NEW YORK – Luxury watchmakers have embraced social media, customer relationship management platforms and other digital tools after temporarily closing their doors due to the coronavirus pandemic.

During a panel at the Future of Luxury eConference on Sept. 23, leaders in the luxury watch industry discussed the trends shaping strategies post-COVID. Despite being slower than other luxury sectors in adapting to digital, watchmakers have been able to weather the COVID storm.

“Everybody loves retail therapy,” said Brian Duffy, CEO at Watches of Switzerland. “There are fewer opportunities to spend money on all categories and so watches are an appealing item.

“CRM has allowed our teams to reach out to clients and engage them,” he said. “Our presence on digital media has brought us a lot of new clients too.”

Future of Luxury eConference was produced by Luxury Daily

Industry adapts

While slowdowns in tourism have impacted several luxury sectors, particularly retail, the panelists agreed that domestic clients have filled the gap in sales. This includes domestic markets in the United States, United Kingdom and China, which was largest market for luxury watches before the pandemic.

The panelists also noted that demand remains high for major brands, including Rolex and Patek Philippe. Ecommerce platform eBay sells a Rolex approximately every three minutes, according to its general manager of luxury, Tirath Kamdar.

Rolex is among the brands that have successfully leveraged digital to launch new products during the pandemic. Education is also key to digital efforts, as brands look to reach consumers who are still developing their appreciation for luxury watches.

IWC chatbot using Facebook Messenger. Image courtesy of IWC Schaffhausen

IWC chatbot using Facebook Messenger. Image courtesy of IWC Schaffhausen

“We’ve clearly seen a huge impact on the brands that were either digitally ready before the crisis or that have really acted swiftly and proposed something to the new situation to the world,” said Pascal O. Ravessoud, external affairs director at Fondation de la Haute Horlogerie. “They have been less impacted than others.

“Here we really see that the trends that have been initiated in the few last month being accelerated, accelerating the digitalization is going to stay,” he said.

In May, IWC Schaffhausen turned to Facebook to introduce a chatbot for the launch of the Swiss watch brand’s latest Portugieser collection.

The collaboration between IWC, Facebook’s Messenger team and Creative Shop is meant to copy the personal experience delivered in an IWC boutique. The virtual one-on-one Messenger chat with a virtual advisor is designed to improve IWC’s customer communications (see story).

Meanwhile, eBay launched a dedicated customer service team for affluent shoppers as the platform experiences dramatic growth in its pre-owned luxury watch sales.

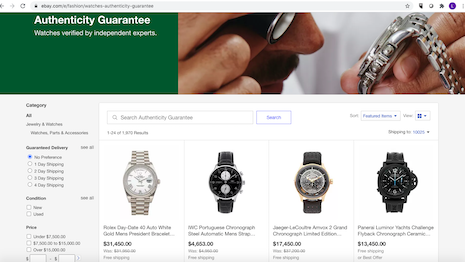

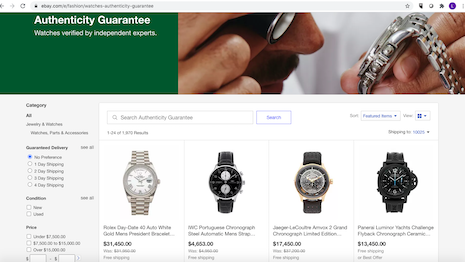

Online marketplace eBay has rolled out physical authentication by third-party experts to allay concerns of watch collectors that the items are the genuine. Image credit: eBay

Online marketplace eBay has rolled out physical authentication by third-party experts to allay concerns of watch collectors that the items are the genuine. Image credit: eBay

The online marketplace has introduced a new third-party authentication service for watch collectors that verifies the genuineness of the timepieces.

The “Authenticity Guarantee” will offer 100 percent verification in the United States of all watches sold over $2,000, including brands such as Rolex, Patek Philippe, Omega and Audemars Piguet. ebay has for many years been one of the largest online marketplaces for the purchase and sale of pre-owned, high-end watches (see story).

Looking ahead

Expect ecommerce investments to continue within the luxury industry in the coming months. Panelist Ruedigar Albers, U.S. president at Wempe, hinted the brand will launch a new site by the end of the year.

In April, FHH, producer of the Watches & Wonders show that was formerly known as SIHH, has launched an online platform with content and commerce from 30 participating watchmakers (see story).

Online retailers Net-A-Porter and Mr Porter are partnering with Watches & Wonders to bring luxury watch brands directly to consumers, as Swiss watchmakers continue to make up for lost time in the digital arena. Fourteen watchmaking houses will be sold through Net-A-Porter and Mr Porter, positioning the Richemont-owned retailers as one of the leading online destinations for fine watches (see story).

“I think this acceleration of digitalization happen quietly in our world,” Mr. Ravessoud said. “That is actually one of the positive effects of this crisis would be actually to accelerate that.

“Five years ago, it was very difficult to think about 5000 and more products online, but it shifted totally,” he said. “Since then, I'm a big believer in the in the right mix of digital and physical.”

{"ct":"4lfjmbjkwxIjZquB8IDtSV3yaXOzIXLU8T8gS4YOHnbUWQy6DF9NNHkXKtR+wjeAZ0wOFZBbUz4rWWO1Yt8Ott0PY9tJY8CAHFs6E0iEXl7iBs2N5CcTk\/Ab7NebPE8QN\/coP2HQTA5DadcP4FnOpKulW5V8Jkmxz1NF1HlRIcJqJRDkz69HTb\/fa\/7hI00DBrVJjx7uUrrujn0FaCwSPMJwwyECTLcoS8CKb2USxtYnzNteA12tAfbP8ROohJCX2s7VOI4BlEP4mwDAPzJBD7losxbLiieHvAexL7yEDoqsFgXU9ZlD6U+OUwLPNoJJAqFIDmf0DuAzzqQHp9nWu0O7mDkrgjunZ6lnir\/hl9+5XZrl1a4QkWw1NF8LWvyXhJJ+RUKJ3J538B06B8YcPhj7HjyOR6fl\/O\/EibPMseYgSkmqKJCGOrssxKKXiyzUB3XftvbMKSFuY04YhvAOFSBHFeaHJARTaWTWR\/bmFfLNwKNcrLy5woGD++g+ujDjqRJm3j6gKActIXQznCg5j0yS9wurOOpKHO1BRg9dvz6r9chut8qCe3T8ZSFgwVA4\/naVT2wTLccJ7qz6clNffthsxXKUy6jD0ESd104Ve0wpoW0NTPjp6y66UEzKt9lHL1WY80V+rqPiv2Ex\/aytsf00maV0CI3vYdMQ2x+2V4zoplliamnha1O8DYZdVc6RjrOH1+9jgoy4pPbSElgeWmDacag2x39hywi\/GmGDkNFLoCeXOS9bpUAXUWfMHpUDD5jCoMECXs5mRsao6MkwsBgtWqANOhO1TvPlhJPrj3PbMMZ4ft5MjHl0QVTSg4PS+XHopyFzNIhuer738yWqPYPgBeaQLoX84ycEgWNB+Q1Oh9H7JlOnqD3P7wPsDtgT7S0D+rDDsS2xk1e44D0cUWmNTOzYtgJb8t4bZ6EGRYTVKWAJoTJZkRFv51BLOmutnRGYSqp+RGZAJGTAz3rG7CGGqNPpda5etpWYI\/gCxMdjsGe1hrd1WYTCo8TAJNkSWV9z5OrztJfQtX\/dBUSfHkx1X8iFpu4bjpZhinEkV2CqosUcw5VWzxAasD4errp+ZlkWGBBADXKE\/CB5Mpi6fLS97+gmnPaZMbFW\/Zy6ykuD+KaScEj0rxU69KXKamx4qiP8JyBr0KN5WkFlzEDHcTOFXNJhayvCUWkKQtkOUIbT+EPYAydR5T7FvwpR6p3xnC22mFfvZzXBAxhH8\/LZQv1gawp2uNOul\/EFO2VuJbfJHV73rGj1A50\/T1S0gV61u0bo6fjun+ny3H2uvfv7K7QGkHYykrFJKCJZBSkyz1iSTTtUneBULTzSUz5AseSz84mp319fZSE7OVI6pQ5WLO3+jVuakxiGGpYrvcHEqavAzmqomirsC3agMzA0tosp9Ro1tf9ql5brL0x4WK6zBXmzJTbi6KWZ53OGlpN7cXPfHPlCK5Q1yfKntVs2A+ZD9r8khMtAIOvJicwwSUbU23VMbPFpkvc3Brc3x+prmjl4c6IXTYJAha37HRoyCjZwwtcmlmokvlkIkUV3cqz1Fu8hHqTwCJhpkc7OPguL4ow3xs6NXvjLc61fG+qqY5HkzYp1+HSyYBfYyDPXNaw5rsQU01xkc4qMcu7BRdUGnRe16IktxDIHe51p5y4xBplvumN96np4PjAKgr98g3XpHp1LCRLWmb8nIADnYk1PMduYDYdDE8\/Y1yLmemFPwXTgrnEJKjcksPw1nk64jr6FalRyDSsmvCFJbo+YXKBtaKDOXgNRFiVSTlxp5\/rryrpjihpOx2hiPRnb3iI4SrZZgZPU2UoKnOZ7BB6MvmupA6BgNdrn10uQ5ut5Y+VM+XxxY3vksA8fyFsGzEkyuUCZcRg1NIuuDDFjLwePMgJ4MFyCcd8gjDF3Ol9z7YFYaO0daeFVKBFq2jgGOKY6vQpNL1N3RBl2TwAqK1pRd\/0nsQYQ4CJwMNQsardtSYnUzEub\/xYwp0pKHd6chV+5uwDd82trRAQXjWmBcjPx1vCSm1ttXZ1o3e7td5J3mEkkeCD5jvp8rotb8dhyo5mI3hIC43bEaEosaGalq3RVRuIeGQ2a+bEJEJVEVqBw6Qdu9AR4rK+5L1aarkZihIw3qpnif+QGOSl46JyxxzQS92cLYFxCxirb2SA9+qO+bfRMJ\/syNAQn\/e3vDjeccLK8b\/sSN1ftOKcGUHzMIHJ1lh3Fos2cPWbC\/RzavvIF7523iC7SazpWy6mJEuJ1p+sRrEQDmLL+uZOZrdWif+UK9BVPaYHFcEpf\/RSwfFRsCetrLaDTzmqpT1bxqGpP7TJUk\/OYnY+YImLQ4MRRuXhJL\/tsUDiAkOac5zeUrFKQjwHNjeKTEhkKl6HEeieSsN7ciXHtjydeMXJRfeglwVyq280f4UHOBSzLvgAk\/7JXKO6H7tMuc7wohPyESUjveD2aeMCjiqzMdrE3qmf4JZz8Vy8NEQW7ZDVLY4X9qqmAHuER3LQ69KpAonP9+\/l4uXAqrrL\/Lrds1illRQtQBv2TXxXNDxJXM61OLFVAuVla7tbV7\/gw2vxkwrvD1K0DnhWXW2mL\/egCPvP\/h+jSNZyqHYrMG4VDLUC5nK4V+jXW7KcdED6WpsnGPXWklAMy42tv2PLYIwV7Ge915sqnhwMtustHpzlmwuTj5WW2QhKsD+1q09EV\/fn9NrLoCjtm44YT8gZMlJymmEjRPFlt9dh9UloyPH7Hg64Co9rJYXvPTKoSAYVmjX+COTHKdIq7QYQU0w6ncb5FCc18sPtLVL152BJtjepNd1jM03bM3UZRacKTm6kwkQ5wvuj3QzPAxk7oxc8e3\/xT7WpqaAIXrGgvXiWjb5zBJT4ryaycQeRJ5V4HVmNKairbrEXS4jJRAcm5nCp\/sv8DsJ4XRyYMDY7wESFGizhrDrpGENnyNUIP4IQOnuE1lxIZa1NJAlOiePID\/B4Fxl13mcRzcB2wkOu\/ewRzK3D2bI9Dd2JDrpwaGuRbT0+0uOQqj7iL78quFSdddXvrIs8pWK\/ZncXAtmdwWs2Fcit0cqgWM9zjg0wl4hokKiGip3N1JvSnqE8EURv36Fc47SUtQQb9C00lqxBrLd+KsYt532Nr2sX9v0PREDUEy2ac2kbcdcdK212b6InFmFTiFm5zpvWTgitFPFQ9dWOkjZ7qCPLTV\/znK6nWVuJYhEDb8bPSVwuVobch8H8\/ix1YbP9WA4i7Gd1i4CRTGV8fgGayWUr+azJePh+gsulW3FJbIjc7Cog5dalZ2Op4RFVnlfzthe\/HUpkTBcEW0xxKRjHrKaPuayvmbhatjzjDsytVTcUAxdohsJ+4CGzz+PVfJCQJybc9FIi1TQfh7LDLpfw84GXDvjA55PEl8P44QztQRDhNes9bwYJAbn990RmhPHh67f6ua8sEpXKEO05rqzSzXp9PeQXu1AB8pTAkt6N4RGd+f+t5PlX8cW3jKkqDrarQo6Ih7+12eThBHk2LNtSjwbUOLqSBQo8tmCJqE1mcZfXHYrXh0fJHcxnVOGfpzClJtmW2GXw\/9VgmnZHn2Zm576nkTSt0uj3M03oFZcDg5xQio710RIk\/n0KFbBANOxORXNdHiJ1YC9NtGvzxmBHz3fU2v8+pTJzJvFb+YJwK6lur+5+LM3XLC9Sqc26CJpb2y8\/kdaRdduG2OzkbY8n\/wi\/2VADWfPX3so+JANXr5Pb\/7S\/zLeeIi0Yp\/cicGl5gtrUpFTmQLmRXBavuzG6Iq7AxIBIidQcbDNru6EpC+\/vYstG\/9wR3CvHVbeYRVLhHw+jz3XF6igD+\/YB\/hA\/x6onKt4Z4mDzWq2IgyRKcuT1h5TfzAALHG54OMZOcSPcXAWJm9G6oJk+koDE3cnmsM9llXF+08FuXZG9GNuIBzylcWM2srU\/7vaQ7st++0qCrNl3lI4O6J2orkQM4gPx0URdPhDQUhYOQTfgoFQbHwmBA1RwPjQ0+9yEF\/DGo+4w7yeqZ0jgIRm3PshZsqNnM1u0B\/SxKHCCTzC8xzY2CuCLTlPyuVep32qUNBWig2LiwjQ+IlF82qpKW7QrBYKtuthFx3IYM2NjeChckWFCEbGfufJQifKej\/pnUE85wO1WuOtHWo1mE1EdUUqVCmq1MDEvEQJaueJNb6xmepA\/wlRg8U1nw1ufP\/MEWRv2oM5BZ58uUhyMb8GIy3d39DE9KfJu3HHkDR\/v+1upCXZjaBHT0e9n2fKDKwUj9cy2FO15dMowA4W69fBRoglkgFjNxWeWnUClA2VGpnzspl+v3L6Yh\/HD8EdaY3Dz0yp+wxqOImQBH0IRfXuFslGj9lPZW+0BlH5fXEnPPy\/4HXW8BxCX0IA8mLAjdhi9Zm1Ir4pGXui7HseNnVhdEfuAl1+WOGgmxsvGhiR2K+mT2JxeU+F3VlTUOgunQbBI4z1UuI4bwek27uzgB8yXX3oO8qW7kio1oHkqvfauzlqqV9ZzWdQGFfiw1Dx7LSW1CumJXD75HoC9K57hOtSdlqREUsKp5I3jtSS\/UAsbQElnNyBArmoJXthpZgZC+GoLCN7VzO9uQoB8sxDZ\/37iI\/CFsukhuVo\/Nqen6GcSr7exHdnYp1awjbsKM2+8TIAAfHEwUNcCQWkP3uUYvlQQ\/6+syj+PgLEYS4S9QoKi\/7pnzNlThSysbz2cfZ\/xWpmcvYX0WcY33iR2ips9\/gRLuK2+JuXQfHuqGBri73cnJdBvFRye2iDeoUXk9n18a8XoR\/cX45BrGz9YL7+TkdLTtuoz+745t0sZNB+2eNCjyI2jEFrOj0NKK4LADU8UArATOUgEW\/oGeglQWEvpSevbtqriniwGDB4Az5fFt50+Dc21uV4K\/WTmAPcieYNntckDKOa+JQH4O4hIszAKwU\/uuB11HMUhljuID+HW1KrDzJ1I2kLkKQpX+Ps5UdeSnNHLnWBZqGKgaPvuQsYTZm7H0CcyTK8m\/PaV\/hUxHBfwq2gv9CkGZfFoMTOnaV1mhQ7hTR7E7saq0gaA4U++WokcuXWYWDj4FI8xTYqMSMOPLhsx2wkhTrmMW9D03Zf1UrTeIykBfMJ9e+b9WPiUkA6Ks\/xFE+KFuzOiLs2Argj37JGGi9rtumCjEF8pVP97ibWzZ\/ZAVCdWB9SUxqJhCVgB8x3F1i+\/ZRWH5\/49GL60qBjouYAE7FfrJBBN3xHHT9U5sH5o+AstKuBob2ZnOBbMnyPgA5tMMQK6Xm3s63h+KE9\/1pZpqDr\/lr0KgygpGMaOeFkEIodnb8gcstDkr4NFd3q8XDDBg\/fB5nk8movqIFaapvTGnCObV83pVnX2ObUbo3Ozg4zRqJG0TA1Crf5oykq49yJJYs1+R2mk8OcT84bXGTex6s065ptQuKl+ft4t5HIb1PeNnvk0d6\/+p1keWJcEKtwZK3C58m58nqlrheHUUZa4qx8zpm1rkZ7KVVFXut221vdLV9FX7vIkciaL0u3NFPUtZtEgrG1AlJBnCVH6nzEwN\/A5xGKWU3RK2xpy6j+PkN4lSIdvxDrbYW8oADXP5fcvNwLu8W+PEJCpUKA+B5hMaeNzzJEOMigY3ViWLqmeDewD\/WNKHJuVxqRAQb\/F7uY7lWaQXS8XQZkGebsXtBHgi+qrIKTa+jgBqC2dCfE26BILfe3NkdZJBZAl5tqWKZe3xkdC950+ZnjYEa3On1kTq4QZzWSPrB9iGWREHj9RzmscvE8qYZKh6fGAyCj4idemHS5bGY0ubAyK7oTixqCACQJsWLk4EmVOq9sHIVPRTh+J0AK5iMH0KrJEHPeD35F2qh0K1D47F5JpumxvoSndzzpT5ctv7zelwijFsShMww0f3EIdvJ1ep+czA2OZPywPL6eoI0SYSHpnsQaVGw0XAvMNwEX02pGcei9hcZc35wN9td0BJbPAQ\/jgvv1PxS7a3wD8gcXDOi+9MOXWCGbD7YzyVj0OBwo\/ASrcPOmd0HVDclnH145UGjXBw3RwIIWcCO8rUFIK5Ktqycq+2Bd1xAY4zwWgBurdQpzwr8oSYbZMUc1g8K0+4W1V9cFoZww4ZZ49oucy7BTKo6x1V24Je4YR+rI9q4sw9N8s7fmIHD0QhS0Gf\/Hx+8tvVjSka691GPknbczpipX6LRxj3ep2FEryK\/YBIRgxVxzJC\/L90kx1h4ERFMU0tMA0pkBgJrk9V\/tz66897rAqG+mQc2sKMpw8xy3RK\/d9+3Lve\/5cf00qNFMAO3j8lD6AvXhWMJ64hFVnmoJh5hUz1Ay\/PMNM1eO7Md\/4\/vWWgXI7z+8TH8wI0dvh8hoW4UO2d0xgQBizLgM42ikKIr4o1cVjGJUtTmTOfOlMg6vTi9wlGb9DT3\/B3uhKHQ7MwD3VHEigDTjvp6APggXbWgeWsbeZy3v1aPrT2fFHwOZ+zdEusYBGg5imv0KhzdtGTxtQwByewgds0aqacfEwxDC2hcHw3xRMvwt\/u44xoG3jGsVZP\/KSNV5qjjUwmcxImW\/XQ+nWEAvZgfyo7AFN6T+WxpJ3RDQE5pu9qUCqD+9Sw3dLnL\/O3cR7xyW5t97DbhDRMe9aKR\/GNAjCH31WTgigyp+7byLnUiOhGH9UZZmW685tB20y5UXRWiv6aWD65Y2\/5VGWgDg1RA5QPM2GvsJGwpVVqWi65ORlKMcALljG6FwPKxCC6OVuyjESj9xHuUVq4JMfYUP2Lf\/YNzt1xE+gju7tPkbWgP0T0RJitn0cHlgjOaINuUJ3qwZO2LPe7x4N6fBuwyOCWO62U1gS773uSBKTlqvxMD0seW8c3beB37oa0B416yLj2GZkcEbJD6xEiblAEOJyW5ZSkYGemfq8QjTNV8RLLd7KQ+gvfA6b+haxdVXOiPMMV4aFeTDzilK4cpRqD8LFzSx5GIxeU3bc0ILb2JkoGr7z0GlSddy6ZsBmK5s\/yF1IsBSO4AQ+oZirAJCd5tsQxLfFFFGAJ0DKK2a7w3BPYCZSMdEFMLnZC64FLqys\/Jt3x3Z9HUW6a\/P5XVZXgJFKR2eAldj1klwQp\/\/QGkWE8Bi5lhZ3z8VFHxxCzLkFAtYcV0g\/QfLU86QufRON3dPaXIyiklEDwNK0BMi+wtjkyrHb1qVK2QmJpFiFPn8XaaiUYGrA93zmAl3\/ZRTfpom6sUmx6e1qiq1PyFISp8rZr+iQZs1nFIu4xugqvI1rOB\/+B9Cgp1N\/mbi2t4shEk08Lpf0EmKGnR+GhBWV77cHIKqD5qPgczYzDEYqx7BKyJcn0vcbiXND0yhT0jrl8s2D2eYCAyKeNS7pO8YscnzssD\/OiPP\/7xSE9t951OdfHMLBkFpaWYo4Zj3sN7\/LOAb\/8FGaUBONbFyj8p8GU\/3c62s4ikvioPdkleHYTHRvtD0LyZgCQ\/XexaFurf08dAfvGQCsWcVv9VVG75oj+S8B6W0tkkgGqSYw6bpDBemTv3peYVioOADbjf1nuH4lhwnaXdO+ZJur\/v4IivQ70z\/CfIb5WNYED0XQFRg+9U\/ppNkHljLH+8CXGE6Bq1+pEUPbnuhRnqTnllZTanSJHC8oQX9kYtobISFozr3qp0QD\/bxL3dIlILvS5Zh6MT4YXNszdOe+rRlMCdkHPqS+WuKpsPdkG+I6yr\/XLqEWtH0p5MDl1a9IM7PEFS8xrZw+eCVfSibrriilmsdXA0kna5FvbPuqLszOajm+dsqi4WtMCHJ5HqDFG04QV05sKaUnEdkOdnELVhVwX++bNFFn9pQoOeqLXAeZbNCN00\/Zt8wDHi+GEu0y5bUoPz0mLV43NbrTK7NzL4IkvxzuwjgxSoQBy2\/rgd4VxGgkjr66ogLfFcTA2XhgGumum1vl3aQrI4IgWphEoMUU3qVQgUyT8xNE0lKTcoMmq+MPNY2uvUXK0m+Qiek\/GAHRKGVlR2D5HLWoQLGwFs5z7Dcpe+ho2K1A\/c4jtOjXNdG0VNMW7SRgOS3c3DTJs6bwI6nPCr2NuvRyqLFn54EJbX\/zBSdBEdQ1RwD6+ql9P9ubwuMUOTx2wJeDDtQYIfgcXyQ0mlQIjXNkQuhcNZWuhP4kxXE4M0tOLrLc7qmGbJB27g\/1ebTQYNIGVURPhqu4vGg+Ez+wFKjVpBSEA+NlxMAeMY8GMDV4trXIOF9F8a\/CnOdKko9U5uAeLFRwi2VVcNeEAq++6FNVJpuSPkvflunoIeDo0U+HWGk+k40fujCDWnovTRVlw7y1rvQccr\/hQDUe6OZouzFVLCHVCaKfCQNvtihnuFjPNDmorcoY9C8YQuFQea461Oc52OprPKhdO9zNjZhNUY\/sISsvJlmTdeVUmLBX2vrSiIU6L5izp4wD4Hd1wVyysx4O1jiWsZhXD9+rwjwLeW1EsAjjUO201MMPUM0n9zlLoC8MYYubCLAE9tEUhKGwToUpcN8PSoGspvz7vWMOdccFg3LXrygKCOuKnfMlNl1oK\/5T2YCDwfZRtSl8GFO1uAv\/SSfhQ9wykYjzKoz2VcFdjcOtdqR3TxO2jQMEymO9\/I3htAdfoV84wlcOpEjC8hRlGA0\/jht1cba99TaBP8JtzJB\/k3NL\/Edj9fk1bPDjEEMSg6L1j5pgB0t27UhkzjyCY8IDW3VLYeXFcAA4y\/P3eQHHl8bPyU+DPxym1t4Ljbd5V8T2X3Es1tPtqlN5x6pFffw\/C29jTYbVV0mIAqUQ9GFTEBw\/OqUdfaDktLkYLM1kSlSNQgHhLMCln8CG2T218V1bKcoNG+8wWfm29Y+f++Z113zxHuZXpo0Cp9m1iilYMS9Yd\/dqcYXxMD5tBhffHshCnsY2vcGi4D4HnJzrZWvQqu6tme\/067PCXf+nU4FAk0C+cyD5nylAsu6qQmTXDewnesYSgx8wHpEoTdRRhBGiAsCWJ1RUoLRyMD6zuzDcZEQ6XYNaSw8Efzx+sEjVP23eIIzmeKj0r\/LuqIbW4Kj2P6k4lw79eNmV9Q3tik5vC8iQYczHVOeRP5eHAGv+IHEndvxn5WiDupHbtvmebTO1YjEvm3fjg9P9CauZOk9ZbjZ8wWlvfO4WhDiTbSw5lx1onnzuia978foNpeSr+cRDE7mU9wF13d7sGIoRbLzxt15RfUMELIsWt2HbT1BHnNvpJJiPsFzf62SAV0UVT52dEy41pCpc3ipYK2jDleURy6uPn0UzqGGdyPhsw0Y4rkuHTVarrcoZRaCtQ2v5icI8szWOSsSgyB5vUYvNX","iv":"0200f5cabf223b2444dbc4a7dd5c77b8","s":"3d2371c0ab27eeda"}

FHH’s Watches & Wonders is partnering with Mr Porter to expand brands’ ecommerce presence. Image credit: Mr Porter

FHH’s Watches & Wonders is partnering with Mr Porter to expand brands’ ecommerce presence. Image credit: Mr Porter

IWC chatbot using Facebook Messenger. Image courtesy of IWC Schaffhausen

IWC chatbot using Facebook Messenger. Image courtesy of IWC Schaffhausen Online marketplace eBay has rolled out physical authentication by third-party experts to allay concerns of watch collectors that the items are the genuine. Image credit: eBay

Online marketplace eBay has rolled out physical authentication by third-party experts to allay concerns of watch collectors that the items are the genuine. Image credit: eBay