe7wBuTTrGPPIM8tyefvRICMRAqMdeTZrZJK0zkoeRpZNCXQ4LVgMMnURDUU3P0vnBlYtCCJ39Mp7dYG4FcwGJfG2Wt6MlRI5jfZs6uY128V9ok3iy9zQtNFajqRxl9ADeTKSRgcp\/OBTzuH2WGDeHEb0FkQBsU8qeaDnrKTUdwaV7ZhXvIAaD2cRVvdzecnN2XiYPNNibKWMxbPfcOJm6KzqLwaa7f\/nAKfd7YXGFNk8dSSOxucxUfWacrw4Z68UcCPA15WA5IRK27NawM3zLHDuvQhxh+wwNy0RHMa7CYLJLzN\/AdBdN5iLHNo9l90O+pZtvt8ZYMS2IcQ4bS\/8UGxZPiiGlyLYlN1wLjQ\/ZNjj2ACKe16j+\/ZsuzTSWR6Xvos4wwSSs201z2zkja\/kFsZtQXcLzKs9rby7pRmnVFpd1przBT06WNLYxJf18k9gp1WLMWYOAOovAFoum+fTQkpmdwkR5kJMIVLSSl0PQ1Pd9fMiHWH9NHyv1DSkqNZOMcvD+JJ\/xAknL\/CGLGaeG++maDTcaTWH7E\/RW+05cB7qpukwqQs6lWkoUEnxNAQdiIEXOUY6rtC0VZp9VQTH5YWl8YRuArGX9\/UXqFrcf+eElwPnSYolucucaOjUQJb4AoDV2g\/N9q0cqxbcpviPtIb15QpldTsOZr4CediHeW9xypI3v\/wUs\/YH7A68O9\/09hV1p2IWZgsvKs32twhTcL4lqbWRGQ5Ny4g12+rMliRr77N6ZFkhCUBf4TpTxclyP+D+jkfYCESfS0DoEOiR\/JLXJKENN1SqgRWLNkxxNyWnnvn480tjdB2z7AeG6JiI9ZhiZ6XkpObF+rk0VDB6YCd9T4PC2nc8OI75GJrq3XtungLf8eVsWvbBNtfHuVASeM2xv3woAUsy6kvAW21fNfrAA35mZSpJdjmgQhIjestdXCuTWKvyLy6I3wKWBtfNq1DV9hgnclM6l+ZFgFDhiOxDcJORxQ+Ccu0c8\/CdGHdH1WEMTDjGc2xM\/Q67YhpqaG5j2piU+vYhjc1VB8CUMuX4KSI5sGpo53IrZuNIfO2kzY8HAVTzYfGHoi4COyMqosCczBYrnD7i+7UQk19\/xgehRPbl8yoCaynFNFvn4620KGmikvWmxaLpSe1yk\/J1c1r\/lLakOuepXGd9TH4wqbAkna0698kXSRN84JnR5DIMsxP+xcmrlzRmGy7TrXRQ5onRh64qyPzn2R8nueZxBxUtXJc6kuG7hZdLwUSKDueBJu9aKk6TswnycuI+R4fzbILNiOUz7AdAKKgyyFGHezRYTcmYsuyfTkCWrScx2LOVG+4shCfor5EEx\/36dVSSiM14mq4F7WJc28PQK3Hh16Zb4i+HR\/0aybREvVSgk9JNwH8VNu864lAjk\/PIH15blO7cBTIl6zDrgGVJaBidIdwK4pf1Jb+AsH\/Q96X0bCEMrwqtOik1dn5I0IJHfETL\/RMGhOoLf1XWQ5o0bkAC\/6GLcOhsPi2Ut9dcbc+LR\/0CyFeOXXIoxymOVBnuNnTe34oMdtoyFPeWRR\/0pG58pSiKbDzON3oh3yxLIMBBa55yYRr\/RbyTGgyBr3Kie5l64AHns8Aoot4YJ+Mtj8syt+JA+DIsYYVtacOLjg7DOzxcxVy6pHGqQ0R\/wsKMTiJu+3nVQV\/1NVlxh5i3W5rs3URgCb5LCAVAWzBdRCXdN28LzrwDh7zr+XUO2yT45M3y7qDB9oQsMNDhJUxX4KLHr0tx\/1iIp9SqZ4aszzfXEX2XMkQp7j6\/Tm+6H74Sq1iFP0YQlxXFevPOfzliqUNZXZwJBbeGXDNNuT4232VlMQN4hzBqONqsETxNVGPNOk7WDuSE7uxjIE6xOl3uKnpmbqd9aDX8\/nqxmNpK4DxPzLnekJ2NjpKr\/eBCk8ic2YRxI1ZwYM\/Jq\/PAOv2+O+L28iU2uVwRPSfN8J8+SxqyMIriCDomCp8xQ8GQT3kfnKyJzqqySbs0iQSItGAufme6dNV2WBzcLQLAgQQ5ui99\/hObfbrGRk2OND4ElXZLTd0+FtEbQnl21aDU7Pwz1XDf2dhf84HXZE3R5JGSSRmk2wCUCdIipJf5n5Sq6+rFW\/juUkHOFWCo7LbkwXSJeVcCTcALnk6VoV9GB0u52Dva7T18pESfhgSuuQvg3QPBsy6PHSE+5yPslTE8H8djbzw0rTbRKRB71lEX1XOCq4iqhF6IUiJXC+P\/5swoJsiWP6MOZcneUShJFwvv6pXfbqwczUA+YMSGKzkN5yu3kJ5ZeVlGyWonANuYwQYVYZElDiD\/HieSFplGzFiutTXGTVGdzeXt1M6on96\/Ikm+\/nfTxVfSZVzPvziN5VSWKNjv1g3UEjvYdI5U9pPwbVxAv6JgOIdeppKBzwPOdsah3wrG23tL5v\/sjkJeHmADy5t50yUylVALombnLdUEYdQvVIVSWCPj5M2Dgx9U0Of\/6srz0uZmxuA8kP7k0fuG5kH6agoOBmIazcVWV5YzQpZcCkoSzgwYqJBejMBZeD55\/k7eZLTW9MnTQ\/wljCWV\/nYm4iQX1zmWJJIvRAR0cuFmkee9p2F1vCSLTsUP+6loy8ID\/qVtvl1jtRdeV2lueWGAWXDbUWV3WEkQ8m6dxjO24Uqbqiv+wHmPuFwmZBC\/SarXvBexcfLt2iREBlXuhHJCCRc0hMlMJkyZd1gQ9S\/BBV6TM7B0Wi6FRRe0fso8K6RvtlFAqYRN+\/HiLC6YNMWzc8rlMIgPlGdghO+HQUJx9QZAHRswXymbpS02Qj0aNzdaziOv+UlST7ls\/ekvGimf9s06VIhInX0i7cgYvLpXxB+NXBEX54cjjpXzTXEfwwnaS6VKTFVmcaBY+BUkM9+vEOIa5ylpQ16spV7\/P+Q3GmSiIyq7Gbr\/zTZxsh1AN3qYn9Lr6mh7E9OafrUWZCQSjvFHDaQmQApCjwcOfsd6bduPsLhrq3BuiKONnI0FROR+7tU72Ak9qT7tVX60W7mZL74xqjvHE1rozE6vuI1XgGE2wRvVwJgLROJ2Od46vsAe3zTlX1holY4xG+f3A7UnILXuhOoRIHUqRn9ffpljNfaZglZN49K9gWbVXxDghB68IM670dOg0yFj1j+0+bpHgW\/GRXGJGhWGQRFQsJeUWPqfxtg6aPfUoirXMm5m2jJJN3P67kTc904XwXfraEKWBWCiuz1rAf\/8XALhRdsDK1VhwKfgAVBHMOzUXpJp4xJSz6AcgE+COvn5ovOiP1o7WUQh1jDfPh\/mg7iG+VbC42MRqAhwwaHMIBqMTDZm9sOutJeKOmVs8jJ+PNqS7xDFMG0swT6p9JDPNqycD9kAmi7d\/yQAo987LFi+\/OZIz6gX8jnPnfXNNVd2uR95OQa3VJZ4x7VqbDOPsmoNraYUFAp1dHB7J1+1IgLSTKJkgsi41R0Bs85XNuEVDfjmrgdnpQRXlm9HVwpNIEpt8jVR3GjOzVyW+amFRv3V5JjOI++Qu0xq3Ie1p4lz0KBsTcgaNoK5riDsQlVs6P4lz0T10P5Buenqw7oqM8JY+JWhXV0MAU0T\/+AeVycWiEmuzuXT9boOGqMYBjw53t0R8McuokMtj9O3YVBUYKyDAp3dJQ7fg4tjyzwM\/CNZggzJSVQHif8gVpU8nivNQ+YovNed2PRXF+6HDU73YQZImKCZF7Kky86HHy06mYcnUZXfH1RLzBnQKx46Wx\/COlNExeM43zXrV8TZo1OTkyslsT0+OyXKT\/636JHpCDJ2iL+9UEdgIa7u7PpzdMLUgqTX5gVIe\/+6EF8Z2f17REAd3ItCBLbqYLxHkBQCT3ZEhVuxgjqNgzfNHuoFwKCaqfFcuVuvgC3UGl+T441q9tSm+v1OAv\/Dm5kUvI3VUVI0YGd+URLmj84E8wAoRjFrJp2tN93pZrg\/tbSNEGTuoqb6feKB9nnRDXXY3\/pzV7pDpmUAE5EKPHpi49T2WP9KTfZRP2qb2df\/O6FgjxWc51VVm7+QjOdDwNLaq1esskSbzd1FFc2R\/fenuNMLH34YYsPv0M2h94kfR0xFa2Bu9\/KXVf3vPiiVsZ1u\/HoJnm8THXBrCMasSQ8HbQXWKiB2vg8fjh3tffxrlOXMeyrTYj1mf0f7su7SBKIkZ8mP6YoQ\/MCg+V1HBa3pb1I+Sc8OKLkAzBhrfrQeFTseQy2xmrqGgHB\/mq74EPDwZz+A5vNWcIJmRjlwwNEOwQsPmwJKhVv+P65kRCLpwVTz14wHBLpT8dTSiigUpNnItfSXOZGQ\/Z5x270fHTWLaZ\/TkGMeVAmxstZm2pq66QNv1Cur+8IvXfLiv3nHo0nWBEwQDlQCUVII3woM+7qS\/WUzlos41MZRTUhq8in5CnpnezG54UxhA2Zjhmwyui2xTYcMzwOH3iq5zAgbhr0VWGo5xcE9CUPGi0qdvn9xV0VWNc0ABX4UHKH8hKIGJstA1s3LogrZZDlKw2T32enL0fGCDV9tbttJOMjOFXn\/9rqdH597qpJI9TgIzOcnfIDklqh6ApPVYEuG5OhFbTWPKjeVDqKafUJr9dQCVpWgcY8Y4GNNJfbtJo7v+HkA\/sw0VfB6u14D1v3OjVaVNN\/bSNWmrETgiV4YpuHKlOUlIlxma77KDTmmBuKGnFiCHMaZsLgtDPke\/TyoBEh2ZzIEcbbKptzeLFO8jlWqTes6uT+mI2gHHNqyEAUJBOBu7ydYAD0N29pASiq8PlbfoKGDvM9cvxRT64pnQ9I9y9X8LCODt5ZIJlN5bT5Jnu3oTIY5SEpawqQWmFvee4E5QCQNbnB2jKy0Amjf\/UdSCPlaj9wmmI5LmI\/NitJ7Ee61hw\/UM2BG3ySxsJI3lj22+uIl\/qAFB5YZ1fqsDh4mYxVh0dCl+vDlRG\/qQevOc0kKdJ34GpYw\/7ttRdO3Wo4DTf5DHYMY0xtw+X8hZx\/PWBUE\/2fmM6DjgOhHpFf\/QMjHW2RhSVHjLm4f9wK2kPGFJhzqI6\/1\/9\/PCUzJJ9Qaa+tg5Xu0y\/A967SwqgjTNoxHSYVjbvD9O7CViutV+qWHs8qCrxbC3MEMNJWPHO1SMXcSnF2i0alNL6KPwE52+vZhIRC8WkFtPRgSCh6jLZ1WDJ8BR7APQkO0U\/j4LR6u2\/9xpmQqb08Cn1a1O615GBK+4rTDsFxGneY3nr0i31a4BVNciy8He\/twDeo8r8TrDRTPXtbhe4QZZyPs75nXXTfSKHSSq\/LtSneYFahovwf8JhVPryF2d3NnTEXEJGIrJMC4Z1xCpNulou2BLbWgjDEtEvtXpLixlRjVba0tiXPZ1E1IfhPbBmp6gjmxkE+Q0msNQ3qCuOEcWz3An08RPRSMFcstm0W0ia\/8E8S+0jNDxFRWymoD3oDGMzpF6\/bPaib03Ayhu7zN\/jlIbnZuGZiTOgVvHQ43e3u0EBQDmjTw1k7z6dbTqt1kgES1XiHw6KAuReBsc9sKo4yh6g74VCcDS6vxKKun7OtTJ8w6qrb12Elq\/DyhuijsC16WFmh+iAbQR0BOzRQWeFrhHx5tKdagJ0fHM\/kobi47RWAYsqbtjMAoC2hc5wSPonKKhtHUCMmnOvIlAKisVYJDHitowqr\/n0+1bMkPfHNRwlF36rzVgfi5qgofu922CjN0gfNayjMF1knGylRV1Dq5nvJDEylj1MHMPIZG1To5V+w9\/9HB+ou9KTzUVUW7CoPsIiWDekDCIcbdJMaw5qbaFc\/dHeUX3dlmGGyRPTY4nHr8jnjrWBkyMnLfPq8UKmyD76sNWqmRNIAMrsB4GZoQkp4Wq71BNBwIsgp3rmR6F2vJQXk4MEayFCQNF20R0NvoAOrmwyKE9ThggJX+WCAaPmbjP5fMbh62RGg5FVjQh3NdOSMijHjpcGDn+U+sRGdltxP7DLRKh\/DpoI0mP\/+2Jw3efP2cNmWHDxrb+7+xeuDxAk3sgnp0U0FAgE3o5pn6Gxo1WuItmFue0OPyGRE7YPXab3REd0MgRUYB1WkUzkOa7QaXbOf+qFfMPqExTRewB3FJZWvUSpkjyvB7DGFDLpsXB4VD\/UIWjqYjViDxiIDwTREGSAmN3\/dNFOTRppf0mNPzy1OV16OibCqeho\/nXx+i8lyb+XyxXwulDZYHwsSYsozYX9fvmB9btarR2M2giPG3IxDy3MUANjwFbB5PUAhCO3QM62eJWhLGuYR2k6Qnwdi9D0\/P9JpgrvI55sxRFAYzpWoTCPJd5AVCq+8Smm6Yl3TynHPVJ07KYnKA7hh9+TljRzpSq6+7jd\/H0Z9G92NnXYyEmdicazyN\/D7hu\/wK6FQnoPZeRGfCddJ7HX4fj3iIVispHLl9pv9yyjpnDJGRvZlT2pbienHlWD1sCQ8ljARwUzS8bTTKM4q2JFyTHIvzOL2wyutJoTDVZrbKlRZWstOqNKemtjB3KGvnKxWRh","iv":"1364a4126b10fdcc5559b4b904011f2a","s":"797a255a9bfe79a7"}