As travel spend by Chinese consumers continues to reach new highs, hospitality brands must be responsive towards changing attitudes and preferences among this valuable audience.

According to a new report from Resonance Consultancy, Chinese travelers will account for a quarter of all international tourists within the next 10 years. Destinations need to capitalize on this opportunity by showcasing what makes each location unique and embracing technology.

"2017 saw Chinese tourists travel internationally on approximately 145 million occasions, a number expected to grow to more than 400 million by 2030," said Dianna Carr, vice president of storytelling and lead author at Resonance Consultancy, New York. "What I find equally interesting – and this is also perhaps the most surprising – is how quickly Chinese tourists went from being passive observers of the world from the seat of a bus to active, adventurous experience-seekers similar in their desires to highly experienced travelers.

"This evolution has been greatly facilitated by mobile technology, which we describe as the ultimate travel companion – even solo Chinese international travelers can explore with confidence," she said.

For the report, Resonance Consultancy and China Luxury Advisors surveyed more than 3,000 mainland Chinese tourists who traveled internationally between March 2017 and March 2018. Seventy-one percent were between ages 20 and 36, and 32 percent live in tier 1 cities.

Traveler growth

Although only 7 percent of Chinese citizens hold passports, international travel spending by Chinese travelers reached $261.1 billion in 2016. The number of Chinese traveling abroad is expected to triple in the next decade.

More than 60 airports throughout China are currently being built or planned, which will make international travel even more accessible to citizens who live in third- or fourth-tier cities.

In the past, Chinese travelers have been known for traveling in large tour groups, but more independent travel is coming into favor, especially among millennials. One in 10 Chinese millennials will travel solo, although most Chinese prefer traveling with family members or close friends.

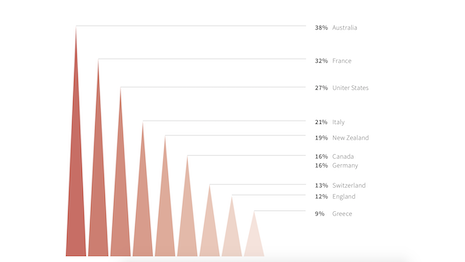

Australia is the most preferred destination among Chinese tourists. Image credit: Resonance

As mainland China has changed from an agrarian society to a more modern and urban culture, travelers have found themselves drawn to destinations that highlight unique natural environments. After safety, quality of natural scenery was listed as the second most important consideration when making travel plans.

One country that has benefitted from these changing travel attitudes is Australia, which is relatively close to Asia and home to diverse environments. Respondents listed Australia as the most popular future destination.

As Beijing prepares to host the 2022 Winter Olympic Games, many Chinese travelers are also becoming more interested in cold-weather activities.

Other intended destinations popular among Chinese travelers looking to embrace nature and adventure include the United States, Canada and New Zealand. Canada saw a 12 percent boost in Chinese tourists in 2017 from 2016, with many traveling during the off-peak season in the winter.

"Chinese travelers have become more active and have developed an appetite for risk – they’re engaging in outdoor recreation of all kinds, from skiing and surfing to wake boarding, stargazing in the desert to following the Northern Lights," Ms. Carr said.

Regarding accommodations, 60 percent of Chinese travelers still favor full-service hotels and resorts over boutique hotels and non-traditional options such as Airbnb. Seventeen percent of respondents prefer luxury hotels in particular.

Leveraging mobile technology is also crucial for destinations that want to attract Chinese tourists, especially millennials. Eighty percent of millennial Chinese travelers engage with official WeChat accounts of destinations they visit on an occasional or daily basis.

Alipay is the world’s largest mobile and online payment platform with more than 520 million active Chinese users. Image credit: Alipay

Mobile payment platforms, including WeChat Pay and Alipay, are commonplace in China and are becoming more expected by tourists going abroad. Ninety-one percent of respondents claim that they would be more willing to purchase goods or services if more overseas vendors supported Chinese mobile pay platforms.

Recently, Alipay worked with the Singapore Tourism Board to show how easy cashless payments at various travel sites are.

A group of Chinese visitors were given itineraries catered to their personal interests, which promoted the retailers who are equipped with Alipay created by STB for the Foodies, Collectors and Explorers tribes. Meals, accommodations, transportation, gifts, souvenirs and entertainment experiences were all purchased without the use of cash (see story).

Tourist trends

Another trend responsible for the increased presence of Chinese travelers is affluents who have real estate investments in the U.S. and use the country as a springboard for more overseas travel.

Chinese ultra-high-net-worth individuals who are considering emigration are looking to the United States and United Kingdom as the most popular investment destinations.

According to Hurun’s annual "Chinese Immigration Index," 37 percent of respondents are currently considering immigration, a drop of 10 percent compared to 2017. Another 12 percent of respondents are in the process of emigrating or have already done so.

American cities dominate the list of preferred destinations for overseas property purchases, with Los Angeles taking first place. New York, Boston, San Francisco and Seattle round out the top five (see story).

Despite a shift towards more experiential travel, many affluent Chinese consumers still look to purchase upscale items while traveling abroad.

Chinese affluent look to purchase luxury goods while traveling abroad, and Chinese consumers spend the most out of any group while traveling. YouGov's Affluent Perspective 2017: Chinese Luxury Shoppers in America found that 56 percent of Chinese affluent are planning a trip to the U.S. within the next two years.

Luxury buyers from Mainland China start younger compared to other cultures, beginning at 35 years old and buy more frequently. These consumers purchase luxury goods about eight times a year and 249 million will purchase products through cross-border ecommerce, known as “haitao” (see story).

"Luxury brands of all kinds, including hospitality brands, can work to satisfy the hunger for fresh experience by combining familiar social tools like WeChat with exciting destinations, from National Parks to luxury shopping malls, that affluent Chinese want to learn about and experience," Ms. Carr said.

{"ct":"8KLQ2OHdcbNHddzeceMH8a4gn09QWN9gUMdPohNeU6q5ey\/K8I1qGSFWogQaa3Yfe6whGweBPg4J7oA+bQc6pCqV4o22WBkoTnoBIkUjkQgH8gSR0FhX0sd2Xeo6hgUn4Hx3DAiQHcrpMOuTr38iaJMK\/QryrKI1Pk3XxqWSCezfmXitfOKq0qRNYcld\/n\/GX2EyQklVdypFygMmtbAmhqO+HmLiAw7qlYv5KbVbMaM7RJrI7ZM9PGRKNsOjpOGRpLDLMPUbuH5N5x2+PrKjp+piHtfMrh0qaHc0BUTPtVwGGvWxo9qmIZ1wZ+2zMfHLdTb6wzesFMnV0NKnhwL88IoA14rIxCa6HgNmH8Oc+tFhM47njRr1MXORYCJZlaADG556i1PAXgUORMtXlU8rvg+9Rf4sVCi2M9XinQlH2EQnv57+oDoEX+dxXHUc1hCtIh2eL\/cx7Ihb54GalXbL5l9SfUa05AkZxPjXpMlvfxm5XjN7624D7yavOWasyTheb9HTSe3Mci2wCNiI64Kn69hQSxXueavDW6uuXk53QC6D+6N07O7tQI+MvJTJYAXFBlQtbQGSjncRDgYCk4omDnDPjTXtsE1jpV5s5sCF+nLr4jV5e46WhzBpfye1XznytYe4CY0wJHvB9XROc0ZgzUmIKXymlMdkY0ugMumFzZVMwbDvqpqTDkc4A3ZBjSitPl8v4bcozbDyQ6zNooyP7TcZtIeA0ORxEp7xAvNHtv+AVbWz0Kr5fWtn5mVvLPr872hh6lCp1XoyvKY0EX7hDn17ABZ2g7yMgxajyVaCLh0UCzzd3tDr1K72MMFm9s8dmgrELDc8D0N8ssyL4TWPaB\/7vze7LEG15GPsFIKREDHgegv1Wd5MwO7RV5sCiboJE3mgl+9CI4ujXqbGNz0knsTkVLfmjDPQMHBfcpErfhVG+CgpJzjMCkufFDzw60Ea\/YmeuVbpSJeVjDC0q2OKZLZZuCw7Mfn1RsWk0axQg+MgX\/0cnRpQ7cyUf0sknbNP1DylIM947aGSCLi59NXEnx2ASyXO1OOfGPrM3rV9QpwPy8S1TdZATJiahNGB2HImxHTZrKoTONH15ip65q4nA\/\/omqDxbGVdHpidWRBpbsdZ1t31xRS46Ljo0b2kY0qh0FCpdFGo5qJALXiZBqzcf1PpccHdswXl4olWMpyiJhbFrr3IjB+wIXscLHM\/tNi6MMCcpzhFrxKogRpeRS\/RbJRMyxsaEIgD4J+axbDl6aRnv3KGU0XJyfiF\/54TAjc7IiRQrnPnlyZ7ijNWgvuV4ftmOF8YLHHFYd2529umTwhLFEF1MynNeEN9o5pDdHKzXZerZMVQDMgQh90E3Z7FpViwijvx07IYEfJeW+yFnGY7AodcOYHyowowqXTVB5NPNnNA1X4+L9puSnK0up+4Gqz8cQQ9q4ZTjNhYoHcQm79XSbyF5QkU4r5HG6I0HQMb8\/3IPFPRyytBF+nHHhpK991k0fLBDa0yq7hA0+umP5gQm\/jrY5r8c3C4OgBT4S\/s8pGg\/ZYUAIUHzUYZbGpiC4FJmFE6nmNfzIyz5zInRQSa2ADxIu5usgOUQjBPWpsjG2sSMXJ7doEGyslqnyZPgFYvsP7T+L6fk0G1oAOM7DSL0Qd84xQ1vxwo03xmPLEqPkwxhfWXIrT\/JwKLKXuiyE\/yl28mFK9AqiDAGlgXVBpD5073L1YCxB8+iyfZrZVafq7G3dgcHXKVlvGchoqfofjNBb9NJBTTvY6einMJFe+pO9HUgao9vLFgHsKBuck4sqTZFBvsQm0N36pps6LUFzBw3KDzMl\/Mw7vGm\/k0imIHa4lHqQlaQ4ubpbmIT4Dv2L\/sBYWLZPyYJY3pwPVMiZgOBY05KuF25ZVKserzZMlxLYBm8mdrQ0BJK9jqfiINVKOmR+s4d2gLSkOu506mTWdHg4ZmJWKQsmCrBD2coKy4Q2lnMQLT4dUCqCT5\/+0HcaYNf7B+DMEB2ok8lZoeVTNsiksaK9szTKWx91mtxeLHvkCX4+btqurlKZNdX2Q7dcKuxaUFbbpzFGInBwO8KAlsBGEoMoMpUDfbn+YRPpHIVRtYan3IekgZ0y9Ryy9c\/vOR4gSaXdGg567fy2d8qidmD0z\/2gKzmZdzKKcDpdOnvIrv7KTAb2bNDC6Umj+sVJCApUVL8OluVi+UnWQFNSvVfxp3MKb1w9LvtkDfmfP6cm1o7rw7f3VWyxCbXFzG3fWvyIlqivgmsNgwyEN7ZIrwnFc7cl0UJdYUZ48QAvoBSPonE98xtvS+ITYRsFFhdLA8cfWafrPy9pUCR\/vvsD\/WIY8uGSzsSgaY3GiaZFLVOGdOGI\/1f4hpDlpMq2mno3GNXEEI\/Z+WORjUV79O7i8ttPlMYGbNVaOE6KghrcGiw5QJ7gIOM\/CsNxGlcmZdyYKo5YTrNUjN0wtJFxe888XNjzEcMbo6IkZOiwtsLiAdJEikdljOrivWHnEiRICE1q01PrWILwTadv5ClVPQzHm3AmciOMxBjhkQfZBoNIML+woTFjaYOc0HzkfNwUA24ioRf+r4QY2X1O2bkitKTL7YuiGHuo7eLZs2xEgFLexK5pOdG1XenvMIRIoC+K72akuN6gioFbEOi0IhJA6+qGlbVnn8WesbsX5ZOWHl6\/L2uDE0Fz3YR9nXMvX+6KMwTtdgBYoZTnf\/cAKwv1bg7f1XoPq\/RAkKJ0m5QEvo8BWsgPnn34y3JdUGUn6C+im7HjmFGxm7zqojt8En61TLOg0pvQs7sqj4OfVKPLYi+jcp8cp0uYa5SRVF6a12jh0ANvXvvLf40qiTvIgAStVV+jXAHqpqh3+b+Mwq0UuBO8uQwB5RJwcpEeDeg2\/+8hQ\/S460Nhd58xP0c6mg4VSbixn319g4trhy3v346g8pd2uVmE69iprOycH03FD0tq14QIX7J+6oNUihGVHv3tptC1gECKWqKduxMAPNdB0EK3qG+A5nQQjeD4gZ228eGMxMCk+DLMP61ApfHtE1+zW6Y8THVkUhSgfI+ExVuVychTT6baTb9AVMe8UUqj+iyWBdG3DOUYIhyPB3YjbMTPrKLPZyzj6aQQ1ZogGNtnfH5bxx7SLmID39QtIgq54AeroZzu9p2M\/+EgTCf9ucRXC0YAxWSclFbYDBFlXCbacY4W5gOMvHQ648g\/GPfdwpkzrP6Zeq5rolYehgOz\/7aClbXoMmyGRhEB5Q6G1bD08ADLNrJ4gMLd7fqZxUMuENQV6ZU6aXMVaMwcLcOo9qi1cjN2UojXz3g7kFwk\/jOmt78eK6nQmT\/qI+jxV\/6sf3U2AloIx71arw\/0HfN7\/AJcLbaDcEw9zkjrVrtzxPrW84ns4\/6krtLkONZnvO7AnTIN3AgmdmnXvCFR0pX9FeUl6+Cw0tMR0oGYNPMDFG1bg2usKQwejC7Qa6XFQFzhlp+nwOqEIyoWPEvR8JoFdM1Iiu02YpimxJqoaeNwdymfAnO5oAeNWRZDceSsUsnYdvrJnLonT7ty+VSsqBrlj7U4JKRf6xZzZ2vB4SNtnS\/GGCHGmSQjyd9oux6FgDtAczNZ\/8I\/Rh5rZFfoEEhDXevKIrDQq7Hp\/zF\/13Iu67mLZtVU2S0l7Ih\/IbZ6qm5UXe6umcXuiZ9tAS\/P+faX37nRKCkCtcoSQXQd9voEN\/rsHAx7MpwiAdHrqzddef3GjOCZ\/c3NoskwJexVVbxP89T58RpwcbbeB3L1MO4ycYid5R6bFBftO2YGYFsBRFydczTWUxSghsDcjLSVEK1g8nsuAMI+9cFI7Hz2MrzgoI9cMX\/C6hkPGzjj\/uoAkpimOkJqEiJKmUfrWKOkI6XePNlnRkoV7Q93j8TDVtFjlechQ4EZkMcStoleOl23WNr+FHS1eehDo0ktZaGjzfBckcmyq6EdaIau+a8HavOzNUmgDrrX\/XANP\/M0Mi1vLFL9kO1RojfLdMI3ftLqI8Kbc2JvJFTOusf54Q70KTA4pdsuV9Y5fzyRH+wztM9w2dm9MuMGZimjwxx8ehsvpZCRjKHOpcEJu2ETr\/nSYbHsngTpVzrwXGXKGqcLwfaTeRcWdwbnwutKyccgu6DfpLGT1s1ZCli0fo26XxgdYQAEv5UtTLc\/I7VcpfqosU5+l3burp429HGGQL5QtalDx2c0XxMUktiRsjo7g1HiqpwzRdYUCn0xaLw1Zbj1ZQgjbFklkhdWAiugWhfXjIhWmTcvdjsJMvl0W0pdlOOHKrWAt30g74KjXRlqZmEWpLkMBXBn7QTjze8WfK2kjJk75L5V1ycpgDqYugfw2ZUZYiTXwjCd1G6iMhXux9xyjxoOEzlWV1Krh5p2Jmzr5DT+TflUDnHo+UjsbwuPHfu3snygX8Xr1P96Xz\/Xs1daveCNGkBKQBFMINdU3PBUTGyZB3XvJdQc5ZbKEv4rn5\/XiuAIJ\/KenN62K\/xYuZhAEKKtE224Op2lL7tD329nyaO9kRQghrmu\/wVxIlo7jbySb8RezYEU7gP5DcObttfFubSjX+cBZFkIvNCdyb\/x9HDefhmjlPvwzGMLqHdLHtmedFzCXitQaIEm3ZWvzrk5HWdUsVLbSDLGfSeUIV5L2jpsjjVABFYNpm6DSwMUxYCZtbltgibopsSFlrmbaGsOKHo8gux\/pZO4OHZ9Rcm\/tbI5eZKvYIo3DPkUOAoSaUsj506bP7At2EE2lj2BaJdgoivUZW\/BzpiiIvOmvrlviWtUK8SGtIC2Yj8Ou\/dlOpwbfS0SF7CXiVSSRUjkPTklZGe6POdgwtTVVKWkjEwQRP9UTlLHteyUNtWy0RVqVZOJGMeZLxAlwPME7PJMT1Mz2pKSpdBnPuzRXZALs1AvBu3XNn72k5z0Pu8t71fejN6LeR0YXp3hjtLRGmF2aWSWMAnFxuUX6fpbakCvGuthLYC460ziLl7jBrMGnRlBcNH8hrSFPpxjzvSHZl4vrzWEW5lxzpKQSy36Ayhfvt94zxm+WqeTPpb0ey3MsJ3kVNjsn9cZXH9jNnb+G2wqDT2zMoO8QrkcAi6HAmWiuPRbmHYkY5ZCKP8p9DaO3G0O79VXqkkJgDb\/xVJll5QeuSKIWqcX4Z7Rte\/2Ps5+mhzGtP4RWAfbURg\/FcVybyrJtmh8aHBtgB+FMbKQW0A8VATbzbQvyH0cfSVjPA0XD8Ty0Npy07nE6Ey7wkTNLi+TnsAO77XnDuwAnVlvFIOeOoQzHTAFh865Zgs0U66+IQxIiwI\/2JSV57EkAp8pUVZFyzYn2\/HXFSAJkZfwurulNBzIm7B7y86b7G+ArMXCvCcVhLx5Tr3pgufwOIMalNKtIYhJFuIj17ymvuOPXNEPh\/cRAFrdToPr\/vYnL37VtBunRHlgyt1rqH03jDz\/o3xTw\/kHnR3mcK6evZgM6g5m0NB0KXE7boAOk+DSlteEol7mj248gwjpEpYnLsKHjPo56lmKI\/KcAkLSO6JNply5Bh0Ef3hL8ZLHAKwlHkzoUmfOWvMnNyrpCFW3ukI5yR5zPMP5mbvpoaKzbqiwh7AzldLMNIPS+aAcL5DFqBvwrNrpBX92UZhw9mOPu7jLkxY31hCgDrDLS+DFJ1LmWadkwkT2rF0A57Ud5ktfgwExo5lfNhRvtDCy6nXCvV2mRrsq3i4x0\/Y1xUxdg6pAOiJtjUUZTsPjUJYAlYQSmfbIC5aFjggo787Qo9LTQ5siPxnxOn7AoYRZDwkmER0m52+CVmc8nPUyTqBFJwIM\/jrQE23iXep8dhsAEcLqv17de91B7lpjyAbIdQlBkVok\/c2HexNEufLwYdhKRN4k+xsnnVpTIuSlATOlNte3kCcFiYMK9TBMcvb8LmgXC\/t1o\/8B\/TPanhwyv05JKgmedW4zuXWEfzcPrOgW08mS\/UgC0C9MuNnHFF\/1oisOL7gYdMVafPY6EOSsFtIngNmSgsBm4GPAm3YlzToqv1pLvew5s4kgFcpxkqPWunoeVw9rVJjmFBQDdypEk7\/pW87+MjCzcMIQ5BJeZLrGBiIIb5zj043gQw4vxASKfqdyIZ1Jp5YyVbYl+3DO\/KTuzIBJ3FNIIK9ZWptN8xQDtYnJfbtCB8jfdVQALXlHiarh5\/LjPnRGnXn0mJ0wPTU4pMQ7Wrljr8DKp+EFz7x1T76zzAH4laAIP9XpJGTSwEnOL7yXJzxxYRJpCoyU1yqxr2dx2P0r5OwGVnyoNN4KRkfH4BhAr627syn7QvbfG6UixBr2J4rdWH5Af86N36BsZ+1jVoH4K6Wf+BUmg5fojxCPiOTCBsiDRpnUTjF4W5StKudhHBfAamnj2CDwni0U9qM95onG8gfkNN0QUQPduYSsQ9F3WHrfjKOXYnIq\/CMT8UyWzXMiVYDNnL\/8LCJVcf5sTMvPZnQw3KrU6h9l2eHpsJrg97xPIZPzkB\/5WnLJamgVZfMSwnj7z4FHIM1vS67L8yLM9km+ILxCqpBn76R3UrN38tK74ZswzBWLUdGv3S0F3jVRlh3tD9SjWTdfhcsAjAi5TSM1qqoNMxDNcNqDoALheSIQXUWcW+iMERfDA9rPcY+udhNzuWvt1yMhGQWZB2nEfFk0FtrdFvQd8ToiqPTgFyCnNqUOnTsvblYxLXXgza2H5UREgZRRa8F+1W5xF2BFFg5aIMFHP1BMvNi4hxhOKyFJJW6I7N4qF5rUlNcSIigyBTeZkoXn1Fa61z5a\/Ka30YLKfeTSTzv1+Opkx2GyVCmGF62x5jBh3dqUD0bcf5y3B0zye\/pS0rDTmD5ZF4ytcPRIlGOCVCIOvn9IeRftuN+R0E0Zc2g5Sm57+wWpHziK9rxFpHMtCwxgeTQxiE1pUUL9lIQVQy0G278SgREvzSsCv0lTzaLJI\/EuaUrKt2wZXRC3lnx4t3EuwcoVIrNh5PR6drsSpJLvqZnCLSsvsBkwUstFw0DBiMRgEof0DkeYdOgV5ih0qgkjGf8D\/IqTMlr7\/f+pjts\/1CMJ2PnaVpyhSiNhnGoYIGgeL1KYWE2fJZoKDtofbWY3mTvP9uARlJyzpDMeXBnGynqUHe2rOiVL7HiMIcHfdRN82JhBIdI+xFqh0giRa09zofZWKFNLbpKLTpvbWwB+4OPg7K33+pIWC0wJqi0c2TUGQCknTzi8PROKSDY3dfCFX28Biu3njV6pTpJoah3CBtch8cSHCe+zp2v0To80U1p6LuV4N\/nQfhTcMgddVw+1NEkECy2A9YmWAkbufnQTMg++cgaO3Il1MOGsndUo91CyCtm0Mm4x6hyh6ZWA6\/YQQiRpntQMp4cE2CLnmvGiqmLEJLTnRt+PuFk4smWDNs+i5eHm6Ur3kN8Nrv0WwGw4F6VgKPmxrVzql6SZoTWjIupnfocg4bIPSm\/bSQMPKsGtr4\/iRouwI4gOSmeyAtmZT0NBvw9DxlfSS9gp3aJIAwADQrjCJ\/MzBAFt4uJ1kqCA1i34hyvD+rEeJ6KLixHJOUTVqcp0DrUwDkUIx7wOQn22Smhg65CJmUIG05qwYuVu8NeWrjYPpWVXvRUsXU\/LNHilJrjJjQqgC3uHP7s+TH59W3a3ls4x1U6IHzZ7HreK6JoVpTcPz0Nrd4cNu\/UZV72yXkHA3qHIGdkVXfZSJ\/jIoPs2CaI+xkroubTl+67zSXxP9xkQUhyra6gp2E7YlxY5TPIEFz+VZ6mEXnXIKMi0WxaNiDp8RKb6\/k2oJe1sGOsAkISwcCzPRuWzs09k0CV8wwkBkGF0diXFariuJ+OjLZ1DclVgJOzYP17BDuqVh1cNOADvidJDOvG6a1AiXL53ievmI8\/0o+EqSHQNmInl3+1BSe5faoFETugnVYefT3SyGFpc2DqMvqW\/RrpvwQEVPlhBy5TFDiuqjg5SxOWQXsoxxyMceDPZ3PXEqfkhcj731bOY2eUwOnAlepIIODtg5tZYO4116rhZ6F3zuPgv0FFOvni859ANOCy9TUgBoYhJ4Qw8VUhbRdFscATPAopkMx\/wg33YHnezkf+V+5Nf9iJT2COMqtX07\/PRgtKf1a\/BZ1vweAr83mky9SR\/DJdWTJnDR5sJo94BrE466TFoS0vzbUNFPxQ1peFf0JZIKSarVvpc6T\/yIVbASyWXxx4yaFaumOKTlZcWVUN3FfwaD5dLPMZLobxL8zGTYetfVFllx0aaoWShBJA6pzIBdkou7B5P96KSzR3YCIwFdF+T0MoTjbVegyz+\/8Yjei+dWK0sVKlHsCS6kv8Cs71Gijtf9D8IulLSYMUGfG+Jop0U6s3pilXCvSrlI92cxdCyn\/N5eQG0JelSeUilD13gSnFiHSfycLU1+wYb0R5EYvp5XJ\/RrLjABiCd61EMwmA9wlJoY4jPqSB6HgFzGc6EoC9fQqPEz1ie8jmJDLX1IZc6WGyWYT+RkwJweQnX4fPI\/NdNVoDRfjK2X1ES57bN8wgRIZ4dwP\/BOqdSXwP2Utmom58DZLOZtm9zZMyWkqK6OuTwXUEPsiX+Ckp4C54Q\/wYHynH26pikmkLhsjPmXHUB0RFdzFdpSEqiZA+7NmH4PiIDAn4plNZKXKP4BSc7YG\/a8tEWScdElADAKdE4Hn5PrSnsQRHo9SQmlOW\/E8Lz\/7hgWB0QLcQZROxUJjN1+uY1PUKBgrvYPESqbYSjtmOSJetVttQ3+2rolzab8avDuDaG\/yuPAPXWy2WWXmLMVm5S9fIKlNdXR5w\/F9LaUOfCX9NHunO5vjn+GL73uEW19JLWcHhJsgdMiQW2FudAaZeCRA0yj7h8t5RCwP1nrRaehLwCPdXd0nsldGCT9AKmCNK9UVy6nmogNfosMj6lhBT20S8ZdqaCH\/JY9MTbCga9Hyg9GnDaYnD+ZIqCbQgtCpMHEPXIu7DPQokdFQt3VQ5jfSiKVtdgIsuG8GuVAyJCXr6ocm46X3gNWCg0F4zkxeAZ0XFFqzM8KpnbuBtAWAExN0\/7C7UCamLUTy5dkikIyMJg4mVY2t6q7o3Od2YJWFXtSbN4IcodBc56LTr9QeEe4o+SgLDtaDX5Iq\/QHWNdFVoHcZkBs12AZT1oOQtqHdajyz1TjAT6tNgzXlW\/JtMBbJHY3cI73cKHsVYOP2IjwpSRcF206eVPykjOkXQMu5qBesBF4lTi1Qj6izfcy+6UvkKPoRPIu2L3LZfIHGyAlGyBhAX6FPSHhwH0rvOys231BfIjnntyfFQXXlSQ40sTvvQpHqzrT12jqatGkizcJuW31Ms\/9lEZPDwGKew2nY6oahPs650X\/Bwp7UCBBGIrrwnc7jJ7u5bf1syKhdOgLLykYiuqvA+C69G5brqMjL7BFIeSBIyjJVlWQLZeEMF7DAc7i1ZmMuvBSiprM4cAj3t9Iu4lP3rA\/o4GmAAI1W4UCwVlRCcXz1bTER8FNTcSnou3gQ\/Wn4GvMjKMtbFMadGqT2Q1cfFq4LSJ9QJHoJyWhhZ8u1gvePMh7VWCYHlMXW9hSfNCluuxGM0ssiV90schcMmjsFbS5psyIBbm2N\/pXUJ8iQtZR+iFuA1p5EZdf2vZJNZ+67YENodpXRAFaTsQD+yFzeXuoVnM1As9JxlqxOH17hy++sfq1ng15RLkisF\/UlHpr48MQ2krbargNrtWm6iZl8qfjALMgqQ3DUY\/TmpXlKs97dGN9kHnioNGGUs+MqxSp51M0OIlkhx1BEHar3YIexgzXXckSnzj1T40cbMhJWM1qSnZZpfZc8iHFNDdAoT9FL0Ki2p+Oq+qSqXpjDs\/zCHZ1KVi3gUdcebScvZt0\/e9ej2kV8iewgk08tH8CkeiQ9pjWejYGER0UO6O1Adybt7InBzIMBMutTgAenBTw6uuaS2rHUL9OYdY4p0y1HcyDn81WWsSLagU6eMxcPujIK3xr763eb3yXTCs2A5FEnEQPf1fjfjHX9QbzFBETQVZd1wm\/IgmyvHgcvH9Kg7nqv13JF1zOTS8V261x3s4Lh6n4+m92w5DRYwuD8hSB8OVYuUmld9dQrl9YNhYZURQMRrkt9TZDrcDo393g\/EmITHLwoCy+a4jaY9JQv0VHy9qT9jgYvBBCWp9\/Zj8laAXREZR2oWLv9djVmYCEAJmy5+cvOXf1e0qxlBdLaCtaZEUwKEVUMtchKfAFn3EWNY\/S5gg\/jxZs43NESAe4oN49SJZ1bjdKEq5WkBntj3qLmL9Y+jRiQ3a+2BWPi6hWp4Rb8wfauLOQ1V3zoWoFHcjhJ8j3APjBpMg7BzX5IIH\/IiVGNmJvz6p4S4f7KEIXlfEQ3v9T\/WM7\/gUrQbtQCMEI8QHf4zti7XVRBVNxCQQlpO98OY9TZH8xu5ossWwGz86TbymDvwAW4UsHkIqQZ0Dwi6hFmO6J8XrprLphgobhGSjecfKwOgNP+gGZ1rrzvDUKvKks+x4CGoiYwzYTRo4VYtNR\/85U4farApxvy174+rk00rAcZHwZDTdwtDzbc1X\/7CmlmzhM3LscOcZ67SfAyqj+ZDUJ3Fci3qixwYF+r0KZ1n6XZvmX8YY4udpHvW8uO96XnP+WLEmzZyNroligtuOuXB7XGRsVziJxzygeB0rjJ1KWYCfmQVr7Imixl60VW5KA4p5IewNN21v+iENL4cbXeIXll07rxqR4ywztS0TvRaTiVNJ11uk5MlIhJzCgGV+z6VXrlBvdrlqbVyIOShbp6HhL\/pw6MI4XUgKcasBAFjzV5c2mBhgXF0GgtWrYRPz6Spl1JGzbdPZLevc3kpxbvjpz4ZRzkUTRKKcHCJAuE5wjrE\/AHggPRzzibyDGHWlVeJqk7K+SpOJCKpdw0uv9EXfyxsGv2xVuWqepcTuF2iuW\/SLhr\/zk59488PgGhRgKZe+xjz0gf5mFa0dd2xabw\/Zi1EAwkL26MBn092jTYYDTmM27d2e5o3Nj5eYes5Rf0eOwZfGtslsrH1AJzTN7Ha4mzQAPgpBDknMIaG0k+U6WOZaCmTy7BcHt6WYwfERLOPTA9OUF5bQ9q4GpTIvPVHvTe6VWL9qb7W3YRhnmu0xVbF7ptO0tzI7sTuhmGuhvpwfUfzYVXwE667DW49x06eOxF3H+zxLdydxENC590V\/8b6KT5GqLUwyZKAx0EgDSYd\/GySZlPIsR7k7elZDYjo7dZ4XpRGOPuid5bJrkEirQYkdkwTaC8BOJrJore68u0gh8Q2MrtdjrN7qwEWyurnYeq39njEx\/vM854pWR71wluyvdyq5+WT6ZtoKC9iW5g3ArUhMhF4GdjB8h8Dvjft4Oe8aIee10S2lcLtS22Ngyto5R7ll76hJw0uBs8xquyDg\/yNetRhHA=","iv":"2c04e1a050a88fa1a0d425a13c7e3610","s":"e6ef0be9a1d01362"}

Chinese millennials are more likely than their older counterparts to travel solo. Image credit: Resonance

Chinese millennials are more likely than their older counterparts to travel solo. Image credit: Resonance