The digital presence of a luxury brand is increasingly important for the consumer's purchasing decision, but among luxury watch and jewelry brands 90 percent do not offer clear pricing information online, according to a new study from L2.

Changes in the Chinese economy and the emergence of the Apple Watch are forcing watch and jewelry brands to reprioritize jewelry within their brands. These changes, especially those in digital, can reshape brands into a more relatable and enticing brand for digital-savvy consumers to interact with and purchase from.

“Over half of brands now support some sort of path to commerce from their Web sites, through ecommerce, econcierge services or both,” said Reid Sherard, research lead on watches & jewelry at L2, New York.

“The watches and jewelry sector will never look like specialty retail or beauty because of the low frequency of purchase, slower product development cycles, higher price point and lack of promotionally, but that being said, brands are getting better at supporting their digital investments across channels with social promotion, ad buying, and email marketing,” he said.

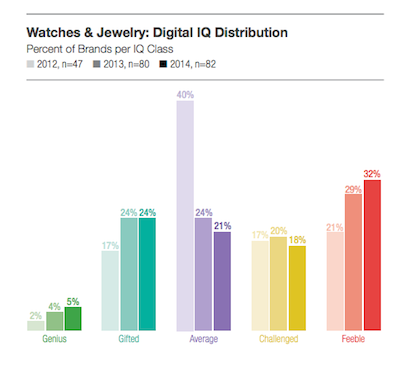

L2’s Digital IQ Index Watches & Jewelry looked at the digital competence of brands based on their Web site and ecommerce options, digital marketing strategies, social media and mobile capabilities.

Digital gains

As Apple’s first luxury item is about to emerge on the market, traditional luxury brands are feeling the pressure to upgrade their digital presence. Apple Watch made a presence at Paris Fashion Week and on the cover of Vogue China, both indications of the watch being more than just another Apple product.

“Apple's entry into the luxury space could mark a turning point in the way brands sell products,” Mr. Sherard said. “Apple is an expert at making executing large purchases easy--with Apple Pay, buying an iPad can be done with one tap, and shoppers can research, locate products in store, customize them and reserve them all before coming in contact with an associate in the Apple Store.

“The Apple Watch could put pressure on traditional watch boutiques to up their game in digitally integrating their vertically owned boutiques to optimize for an omnichannel sales strategy,” he said.

Regardless of Apple’s presence, establishing and maintaining a digital presence is crucial for watch and jewelry brands looking to engage with the digital-savvy consumer.

The top brands according to L2, include David Yurman and Tiffany & Co. These two have used digital campaigns to reach consumers and have kept up-to-date with changes in digital trends.

L2's digital IQ

Other brands in the top category include Swarovski, Montblanc, Van Cleef & Arpels and Cartier. These brands offer consumers an omnichannel experience that streamlines their online experience with the brand.

Brands that missed the mark with their digital presence include Breguet, Glashutte, Fredrique Constant and Harry Winston. These brands lack in online commerce options, are not mobile optimized and have minimal presence on social media.

In the watch and jewelry sector there are several large parent companies that dominate the field. Among these, Richemont brands are ranked with the highest digital IQ.

Among watch and jewelry brands, their online presences are slowly emerging. For instance, 38 percent of brands have a “contact us” option on product pages, 17 percent reference the last viewed product and 33 percent have an email concierge. These upgrades to their online sites give brands a little more options when providing customer service online.

Another increase in online service is evident in the 45 percent of brands that offer commerce and 38 percent who offer econcierge services and the 28 percent of brands that offer both. These changes in digital platforms allow consumers to interact with brands more directly from home.

Search and social results

Search engine results are another measure in L2’s report. In this section, Tiffany & Co. is the clear lead appearing on 16 percent of generic searches, double the next brand, Cartier.

Facebook accounts continued to expand in 2014, averaging 103 percent growth since 2013. The average Facebook page saw growth from about 358,000 followers in 2013 to about 550,000 followers in 2014.

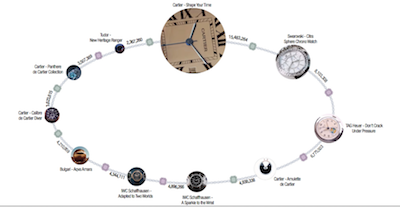

YouTube saw similar growth among watch and jewelry brands with 11 brands seeing over a million views on one video.

YouTube presence from watch and jewelry brands

Cartier’s examination of its heritage while looking toward the future in its social video, “Shape Your Time” earned the brand more than 15 million views (see story).

Facebook communities are five times larger, but Instagram accounts receive five times the interaction from consumers. An individual’s willingness to “like” an image on Instagram is much higher than Facebook.

Mobile applications are in declines as the high costs of development and low ROI deter brands from making the investment.

However, sometimes brands have a “flash of genius” moment that changes the consumer’s interaction with mobile apps for the time being. For instance, a Fabergé fundraising event launched in New York claimed to be the largest public deployment of Bluetooth-enabled beacons, giving participants in a citywide egg hunt a way to access clues, rewards and other information.

The Big Egg Hunt was sponsored by Fabergé and benefited two nonprofits: Studio in a School and Elephant Family. For the event, more than 200 egg sculptures, each created by a leading artist, designer or creative, were placed around New York, with consumers encouraged to find and check-in at the eggs as well as bid on them via a mobile application (see story).

Future of digital

Establishing and maintaining a digital presence is vital for brands and with ever-changing technology updates, picking and choosing the best initiatives is a difficult decision. This year luxury brands had some campaigns that changed the way luxury brands use digital.

For instance, French apparel and accessories label Kenzo took consumers inside the atmosphere of its fall 2014 collection with a 3D digital museum.

Kenzo’s “Grace to the Nth Power” let consumers use their phone or mouse to navigate the virtual space, which is complete with videos and a gift shop. Taking consumers on a physical journey through a video series leads to a more immersive experience than simply collecting films on a flat microsite (see story).

Also, Italian fashion house Fendi gave consumers a different view of its runway show live-stream on Feb. 20 through high-definition cameras attached to drones.

In addition to the standard view of the runway, consumers watching the brand’s fall/winter 2014 show on Fendi’s Web site during Milan Fashion Week had the ability to switch to the camera angle of the aerial drones. This new way of filming the runway show allowed viewers at home to have a unique experience and feel more a part of the action, as they could switch vantage points (see story).

Watch and jewelry brands are likely to follow suit with similar digital initiatives for special events. Apparel and accessories have more wiggle room with campaigns because of the nature of the industry, but the success of their campaigns will likely reflect upon watches and jewelry.

“Watch and jewelry brands winning at digital are using their digital properties to provide next steps to purchase, either through direct e-commerce, e-concierge services or boutique integration,” Mr. Sherard said.

“Using digital to build a brand experience divorced from the shopping experience is a thing of the past, as more purchasers research online before shopping in-store and expect to find pricing and availability information online,” he said.

Final Take

Nancy Buckley, editorial assistant on Luxury Daily, New York

{"ct":"+K6hwxL6Ja9\/WE7b4dI0TGt6JgkkeHN0qo0Y0PDvzOJDoqYgDGQ+D76yZt\/i\/A0\/\/DFYKUouk2G7ShV8xNVBivkGJFp1SW38UwqzFxZjf6U4rFNfFyJ7uUTTEs1pVe7JHbM1O5TqYAOL3cVjU20g2ZdxwHNI8CDDyPfhmDm0xA11\/LdslkxKCXdQ7+DfDqhQbku3sTLGitTdlq0cb5EJYwB53Ac8sIyYqayyXDFXCpRKHzuqTmAH3M3nHWrSVUZ+5Cgjt\/A87iAi+uPezOcTc3wzHI6RUkj\/1tIoFNRev1LJEjmdwRYct500d15Qxee15EeGf\/PNNj82B8kbS4zNLlTbwYAr\/3QHlCCupoodSuA9pJ6Fsg0NJ0Fp+Hy6NYcMMMTy143zlbQPPwj1r6k7ss3tNJ0qhzVXo1W7JUEym4ndAOYYPrnzmwkCz+ht6hEQQ7cn0+Gio6P\/ddv\/s8jmqIyB8SSQ6Jsuyq7yE11mhCWCdDofysR3oFKQQoW6BviYnETHvTzcHfH5fB\/nfAsSqEYGMnEmdcjivwR24bULwsCBETRqWigLBdPH+D+G4xAt2DuQbcI2aQErbJgbdMmnmsat4PByp+FeNkAhoppOml9n3tYs8qxDjZwcTsNnTIW60n45xV28B\/rZE9lQWZ8YQIZtw8DlwPHfW2TdtMIWRXa+2MxK9\/35260SjfJGH\/4njkGaFJKwxP3Bty75UoStYWYYLiK\/3BPXdC\/YPiP0xXkZv7\/ghVMa02vxLfKeN78Y8NdOyr1R3PLmdczMfNryqP9LePfHRqZuWIXptrKVEPbCz06cycPIHWSq\/WLBIZe20pIQpcPlKvTXlQ6q4s4DiQ2s1FWz6XYWKUPBOO3bjwqoStFuCXvDRpKTuv+xAJoI5Ai1\/fksZxPu53nmDfS10ILJoyq0B8zZ\/kaCSgP0UicOHl+\/p4B1Ydbzbr+J66R\/su0fi7kcQf+6RsoIrGt9htAo+OIeHBIqVlbrqHqowhqZnb09daEi8PBF09Wychd3VinJjfWcVXHzw3HTf9nbpIvLSFWDE\/VV+NXdKPSbmelSocs1UCYH7wKkEAyupy38K17\/DXdpHzXXgR\/6tBo2\/sskMu+9oV3kycAjaa2sBHBc2tkBHOnWXIF3q5SwcfmPfsKVQMXgvik7q\/XzyPZmH0wf2vyDgnkcrYV+z\/LaZboafL02+xZWOcLZ1FnqHALmToWVFtnQuGIGqS9ciZvmRMErVyjxNKHvlDMgGroox2+ge7HK\/jBhshzGnu5DF18O84ShTGIo8wofagMF+JGS1QHTqVNb53\/3h1j\/NWkc0\/K1y3TtdNyrPeBuDwdsoquy4L5xGyPu1ddV8Mk6lPT0OZ555hhPAxD03NEq+FuCZiGFhQKUmyDwUxruYtHziW5N26AJP\/dTnIjGjswVnHeq7SHrgpKWa1D3eHAtYFvofrSG067tVUNpdNIJ3u2Lu5YQkBaN\/nlqsLSYij9KpgDVHSW0OABq81U6N8OrdiPx+aQujw06YcYxKeZbxwd6HbFJyY522Fvja7TS6FXeVgT\/VGLpcCBeW9gQyNBiqaFgRJRcRIa7\/IhrJl9ITWO3rhZ6IwVh1QFYVbp2SvCSsKEq9gDCjzGxkBfIaS4cPcU92AzfdbytoabSAgbJjz4fQQI7E9YVGjgSvlfCW2x\/X2ISjvXr+sOJ7oJICw0lRilgmEh2b3n69uEyf3kAfPc7tINj3A0YUKt0NJBDsjE7Y4ct6289yAy\/gx63MMoV7tELRZKJGWcMEI9VvE9T2kksJaAA54KlnpRObOsWm+XEqKNLHB8kkjfOdSS+uRALc29\/66S3I3n41DGvpgP9scqNV8X8FGCwTIkLr6gxXheQwAnVxvljJcUiEZjiEwPZZKzGGnN\/iln2aEmbcOe8zQ5Ot\/42C3iOBiL9ACCle9LbEKSh\/xJ\/maJpfijR6WKXsqsdSHe4xwRdzfbacFpae7tz\/XHREaYcI0HoX9MLdDBofK5wFooRFYMUPaYJjy81Wa\/3GcYCEKWiTZe8LpPn0NHxYb+3+HEkWDN8DEoVyjFuq+JoPD3UBHU4kMmcXCDFmIMLrwcVSmYvl+eADZXrZh76ow1c\/aolXHyG5te4HUWO1CdByDnBVM5Q2+zMZj6CFosSTXtddlLotT\/h7YlDftZ1veT67hjhriVRRcYxz5TQQ2YmHVCrHs7ShCYI9j3oKHibPA9nB0lREfxf053z4pVT+3HZBswfF6fUb7CxKYb2+PmbxKLvk0XwlwRl5LXEysEB\/X3ykkocWMn2h9UPgAZvDNKpHcI3CSan9TDm82i1MLnPIjNBBj4EPZnYFOPJIlBGLbxwJdpHHZn\/4sSdemetzXo+kZG+k7IAfFWnmSacxkFeMmP6PUlDbnaZoX7wHIw+tj07i7THoBWdMSwwdb4PVibR+oK\/obg5A9ILZkCeqzGCIMXhJsg+CuHLp9RA5F9bgU3BgLUEw7zkthZ8N9CYnRrXR92bEPdGxRFIFp9RX1bFFIhOdhgnTVq657GDujcPnOPCghf4ovAOPVeZv4WiMcC0A6IUO6VH2YK4HTzXy\/G1+F6aw0puuDAIXjUaKqkQRtpqwdJjW0GMVvbcfhz81XoPCWyBL5cJA0ajT\/GsZu5qnuyJB0l49sAhgsTw41JwAMeo5Z7Ambl7uZzp7mKNtQeZYGlnSmdV6GfE6+ZFm+onOoVXKUSx7G+elEWE7H0bpglggb1z7j0\/d\/4VgzjZaMQ7qw8aivBzxuKR9vtnbAPiuRUf\/5XUg5tCRVahUyBIt7ObPoGzrvkpP6XArI0wEj0RF5LvbENDjy8ENI+xvYzjg6jcJmFQRUC\/sqhPC9TYSxI50tAMlR++3+raQLsVuCgArMAZKCbOjfXiWHmM5ADRBK\/\/HLoU80Em+2ItTUUoQyQfaknNtUorWaPhzFpNMtSLVKSJHtHGXyYcRyINatgDpECV4OMvwmFqYS6Eb97RT8ZiYmJSH\/gKB\/BLRmdUsk5Ac1RcYeK0BrYmMLO+VZ4ynIMrKUxQOydz1SdCaPlcaRBpnd2kGorr6gWfcsaatymsYGj5KkY7aH8Q1HmnONxGQakZI8IsHCbwhWwmF1j3DpCpv+kEmlwPcv9UBtSTDa3nWjUTeQ0sktBYuDPSYTMpHzrxdMlRdfVmKpheSuun+PGGV61d5uz1B+ubMUBpHf\/Q8+LkG7swY5pRmXNj9LIn0JBwawKIAr+38bsQFibvrec4k+9jzO82VNlSEN2uDaRUm9zKKf9n6C6eSb0TU0n2u3rYn47RXHFhI93da9R+hqh6GRm8caXPPQwNLwJvh6H9C2oV1jBIici8o3itRGgndhDZ+Ap4X0hXzdPwNBefR\/mjqDoxyOvqoJWspUoghB6AZ+Ke3gVlaydpAONcTtTsZUFRtNXtTfKOj7k50uzr7ZEHaygFB8LUV4X8+uV7KpLvdZd88V7PsUc62DJdnVvXRxvikElPNUru1FFQqSgMIFN12fLe1iBvJT+IAlUjNCkoIKTa8Oobq4ROTAMnurbTMN3\/cFih9Vx1eOhK+bdlvzDnZd+ED5u+7yImsNGmm9tccN6youG4aghs5975y6sUle2Mp7uASwVxJfRCBoGUgWe\/9UKL6raIkUgXdGcm4Yp7LGF3L4vY7RKwHG7nRIyTTH2YynuAaUJ9lMrMNQN5sl5Ts\/Z7+XfjQ0R5wdlz6kf1oeOwGUJanRwEGaEmj97Y65Y7BPu1VCUxkHNXsDc0oacfVEcELAVJ28pCg390ELaBQW\/HaozjP8rEW\/F6fw2mCKzyY2p5KEcGZ0Gc7a3QmyYFqL6GHjpzlWA81QUjFgqi6vxGfWyWMngBhqV2AcM+z7LrGNjIh1QFGzcyh1E8lAYO7z9Zc+Q+bTkwD5kw\/oOkF0aU3+v4ByknRu8IlLQsc884FKIaho73NyBeF5nOz8rle0E6e4mymFTiqqXLz+zexU3CVygRFkjzH57ekZst\/CYSXBvmfyq3G\/aFJKJGZEhTdrOao2f5XsmTSSzuIc4KMwr\/3y26K1bWRtXvRrobaJye1d\/Wki2rdnEXpdqIrkYpeF+DVWvYQhgcPSBQcUvp4xRGaVV+9ytFQVie4GzswTjg7XuGo4Mi7jbdUTfr2Bq9P8r4eKtZ6gnh0ZwwSiR9yK3PyrWxYDZVObPl3lItESUgV7qpmcWVBc4pNEzuIwNV8fcR\/lVOP5L5PGiFkGRsy+AD8PTPMjrcru1McrM+puWUNbI2T0Veo5Da3kknVUWpNz0M5BLumODaxPiYR8OTPvC7RTg25ehnV4ujO0AqXxg0vHl5jTd0fWX6dJGbBEOZvHnCCklh3+w3ZdEEOkJ\/Jvw+nmanNSjPEMFK6\/cGf93kA\/7x6xZUH0584UTDTU+wF81bxWMU03RdHbwgEDRv\/zACGmja+G+vzL4Ea+nNYWuf0HuZouGUEI6\/h54k9IYUi3KJzuijRjKVbNKR6MeticrY6tuUeuU1dbjsVbmM3rhXMAAtCsWfN2YpwWmk4+BdFx1IVB3GJFIqLWsjPiwRGiYjzGMLHDsRiiPpUXSdweqzn8C9dtahmEcrNIylvn85\/ufxSYL2HFEXCPVmuqyom3ZZ+ZCWYSfWKy3ZgTuVIRipDq5NE8gD\/TATATSxg+TiuztEMCaHYXmLth68kGZGInDFHEBhlfwaqPB\/ginKAIJkBRltqKvZfoPZLp8an+aAijqIf9YZnww6wq1FwBLyk7gXggGa3mcJfG7SIN+4avQXzN3cTj7LkLFkj4D4bMgs65U04vc7lTqFfZsWwhZ\/0IFYrZpTpWlEAW1eBPPZwNTqXj3mprW8sE+7stYwbiKb+GOTDY4+vCk3FGVUO1a4Zv7KJhgySMC394yjGZzQonIYtAtKtdGaJrpHcxK\/rcyeefc2ID1gfPjtmo02qqBRf+bekttINa\/ASlsL7RtbTnG46ht8Y1vbLT5B0RytW4pIGB\/PXqN3Ok9Sk7Uez4gZNNpeq\/8gytgaVi\/niv3zrFweKaXsOiQelA981rkrpWOqw1qJN\/k+z8KQxEnvzSm78QxElxelpC3G+6C32MSXiymll9X1HePWfhRrLaSVx0H72OgPA0ARqXdEN1L9jRmN\/U9DFvBNZBR9Rw2U3sm2CoHmk27MxpiQ\/5vzvZwAUEqsI3qJmlWgKKATu4GXbhzN1PPGJuabGbUbUISDy4qW5JbSJYiFDSzc3U\/oFcRiwLV9tHmzIY22GoiN5CtfTPTGis2BzHQ46li6Jm4+dWCJ+A7+LFSpdwKxvJhmXjol4h6GI1ms+mu8Xx6CsEcXSnp6Jtw+njJouZMd1beWTkQcVC9CRbn2MvaxffWCkiLrpIVsBtrRqXlicBnEKQoZsYgKTGCDTSYZgfYlErId+hsxYxDMesV6gfTk71WWvmLBHGZBo1OAmXZ1bIos1p+5O0MhbjMRlq4Ewwi+WCLTHs7w3svcOV8M3hY8wfM3JIca5p73HGbZ7MAl2pm2DwEjCv\/oM59zFlZ3OhpVC9bgC1vUrZ9YoqGXXmgybrwEcs\/cnuMKnyEZ9mX\/MEb2bAnJX75rq0pkzrNoKV9xJPw0xrllXFPQzbHnrrZngrxd93ug0bvCDe4mQxN8s3kQwplfRquL6kPW7RQfMf\/mwxxTGGrHG8llnAIFBzNmjvZDAje4pNoheG0RHJdYgE42YR+NX3l4Pvou0LYAAzG+XdyGm7l7kp6qpICVEh7bHMYrhpOv9E6Y+oXKaFO15xbWAmbgn51n4h3944TbpsH5H7IkPccLI8RomKvBVO8C+3FMILDCHe3FWr3u434ND26F+Sj3rkTBCC23lbnP9AuLSuU+2whYy9qYjHP2IPzNkiMkXbDSBX+gsffcjaQe2TrQg\/kUSCXMmFHx9f9b2DjaaDeZ7igpO31RReoqnQuPPIL818oFSpQ2IlM+nqCP5bRz97ZNSct+cArE0lQMKBYJF89pQnttMetXXwd4YdeSQR6lOtZYhRcizAnKBsafUIiSjhRs4cUn8fTMsf8NGiOWvYVQpLayYepftpO4fVxVnwGspdbDSlb\/+0Olah+SyzrHKu75rD47o2KKZ6ABbauT6SS0cGEtZlvzwfGBKewPQLwsdECCHcwd2zj3SUXddk3vl+6UYpuFQJzkvOof0LanDZKPkm+D3ZfroOTM8iZjA3LXatD\/JdUJTYt6k4Y6zrsnpiDLE5m\/LA7iuZZuhgEo9iHevOzOS05Hxr2fibHF3fk+1Xyg0Oco8sfdxt4URdIW1wi02ThsV8JQLRlnl+dMKx2M2IirbiXDEFzCK3NGKtvVmkTOJlcGIgp7NdIn6cy0+43dA0ho2EHlUeOpp8UwrY3J\/Jecvu6xgXo4sLmJeUJxRh0YSHKtkGRtpMlRsX3MxBrFj2lDaJx4mEG5CRK+HnAmGgZnOZcUmGs4\/uuOXakcPc0p7ijaNLhJkuMAaVB+9HJIPfudEe9r7QJqaF4uBOKlniUq\/3o+oDW5MeoI3sc+5rIvvzziu2zH0lK4opAJaTtUWfwxvbyTAWNrihtrPeBixWBrpjJzDJU4Gbixfq4ZP57sKk\/Z7x4JbIeQYHkRL7LW+x5qp0IJ\/xWyoQ0SwNWZ\/8frEt+QbmGkfUjijvHCr6O2J2qT4PnIaeJfn6K4QuNA2GiujynNpdllbSoFL8zMh8gqNGTsP\/voqTnEJmV6HTNN\/2aIBEmUmACa9OdVW\/y9vJfCUnmSHafhokqyuaukJJL1n9MvUdMJJ1uCwX2MsVCr2RcXVeQ2jOXGIT3\/q\/Lrj9RF9312uq97orBiv74Li78i\/hugvFCQKTLNrGOtORnLLo8kl1UDIr7F9L69kCV6ZDUX5uf3Ao2tZw1TjMeKT+jDTbCl7It2MXe3EDXzetQ0ZRxdX016h4h2MJaD6jvQdATeic6o3dwVRSzmYP5ke07YZacTckvtH07JYoQxlNhGMfsWg88qgV3KFHR4Nq75Slv8KG3gOsLigUNGIBl\/kSVJWZBw0iD4raTc1vhsTXugiZjtKhBoE3ZbKstDZvH6\/x+28wRP9j6GXGLbYBL85BBTWbnIZLA1GEQH4NeAMnLfN6y2y50BWH+csIt3nZpr\/oSjGpTBOrPfgW8\/pE9FM6Hz8Ywm8yYKeUyqGG0gvUa56W08GS+yUKjebA9kXCYp6SN8auA7IonOx5IYPxD2BV8A+JOs+U7x3MS32vC8Ij8agTb4PjTpKXtkwkoqbnVOV0rfaoNrK5QG1Hygw18FDCbRHdmqvMT0\/Q6KhAkuUPlE20jAvRCHqtsmsT3eudj0T29JRmCz5Pb4V1zW5A9QE8yCy2+slamM7piOhoTqCbyl4n2dIPjwiy\/6EBOVifqMdP5zKs5zCTQqCU+HxHMTUShsDmkvLOE5n0q12xQM8ywxTIV2QlF90nduZN9aJ3smC0n4KJUV96CWhiNls+pCDmbYobWRAL\/B89X4gaA6A+hABRhVi+l0A5XwJ9wnwdsFHGrFdO20deh3JRzWJqvSP29ovY3UDm7Fj2O3iL45A5gH9iTO6V0XE+12Yz5\/Ovma\/aNd7qOpPFS7H8dO+k2QqdBgbeV7lu4Kv+U7hLM15ZjLWBgVUoSydB4odCwC4MHyjRiI1g8HWiYlm3M\/LCbAQlu5BMAB8hu1ZAw3K5sAFXPoUHfArqqyWZ0QzK+Yhzt7yIs+NGr1X2uRbe2cgDfaSnRIPq43Z43lypol\/YWUa69ms2wa6Uym9iIa0fll9I4RrtNsBMFArZu\/PXpAuMJRvVtSUckNVJvVax+2Tde3nbna7f5bkk3kEdKflk8PawqKXiGpHT5uwGo7jpN9yBgMj8u\/XKuAULO7YZoSOaa5mDQbSRPmZji+4AIlwcB3Fq59r4UNB2o+7QJEC5\/YFVris4NSq\/rR+8qB6i7TlnRWW2lA8oSLCdcH1goeLG79mjP5hcmWaLpRzcqMAPVH\/ctmSj2R5IyguzbY7jGl0YqdaKDVp0Lx7UrXqQ3wNU7xv2ZjuZ0eM8cnE73IZqw2cV3jwdvyL2g9gWyZ6g01urZ1XURv8IVQxyWtx\/pyf2xcfXUKDtR4R1SAAeBdp6ROY\/2M+oFGx9pmZLD4b2KotxjcLkeZji5YORWtJ\/tdRJIai6g+KdduiJhsK1Nx8L8CbZyIto+pgTUXWdOjmUr87nDSQ8nrEnW+LKvBOdW6sf7+UC9f87ac+Bl2lMdk4FdxSHqAWuJ05XccBfD255x\/uV6c7694FvSWP6BzGbZ5J\/VkxcO52U5YQb6nIIluWpkbAfTJrIp10Ux17xrdqOHpmqQWnppEfuii5MRC5TYU1526lGzf9aFMwZmVaB6VdwbjF9qemoOUpmn7226GK2n5gxxoKNEZOT8kOQaH00P\/SqoU9a19q3VFWJSFdFVMv\/wsER\/HEoEpMe9Bv1x8OcT1Y6OLQ3hEhi+P7uzCHLFbk4mL+rYdP4WL\/+PDCDkV2cpoIP\/Z4qR9psnLSvVQN4u0d6OYEkG+3GMX\/Wg\/Th7iZG0e68RMv3uNs6nSFX1A9VBHoY1WutwtQSQvmEkEHcNrk+OCPMSwzdSr7mTGgXh4XVZcAWafuL5YILAblE38H7GvtCER9Bjk2IMCaQW7ql75lTvcimJu4ElCcpN7ue4\/c\/RpfdUx4VtmTXvVI0s2hXIDVZGHsdDgeHRpSOUkY9ol0dzbCiocGKrMyMDFx5OJB0MUr350hy4VSJ85923QZHVrchdg3XeA+K5368NqzeLElXu7Vw4m\/+8xAwX8k3BmsaklnN3sOXoalugepGu0nXGC8oDCZXvUd65+FeHI5B80wzIz5D7FjNOe06sFD8mf+bLWIWhaC\/cvMzb2Jco9bmPy1X9YNExep0h\/1IZ0GPh5ZRhLAhZsGqI5thj+7YYmIsrg+sAkRIixE5u7zi4F5dQksVleuQtPUDnD3u1g0WBZ0A0+oJpG+4X1surallN281JiZCGSg1U4DoLHFOfL89EMt394zZyCSm8wEo5kv2xlTSuaRd0NontWkCbIcTBjVRczVI3ptZkP+D3H7Twgg9HQP9mUmPPU0uZYAYbvpsbf0LJuM5mcDMPVYasx\/iayNiH226qRCxZMtotit9UDFYdWG0dY5lWXLoQC4MHv3TbwcIKcDPWWTvcWPOW9YSkXTnmzu1AXNVnQAw0i0LFHMHxU2XsiSLAsvrJ1ywC0ubLRXrtSTg8nH0V7uVsTEIkxQgj+MZGxKu4TGAeoTaWX4DhKk4kLFgcrn3x2lWIIrQnG1b1NScHegKNDvxD1Oto5yN6YIH3\/aYvPYwYOt3Xhgz2SgRewYtqrPRV9aD6X3oYI6\/E+qiCRvcBDfXfPoAepqIdgizk4LEBE+yr+do39Qs4POl0FC5cywJIQVwAaLLWlPwxANnslrtz4z24hx0lCSFEik3NQHamCvvswWY2JpdMuFzNEJMzzk8e0f+aq4L8OXLnT9WqZDasT6Qnq0ajhhYULLBKcHWl7RkzlvYM9+544BqkhqzF7FDmM0AtAO7cGgapYN+Duz+6hXVXS0wtyy85JaJbRROaZRKxbSPpVf+SUiGzA4IpgqVbzQ9fvmWJ8BiQTIW1KV8c2JSSCgdZmHmqheV0Ke+fxZqL3K1ql\/4sDRSUlllx1eMtjtJIBuhVkejDRiInqS8dRt6LxES8Zvt2jpMKjdmoyJottjDOMtQM9AZ+Avr+cxAUpqENUmIoKy7TA0rv4EsTSWcpL4Ti1PpqDytIcikTOtsAqyoRLVVYyxiOxvQ5jSI6SKw\/Dc7Rz3PJQaWGwJ0I694mQcSII5q1EjWy3pP+5\/2AorwQ1vPy2COdyNfFuonL6JuD\/IgXFRNIwoemAX83MRQ37bvM2kA9vsfZH1y5XuNNgO3uKeOfJxX53P6tg4kxha6iN3k32MIlvb+KQXAj+c6HPwDo9HxSkDHBw2jQjCOx5WQedFqC1uxKn9JtC4VkLwrnpyMkzTnBs35XVCgM3fLWyjxOWVlRJsutTDN2WzsDQJpOG6GbnmdEhuy94XYEcGb5M16RJicn8TL1LvpM7TxVFJQjgy040m4GNGhB6aUaM\/+6E+Y7gVOYBcpnms1YLXeGcT8nToTpiwosfoTFRNKqIFtcb6TbdJ+7PBSMx3ykMztpRdF4Muen7paUqQsHairaQSDoz6\/2+2Df61rceyuVtYQ0xgkSG\/6buifeEzNBnXXk4jdQeLkZobLWyowVcECB7hxhtJpbbFUvZSQ\/2tSdGoic9vtgrqcqHb5OuehsDJJmNISNN9W7MgMsz7G5hR\/WsQPnlfc7IRGH\/RC5oM\/qh4Gf7nb2iumS+kloVuzQdSFzUinBY4K6h1G0aWDV46sSgUUV7sPXcJQRuAANE1qLW4WFf05n2CyyufizNbaQYFqwV\/ayaxqXKEiAThZygfirgoimukCxRUEIlMCpC43ie034kt\/M6\/Evw2c3uf6mCOtdm4INjmJmFtscVIjnMYL5MIPtOCltRNRX5xIHG1pJasuUQ+EoeKm\/iQaxLRu+QmvCRiYV6DPam3ARqpVElN6DTTxXhRw1ec1w5HzX2jr9cRmD1G2ZmIiGOFyC3V5bmYmezXJgoJiY0G2Cd\/4qrntpBXQYN2QZHy30R40fBHcGV+bdguZEkaC3iUUSKEX8QdneXfGbYerIRgozSyvA4gxfkx11qROM+Sb1buzkYPeWNQvV9S4QUUa7IfTx3jyiQ7s3Al8SqSF5WnvHpmVWUGDXcM62tUSzPJgFg0\/mKCPWxMD9GOEQGVMlLEagG6VEy8ZSLB\/BUd7k4p9oB7FNfTuym+Wr2aV8D1K3tN64js7RtTHh1FUBTg16MbCZI9wOwoE\/qN0TKgEXNa+3zJYVez7cqeZFMWSM+EF7isceRSG3f2F5WrfFnakwvW+Y2n2J00KV+r07ZP96vFh2FJCpVCh3cz\/txX0zpd4vaJppQ\/mGz7xQj97xvZhr0L3XZx6vx6bMsMa8lBXIUluZnfKEPHMlv8QkGT04X1BIEIfkLCoqGRkH\/8m9JqcCiU+JimSAzBwvxwRG3LmdUoUHubn0mbt5okAY649g1oSOosiVacIZ7slTAYMHMdap8nCGK7t8REIaplvWNelomDBjRY2VR7L7xwc480KohZYRGXykzXsIJvLkmJzMC6+\/Z7Oay2i9ym\/LhFEgZ7PbLOFLJTGYUVnKcgnETdnyi9LfwSaZr7Q0kShFvzicY+h7yfD3LI2cQg4LOACe7zGUEum9ZS0tK5rB3XE7+p6JncSVy4vad4XC7xp2Ll00j\/QnKOwiPUIJalARP83dgWaYwj0sbeBM7P\/atBr9IGcvVTvT4031W0HuaCPSbCGO7jV2Ue3+j0v3TjGtocK1xrnA8PeRYURa2M8mYo5aDoJpcOkNIxbAenu1TGxizLtr\/lUC8INSBfomhuBrB+P6k8J8X0892rlYH6fDm5haJ0lRQ1QVEbC5FhJ4w6MABq5ivZorWJlM80wVxyb3CStA7UUblcGvMUbqqiS7mLf0tYTyIP5BV\/Zsq1kS2rZJmotVMaR+gJUkm9Mf\/H8jpKTkVThRvCwWpdo9M5Aimae1o644XXn5L8uDLQr2xrOEIFzr52jpaTVIoWDMUCe\/NztNzoKmVZ+WmjvEXi5rr+jDVDvOInyaWMrroNOKC4F3I\/HZLw4sSNLAG7+jsuqMl5xl9qDHLqJAxOgjLEH7VB6phyeMf01gHvhqHsS7dTaEMChKZfuimbJzoZ35whnP\/nt5N1GTvGY7N8xwpTLzXD6TrULuSbz4GwFqaVOgYJYvCdE6fpSOQWkbSX88ZTq7WVOYU79iBEq7AtbVXrkfBnQlOej7tkJycJM\/k61PbnTYinDvgWKVAryNeIxgzQAReuwvHS+AL5zqNi7jAXaKH1a69hpvY5Nasvtws4aXTMB3JCK3R72RKmm1AGaxt2QTU669Mc7kFkVN3itRnbBcXmpkpkJN4wC3vg3a0UEsNivWBbuUCJ+gdcyg8Ud4mc5CDmmFl3Iuu4LI8otgevFYobgRe4gOWViSkcq38\/Xk3xGjyotUrplRpdrlqI\/T+DdB5K33qQZMTKsgJtYjQrOIrcZSK85xf1A+7CdZ08cyFJEWyUPq8hZ5m0ZuHdnTC0w5RztbUz7V8mrjr1jrdX8IQ5irtQsfYt6D7bmmv\/y0ReTWguBA0AkCDfHBTas+FM9VV451ytlfbtJsPw5s7Qwn54RYxmi2NxOSZSsGnQuva0AJQoQDCKsbGT1wfrMH3oX6Oalx1z28DRxbk9\/mjOUqu3RQRJms\/xkaoW+Bju91dFJprst0qqlnjpu3P5AMWpFbb11rNAao\/44bTDLvuoysGr9CjYOM213+DiNO7ePviVRqERa19gJm0HMd3o9vwzd7lunywcqj1ksJCGYW9timvbjgk0kQ9DTw9q9C15gVEFcfMLdJzqfORLeeOS32iewtSsIM8I3UMN+vxPIeqCZN4TWOxDfqZcj+hiyVifOsyofEbPXxG70CQq69nNaBsMpDf\/DEyVCSDwRoAnEY9nNjOiOGb88Lj6UjKTkneIiSDYzCaJwAs+PljPj8Fg+TT+H6kocC9u2timBnPyZllSK\/ACxj786J1uOejYos7vnZX4tejrR6qaxSHLgTvSl546bYIFdz5HtnpLJ9OpuJ5W5o0A16oZBNWDH3C\/x3vKglr3B8kgaaEYlEF2LyWZFz282a3OaUslsH89cPXpnFyqrOXNDpx+bArEswKGhsVogm+7aqLu8vNxsiknTt77E4giyBn2sSR5KDGxWXeeN8Pa77Kry\/oduc5bSelrnsCpEu8WC1t0\/HEZ3A1KUDXjGB2hU0O8YgWHQTMxu2JK\/0bgs8tIm2LcywUXBxU8a+PcRJZCLrjj+EdlGLdYilvLEqa8VozLsZfvBmB2i1I1TrtS2xkdhpMfKGVIIkwjURvgi8ILWy+scpgfQPetjbH74dLjPo2d6WOK8yYpKkL\/xd2DltuJwibBiPSRPH3BPtDCtZDgwIFI8Z3HxvPnQtFHGtptOJ3B8Tci2PYijzO8bQFrtSFUiAIgFJ3Pj4Hm9Qkf9Ws8B\/CV6Hw2YdH5nrMAfJudMYWG8gVBHJdPS0p0XBScq6xYHaIY+bhVHvc09shgKCrBIXX7QMXYrxZchT2Jek0d7GqMEijnwiPN3rSUf8+FL9xMQe2GK0Bj3+Wqpg2RL4zYN+I+eBuykVvuTlhAzze1X6XiyUzRDQAYFb\/P1clD1mxoCAXyoFS4YK1\/\/ZR7LHAh\/9LaV1hYaPVCdE4vIKJqV1CsR0LzYvdEoS\/yiCVlMtfqSvPYOemwmgauCtJDarkc3YkHzcvmGaNHxbR0z\/WOLIzBiiTsDn2jAe+7LyENkM\/gM774FQh6yP0WOw=","iv":"7369ed36c4e5b2a8a14c72509de9cfa1","s":"6d9636fc90a2b0aa"}