- About

- Subscribe Now

- New York,

June 24, 2019

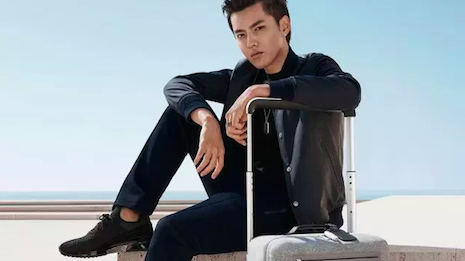

Kris Wu in Louis Vuitton Horizon Soft luggage campaign. Image credit: Louis Vuitton

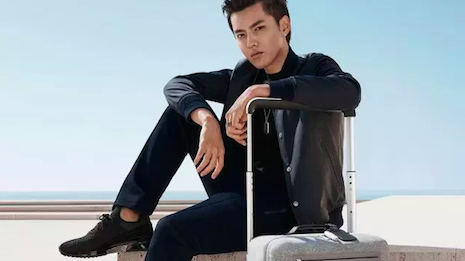

Kris Wu in Louis Vuitton Horizon Soft luggage campaign. Image credit: Louis Vuitton

Luxury brands Louis Vuitton, Bulgari and Cartier successfully reach digitally savvy Chinese consumers by effectively leveraging influencer relationships and Eastern social media platforms.

According to Gartner L2’s 2019 “Digital IQ Index: Luxury China” report, luxury adoption of Chinese ecommerce stores is on the rise. Brands that are more open to flexibility and collaboration are also partnering with Chinese business-to-consumer platforms that offer large audiences and logistical support.

“Two years ago, the luxury industry was uncertain about ecommerce in China with only 40 percent of fashion brands operating online stores on their China sites,” said Liz Flora, editor of APAC research at Gartner L2, New York. “Brands prefer ecommerce channels where they have the most control over the customer experience, making site and WeChat stores more common than Tmall and JD.com flagships.”

China online

More than three-quarters of luxury fashion brands now have their own Chinese ecommerce shops, up from 58 percent in 2018. The preference is for brand-owned direct-to-consumer Web sites that allow labels to retain control over their products, branding and more.

Sixty percent of fashion brands in the Chinese market also have their own WeChat ecommerce channel, nearly double the 36 percent of fashion brands that had adopted that strategy in 2018. This includes standalone stores, flash sales and mini programs.

Dior’s mini program on WeChat

“Content engagement is still hard to come by for luxury brands on WeChat, but the platform remains crucial for customer service, commerce and omnichannel functionality,” Ms. Flora said. “The adoption of mini programs, or apps within WeChat, has skyrocketed as 70 percent of fashion brands now operate at least one, up from 40 percent last year.”

Luxury jewelers and watchmakers have been slower to adapt to China’s ecommence climate. Fifty-one percent have a shopping presence on WeChat, and only 38 percent have their own DTC sites.

LVMH- and Richemont-owned brands are the most successful at navigating the digital climate in China, according to Gartner L2.

French fashion label Louis Vuitton earned the highest ranking on the index, with a digital IQ of 145. Italian jeweler Bulgari and French jeweler Cartier followed close behind and also earned “genius” status.

Kering’s Gucci and Richemont’s Montblanc rounded out at the top five as brands that are digitally “gifted.”

Louis Vuitton’s Chinese ecommerce Web site launched in July 2018, while Bulgari allows consumers to customize items, make store reservations and place click-and-collect orders through WeChat.

Cartier is considered to be one of the most digitally savvy jewelers. Image credit: Cartier

Additionally, both Louis Vuitton and Bulgari work with actor-singer-model Kris Wu as a brand ambassador. Cartier also worked with a popular celebrity for a Weibo video campaign coinciding with Valentine’s Day.

For Lunar New Year, Cartier gained a multinational presence with a blogger content campaign that spanned China and Japan. Chinese multi-channel network Boluomi worked with Japan’s Tohoki to produce a segment for Shanghai City TV’s Style Today surrounding Cartier’s Tokyo pop-up (see story).

Digital partnerships

Luxury brands and retailers are also turning to Chinese ecommerce giants including JD.com and Alibaba to help them reach affluent consumers.

Forty-four percent of fashion labels have flagships on Tmall, double the amount in 2017. Luxury brands with a presence on Tmall’s Luxury Pavilion include Valentino, Ermenegildo Zegna and Alexander McQueen.

Twenty percent of fashion brands also have an official presence on JD.com.

JD.com saw record results during its June 18 Anniversary Sale, driven partly by consumers trading up to higher quality merchandise. Held from June 1 to 18, the annual festival saw total sales of $29.2 billion.

During the event, Prada Group launched on JD.com, taking advantage of the extra consumer attention. Farfetch also timed the launch of its store on JD for the festival (see story).

Swiss conglomerate Richemont’s Yoox Net-A-Porter Group is also strengthening its digital presence in China by teaming up with local ecommerce giant Alibaba.

Through a joint venture, the retail company will launch Net-A-Porter and Mr Porter stores on Alibaba’s Tmall Luxury Pavilion, taking advantage of Alibaba’s expertise in marketing and ecommerce operations in China. This partnership comes as Chinese ecommerce sites continue to ramp up their efforts in the luxury market, catering to the growing appetite and customer base for high-end goods in the nation (see story).

“Luxury brands developing their China ecommerce strategy need to weigh the pros and cons of each available platform in the market, including traffic, control of brand equity and data, conversion, omnichannel opportunities and logistics,” Ms. Flora said. “While site ecommerce offers a greater deal of control, brands that avoid larger platforms will have to invest more heavily in digital strategies to drive traffic and conversion.”

Share your thoughts. Click here