A new report by ContactLab and Exane BNP Paribas identifies Burberry as the only luxury brand fully committed to a digital future because of its cross-channel convenience and embrace of shops on marketplaces such as Tmall and Amazon.

Digital is expected to drive 40 percent of luxury market growth through 2020, according to the report. For brands that plan to be on the right side of history, a robust digital strategy needs to be implemented.

"A new paradigm is emerging that classifies consumers based on their exposure to digital direct marketing messages from brands (email receivers vs. not receivers), breaking down the traditional dichotomy between the retail channel and ecommerce," said Massimo Fubini, the founder and CEO of ContactLab, Milan.

"Luxury brands therefore need to equip themselves to devise a digital strategy able to generate a significant impact on global revenues, no matter from which channel they come from," he said.

"Luxury goods players will have no other choice but to embrace the digital channel. The global personal luxury goods market is growing at a more moderate pace in comparison to the recent past, while online sales grow year on year at between 25 percent and 30 percent. Online luxury is too good to miss."

"The Digital Frontier: Ready? Steady! Go!" report analyzes "30 top players in high-end fashion to highlight digital’s role as a communications and sales tool, as well as its impact on overall sales."

Everywhere you look

Ecommerce is unlikely to surpass in-store sales volume in the foreseeable future, but the impact of digital permeates the entire customer journey.

Currently, around 10 percent of luxury brand revenue comes from ecommerce in the United States, compared to 2 to 3 percent in much of Europe and 7 to 8 percent in the United Kingdom.

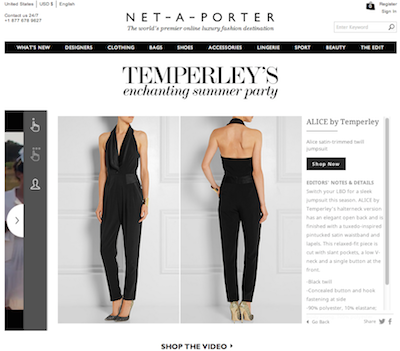

Temperley London on Net-A-Porter

Worldwide ecommerce sales hover around 6 percent, according to the report. Consumers in the U.S. and U.K. tend to shop online for kids items, shoes, fashion and jewelry.

The report points to email marketing as a way to boost digital's influence. U.S. consumers signed up for brand emails spend 13 percent more year-on-year than consumers who do not receive emails. In the U.K., this figure jumps to 22 percent and worldwide the figure is 9 percent.

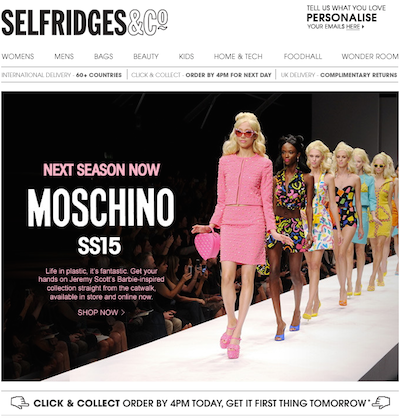

Selfridges email

Brands must be wary of inundating consumers with generic emails, the report warns. Effective emails are customized, relevant and deployed sparingly.

Around 20 percent of in-store consumers agree to receive brand emails, but this number is growing. The report notes that brands are doing a poor job at "integrating in-store consumer knowledge (store managers and sales assistants) with hard transaction data," making effective CRM programs elusive.

In addition to Burberry, the report identifies Kering and Richemont as luxury players making the right moves to address digital.

Kering enacted a powerful partnership with Yoox and Richemont is expected to expand ecommerce capabilities to Asia and Europe.

In key countries, Burberry leads the way among brands with eight ecommerce stores, followed by Balenciaga, Cucinelli and Armani with seven stores each. Laggards include Chanel, Fendi and Céline.

Mapping the state

Although digital ineptitudes still abound, the majority of brands are heeding the call for improvements.

More than one in five fashion brands upgraded their Web site in 2013, evincing an industry-wide push to catch up to digital trailblazers such as Burberry, Gucci and Ralph Lauren, according to L2 Think Tank’s latest digital index.

Improved navigation, enhanced image collateral, increased mobile-optimization and expanded ecommerce support are primary areas that brands targeted during Web site redesign. The index also emphasizes that Amazon’s heft and Apple’s imminent descent upon the luxury market calls for an even more aggressive pursuit of digital innovations (see story).

ContactLab and Exane BNP Paribas created a Digital Competitive Map to demonstrate the gradual shift toward competency.

"We expect an inflection point in the number of companies offering their products online and exploiting digital and physical synergies," said Luca Solca, the managing director sector head of global luxury goods at Exane BNP Paribas, Geneva.

"The Digital Competitive Map allows us to track this inflection, and to measure luxury goods brands as they embrace and develop their digital forays," he said.

Final Take

Joe McCarthy, staff writer on Luxury Daily, New York

{"ct":"4AqEjIHuxggDj3eLZjGcmzEyJG\/U5fX6m147sFIcWA2sTbSinoE7x3W2H5V63EPXed3BCNDfTuc53nil6IVB86b3UWFQ0ub6Ez5v0wkgEbOsRLJWk0FKm95XZykNy4OVxzs3n7QgJCojds9abzwfY\/ReMtTikBqABscj+0U7az9PVWquMl+prXUvlVKIT0iwgPg7JO\/TEvn4LcFuwjnKmUAv71ZQ7mxF1\/IS\/kcq2jqiUWMZ6nKRT3GmRcrCrW0bsiYcKyXdOUNsF+RtaRJEuzSap40\/ToQzLv97W4Vd1VckJY8vwgqTl8TfmPOC9LftLKMi6OUBkTReW7LUbnp5N1oq6taF8lGvn8Tk95IBQg9dqexW5AD90Xv1y7jSimRyKaILhNUa5Ra1UHM7\/EhHfZmuWuW\/zGFCQR6mNPdeMJPSMnS76LDi6KsO9o3LwLr+EQ3P9dSlEnduePnx\/FNIx7yrAkLdCMlcXkKSa8gNf5Wdb88ryFyuGkXFk4XSNR4TapS3NGEunkD+SmZoHvZ6zIvge6r0Wy4xX8ZT2TZiD+eLvn\/JYUGJERs5+SJEbHwWK2ExbAMVgK0ydc2J\/d6jxdlIr+oh5JpaFJYU7aWDtOXOn749bOUU5+tZgEZxJ48t1ayUeT64jV+loyS8YJxH\/XfUJlOBSQ3dvvMjWgFxGEroqPIoPtvc30po7OavDXRGGnUex2RevGbdJ2crFJlDQ\/nLRNsAYN\/jeZXuDpd2dPxNaZUNs+AV0xI4VrgOGS2aRXBNrZpkUydq1yXwiunhoklOSaAIf0rqwZKrmB7MtZt4H\/YDy1hD1PYO3GwcdCqqvmffpDHdf8CGz4cHalKAUrSe+TKVuQrtgiQSE1ye\/2BLID0BRffvsYRkJYeTFN2qlIf8oQlkpJc5I4o7UFDbhO1LMjCQEGrbrbrPl\/Lfq0XohGU3mNDxtFQew1cxPD+dPuo42\/jfm1M9aHzz2JXZs0DPVDsHtaI6WSvQV\/CP01o+ucbmu9wSD\/3APFkW8SwJs6s24d6MIPpxljNYOIcWa5cl94ESDya54vdvaEJ4+JzHd3BT7G4GuWK\/3R42dappli5aiW09G15W0qHJJWwVRXwIfU9v\/2BMYjW2tUAuOAczWfvKA\/XhgnBVXzLM5q2ZixdbeexBX+6XvhrYoUkf2TI3xSHz8jmIaF4dFV+7WcFwy2p9oKsqZjpn3S1SnCnN4Cd0m4YfquYvl10Mn7r6WvfVbJ2DzQdXoDbDPBY2GKa3h6ojgMcjoh6Mk7SZ9LRT2b\/9LkB\/vslUZr7XoiOGrSq6AnJozzrrCKS48MwhJVIwkUVtPJU3OzQT9Fy7fqA8gDTlvZwys4QGZfubEdQDnROA58adrRu79swfB8JuXJNfLpr\/ChQfZu7vgVAxjtVmQrrg3Vf9MRSww6OUHXsUI4BRGEu388irMCdXor81oKXeYit0wisKo7jCPlOVNoBS5oTTyc92PrICX8OZcnE1rv5wjcsLLwBbL6zsyFio067o09ClLF1Eyy76EIoheEWYEdX3F6Il867C+KgbO5KFcK2v9yDkMGzMqrZ09nv1hZd7qfTY45Rgr2B\/YeRctEUdnJdQzU9wX21R2PEB80IzRXCiBFM\/nyWiUm0Gwkp6ElpeAleS++8yTPdnlNbzbgdmX3xkHdK8z5risEX6LkoTKkAGdk\/A69PIeYxeE+mAHvMskV5HSxA8ts08Cnke8s2lHpo0qMX541nxZVHg8BSgekoQoQsyRYj77801q0fvuOYSjDmcCR4zVwfKmbYYjyJ8bzNuUWkMnEa2dslxag6AYmk0mXasRDmZTLRqa7im9kwQCW\/K+OJGUUZ8h1\/B27yxZKKw0xsXxYjEHCfyjbrAgwMOF61dey0Z7GBOMZLy+71QDuSDUammbMB1hNQ8YbMSe9ZvVV77bc9sBxSbHA3oCLEP2GRJTQupIUwK9lYOw\/HliwU9i\/NtB2c3cV5NbVv6TxspOAyjAWPDXw8N2TPX7PrbmoXTINF0lzGAt48ImoidVXEvE13y\/\/UQCMeCLIE9+LdUfCfJ+9kx5h\/zEgGQbvLJdQmi3\/ytu7y0nwiAXOaBf\/2sTySGiuA47SC1aoCU7SBuhmlTYVCa8uch85x3HbdBx4bey+Fir2l7uyqEzeihXNCQZWmqmBeIqEPWvd70wg9SVSsuYzviGQDz1GD\/vt6VxHBEM63W6YxhinkWTu31BaCqKG87WaupG3pGvxweU5TiebVHtmAamhatIcRiqTIZHUSMIgHdXR8NFkVdtPorWuO7VwxisRXO1w\/DJdHL6GY4f+CFBa\/0keBMIqHg2OVPRL6kO\/V9i5D7+zPOFFtegy+mVb2bRi7uIWG9Eq0oQRxqcS9nlE4NMOa1QS3b9DSwK9Af4eYnFGSXnqpSxtWF29BbhTgIpsP2YMqKU4Tkgm7\/tllVkyM\/ggNL2BgkVbHYEi+Y5KCSa4d4cOHjdp8qkNktPoucTJM9WopDnu8o9uxRKKgvezPVKgHudTrQFW1oMQsIghQH\/8I\/GuvcthoQhquMjB7sqh6F3AcvvojO2+8JBHCiifWUXwqCX2oNwAI6MGK2ybH3z0eCZ4T08rSBXnI3lc7bFPN\/UGKVm7kV+geDMR5H\/+wqHlIJBxDC+elAAi76xWk04YSaIjUYyJtuzh9hjV7JKO1zEsbyg96vTdrBEK4Umd3It4x46HZyl7\/5MKr6MnBNEzzp\/+oaCojQmymNGBwxgxVz3V0Un0ScCg6UPniHDLVliyxc81kqKWPwPHaUVTBQEnNpOBSux4SUZrElCgcs1B+JApLIs0iir1nD4RuBwvyxncagzJpHoGvFFXKs5ESlLT4c4l1zZDD2xJHXyC3YYslimWeF+4\/Y80EE1oGlL5t3rwdtK2KZAp5wlSxxIJmhMjyDJs3s9pnBbja1IhVxaWuxP02C28CODmlOSuoF5QgWY6f2nWthXmLAZmxMhOwO3q8\/0pNKhk8A4Orw\/HKsJH4FoqMNEUaEvA5haO1HJmq3mavbC0Ztuoyeo1peG0AIAhBXLw+4iiAu602bfWp6\/4Qrq8pmb0nvnSGghMMpouTjG+RBL1bdMGJC7SPQCsNDGgQHC0SeTvkKwqSn9Qr7LV3iP8SLfyqMxG3WNoo8eEzHGUig6psK8x0qgy5fUQLIyN6ciwjtJv1\/Mo1MPFbjPYYnK0oasQWFjOoypMkSAszVuxfzeprqk3DPQgLFL0A48f6ssODihV5UmAe6RNPTZa89Rm2wKvKYeO3WxjlXspbpib1PkECtNj1fzc\/YmBbvmgzDlUrO38UgdF2oLepSIZ0RUSaWB2y5iEQKb\/QtkVKdq4RordhIxt+vAH\/S6vIovLx9RsLPA1O\/lnkCOiXJTHy4s6ZLkjzn0ruOUNnS4SoKoYLJOcQtG1L1JkmVCTWkCebsZscbcMxrqotuv2FPRDYglj7F1Cuos91Fm3V7Y6mtGZV2hRpmyfFJJ2GWUJPE3Cl+VDm\/hgEayiKxRB0vdMtPY1YrSssuMDDA+DIyRf6XcZ9hNfnNbEaU5NzhhpgsSlV5ME8C0+HayAnz3iOb2t2PCAIM7ODwJmf\/PL8Qgq258j7nU10YcDtEvWOkLHhTAGZab83yoDhhIRyfncPQfBbBAaIDTmskEXsr1ix3yIt+kntyP7\/lCqViOCMAHiyQ29wgVnrZZtIn5zU0wpPRBLKCsdzdGIh4LHXQr71dtjZU7HXf+ecferC9vdfP7hQRIBXzuz2PCpyI\/s\/v8hPcKzUD1hVEeUG8Y1Je\/yDuPOmg+Cyg6MaPthqtjvreQI\/gYwaPZxoGgdtQkF4z9lhqSEPH+oI1emRqtMR25uztJQ1g\/+dfDS6qZqqMzMSB0GVDDd\/ADa4ZzC95plHZkwjaZTnUB7OWGCSr8epre\/s0n14Qm2LFE5KBGiH9ZZ244ZZfYqpzCHwTh9ZTNcgX1AMgypLJ1\/E8NdUjqsVwG1k3sX1c\/DgbpAcXf+V\/VHOBS6Ah6+6By6KbPsblswUVH7tjD0oGR3tdQFPw\/Skk73wdWtZhVIQRszssfU3+n7XPXnzZqiVs+\/aCX9qAmVc+qFmvjjhO3Ax3QfL1LXnq60R+dDIb55NrwV9gPJe2vgizh+5b5n6Ae3YGxVVPWFwzYOeDPBuNgD\/EQ00Jc\/wcguaT2whFSQtIRDhKAgcK8yHfp3aHNKcD9stlt6WdSCr4N6DFXZ7E8uyfLER87oJCswgdPuzOTqE\/ZYzOVmg0d2IFSht\/cd+w\/\/E\/hMu0dUimhtJfgb1\/i4SIPaOY6QYcHfRo7uiLZg3SU9F\/xOaLqGJBAxjn5k5iwelwBuGP2V2d5fWcsIDiv4ajjl1jJvDOgBH46dbZsSJDHGEd6nsYetQYNP0HRUMAY0VTtqJ4YcpfFy1HG8ZEIrl0IeJ4ttvt1xZguRYaQ4KSwDRwAD8E54KC2iakM+bz8QmiyfuR1WwpOz+9o+dhgdkpwyaOef7lJOmyZlraDXyjxHzKXVYw+WUDOzoaraCHKvRtfTNGFW7b72w8M8JlN0eJaLKFcep9LzcZ\/DtKHgF2arxWwQPGEC3Ev5EbyEeJlOWw9IAfQ3YBh\/kbvodUw6gg0UIsvZgYghk9ZAXsMYuEJlFFHpNNgW0P9ejfv5p\/tYJ7DVm9KQ68dXFQUXQX5OiAt5Sv2NE\/HkWoffNhsU9kyyGz49IBpHqNvAWpagWQ0Ygb19WRRVtcRlBz5MWR3DEL+8t3dZtuLjaCSF7mragIafG+EwVIBIjTfULtEd\/uMUWJSJLGklZ2c+zNi08ItJ01zE7AN3cztCO4Mqv50aYjoqY\/FiGSVQAe5JbDeCusQs\/rSfDTdD1PjUY9trUp1KWWqLTYvqyQmy6WkY6mc1ciXaWyJbBiAzW1xKP46Obwie5N0k4i\/88\/UR26hkQ9WQas5CFcDryrUsXhZibQGPrS5\/BEflb+XY3jE6nbu0qn1V\/nYTuYknxjgsUCssofUsEK8eg6qfvBTI7i1SeqCA99DNMpd7HPyfa6+CraO87TpU2p5JF\/sq8HnjzjEoYpvH9rw1zyRilgYJ8NSPSi\/AyqkSo9bq2S1cIvfKvnmjItCh4yPTewgk7Cv+8fkd\/l73M3tFFtOs3oOJMp6q\/zNHUyzE5x4kDxlkRYmBtQmbktLk8lBh28dQRWyahX+tlmBltE18\/kh42wGaiI5detm+fRZ83xpjlT8zm+cPwiqcVbi7+aXbpgCBBSlva+C6mP5RqD8GdXcamRalcSO96I6x7f03xqn1l1ay+BSC6\/fmBuq\/JTmP7it2X94rhrFM7ph22fBZsTmZpBFHRztGMLiYWvQYpuYX1nvszovKicl\/p8coZjz6sJJxIDcOl+xIBLIoHT6xyhBRqqAvda0aSAncx8INmGgjy3CmqPX3Z8eA5OPsuP7flKbKo1ZcBu3V01CvvMFWYj+ZPh9cYWfilyouLriun8Y5UThNpyscXWdBl\/WiCo3nuBd\/w0VASxWvir6AurZRnj4WSVBFyM3AQKDmyMXnTnGCck3Q+5W+XuVIlBLn3IIR3rhiBdYYOaKCicPk5uABbWSZAwr14dZXtMCW\/eFzIFKFUI19boGZ+FRnTv9C+Pqp8zQ+6TO59TwZksQO086q7U7ULpDgTAlzD7OAFCG38TfJS6GixJMXPup+PcpDm+vnvRfoJRR1VIxEDlQTYzEqKEK7wNDusoOOuqiZecztXxEEvOqvgpjUwAgAVBZ8kWy+msuGsn0ri7ugzosn9TV9oC+5+a0Nq4nI++WGPPdwxLd+JnDQi25xO7cAzdkkgDwoe6r2oBDyYefPr5Ubcf65sf3ODpobE5zaUYwI2eUIxsdqD2rZYHsp7h7z3FVKXSCMXTkzYAHr8\/2I2G6krtoLflJq99JlM5fuPD+pNLOC96NUQZVCfwaTVMeTBIf2SgVBSQAJivFdczOLUzxXkaXr77NviT+57L8AVr3gWICA99jJditOjZL981DlZEd5woNGCAZsv\/dpJ7+3XfRtzh3ziJq0VFyw84zs98drj4ncbmzhRmAr+P3clJswNNNfmqPJ4X3iU2csITr+11ulfN\/m0Qh4HNGG4q\/PaJRg1PAI4NqxKWtT2z\/vToZDsMmoczhH0fTvwdDHdlzoC6EMtO7OFD5K0kia\/xoZaHgfwOyeSJ2guVLjypJ0GyoyDBoPRhwKUdGvM8YULi27yEa1W3uZBCmj6OL0usA7j6atQPPHHNGLo4W58AJtPwYKJIb+dFo+IkyCycu5N1EINboC0I8F8XPu0WInYs1Yxf2XsSiOhqrFJC6Kt8mnW\/MoGPB9EzKVsxhN9Ll1glyx6mMpPDoEtk4tTNGlc2WAr8GqTzI988Il1LhMVOWi\/k0+HFRZtySkCohZvV2LATVNPXjbLSjWRZNhsVDeuAa2MGkEmWM8TQQ8FORgAIh1kcT+smJQqeWUDFgcSEgsgy\/SYN47ZD4wf5Jqv3qWLkQ2LGJUkFq7tDE1JDkrNKz7jPBR9PRg3eMmgb2WNYAVAiwO9kJw7kZmutLzjh6+I4TBYT2NprHUP0ykuEao2STW1HH3HvcvesOGTv2Qk+pe7RPZs+TWCKVZSrJhaYtmIMTlxaCu60QXUkj126QMGGDfOP0EO10XbyP60qOeZH2kCwJSyHySMzng\/ksR3n0Fbpyd1vxbDIMw00RJ3Llg96THybbbuUHpp21EqznSe\/PlfMd+WnYBBcUhL+84v8LbEh8mvLh5qWvo7Jr2QR7yD0kTTnQZhrASRlEohkMKGtQpX42ZSQa+P3WbJVYlSqy6q5Of5HksazCjihCdI4b4lmua\/aoMSXe6hJgoHY4c2vXIG\/GmQ3xWeCQ7uxuAIZeuXbwY3rwV6peU5TFRpqEDw9my8Dai5nqMv06CZdj0qARe\/aROKlLG\/eqmACxv84XPeLR\/jXqTgqGl\/d5rNc4fWVrtG76BlRn\/sBtIb0rmvh3Dw1K4eV+yoezrU46hBy9TAQ9fKTXj6\/so9hqRnbCD2jeOmdd2bHddAdsbJb91d4Z2X7CpmDSoQ9sHLNAHUGgM1b54MkH\/j1FpIR4PUkX0wpww+kMpMlOLue7vdbUd2Hcv\/mMObnz01h87ILfo5o9gFFdQQotyQ2oj35RtlR5bFWU2sFPS4OF9xQChr9thWxpLrNUU9DaqMtEsn31FK9g7npWyvz4cT6bLp5BL0z4RMbChaH2I8UrZf7GC1sIoujzQjrGaw5HttCBhk8JjtQmflvb6pamKtRYJF7UrxVy7cEEXDI7AbAkgN+MVgAKpwgqTA8J4RBQTqo9CCpaFLk8wmzmfGTxFqZ4sxiCromvOnnyR9iTt049nsxFkscMUvTRlPavHtwESgbQvjI7Fo+QP3p5X\/UkwshQveZBhoDV5aPe6nb7zhwwQpG9OahWMW2iJ63WHl\/hpDs83okM1c2TPlQoTBKsT5vmbomhP2FRqCxs\/4k+rVTdt\/Xc\/7ZpjxMDrfVF3pXOmCvs7QLlUC598Y18knjxr01Tcmzv2lI069hffl4HH7h5OnmuSdvMsG7Re0\/DwVwXC6eDFp8aXr++szdRwPzRVf09pFWSfWel9vpqfgD\/9FH2le8XaYfY1Jz+KRo+ElgiF6wx+Wdm0bwFVRxu+fE+nGfEcgiAx6J6Oeb1A7Km22tMuADwbi615nkqXKkvXvWyuSoroOONUyMlk5ArXGE2v83LF1M77S8Bd+JIk9KG6qTSIhZ0MD7HosOacEWat3CxVdVzwJAycbN9kBfiOWp0ElzdfdDpultBOcHQMzwJrdQAc1bXsDozsWDgWYjr0YzlcPLGseI74VH+vW2XICtRBeVovl3KoIpqYJReqHdNxFdyZSlYsn+DwlVtY6aZLF\/xEuoE\/Wb0uc\/8Mxcq5VR0UYLCDWFJvU2yvAUHvZwCqTKFE0zfGbZ02TSb6kRucDD3ZQECnn\/vB6uVG+cXfbR9oW7g9l0tfZNFQixMx3ZLrZL6P7LFzu9TvvAzFzxu1in9fAk5CjIq3YRF3k5A\/8VbbJG\/7ggeAE1F4kNFWW1FjhvPJEPS6AO+XZGyqJutx0zR7gVW+acX4RPK0UfWg1ioNEkREVdCSCkknRNgyayPjDgn2tGBZmONf9ZhCnJZ6iawoHk31SWxt1Ywp+7FqPiEZQeenkhM158CtZyLI1Od\/IqbbexQMXNfYYH7V9BUbKQrRgJFyjp","iv":"172c7f0ef92c324c49a3794f07ae5dfc","s":"6c54d44546f6bee4"}

Burberry women's wear spring/summer 2015 runway show image

Burberry women's wear spring/summer 2015 runway show image