- About

- Subscribe Now

- New York,

September 6, 2019

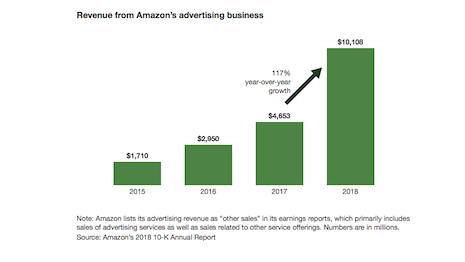

Revenue from Amazon's advertising business is on a steady upward trajectory. Image credit: Forrester

Revenue from Amazon's advertising business is on a steady upward trajectory. Image credit: Forrester

Amazon will disrupt the entire advertising ecosystem, turning the duopoly of Facebook and Google into a triad, according to a new report from market researcher Forrester.

The Internet retailer’s revenue from advertising services grew 117 percent between 2017 and 2018, although a few weaknesses will challenge its goal to achieving ad dominance.

“The duopoly, agencies, advertising technology [adtech] vendors and marketers all have to prepare for a coming ‘triopoly,’” said Collin Colburn, analyst at Forrester, Cambridge, MA, in a new report.

“Amazon will force innovation from Google and Facebook, and adtech vendors have a lot to lose from this new ad giant,” he said.

Forrester is one of the leading analyst firms covering advertising, marketing, retail, digital and technology.

Stacks up

Amazon has achieved remarkable momentum in advertising over the past few years, Mr. Colburn said in his report.

The Seattle-based Internet giant managed this growth by offering search ads on its site for sellers to rank higher in product searches and building a demand-side platform (DSP) that lets advertisers leverage its customer data when they buy targeted ads both on and off Amazon properties.

This growth has put Amazon in a position to disrupt the digital advertising industry and weaken the dominance of Google and Facebook.

The report cited Oren Stern, general manager at Kenshoo: “2017 was the year of brands testing the Amazon waters, 2018 was about brands getting serious with using Amazon as an ad channel, and 2019 will be the transition to Amazon as an always-on ad channel for many.”

Collin Colburn is analyst at Forrester

Collin Colburn is analyst at Forrester

Indeed, Amazon’s ad revenue doubled last year because endemic advertisers are growing search ad spend, whether they like it or not, Mr. Colburn said in his report.

Endemic advertisers – sellers that buy Amazon ads to promote their products – are currently the lifeblood of Amazon’s ad business. These advertisers are placing sizeable budgets behind Amazon search ads.

One director of ecommerce for a multinational food and beverage company told Forrester: “We will spend about $8 million – about 33 percent more than 2018 – in advertising on Amazon this year, with the lion’s share in search.”

Mr. Colburn does not expect these budgets to plateau anytime soon, since Amazon continues to strong-arm brands to advertise more.

In his report, Mr. Colburn cited the director of digital commerce at a multinational pharmaceutical company as saying: “We have seen [Amazon] algorithmically place their private label products prevalently, which is very concerning for us. So we have had to invest more in Amazon ads to offset that risk.”

Non-endemic advertisers are beginning to flock to Amazon’s data.

Brands that do not sell on Amazon are called non-endemic advertisers, and they are increasingly taking notice of Amazon’s adtech stack, Mr. Colburn said. This creates opportunities for Amazon to capture an even larger audience of advertisers that want to leverage its data for targeting and advertising across the Internet.

J.P. Diernaz, vice president of marketing at Nissan Europe, told Forrester: “We have started looking to Amazon to help us profile some customer audiences.”

Even other sectors are looking at Amazon as an effective advertising platform.

Budgets from shopper and trade marketing

Jeremy Hull, senior vice president of innovation at iProspect, told Forrester: “Over the last 18 months, as Amazon has built out their DSP [demand-side platform] practice, we have seen growing interest from non-endemic advertisers like those in the telecommunications and hospitality spaces.”

Amazon has changed consumer packaged goods brands’ mindset about digital advertising, too.

CPG brands spend more than half of their advertising budgets on trade promotions or shopper marketing, with digital ad spend lagging due to measurement challenges.

“But Amazon advertising has bucked that trend because brands can measure ‘final mile’ conversions there,” Mr. Colburn said.

Nearly every CPG company that Forrester spoke with cited shopper and trade marketing budgets as the sources for their Amazon ad funds, and as much as 65 percent of some firms’ Amazon ad budget comes directly from shopper marketing budgets.

Ryan Sullivan, chief strategy officer of Performics, told Forrester: “Amazon is allowing CPGs and manufacturers to use advertising and marketing dollars in a more accountable way.”

Amazon has certainly grown its influence with ad agencies.

“Advertising agencies hold the key to marketers’ ad budgets, especially the search dollars that have historically gone to Google – those are now at risk with Amazon’s growth,” Mr. Colburn said.

Forrester found that performance marketing agencies control more than $14 billion in paid search dollars.

“Amazon has strategically cozied up to key agencies by offering special beta programs and exclusive data partnerships and has also sought their advice on how to improve its adtech offering,” Mr. Colburn said in his report. “The result? We estimate that last year, WPP, Publicis and Omnicom combined spent over $800 million in advertising with Amazon.”

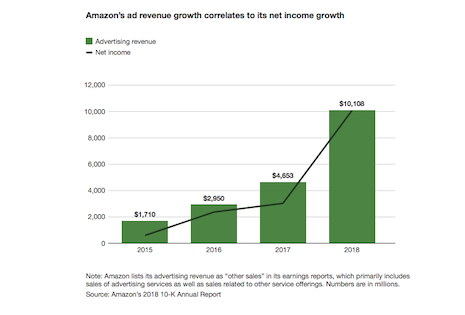

Amazon’s ad revenue growth correlates to its net income growth. Image credit: Forrester

Amazon’s ad revenue growth correlates to its net income growth. Image credit: Forrester

However, Amazon does face challenges on the advertising front.

Quite direct

In its most recent earnings report, Amazon reported that its advertising business only grew 34 percent year-over-year – a far cry from the typical 90 percent-plus growth seen over the past several quarters, the Forrester report pointed out.

This could be an early sign that there are some limitations to Amazon’s advertising business because of Amazon’s adtech capabilities and user interface trail competitors.

“The No. 1 complaint from Amazon advertisers is the poor user interface and lack of basic capabilities relative to Facebook and Google,” Mr. Colburn said.

For example, Amazon only recently added dayparting into its search advertising tool, he said.

Also, Amazon’s targeting capabilities within search and display are said to fall short for many.

Nii Ahene of performance marketing agency Tinuiti told Forrester, “Targeting Amazon Sponsored Product ads based on a consumer’s geo location or demographic is nonexistent today.”

It is abundantly clear that Amazon is primarily a direct response channel.

Endemic advertisers typically use Amazon ads to convert customers immediately and have them transact on Amazon, and not for brand awareness purposes.

“Amazon is making serious efforts to change that,” Mr. Colburn said.

Several agencies and tech vendors told Forrester that Amazon is pushing a “branding story” to them. But the market researcher has yet to talk to a brand that treats Amazon as anything more than a direct response channel.

Agency holding companies are building or buying consumer data sets, the report pointed out.

“The industry is hyped on Amazon as an ad channel because of its rich data on its 100 million Prime subscribers and their buying behaviors,” Mr. Colburn said. “But now the holding companies are making acquisitions to build their own valuable data sets.”

For example, Dentsu Aegis Network purchased Merkle, IPG bought Acxiom and, most recently, Publicis said it was acquiring Epsilon. These purchases will make agencies less dependent on companies such as Amazon for consumer insights and audience targeting.

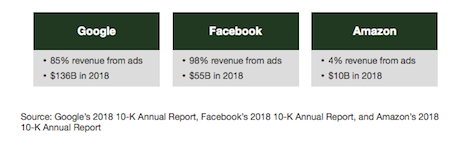

Amazon's revenue base is more diversified than the Facebook-Google duopoly. Image credit: Forrester

Amazon's revenue base is more diversified than the Facebook-Google duopoly. Image credit: Forrester

AMAZON HAS LARGELY been viewed as an advertising point solution for endemic advertisers, Mr. Colburn said.

“But Amazon has its eyes set on expanding outside of one vertical and wants to play a larger role in advertising across industries,” he said.

“This has Google and Facebook rightfully worried because advertising is their primary revenue source, whereas Amazon doesn’t necessarily need its advertising business.

“But the duopoly aren’t the only ones that will be affected: Marketers, agencies and adtech vendors all have to prepare their strategies and businesses for this increasingly likely triopoly.”

Share your thoughts. Click here