Despite geopolitical uncertainty and tensions, a new report from Knight Frank shows the population of ultra-high-net-worth individuals is projected to rise 22 percent over the next five years.

Even with Brexit on the horizon in the United Kingdom, London rose to the top of Knight Frank’s city rankings in its annual Wealth Report with the most UHNW residents, making it the leading wealth center around the world. One of the top trends among the global affluent is the push for stability, as they emigrate and seek out international investments as a means to guard their families against economic volatility.

"Over the last 13 years of existence of the Wealth Report, we have looked at the global financial crisis, wealth creation and the decade of globalization," said Paddy Dring, equity partner and head of global prime sales at Knight Frank, during a presentation of the Wealth Report hosted by Douglas Elliman.

"The landscape today is considerably different," he said. "Geopolitical rivalry, competing for the wealthy and the rules of engagement are now different as the rules of commerce are changing. As we have seen this decade of quantitative easing disappearing.

"[Nations] compete for the wealthy, but at the same time seek to control the wealth inwards and outwards of their countries."

Knight Frank’s research defines ultra-high-net-worth as individuals with assets of at least $30 million, excluding their primary residence.

Trending up

About 43,000 new individuals are expected to grow their wealth to the $30 million threshold by 2023.

Today, the U.S. has the largest population of ultra-affluent individuals, with 47,000. Existing wealthy consumers from this nation also show the highest level of confidence for their personal finances over the next 12 months.

However, Asia and Europe are poised to see stronger growth over the next five years than North America, with a respective 24 and 23 percent uptick compared to North America’s 18 percent growth.

India is set to experience the steepest increase in ultra-affluent individuals, as the wealthy population climbs 39 percent, with the Philippines and China close behind.

Some have forecast a slowdown in 2019 or 2020, but there is still a positive outlook for wealth creation. The global population of affluent individuals with assets of at least $1 million is projected to surpass 20 million for the first time in 2019.

"The uncertain times are supposedly going to have a negative effect for us, but hopefully that is not the case," Mr. Dring said.

Among the factors driving growth in ultra-affluence are real estate returns and entrepreneurship. It is generally easier to start a business, allowing for more self-made millionaires and billionaires.

London has the largest population of UNHW individuals, followed by New York, Hong Kong and Beijing. While New York came in behind London overall, it has the densest population of billionaires.

About a third of ultra-affluent have a second passport, and 26 percent plan to emigrate. Some markets are making it easier for foreigners to buy property, such as Italy, which has just launched a standardized tax for non-residents.

Real estate listing in Florence, Italy. Image credit: Knight Frank

Meanwhile, China is making it more difficult for its citizens to buy real estate abroad, requiring them to gain approval for overseas investments.

Consumers are attracted to buy real estate in international cities based on a number of factors. This can range from practical considerations about their children’s education to lifestyle-centric choices.

For instance, Chinese real estate platform Juwai responded to the demand for international education with a platform dedicated to helping consumers pick schools and real estate abroad.

According to Juwai, China is the top source for outbound students, and many of the parents who send their students out of the country to study also choose to buy real estate near the school. Centering on this relationship between education and real estate, Juwai’s Education Channel provides readers with news and information to help parents pick an overseas destination for their child (see story).

UHNWIs are also global thanks to access to private jets and yachts. North America has the most jets, with almost 14,000 private planes, and Teterboro Airport saw the most private jet departures of any international airport.

AvYachts makes owning a yacht more affordable. Image credit: AvYachts

Some of the top destinations for the ultra-affluent were the United States, the United Kingdom, France, the United Arab Emirates and Germany. Knight Frank also found that June was the top time for traveling.

Asset return

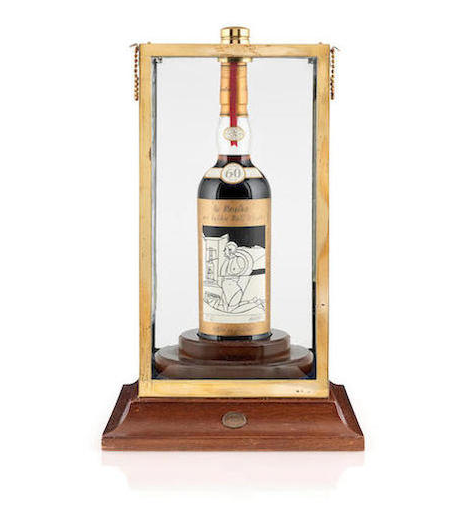

Knight Frank’s report also looks at UHNW investments. Among collectible assets, rare whisky saw the greatest growth in average return, rising to the top of the rankings ahead of coins, wine and art.

From 2017 to 2018, whisky’s value has grown 40 percent. The category has also increased 582 percent over the last decade.

Last year, auction house Bonhams sold a bottle from Scotch distillery The Macallan for more than $1 million, making it the most expensive whisky sold at auction.

The Macallan Valerio Adami 1926 60 year old. Image credit: Bonhams

A rare The Macallan Valerio Adami 1926 60 year old fetched 848,750 pounds, or about $1.1 million at current exchange, at auction on Oct. 3 beating out the previous record. The interest in secondhand spirits sales is driving big-ticket auction results, with whiskies and The Macallan brand in particular seeing record sales (see story).

Other categories saw record-breaking sales last year. For instance, a 1962 Ferrari 250 GTO was sold for $48.4 millionm making it the most expensive car ever sold at auction.

David Hockney’s “Portrait of an Artist (Pool With Two Figures)” also broke the record for the most expensive work by a living artist when it was auctioned for $90 million in 2018.

"As we’ve seen these record prices, we’ve seen the wealth growth slowing," Mr. Dring said. "And the number of wealthy also slowed.

"So compared to 2017 where we saw 10 percent, we’re now seeing that UHNW population growth at 4 percent [in 2018]," he said.

{"ct":"VAM3jtaHhzYzwLQwK+ybQ\/jdbT4f2SOvRXHK7cCpROp4Ua1lBVZlsSz9OsNXzN3NdyBCCbsJmQlTqVQsRGrrnyUXHGU7e1EyTaNtC89AchSi2OCY7rqs5Jgfd+r438JxAHWtO0Yt7NYs7PkPraYnD95QHe\/3onmDJo7wRHW2x\/q7sSxqREC6rOLpf+DlSnkFRdMoegKMZEZ6m5Ff0vZAdNQ+alcKC\/DcNS1xmEmOTkskLFcD+MIIYNHDaz7PtAo4s7aaUiKpZcOO1vq0gNjcxL\/uvys4nhV8E9MGEP87sP6rn6pe\/1nC\/xihYUoKceBCAznz9Ht3N0\/9ZRGToIM7bEI21QC9NEwby1qNxf6QJ+zg4dV4wea50GZJ0\/2Rwecckb98bZ6VxODLsNkEMq5b0EHBACyZsMvfEI1eUU9PLul4+zj+nJK+dgrcseSAduC2fwe6FxurPH0rJRyV6AckPwlrQu4ANhpKPOoW+1VwLNDbzWTuoEaRIWDghbdAQbJs3l9SCo1f7RE6ggwDhhJ7U821ZzUWXE5C4DtNX5r\/Tyi3r7Dhqa\/nP40FD\/e\/Kmqc5ns9LAe8uUUqOzlfwA+02aAzQRzzaNfXDtcGVeTGvo4OKtvZUnwY6T4OgY7P7NMJ7EoI0EJA495piW22KeKj+JGe4Fw+\/wOZxO2QSIjFfq45HZ8emk6UkkFaTxFHjyuVW623BRiuJk+KdM6c7pfDpOSp7QslWhJ7oVh0iRnOv6zs1bBSxWtJ58zH6iBTiCoJb6pVmtS+jGfqquK6ON\/OBCVBypG7fFFSZOFmfGhHSrNKojGuLJslg8qmf3k72r5edMxNG9gDdNG6Ed9328x0U8eT86O2O8fC3fzfPJ+GVUHckQFGKBBatJ2qFRngHz1lNxmJGSO0vM0HrPWlscsiJoY88Bw4p02itWoThEYgvfmq9vtCof4lDzbH7wwfQRdZOVgFLcD4U4XXSy\/35sP8vygybwGD84ZSmMZa3ugFS5rJf5YOZ9+hmWAhKWkhiSSZddjFKnfE0IUEWo\/DJGKHxH9o3zMk46K4Bm3oWbvjJz1I3f0CXBhAcM\/h4K3IbxbNMo8k2tuArzlzwbtaIsY24JLY5pAmTTUn2fiBXvvWuwF6XxeXyX4o6n2+yKbt87qj\/D9n0r94OwDFV3VcbFOAKbgcp8rA4BqtZrnmxNSHVhmCEIT2u5acoRI245AkIutv65xq7eSv\/pFtg4pL8oHQo1hsvsivR9V\/Etvy2XvLPw7r7\/fM07kgeFXeyBS8OBlWUIAm9q2XC1AXb6SWoxWdLo4jsM5w0WBWan6dkY4sezIsd7eZLZpQ\/TEpGy9e7WRc2GsDU68Sx5hovbjJ6EDESpuprf0G74sambzktQPv2CFzRiMBgk2PiVUbCcHGyag85E4sL+loGK21IYjSDZNcDtA\/J4LRqSiIQm2rpWYJPYPCmrMLa7TZyPfXitJE3WJhN4k33Hf7JmXQ9ZPEsvk4Xmbr0jTDll5yEARz6KS+EpWIBnjrJizX9uLEXPXJtn33I+pTiVFj6m9XNwocel4AQ97PvOZb2ePGyoc5E5gMaAi3e4cIK4KAVd6JSkKrsIF5SCfC24NsZyn7ElNe3rchoyot9BurEbthiWbtUmUrY0gNLikJPIcS59Nk2je9m0g2FT6TZkYXxXo24aYVZh+JWaDUT8xHcz1BhyFQ3O4fVf5IPOulPIZTNvlb7u+1wNSTJZOAtDCmyct8FAMKYn5orIbcuwxsVDIqTNwUCYow0w47pW+SkBruEPcxiXcRwJGRVdefEraswgdHjpEK5fEmhK2ihkMMxAHnp4zwv5Qbt8Z+GKs4Rk0QHto\/uR9C0W4SaUCSJjsxwtNArc6sVkcZ3xb7MtfzUlE5eWzOQm5hLj\/jQPpjjSSVIU4UlgBhCyIOKJ8L\/tZNZkEX6o+W0ppUU5t3eAkQr9Y5imXoC9tAqUegMWhISo1A2gdvDAAC7EfZNueUQleO3B2zGgbmSlooH3R10e7KkyKueigOuznfGpM+dh8GYv\/9AoHy1elJz5nqQFOJjYluy5J1Jk5ihL\/pdqfSmrvXgOfqx8BgLCPfst20Qot\/uo6\/9WVPL2o861FPoBU\/Jk4Au4eMlrB4a7Xw+GZlRHX3vfWmb2VDm5W12qdt663mWtEyrfcGOFNHjO3uy5ZTVdYwYv\/6j3q0DinVr8kX0z6sy4\/YXLQq3S4ipAZdx9\/oiPUYHne\/q+wDFvq2tOnsnzkodshbsaE4dSOGvFn7BMFgRi66HAQGH2SOBJq8CGaOKSV1oy7xFtG7zoaNtproDsPXCKc8FoGBW8jVJkdlzWRSbqcQFgzUPR+XHlO4DKTNlJbYTYnB78kKXUf\/W7PxGnpoGsQfa8+CzRsKMMksMwXkxQBXNYi6PsxRXMeJilNeIJVGe1EH7H6RE7Y2d8RDp07dAB5EKPwyPXDfJhy943NBNxeurxSUcUa\/bxijgrJz14WDivEjUlXDYZrFl6RMKPB+8jVrgPZvk1Yr2ykYRtu6MZ\/q8SSQlM5eE6aPoap3QAG4nu+cL2wV\/KPRqftcxzDKPu9mHCoC8Q6IqBfWA\/dkM08S7cnuGbt7yndMYB5kSCQSPGuHxeOlgiIv\/Ox0ZT1fylRzCcS3zxc8xVguutwL1Yrj\/ecYbHAdJ8nmvZ\/dxKhyvzzCVUDcEKYeJ3xX6T\/+zFevj0A\/Vt6pDewYbo0YdocIYAJgXSyTjjyp6FaxbdqcGIJoInHqeNAuIdk9cPIXVhL47kiIWdgioNJo1+YSErNZECUXqVAmaAHheQQCK3SoCZfZWi0qAyzOvpP\/cHPUSLANxXfaMrO+k3QJpYSlBEv2soeBGT\/7i3KK2Cmuzz6P15vytSfOAPWyXXbhsuLXyqFYrVrB2XP02hRPPH7zjgOXgHetCU+1iDZrTC3AcHF6aK1UKL2bPktw\/6mfOnpalRCXh7FS1qQ7Uo3qtAt35P5wiuRIo3Or8T0iTonHgxfanF9p36F4KYX+uFgS8+25OXwR6e0EyoR6GKh0QOldgdpQrZvyATtrcFLgJBz0MmVT9xaUKbGiew1UV1TlIcrVnaW21K5S\/bujN6Fly7VkIo7o\/3ODFxufWpqLhOzkJUF2LdwRC0idfR9HfMcGPMWatQ\/w2ea\/DkgrV6PBK6z9v75Iodr1H3KAvodfoJlm3MFilbKvUex8uds6NCxMLG5RtCWPn3Ca9eDwsVKY1L2R9GI1S4qIOKzkSOAjWP+a1LRsrxzkGp08gTZb3V7TdNHl0aco9zYAsRuoHIymqQp1digXs5ymZfUxjJ7pzAheWOiujee6ZklALo2p\/R4NrLXmmgEeh3oFjsJL6sKx3teWM9Ecc\/IYvsBQuJcSP649vCCwLXDjLM\/yVHJDJCYwYr8K2qA6MF6fbtCzVN6Teyz0dbc1W8dRYwRj5Bg3Vir5GFABfXOJfg6bbcEwy4Ksw\/19HoOz7+5Jgs9sFedglntePsGq4tDj3A93jbXkKnuB9ny5DBYAHbYxRDdo2xcmT6c3TFhm5087whEIzqz1EocyodyBtygJsCjatiSaB0dvKXid6jaV+gjqc0OyA9tH6oIIPnvUFy+KepC7lLwBj2IHKJD7n0xyjdeRF+bLHCwyo\/wRGuLNkKsOiRBnjGAKp\/gUkJ5nLqfQiKOpKvcTolm7yr+D6crLAZBSVI73t1sgx6TtivlJigtDAbzMniOBwQzum1FiB6VxQ5iHPTXcfuX2BKX4nIRZiP3\/jnbD6hKDP2XkoxZ0cYiRlaiGgzBCYWqQNGBowLdo+H04swim7QVCTq5ijkt0Xni9rn+MN1DvPGLFIWQ+\/dTXtWaOhbvT+oJL0lo0axTi5qDiifXGlrLFmReQ7c0Z3fk+3YiKtVq27u8glCgsKJThfZnMpQ6q+TMUa2BqW5C+2DlQlZDKXMopkGE6\/Mv0S7NrwXpS1rdUfBzhgea+wC4OemIAQzEwTs6Jezf3TVqdtjdjCE\/mNSze0IAY2GTarSd4Ox0hUYIShxT08\/Gr9lWqsozr1Rrjqs9XNWjpYLO0wgaARNfD8Rh9+y+GR\/pqh6oZmxCwe5KCIvMc09MyOKzOXDiOlu9dm7vUp8SuyIF73IW8MykMJoi4H7BdHKWL7KOBdwkLcSAlZIeUjhRlAvONdYD89nuForX8OAdDKj4ghtwbaWF\/WjMRQroF8F3R+rMj9ZLUoLPF120dsJb1Wj8AfSgPngBWdUCW5Krl0cHUNv6zxAwuBWDV6IGnEHAcBoDooHMAUZbLKzf2X80JMfxidUEHCV6TpzKp97dQnRjSJBY641nhkOfD7WvXKLyd7KRsIcwNVoiZJA7Kff\/iA1YmcUuUgCWjybKYSoZfZBFg6Zy\/BcXqVRPVrUgQdTTdOOmn0RvnzZLeF1ZYX9PhG2j2X8QXJPQeKzQkT0fkOmHDoyBGkRrjN8\/1RHGEeOvwv+WxLrayjfkYsvLlya1e94rZG8B8iztOHlEqYmQZl+gIaFV\/XaXec01RPaRGz88wOCUfvf0ru2UmVgf4kwtFmlsOniLcSvILh0J2auj+\/43vtFpSxQSDV+YukFaTdcARLTOpvXtnY0FYW6Bc0m7GnJU1IGisB9LJYvxRixyABRpWqgahJgG8WjYczxuKD\/PDuCMY\/jRUUpOZ4waCJSgObddRrXZj+FWKFB7IwOjuH4VQO3mFuZHvEJeFyT4juhqJN2+ZlMXbbhdWLWKTm3\/bmb9Iy7zMbUKUnDo8njOOmaPkXZ\/ZGh7Yifl1Mn0XNu9YwUoyA0XbgReCDYsXvqN0pHCA05uJDspFZf7UsmX8dQP1MLZhMRMUaXmWVGX7OX+s5S8EBJsb537n+AM3k4GR8rPLvUzoCBhxPBeaAxlBNgghjzD7m3A26B+r8yKkI1TV9rXNBT2hJX5mtvIw2K5\/CTgfE2yFb2vqRccD8f4VCCKd6EYW2rnWRbmUHTKF6talT9cHdPZ4LJS4zamEzzdydLXj\/KKr\/ahmsdGnZgV6hoBYDOigtL3W5z+NfEzlMZJHrb6yRFYPMxTaZe+8iDUcup8UvHrFCYqcSVH2Rda7cn6iJODIgHoCE9rtAKBYX0bEo33vA4V04VwMQ0DywOCm1jsQfilT29oH7zmGNu0zItY5cNzd7nGPyKclgurnvC8oUCDpVuHg+RhuDxKFVvoPXxRxZosvXq43wT0JVPeL5XayX2HHnYKjBOrbD6nRX\/Jhajtit6U7c1DtZn4q+6lMwIWNLXmWxC9F5RM7KIAd7OJQSqRZAdqf66MC6pVBDHdP6De1bggYJ9oZLVjBwiXGzT3BYtRCvY\/76zJHO6mZph\/\/qI5vL3XKpUpB+MLYFo9HT51OsouiTpSZOnLe+pG92sz\/RAwdKqo8HIbHNdRgtJN25lWZhjSdt6P3WquH+I1wfCKwvCJ0iU5ZO1MZGvUBOffnk9N2\/+WT+tUUjqzDpDDPCqjxBz2OAkujYkRWqYBGeoFBz3KCdgL0brdkPrgSvlPe0zTJEPNmM2jIOkga7H6PefDjyM6AYO9myIXrgy\/U\/Ly42MrEqm8uUCldC\/nnzgttMZe0pSBSQcazOb1L\/GHQrM25sHufAdhVvkzrEbSLLFnhCILPGFKmfVljK8XepkG0nKtYxmG5QeRMxSIhsEyihEQoZYs+00RaqUrpGvXy6468EKu3KemfcwZSeMLH0\/GqWmxBg528fSEItgIwzxUNyyTJOy1Dhcay1HRP6PLbw5A5NmWk20RbePuPKNvzhLPLu2TZATg\/yD6ZOhc8FehiBAayHAeq9+0aXkGknJOo1ewXyjrC1YhFR\/6gm6+AsvdOwJKr0SI\/ZKYAn6MnljQpGFHQxtH\/oP9RKuBQN+A99CGGqLIE7vOdP+2xnOagwf\/FmMWOtPzMvHsvo6sCg0GVH5HDDa+LqjdY+xqMnXfKs32gvy3uZl+\/U9bYhuAuQgm7WGs5mgl4tIfP5uKNKuy6zW\/lAgvWEU33+Srm+erwjDYQf+wUIecxTx+5qhzf0NbcZaTElqnSs3TdGXB4H\/dvyVH5vtpxvzAPyng5LRaevWit3OmGBdpCGlaN8jd\/fmtyDPUGMD6++vZ\/U5wL\/NQ1N9OuxnBjsW8\/T+3CHsv5EyPj2iE62W7lUpBFg4eLo8NgK0IdaQVRq41z\/ltRNKM2\/FAUoKWIrxmvjaQ9D5B2lGUvtZDdSpUqLd4cn\/6yRytRb4yInPjh5+ZHM8BTCz7NmzessNox2iWbF1fvDI7fwkize0LlCQBjvk95ER2FCuceeWgltUGXPyE1v1\/mGWzYjrCe9lKUJXE\/rVB4ITinnQlcWOUUvcF2q3JM7WemylifVYyMwLZIJ5yju1iyBdcpP7lxJCEzt\/OhEGDTZyxAzxrMKzCowLBI5qTWMI3zyY50Zi\/F9TWDShWzm1gqWE2Vv2Ydtj3yuro2eRX2Ph38FU3bQ55s\/4671chAZAvcuAbBXWr9ZqEtAPjqC9EJZhvS+NgCHPMshlfOun3fKEqXKDxN1hMHrMV1Z2fUMi41\/fvGB\/wHmYl0tpZ9FEzPEMa4cVfqgkBEzrCtDG7rWlQJzWzvezVDPormnjRzEE40\/gnP8Icv3pHQjQTbwHZdzMDPuH9z0tlrPPoki+F+5GoTmTtWLSdE5W82CDuskLVD0DvWZhYJp+Vo8odfXGum4lreHLaJWc5Q5ilHsR7Fti3i+aSbkz130XihNtZZgnRQpFzG+eUMVMNRhFgueGDpJIqXqPlZASFF7hROAKDuK30kWJkZv7oIWYSEFKL13YOsmjkSMRGBHr0i+CWuPJ0dxfWpbgZpgO7N07b0ks9WgVwsJC8j4oh1\/1gX\/AycJUiaNt12T9Uj1IPzrbv1HqYTcRQatJSNKzqKmfBhRnSPP0lI7rIyCLOE75QLln1vpV2a1wyutyAuAhOUykDuqYzbQcMVzjPPrPAvyRnol78hUJxnXSQwNw3Zbmfk29t0dXQjx7aJJotnvtr0XopEMhxPgRylQ7BQvR1oAE9YLJ2rLa0qJ9CqJsc0wlO0+7cADbk1\/XVotKXP0ZcPS7MJX4ad9REWt56cA33wSsugvmJJHllGKp98eWfnTqro6XkW4jN4EyrwDeDLJ9E5OFDtjDZMLWoMYtQWtxSFTqPFktlpVdTgn7jYuFJZlNG70N\/2GBSKNdmfxqsNkTcmJLdjGpj3fPyHF3a5xHxZC7TNqavwY+jwmxKoO1WeBKVRR6jhLFva4clQYSaKhsG+HqsqVQT5SJeklipRiW21\/jZSMaUsWDvzOSXGobHbodzgMpkriRPTt3vUpVMFK4uZtY3Fm5Vr\/CHv1jbpi42sKnNwouz252CNfyUDHI\/kkN9mSRVxAtZmRn3yf4nHjpoiVOxkVsLoZXqXc52sOkHje6IPwOWLB75zzdbrEXBHr0YsA5yKYaH11kG2GErRonxRBV\/F4FskJgZlEFFD+lKK2ExH\/cVCBwu+yXA+TMbTSs7Z1swhR+fvpg0McTY4zd\/hm\/G8Cz6\/fJqy913Kr2KRxTadNyji3655GTitQMwXmYhSb\/Lt0gDktWkiRitW07a60XmXkUE9go6C0DNyaWFdjXsIaNJIiHr3BN+Q2NORhIQLQ2\/0Q3Th5OdxXbQ4wM6wFRZ+ANs8QmELDxKJm2xbf3KiByzD9hEPMLVx+KeY0AtXo7\/cX\/LsKLQH9Hp7VWB3lBahYuRwrSV5+cKO+yRQYcFb7tQyY8ZwGVr8rWTkJ8wJthk5ip1IiWTo9XGwDWAlR+OId1aOiRnQ4yohUpCQyXwTi7NM+AAOya19G1oXc7W4WWnwvt+l\/EFglljRqSf89mLPPcK5H8kd\/zERguuCYtDS2A6uBAdffgTtWzlxJrHZnClbtgqiR\/PikFsO9ROd59zKsUB3UpuAiXt4OgZVGW4dw99+C86dR7F88vP+YbPUlzyw5Y9G9or9cHLf0zjX9YckB8VW6VijjJ0rz0IkjqngQ9vQmvI8OCF+emAX6yoQ3+rB2rx3eRFE9nw9qiqfExU8fE3M8EMPrUL+YognKN0h5S0ifIab4+EcaGqIz6Ia710KqEg3pezCH1DI7jLgc9KLMVCtPNJ58H29iFJbAtDKXrDBU9RcplhW9DgkgJcfoMsn5C6L2Vz3nsz7+dexhPaTXU1okkEKc1j7PuJhwkMRaMI+03k+1m5DISg6XNIkZxXvZN\/JVJDrBDIJiQGYJjZ0ZA4QSzLMXdmIKsOIYyJgXKr79eW3L6jf9krVBIGWr3I9DnJ+BqvUlFi1obItCVtilFvQ8jVIs6zRm02xm11fsCYhXuFuJNUvh6RFu9fgkeQdEWyuUklunIHUN0ckZVC5ua2E+Zd\/iJNTfcFAkvefbpehEtmeornjhlhAuj5AtbY3oFVH8IQOfvXDwGWAJ1vwLv1AWZDqfqqKFQsvBPtNJmR\/ii6I4Alh2oWupde4OBsBwykmGino9HQdp2+5N6AXJVVh8VmDNSAme3Hyut30Y0+UCV03cLaBJJtgnUXxsFKPQRtsvyVjDc6fVrnhYDWpv7Osxie4InOZLwAe3gv+dG5j+N8wyE3E6RRNjEyvtrvoA3W8ZBwpq+M+bxRUFeNZW\/988EvJ4Bl5plTkJuH2j+mOB+c6vRxBVty0yX2uJug6\/sA87eEbgGMX6y2MeWKsH1nZmHRPp+C\/MbvdcFcs1tzWgH+rbXbih35ACAXnyvKGfKH3mX24vQ09ZTphgdhEjtB28AeWKKADu+5Pt4lqqIQmhPJo5zcU+4PLfiix8QVVkmHYY8Pu5WYEDHBc5zcWRaxBMVMw8lm5Whr7O9NLAvw\/V8dQIlSkRpKUD\/IbeCxqBvF2kl1v57+W34pQg0CJnAO\/GVFJmTx4IcrdQRhpoHPSMUji+7UJQYTsQFtdZYeg8KF+UQ4844hjPAdrnNc2uXUD6TORVz1KTztmsdOCe5wziPDa+PMnXxBEPMRa9+MD+2mn4jA\/AoQf6fKNCH6F8DwvA9if7T1L2RE2gokDNxXO8lBG2vR4Jy71OQIx32wI98OS8eDdqOJLMQjXYXXq+U\/aBbyx8QpNzdAp7vaDeML\/67dVQ5uv2kxSlQT98rKoMrAgJJ+Y2lsz6ci5xaFDxW0+PlVpKNWD3ni46kdjk4QqO\/fyEqj1LfsQ5ffOzgVuInoKm2JXNJCD0Kf+0WGTxIR9JD7tgTQU6EFJHuFERCzFgWL3Ic5PowM64FTMbmTzKQcCf896Td4MlZ4OaB0cy1mNFAcZrEsMjr\/liRqRG\/yYbVON124eGg6t8jvy50\/r6S1ep2Kb1FheS65ciqctyi6USEnCGRA7eQUuce5l9ZvLwzBx+np6bTrJdRY7IQhKO9RgF0C4KLOQ0nUXLyZUWLqO+oopaQx0Xl5D+nv+0iZXEbr7ysEVYI4kiI7pxOzCIdWoQO7\/idBaXhVPvlzDf6gARYoz5ufmhG9OXeLz0j1TGGSp1tPfBUEDSTBrsSAIF9gHW3mUtmmiFhiI5JY1a+LqzZh4yhba0L6AtiHZxNiyRBuxGYUJysajF5hQMF\/FVDTnw\/NhA\/ImHtzkUq2JAOK2vwoRJWh8NJD2fSz1XMNX2d9aWNk8BbTiE9fecT0nSczPzTH4rRAx2OBLcnSUgtCGOonP8KuL8g8dFTCyt2uUKBTYAZA23E80urVEB\/whXWKTt3P+byE2qbC2j56YllZoQpC24iYiYmq4yei2VwiTnKvyIh+IvblfKRfJQL00ELjmMOuuTjUt5h+gWGzuwY4xPZ4WVIxSCLpEM3R8nTWjg8TIDLymIhYyLtoIWGorD02W2I+Gt2wK7HjrU0V\/3z\/9tI+dTifV2j74EzpCKd64HcAAQK614Zc3SKkFBfvyQ1h3Nh1Im9LpgfoL96VsmaL\/q5CoBFJujfsUgOC\/f+KDX8tiKPf6F16PlYcBt6j90slnRckj3DpQb\/IEGGf+EMAA7\/iRp8yFo9Iken8wXCmN0pwE+DJLL0yT1v+46XfYE13svcwNkRKAFYEP1UUvxsw4Sclb5b98yHZ\/rKLji\/xW6jyvzqw6fvM4mnIq4qPSab96RWpWpnlDJmqDXYPt5yeeU\/32BErcrrL+B1CF\/PAeXOt7QNzvCxbnz7gpyEsX6sJ9mX38I6KlYELC2FhIu3+UzAvjFuW7yGFF7z1i1R5WqdyFNaHMuxjJSSMrPd3nkwJehJtjbtHFdF3Og+iyX6eta6nngCOOJn12tkPbzRcXA+ypykfoO2yPLVlQVC7+c8PCLgI2XQxXwAIXIc5akP9S+l8CcbXcDnqHXFfUEkvodj+BOmjxYMVI8F5zNDmr7Z9r2zx8QnzFqUqPv8jOrVwXGarD0Hvz2Db\/5B9VRMTHf\/7iF+StYaaZwPZke7UGynFI\/q7TvECQeU\/9jKyNA4X0IJrczhkKmc7W87Fmap+46MfSwF0erCQJsIJwfPOrl7\/ty02kkW22CdkR28Gt0cswiZBjq8WuaOge\/M+tNjU4Z3FHo0JJ\/pfgGoMA\/LYdw8wnhtcpQFPzRULizfNxD5gbtyI0EzyHFJvcWfsaseGYyyGhjIZcvLjZQo\/0yt1djJeSnaphBZ2oRj63vvEp\/72oZ5jo3priov7ebJNzSbhhT52wauhuzsN7MilTSYrpIoHTMYWjm0FvpgNScOP2cN0uQTy7UUnrBQ==","iv":"5f2208c2e63caaf46151d13747f84ba5","s":"3a7521baeb0b91c6"}

The UHNW population is set to grow. Image credit: Michael Kors

The UHNW population is set to grow. Image credit: Michael Kors