- About

- Subscribe Now

- New York,

August 24, 2018

Luxury retailers need to learn how Generation Z sets itself apart. Image credit: Vipshop

Luxury retailers need to learn how Generation Z sets itself apart. Image credit: Vipshop

While luxury brands continue to court Chinese millennials, the nation's Generation Z population is coming of age with their own set of tastes and priorities that retailers and marketers need to keep in mind.

Not only do Gen Z Chinese affluents differ from their older counterparts, but they also have different priorities than their parents and grandparents. Despite a reputation of being entitled and self-absorbed, a recent survey from Agility Research found high-spending Chinese youth to be self-aware with a special appreciation for luxury.

"[Generation Z] is a very important group in China as they are born rich and have a lot of disposable income to spend," said Amrita Banta, managing director at Agility Research & Strategy, Singapore. "They have grown up in a world surrounded by luxury and are very comfortable consuming luxury brands.

"In fact, they call themselves the moonlight clan, meaning they are free spenders who empty their wallets every month," she said.

For this report, Agility interviewed 100 Chinese affluents born between 1995 and 2000.

Gen Z priorities

When asked to describe themselves, respondents used terms such as "independent," "brave," "lonely" and "passionate." They also acknowledged the privileges associated with the financial security provided by their families, especially as they have grown up in a more economically stable era than millennials.

More than half of the Gen Zers surveyed do not consider luxury as needing to be material, which points to their interest in traveling abroad.

Europe and the U.S. remain popular destinations for young Chinese travelers. Image credit: Tod's

The majority of affluent Gen Zers have traveled abroad within the last two years. Eighty-one percent of respondents said exploring new cities was their main priority, followed with 61 percent showing an interest in exploring new natural environments.

Chinese travelers born after 1990 are spending 80 percent more on travel than last year, according to a study from Hotels.com. They also spend more than a third of their income on travel, 36 percent, compared to 28 percent for Chinese travelers overall (see story).

In China, Gen Zers also rely on their smartphones to get around the Great Firewall to access social media and international news. Chinese social media apps are also an important way for luxury brands to reach younger affluents.

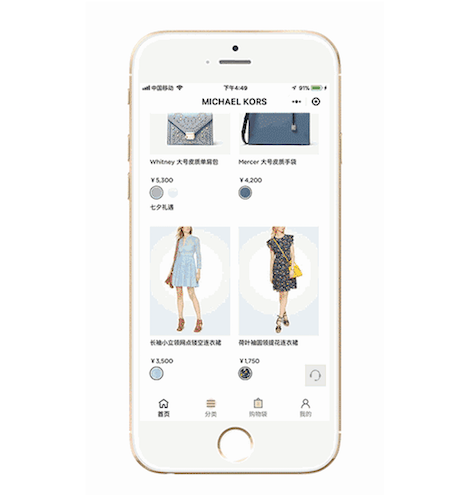

WeChat and other Chinese social media apps are key to reaching Gen Zers. Image credit: Michael Kors

Earlier this month, fashion label Michael Kors launched its first full store on popular Chinese social media application WeChat in an effort to reach more Chinese consumers.

The boutique functions as a kind of mini-app within the larger WeChat platform. Using this model, Michael Kors is one of the first luxury brands to have its own full-fledged store with complete control on one of the most widely used social media platforms in China (see story).

When it comes to shopping, however, the majority of Gen Z consumers still do most of their shopping in stores as opposed to online. They especially appreciate learning more about the craftsmanship behind luxury items directly from store assistants.

Luxury brands that resonate among young Chinese affluents include classic brands such as Chanel and Dior, as well as more understated labels including Chloé and Givenchy. Gucci, which has seen a resurgence stateside, was more polarizing among Chinese Gen Zers for becoming flamboyant.

Younger shoppers

Other retail research has found various ways that Generation Z consumers differ from millennials when it comes to their shopping habits.

According to InMarket's report “From Gen Z to Boomers: Ranking Businesses Based on Generational Foot Traffic,” American Gen Z customers frequent luxury retailers more often than millennials, who prefer discount brands.

Despite their relative lack of wealth due to their age, Gen Z is more likely to engage with luxury brands than their older counterparts. Gen Z has also grown up on social media more so than any other generation, coloring their perception of how luxury can be used in presenting a certain lifestyle (see story).

Around half of Gen Z shoppers use Facebook, Instagram and Snapchat every day. These digital natives bring this connected mindset to shopping, tapping into their social networks for help making purchasing decisions.

At this point in their lives, Gen Z consumers are forming their opinions of retailers, and they are open to experimentation. Eight in 10 seek out new stores, and their loyalty is up for grabs (see story).

"This is a group that goes into depth when they discover and explore luxury brands," Ms. Banta said.

"They do extensive research and appreciate brands that take time to craft their products and offerings," she said. "They also respect brands that stay true to themselves and do not blindly follow trends."

Share your thoughts. Click here