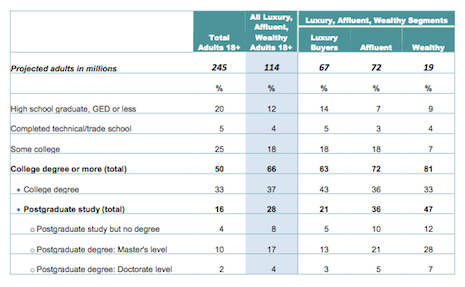

New research is showing that graduate degrees have a direct correlation to wealth, with United States consumers being much likelier to have a master’s degree or more, according to the Shullman Research Center.

A new report from the Shullman Research Center is showing that 47 percent of consumers in the U.S. are considered in the upscale demographic, classified as either a luxury buyer, affluent or wealthy. Sixty percent of the wealthy and 41 percent of the affluent are also considered luxury buyers.

“The most surprising takeaway was how many of ‘the wealthy’ report they had either master’s or doctorate degrees compared to how many of ‘luxury buyers’ and ‘the affluent’ also report they have those degrees,” said Bob Shullman, founder/CEO of the Shullman Research Center, Greenwich, CT. “Then when you compare ‘the wealthy’ to all American adults in regard to having postgraduate degrees, ‘the wealthy’ are three times more likely to have one.

“To the extent that young Americans aspire to live an upscale life and especially if they aspire to become a millionaire based on their liquid assets, how much education they complete is currently a very good predictor of economic success,” he said.

Income demographics

The baby boomer generation is showing as the largest segment within the affluent demographic.

Bob Shullman's graph for generations within luxury segments

Affluent consumers are listed within the report as earning $100,000 per year within a household. These consumers make up 29 percent of all adults, approximately 72 million individuals.

Forty-nine percent of affluent Americans are female.

For the wealthy, millennials make up most of the segment at 41 percent. Baby boomers follow millennials at 31 percent, Gen-Xers at 23 percent and seniors make up 5 percent.

Adults listed within the upscale market are, not surprisingly, more likely to own their residences. For instance, 80 percent of all luxury buyers, affluent and wealthy adults own their own homes.

However, a small segment of the demographic does still rent with 20 percent living in rental residences. Thirty-two percent of all adults across all demographics rent their homes.

Graph courtesy of Bob Shullman regarding degrees

The research is also showing that luxury buyers, the affluent and the wealthy are slight more likely to be married. Standard adults who are married make up 59 percent, compared to all luxury, affluent and wealthy who are married making up 68 percent.

Additional insight

While some themes regarding luxury goods are important to all age demographics, there are many that vary from generation to generation, making it important for brands to adjust their messaging.

Another report from Shullman Research Center shows that millennials make up half of adults who have purchased luxury items within the past year. Within the survey, words such as money, rich, best and classy made the top of the list for themes important to them when buying luxury goods (see more).

In another surprise twist for high-end marketers, it turns out that the majority of sales for luxury products come from Americans whose household incomes are less than $100,000 a year, according to more Shullman research.

Many luxury brands think of themselves as catering to the affluent consumer with yearly salaries over $100,000, but research is showing that average Americans make up the majority of customers. While those with higher incomes spend larger amounts and buy more frequently, the average customer still makes a big impact for these brands, as they outnumber the affluent (see more).

“My key takeaway is that quite a few marketers that target the upscale marketplace use the terms of ‘luxury buyers,’ ‘the affluent’ (adults with household income of more than $100,000) and ‘the wealthy’ (millionaires based on their liquid assets) interchangeably when they describe their target markets,” Mr. Shullman said.

“Based on our profiles of these three market segments included in our May brief that focuses on all three of these upscale market segments, though the three segments aren’t the same sizes and their profiles differ materially," he said.

“As such, we believe upscale marketers need to focus on the segment or segments that make the most sense for the products and services that their brands deliver to their customers."

{"ct":"Az+XvQzzMzz9n1chC+v4w6kEO6X26yHYYxUxvwz0VT66yfs6+dQRg3Zkconm5B96Ly9hXRLQfski5iOpXPzMXkMWJgEYJyxhluifayvhruxJtIJVwWdhaaC9NQcO\/qVC83hJQUGfRZDDsQKyiQwDkgjadzMxMdVz2w0usEgZd+LzOuPhqYL4yyKQ5hYveiSufMhcr3OpRxp9gfWbAGwzXHBijiBus1MtLaS8DGSzPXe\/4DSbE0S\/l7G\/+p3TEgyLUkRBS+Hd6XrWpU36lnr1tN5ho+tZFZSPeUvzDkJUUg4aWiufRpi\/YZQM7iiy+mwJ5BFSHUsWPg2g+M6BeeoDayUBhzmEkArmCipo0sp6a8sQJhqHp5QDaXzu48THLt7f00AQB\/nCNNF7Z8lQXfHvu3mOSOrwb1dz8oeRzrM72Zm1c8JnsoegpkVGgvTWb3+92k4qEV1q\/4bjZ9dY7B6ZVvrkxhftSmhxN3LIYAuj3cRT6bS+AITpnpmpp4+THTxGBoUlcTU7g1p49GH46ouIeFLtv2wCmcs7zNl1EbMOgZMBLNoRMyk1QqeGXcCDfTjGURjliPKTGS2apN9iBbR72Hk+RDHsIGG8FDPt0fg4iCMGFKMOu5LxT73ie+Rbt+oAjNdae8\/6zeny8SYBK5WFSfsSt8dqXzYRcvRod9P\/cg9XkO0Y4ZZrfJJHobtLy\/6yUnNDm4uVGD4pgfZYDPQH6EWeKqr3lIVTQ\/JZsgijCGlT6dcIeWjohK13g3JJuMdFV1UlaMCXMpuVqf7cFNCZE5Q4B+sqLxChNUqCkmaGXbuvjaQ9zaXziwlZIKGdiZYtFIT9RvfW+zDkjXmvCMcDoGADJDN7pYfRUvRz3niftaAKp6eYisbys8SQzZ\/aMHbFNRNA3jdeI8u5k4cTkbw029rcUipR5mZcC6M9lwtjwwcy0EJgoG2jD0g7\/5Y2ZqgTajaJvYCocOhehDA2bqxw7nBY5OmCEuiEMb02l3yIYnYNAARQnkzqdz2p1DT7Wawhw1B0id5D8NRXc24D94WocsWHCRbRUyVimiL6v3+zveu0I9GcE9HlRV4xSfKgjdA+3XxO69Cs\/neoa47Np3l0J6OwqSdA5dNHtSNSZNiB1RstK5QRWwsuFYwll\/uDDqBBczldCHT8yo1AK5XcRA6pi05pB6cfGogG3hc6OJ+E\/ycQBQ5cBIZF3MCpV9X9R\/8VecuPL0mFSQr66i7VI+GVu3zSZYUHu8M8zgdv241yp5qJJH\/mnaQgXcpUFaa8GTeO9nyvnFmM2toHTRjmEtHzSWHsRrz5hyLpYfGJ+K2yWqr9XkcZlvA0V5cxDsBTREBUW9NBMPuq8XpZBrUlUyagOMvztb\/cuzLj8leZuhADq2gU+YKf7oDwgc9B0MirRCfWRtwrjFESThVU4gDrHQwCxoHBmpuopTlv\/mxwWFd08zICYUHczzADibZdBfRszHVzAk\/h6yH3j9w5Tx+wFWF1eoOtdrJiNVyO9ZtWo1IVLPmY4S4g7WybhSCJyWaDsP7fgU0K5rhA9FWhb2LG2pkfN0U61w+PXe2o+gQAd9CMiDz\/OIjb6rbVhEwXsIZV3KIQ4cmqYcQzdelqnUJbkY9h5bT00rz\/KWr69Im1aJlIRLwaTq\/ciEhfuljUCnviXLyM5LHtCVSMynFmRlnqtliWCrlyumY49ddXDJsbXTy77Ldd\/MxMkrSN8Jbw2GPp8jGr9Hp5yHCBDoxAR4sZytJZ\/btN3Qg9cUvVxTh0vEbs69cmffeqC0bVOZwSpIqhDvm4ABeoDBMYpk8X+\/SdnHpQqsHkGLOnMwLDLrdFnn63lnKlfdqwWajpkcLXzRBex70Ea24JncuUBtIWKkHN5YB+6PUtipnwnwoGFwIPJ\/+jo7gG7IPWqei2LZUdMhtO2bS3fZZT4h633wxvXPSLrAYd\/IxNv1J30cBEurG3NIQ69rzmjzxQ7n3YXajWxm0uFQrXQFp\/6buEBJQzSNgUNqHDcDRpN+hYvjlTqO3qwMMl1mcFP5cM3Z8ewoiLgASWZdO0+98xLxnIyZIw1pjoKqy9JRw7E2bYN27Qf0Oqrl+fi3Kh8FI6sQzmqpsyXpjuB2AXAvUKLpKJ1CfyE+TLUd2Z4cT0PWm74B90E0kNiQWp\/vryF7JbQWAnapSJilJ3XI\/rcPH6AEfqAzO1nJrPRuifK8FC3P+oDeXDNZ14+klAgG9oLzlv+UObueGI8uTPN83aE1ZlvzIDzVXz11cIaO6CZ9Oh4WdDJ7hNOL6u5ZIafZdyIl6BLNbMFwuTVEeF5mgkuG3OCw8nzHQLxSVZ4NlHCt4aiTw6PWJCRjILYRbvxmqNdv9X9RUEb6LGj29JdY\/2XmdfXi6YRDeMbKr2VqlkcquFSM+n43uyPblWi7vTBsA64I8I8VNIBwUxKWSUwr7MvUUWOuyODBHACiVP16WLd3Kl0E\/zLRKwVblZQeOGgG+nyegonlXzQF30EOuQxEipX9VGPGMVcWc\/nKbQssJ+Pl1OGSmUbyfIYDjBb1h68yx6vqb3zJt5ZLxdSyYSa9rm9sJthZBijpDuFn7vT3EnuqZwQ4axtlqMDtaCkh0++HZ67WdGmGwQHfsCIrwp4+iAkqRevBf5w4sp0nVVTN\/Qyk80IPxATpYMRsQUX5AXJYwPtYj5QfrnvH973fvI3jKnmR648nS5VPPNl3kqTofaWxvbxeh3QI88MfdCV3Mh8769TQ7glb6JMRS4nShkgDwcSU3xQUiEOscQl5n5acnZKw52fb4TJUh7IiZ8YMrfpvkZ7KDYVpsOHVGMOBYVxWyiIrUSQ2JcZu3YQpNLlGTLFAq\/GUI34IkYB4YG5QM9dwv\/EQBuM2rmYyUxHX0B60kEMKLNGBvsYPwM1aNqRpYmqF\/\/WGCSXHTkGfAadinhpaMnsE7oR3uv9f43YLRGeYlibl0Tcx6nEcYz3Qsr4S2PTCmaD0bRAXYqv1iwCNRgWpdbtWyrIE+LRRXc9JUkCSBU33QylCKojbBVNTNQS7qLPmM+SteedNHXUMi0lJe5BGkUHd5jWji4yVLTZZoFc3msf1qOjJTHyhAPDnPAB2pReY1AzJFqsYfIXV9zbdIzZCFFfwa4k1Qs7XJUocQKz86UdmpTKM3Wx0qqkJje2lRusDnYsfH2SXIr8iEcJ6dUP5cSOJiJQ7wtMzwJWqvqGoq7KGLbz0tf463gAiJIoWwCEMvrO8q0y6w2ggKB6plue6KmShOmucOrPiZbRi\/tfa4q9aYxxW2ve9W3ktSmZNfcn9RZZwRglZcLIsMPJ4FAnX1\/P5HsuMzyCNavA+yKMkGuSXOVR51XYJd809xS9j1DGp8S83jlg3kFFN4MgTySEqerXyANaII7xRXQdf0oKoTGG8Q3paOrqqu8zmu9aFCb9Afwlp1FrK0nFpkcWnsZK0iH99Kfa\/k6CtIqhXEr4ijfTpaE9m2wIxTWQsGfmxBiN5g0jl61NodvxOyoslUKmoeCrKO+yvb1Bb6OwQnb3sHDK030Iwq5fq4NraRpvrihuzJanzRtl0i5fd3v4NZjtywJc1a3i5EWZ34lJ\/EzxIdQy2xz2fmr4UvTgSyD8GFHMsaPPAmDZlQXVWOSwQ+C9fiStV8esk8CfXkmCNVxiHX4S+Eoijat8f5bq8Wd01J607srxKblFh1cGf3MOwYkS5PTjmGmhtDQXfKqci2lT2wWpkqRdxoTRlAgnuPiRR+PrqKoZ10+pmEMS28USfkjuxQytnFa5Jsi\/B\/UWMYJdPkwgf9ZL5fnV7iC1m+8mAKn95xZBTDK8zRySlxTqMQkpWtWYvlNAxIiucxSHp9Cpp2Fpxqbqqyndxsp0Js0hfLXBjPiurjM+KvWo6EGla2Hsob4i0mblxf5TL4Co5awq82sO36trGdl0yrWKklppw\/SRdBG9BsAISbfozQfTSgC16c4zOkTPtTJkSLMzot7hqd7iPM2JA+IgwCRaOcInRcDmh7uqS8WB+ntcg+4Nblc\/ozio0kwiYYWllT1FTXKfZWGae1NhG738\/wKT1W+7\/hOUZIGZyhWoeYyOV6iDq9KIoaODNH+\/H+lpXGrdyG0oaMHnT+NuRoP77UWiXeKr+bj+WDEG7dl\/NHhv9\/jeRnx544vOWpQ9jDzpPD+Z4Ciq57WOweXCeAARDj86ut7tzPk9oWqFZeFIzSXpUc+TE4f4RIVlAOaV\/2ksby6FRUb4BHlE9J5wze0oIoIChcsc35s1r1MoobUxkRi3zY\/GDR9tuu5nOYcCh10h2HCA\/5t5cyj1jD\/mij57NiuJ4yHBeBfx7FkxCQLMp4IymJ\/3Il0gJFgyys82FEb7oA3Qp\/YteEBL+zO4+0I5ZM034GxbBB48NsN0WO0wIKUcUwRwwI8oVvVyvQDAB1xR\/df7Qo2j8tOn2RTVWOvDtcrpm884oZI2n\/gLJfC8E2KLFYpjsZzygK2weF228iPpZMjtPVUhmJrChjxZBnd7w1KS4i\/OIeVpdTgq0EdNJU8RNG55y448vDDGxK2xpIBEkfqMDT7NqPx++HyRTinpqS5C5ec3sMcsLHwSObBrVBtqu+\/QbVx5XYNq+Ujqb6wvy6vmU5Z4FC3aJpxnUjkQypnQ+rJMKi0gzlXMyyDR9MvqpydV\/YjeQW4XVFIzzNxwH\/zOHt6tpNHT1n0lFCwT1dWR+eGaaSkLJ3DF3DsR8wdeOP5hgH\/BNdGvdcPz3oGNqeKxYURkVoE\/3p9joCNRszzdF0wi59P52afjcNUG28DQ\/ATxfkihkK6p0lA873P0tOW2idC3wDxU9T0J\/x45kTaDFXV3AmuYLfjm2\/RCmqUXH5CK3wlGCZfB68hrdpHS0nc7C9FtodlspDyJdzcUCuqO8IJiPE5mOdENbileG\/\/qT\/oEoSuvkR+yUELarvTTGXKHwxyV51v19yu+z2Cu9CA7Jy2igb0yVCejfVaTRarFiT9H\/BJwGssAJTamrhep11X+G83IyoMD9QTs4kf4F1BGMeg5xeTpUUDMizzW4Z5sdpQCLhbSlD68miqXjNh+M0WGsZvrjaHAMs6hxgcVzQHB4Axt2chfmXgLcBsQ\/\/8Da1abgba47vaBG5sZBC7RylerGc+kthk7MbFSVpuzOywfINjLtT+9YXbxe\/ybSe9vdrjULxJ0xWQ9lURBzQVW7KTVguJbU09qoYOx+B99ftiG\/bMKfdeeRyygazoucEDR1lVagxsYcbhNhc3PINN0rDoUQ9beAb0qnORRSmL2mx\/HZ3O4NwJEi7LCY35iOM8PjDYr0S13ldgZQI3JRadS\/VFo6hGO\/8sIb7vexN6rJGwC\/wSSvdIAi6FmTKn8ANtVe5wK9pfaF5mGn5aYFDfu921QiiHJc3VEjSQPLYGh3HUIcsReeAMmy9l8XdknRp9eH0OAnAfLvQJZaG0LjVusAelB96Di2vcchWSBNO6837fe8q0WfeK33RB80noWtt5hI8XIM08hl79J9iwhJBgYCXDTdSa+SKTwGo4rlHcIJPCs5idqclDvICFoVklPpKUG2aSUlvKG119tk47iRC+NsSkdvWDgZge++DVdM9GHSsyK6EO0S45Yap5ErnLUSHdxoaUQ1oHFPt2xf1MKnbbsoaKTQIKfEkzC2bc+v7xqlfCc8Hod03Y4+6gCFWaQHoqgNQaUJmGrNVmOE3Q5Ho6YSimCdqATUB92aBAVYUEyLo6t2Xi1GU+M2DScfH19Smsmpz4g\/jclnJr7UKd\/mkJUcIa6ODljXZCs1\/B4TAmvr1DcaQc3yfqcX4IDBey\/vg3fxVyInY7R5sk\/TYRa4PziXJS3+EzNol\/tx0+Gg9GExKEdac2\/xJOFTVMLA4RILSvuUis2W6wa57pmve5A0oYRHKERc3SPMQ7lCMp8ir2nbrwaXsA64hWit1qvAUI7mEkZOkRytO+HmB67DOW1sxRwHh3AMElFGzfseOI5ne5XhBNXOR7vunHgtocWBkT6H\/OwHjAyLHlzATJSnYayI+OwS5zrhLIlBXTMuvBu8D7bbqHyG4rCwzSf7UZe\/wXxdC5mYO\/o9hsH0Z8tH2BygZ7LaA\/3YZ4l\/B331tSUOAPlIaYern\/fKZCkwEke8k4qIgS9BawsWdpc73Qb6FI9BbxspoFMoA3D8vIzlua+LtBWXTc\/7oawUtCOD2WY3fZnWAqcNycpOt6pADSzNodCI8GrZi0YnPpFw05ahrQhZdPgUMuahhyqwObubf23VboP2ZmeoTFW221wqtHBHZ49XMtpUTK2O+Mb\/AYewWB8+h4RyFZm854i5bEyuyoFKUkpWYYWO9kasSX9jKLeT9+9SZwPRVJ2rNf4Q7VeWvUCilmT3y6Ui6Tz2mv8gIN+csk90tLV3SY+mkrzP4ylCtgpwq4PjgOYGCUq6FACcy0VrLOdrxVc\/xSWl3mnVP5LwS9Y7sddKQOIuJtaywKoy\/2vKyT1cHxczfIfTLY0ZP0IFqwFkiz6QltyosEkqNyuUffKVOzKk3vHPjiAF582YIbVzE\/\/sBSwah6R00Wa8Og\/C9zN0CB9OL03okE21bFD1tnCqQXjtMsMnxh9ivlTlwKgZjnJK9yeJOOmPXoKGCfgbkOvw0m7EEcKw0rCXO4ZtzUm4wUXgP+anBzDzKhq2FBVSBO11V+Ph7v\/w27yvQwuJLn6UGggwyUMnq+z4gWwkNpBxrrw\/6qoeRzmipSWgClhNYcitGLO197DYO\/7\/MLofVrVGiPT88sgljlkXRupilcJtEMmCUaC0j6\/svmGEuEzb\/hZqw1XsR3G\/Y7VWSXnkARK2RvlCGNbTtHi2KkSuqtvd2t2p\/6vkXGnYD6UrW6WyLmU3gydJIc4T886tVzVYgQtixIzU3LaSc3HHKlwI7Qr8WHdwePzryUw+P0pQgOEiLRYze3zv0R0Ru655gzEe+hduCtCbzLPr\/IwfIh5DnMk7BND0eeBEyK1xFnSFHxNEmECVviw0yY3VoU+QN4IxTHIf1bkl7jMCcJw46Jtg2tGvoruUoqaaF84zpOWAP1qKh3DK08i2Oxj13Mc0BOeIJesuCEYcJoAxu1RuxwJfPiVpwYqwefwk+ROB8Kuy6KvELR8MJXP8jYLAxug8eyQtO7QooYquRSQZornSUHlEnZ78mlGnx2YdDA+gQu3M2iVrzfEd5RlOYwxJtJB9NcKZJQEeew6IDhCR8cGt3gGapY5a2i9f7ROap5F22q29xY6xm4VRk71zQgcBXJDlD62EsDlByaBykCUaDvz+sufRmn\/qHCiRMPVCGCQ1X\/z7vUTavvbxjVOrscpbFb3JZqy871lVpsYZluqVu2mokuw8aylPO0LKTwp5lAs3L3YlV6oLzL\/TxJjA4DqHnc7+riacQIaghkjJ\/qN4En1TUZAgF+OMeevFm9BmHZuX5oZbWi\/j\/lBOsyOP+GplDdKJhAI+Lm2EFTmeXgD6SaSNfE7mEoatZ4MDYaiKBshMVk5X60ejHvZ3mTNRU9jKeHPz5CEVu6fcZUsafENypJigo238zzrdAZA8\/kfXN\/QPtTa+ZwKxSPnAc0krizF3hEBC1I5MkUbYSbaGD3MRIPf9p0yB8jYLQ5D+Mi+4Nj\/mgAuyYhwq5eTIZcB1AaWFmB\/rRSGTZBrq+uAMdDKxVoE4kxkbE8fXxSjrRGdPnqYMg\/j\/e\/tuT6Djn3Tw5NwEYKpyzy7eXsdj1rEchNorGZGRLUKGZa7NTdzQSTdKCsv8I66qoESxTo\/VgK8rRmiMQPrKY2hYQa6nByR30KMR1mvw==","iv":"ee853d8866be5fbc4cc5e927ace5c12c","s":"01f48bd8263038f5"}

Affluent consumers range in demographics; Image credit: Michael Kors

Affluent consumers range in demographics; Image credit: Michael Kors