The population of United States households with $1 million or more in investable assets grew 4 percent last year, according to new research from Phoenix Marketing international.

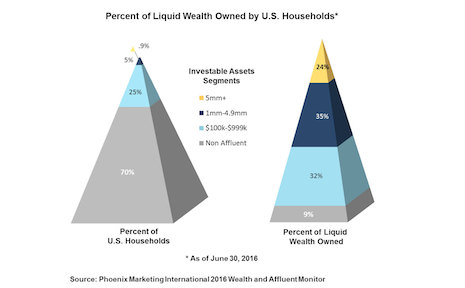

Lingering effects of the recession have created a further divide between the wealthy and the rest of U.S. households, with the 5.5 percent of millionaires holding 59 percent of the country’s liquid wealth. Geography played a role in determining consumers’ success at bouncing back after the financial crises, as states’ dependence on certain industries helped or hindered recovery.

"There’s a multitude of factors going on," said David Thompson, managing director, Affluent Practice, at Phoenix Marketing International.

"To begin with, the households that have wealth are by and large better advised and can move quicker than less wealthy households to take advantage of opportunities in the market," he said. "That’s sort of a given, but it’s really important in terms of their ability to move quickly, and you see that all the time in the data.

"The second is diversification and the ability to have access to asset classes such as alternative investments, hedge funds, other types of illiquid investment opportunities that are not available to the general public, which in markets like this are really outperforming most other mainstream investments."

The Phoenix Wealth and Affluent Monitor combines data from the Survey of Consumer Finance and Nielsen-Claritas.

Increasing affluence

The number of millionaires grew by about a quarter million from 2015 to 2016, reaching 6.8 million in the middle of 2016. However, while the population of millionaires is rising, their ratio to the entire population only rose slightly.

Adding to the trend of greater wealth concentration, the millionaire households that saw the greatest increase in their assets were those who have between $1 and $10 million in investable assets. After an added $809 billion, their total assets reached $17.8 trillion.

In comparison, the entire population of millionaires holds $20 trillion in liquid assets.

Wealth is concentrated among the top percentiles

The discrepancy deepens when looking at those who have between $250,000 and $1 million in investable assets, who are considered mass affluent. These households saw their finances decline rather than rise, losing a total $56 billion between 2015 and 2016.

Again, those at the top of this segment fared better than their less affluent peers, with the majority of losses, or $54 billion, tied to households with $250,000 to $500,000 in assets.

The mass affluent collectively have 35 percent of total liquid wealth in the U.S., with a combined $8.5 trillion.

Households with $100,000 to $250,000 in assets, which Phoenix refers to as “near affluent,” saw their financial situation decline as well. These 14 million units lost a collective $79 billion.

The top 1 percent hold 24 percent of all U.S. wealth

While the 70 percent of non-affluents account for only 10 percent of U.S. wealth, the top 1 percent hold about a quarter of all liquid assets.

"There’s really nothing that’s stopping [the trends in concentration of wealth], absent any government mandate that will free up maybe the tax burden on the mass affluent," Mr. Thompson said. "But wealth builds wealth and absent another correction like we had back in ’08 and ’09, there’s really no reason to say that this trend won’t continue."

Beyond the U.S, the chasm between the wealthy and the non-affluent is continuing to widen.

While the wealth gap is getting larger, the richest are accumulating wealth at an unprecedented rate.

According to an Oxfam report, the nonprofit expects to see the world’s first trillionaire in 25 years from now. Putting a trillionaire's wealth into perspective, Oxfam figured that an individual would need to spend $1 million every day for 2,738 years to spend only $1 trillion (see story).

Stacking up

In Phoenix’s state-by-state rankings, Maryland retained its first place position for the sixth year, with 7.55 percent of its population identified as millionaires.

The states that made the top 10—Connecticut, New Jersey, Hawaii, Alaska, Massachusetts, New Hampshire, Virginia, District of Columbia and Delaware—remained consistent from 2015, with only a couple of moves up or down one spot.

States that tend to have higher concentrations of affluent individuals typically have industries that create new millionaires, whether technology or finance.

Further down the list, there were bigger shifts, as Utah, Michigan, Arizona and Ohio all gained five spots. Meanwhile, a challenging oil and gas industry saw New Mexico fall 11 places to 43.

An example of the recession’s impact on wealth, the District of Columbia was in sixth in 2006, fell to 20 during the crises and has rebounded to ninth place.

According to Wealth-X, one-third of the ultra-high-net-worth population lives in the United States, with 63,350 individuals with assets of at least $30 million (see story). With such a high number of potential prospects, brands need to dice data to strategize their marketing and retail efforts geographically.

For instance, 62 percent of ultra-high-net-worth Americans live in close proximity to department store chain Neiman Marcus, according to a report from Wealth-X.

The “Neiman Marcus Ultra-High-Net-Worth Individual Breakdown” study found that the retailer chooses its locations based on where affluent consumers reside. This insight will be useful for luxury retailers expanding into different markets through bricks-and-mortar locations (see story).

"I think the continued migration of ultra-wealthy moving their primary residence to tax-friendly states like Florida are important, and I think retailers need and are probably already taking advantage of that," Mr. Thompson said.

"We have more primary residence being declared in Florida for the tax advantages of that state, and I would expect other states, other retirement areas—New Mexico for example, perhaps Texas, certainly Hawaii—those are the states that are taking advantage of their climate and keeping or developing tax advantages to attract wealthy households to declare primary residences there," he said. "So that’s a trend that will continue as the wealthy continue to age, and age continues to ramp up, you’re just going to see more migration to those areas.

"So I think luxury marketers are realizing that and adjusting their strategies accordingly."

{"ct":"dqU1tQ6XGvuQsPsWVik2h7kAACNR6uQJelQulfz2HkQq3g625u4+1aWzpP\/sumk2JBTYjw2vqwPkTofH7dBd7M6BiIk8EiOYyBdviiLC3OLNlOJTmsKOhOkimDW8s9PX50R4192Ef6e46FgUY+gt77dadTEfJleBdL3I4Ug79F4eblW9rGuh9sZkTwVOUgTIJw88IPkAcrpNMGLtDGH4KAGWsCobl7ZQqwOl7ChYZoL+zWIgWrTKQ7k7WFbyzjOkN0IBnlMj2vTaFi9IBhf0T1DN+yBeF+dofj2amkIkDttswOsAATGTYNF9BZ5k4q4cCKW0OPyo24iYyHxXYekIbbxkhChL9jVsOduRg4DyCF6IgSHfLsonrVhwIQ\/JQMej0h0Iz+\/6xtQS9RrxmmntChutQc3jaAaR9e6aUxCHHr\/V+Dun\/DfF\/y6DZKuLtv4tPhtSZS8\/hPuioJnC10iVcwDAQwj8hqxrfiIj9GKGfCHwp0RATXrhcH6oPROCIjTF9L8OOYRnEKKs9vScG1+59T9Q+Y1WT51UtHIymFH2iAyfz2OLJrk1UXQCsK8KlAzo3Oju8lPeFdnYne\/djxZCyowK4PxHBzH5zdBlrLFPr6Mc7o6v7lb0Kg3VlPzMQZoUPlR6bx1BM3BmljJc1ugXte1pZon\/rmVqCj5cLXfuhVxb7d0qpA1RA8GiVSrUElP+xS9A\/nEjvOHe\/RJ74IeTVNMsK47zK0v6Krk+n7koJxskCcKRdlNq4+GIRByuGyeI1alsAeDr2hdNbuboU1gWGKr1uROIJIIhiSrRYUVC8ccbeN5IIQmbp4tko30\/HTAbjeuctsqEwgJDqeA8GhAL9dpoGszr6CKgfXPgNgIJMFXEKmJJjL6b4xAASdgRedwGpwoNuamdtlXo+KymJYYPCNi8QwQGCSmKgQkbaByhEjlRa++57OKSIvloSlp3Deh\/FNGsZFhoxQq7KGIVRTPkgj3fZwEuatxSsW9OCjhHAh6oslL\/KmT8Lo8WWtthhm6lSU1NBnY+dGhuVSQ0jhrMb6VkdbX96QITWM0OXRXQQexULTAoBtuIb+O7xj6tOxhig6M9ysPCapVXrCATdalnbzZFdd1RDNvQiccFap3bdQXmk57JzsyBV0icDB4aNLivPg\/9+5+P6MBKGOwrCkqhJ9egBF7CAXkKzIY9ney55Ri11wur4YvtqYhuu9j5OBEulLrEeyKKNsxRFUBk3f\/Dt1po62pTFPnw7Oj80itexWU1u\/9KG8a\/gfvGT+adFiO0lLHukv38MlcDewGgAegOuYZ7A20l1eTTHs2Enhb9q3FD0olT25Lsu0fiRUhJ2OHuaQEr0GQXf\/xJOB2fIhM7kYritv3MX89\/0E23ZMpxAgd0qCnKSTyvS+n9Rb8pkpDuSEkuDO\/3mjbMEw1PMeDvFVPis\/gRfLv5c0BbhRSZYVtbJTDnO1q777Mmtx4jqxJWWXfvX2WnGbWmQVnDIu74c8U1rBl2I4lweO02dNliDKlzLzYOk7IkLnAYTmKbWAND\/9OxREnjnEIH3uwcPXkMlWWbAGmEyCDRIrp4bobS90uEwij2iZDzSA8xz7PMM9OhQRgaS7eWMUzjQwYvGqNtyyE5EIiD+u\/M3D6Po4Um02jTaYsSjWwbJoyE\/i+gTV3COJH+fMTbrwSD3FTLRgGj1VV9hYDv5to0xMVf4+rOE9RJ5Pw2ltiPBl91yCvrQ+hnnqBfFezZZvw3VkC\/I6mJeI\/bBuYwDLGpV+nClmtlTjO4W928YHzawOvEYhQTkYYs0ln\/79ttp1TMEzuQrXWss5\/Eya9dnI1IJGnRqhJJv6EB9qt7jIo41djj4tsC\/XO5gxo9v5BSkOx2pwVL9mA5wTGCc0sZ\/PHL+fEb8r\/eIlIDXjDNa2q\/pmyJTBw0m5oyODcq3eOTt6Ao57d8Q7R1yPiP\/Xv74kXsudK3UkoIEXAUS0isIc0dcev3yZUZ2LVu0jAbumi\/tRSkLXQsUnZEvRN5qg4k1DK3f43QTlS3tQ87jxrGiNb4un7iHCXdbrXdaIknZmoCc8CzuUYyQvYM6YGaUac07vs5SmOASmlRNgvfOc3aZJSqqFt7ZXxb5l4Kz3fG0Ir10Yy85IQriF6aBMzIH8XGC3iccuPMuB\/JbRA0r5KXDlroqxot8U7px3vxGhCWQ++8w3CI5szRgKmWsL\/Jmwgn\/zX7W3KM174rfx+AnKmOlM+sTTfYjxcdsiSQiuC4tWX5v+JexR1swlS7v8ZovsES4jdMYJXUQrUS1qdKEiCNWNuXgSH9lJjZbhuhQvCjmnJPwn3OOyIIe1T+PIVxCNV58hd2xsXlT\/Lj+tSPgzGKUpyYHq+T355vsWRwkubDPM\/WBcIQeL\/CQdSWrZ\/Flavc0fjO4NyNQNyX65EaJ2Gw1IzvvlcLKhr\/+3SCviaFrB9oy1vTfiT\/50ovgWGAAzDbXIZz4aMmref\/oV0U3daql42niONbe3anznwHp3Y+MIrjOTuwH\/jPa+6mMxLtzOYQ6a9SGLkoUQ8QV2U+Ll1kZVWja8EE8Z1HtTdbeE\/M8AnMxC3BS9CpYTD4TrCMYiekFvg1CQHK4KsK9o5Y0P7EQeuj7CehfEY7dVd2C3hH0Iy3jO5ARRypk8NnlQaCffAd1hBV7ZWfmQHai834crbuUDLyfVv1ppHg+YbGfdCRHad1DqewhpHOYagsk5wCbQ\/rbjbeczRUy0dGLEGdgafI7T1RAGpZnBbpKU7tCFMBf8dyKwCX9xBFvCHp0bOC6zwsAI0zZhblJJzxgqshDckbrXY6dTwAB9K0PoRVkbWJGqVQG9NQBt+iRzlRztH933J2zMwXqTNqTl78C67zF3GOv0MNJcr6wFm\/12v68H4d5KqJ2LI033AGQ0M2WWXgkP5oaSbHxDimW1CfG+Nybup5oxbJkNphbutmDpRWparBgBSxu4oF7iO\/huDybz4SKz3YQlHik3B4Lp8dhclzV\/GsyjZMd2gCQjqJvGZrWxh8W2aouJq6D1RcxiQJQ+XOrTiPfM\/6IsjwmJ9JR9wbIFLzbllr6g9g7COh5RRwZb\/DfNeX7\/GLXo48CoesIsh5zPA3xoXDhYBknzbYIGwfMRKLzHV7e837rmkD98YtbD8JqZhTvCFJlgxQHjcvpT9c67uggnG4cwqj57n3CXziHgqYz+T+t6FW38R8n3qZnbnuekiJMbRBxreRlTNsrR3444ZKOzWIElhWnvoOH\/PlIyVSYjr8fI6HTiGxIDBK4Bcv+UNOIkXV35HsaOwtXbOjcq8I5g7FIJteV98rg4dn7DGJG0j5d+9G5sH6dM5Xksw8z98fh7Ahm120mYJAQs\/qm5Nxp0602fPf\/\/oVyjK9qM8TNhhGe1UlKuUgunYsQkgWt2Z4JIoV8iWZTdE4Qxvo2gczA9zVZBKw2UOn6zLkEO9sQmiV4etHNFl\/cCYv0cFfric1jtMhnkD4Wde+1SDx74Rqp4kSk5iDFGOI2BLDP\/qiI0QBhusAZgMyUSNRnNLzE0I9PjQoQoe+y9LUnU5t5FjYO78hfKCUKNlb65\/lCVIi6ED\/iqE\/5UIfgM+nkae8SUIUWjFIYHcvALJfYMvJq+u792B\/XxJOtYk0uQmyGGPJPjZS6hp0Mjmtqy8RbvAqZzJpvTtWJu9I5PhRcteXOnIQFrNIo8KvqZwnBGjfFxggwf+PwsWU5yBdAlLo6iyr0x\/uSvvS5mNB0fWPwzCQkDfzGvb5tfe9STF8wg\/vSX2ZtkL1e0DmWezN2g4d2DP3BPbBNFNU+ylT5A+y\/fRpDxjEvZiEQBMAvT4S6aRP3ByeRnhb7+tZvFzplCB7XpHDv5GuwYVoxp87USh2L0aSzprge7Enb8opflSaWXGhoDCvXX7ELJyzddlUsIbtwt7k4XZK8FOy4UyIdIQFkoZtdsmPYMtHrLQdf8QDGoIcJXamnl3pRIAoo7TvMxeUOL8wEqtcoKaxhEkLx\/Z6J5N4YO3TmO58g7Rvo82w\/8mCqd9Qm+C+3D6FI5w+ZJD7Br8nsi36PpoNa68oaO7\/RNbNI6fGfdt+v+Xb+p7nr8fl4bp+pQneoGnjBYvVbk74QRUnp5nwUlNbXHanT9U2ypBn8FXhQ+CDif8XoKuyOsjTs+SLPdK3u6amyfNA0H3r1BwO01y916tEPHaeEtflbwgCdZc1ehZXTvfbhZ37k0UZYDGOelfIY5\/tkZO0mX5QzyB7ZuCOJ5f6omdHuhEDiycHi39DdoeYOVlvTtni7+MWf87IqdtMirCkEoCtDUrNYLFwvamsJpPl0kQMRyKaXf9QxjNXfv3hbr5KYJ5FlYLFfACUOitCYhK57Z21Om8SuegI6\/Q0nQK0bhDqkMJfelv9DceZ2G755JIgd0ih\/Ii+PUulYPMYtjKF6\/Am0MLrn+Satdy54sUNlA0ZCVX574ixc6LkT6pK2u7Spge5V+WD2tCrl28TwdzfDDqMdorZBJPtOlWLXRPsuY8PPIe0mNwAKVOtLm5fdv4oFS443FKgbIE\/TR\/G3sUPx0+1BXyPpN7Mnu+sN25pGGR2Mdw8Atn+uZpHrTxg3sTFc2I6f4irDC6GtOHbWR3fdybzXjHq8OqONLT6YyFXxoZQ9LMpYdJtT0SSBhxaBWWYVeGI7MXjsKXgCqHbHo+yk1e4pyx63Ag3BuYGFw+cqVpb7eNTPiJWu3GOMGYYg86T\/PnDd2mywpOvKVPNMtO4kW1dQI3z+7EuwG+7tM06wfEb5R5oCnxUTCKcxQcZTVJ611TGOsu0TzWUzcgXcRObFuio4W+\/\/jIVD2lAF\/qLqtMON9JXlwITnzPCFeoawJz35YXAJZ85EihjFAr\/jVWYLhCRt5YYTl8xdgJxt39u0PCac6pMlXmrHOWVaHxLnX9Vcyfk5tA2kCKrq9IVn6lgh20jsnvYKZofHRAdeviNJUrHatPsR3kyC2mFKPLc0ddDP3U+96FuioXl0KVjNSc19I7OV8q2ccBinMG8wzEXwBSifw8sw3OK56q6vWoJE8AB1ypGT6xkM88DYV1hgUwV9qfW0GyMTv4aLcoY\/aeOlFhNM967GL28uAtHWODpYeQKhHVWDxmq9z65w5n0dolNYPAJkUc5gWbCsHH3+YkDCmx\/IZv4dcpASXFRTbjM7HhkE5Z8GS793Id04NXaGD59rt+k2NbVPbT2mPKl4t35inDBgoac6yunFXBCTTcSagd9FkCrAp334j8LEPN+HeHfGrlVaSZJMUwEaesbdx0LJinn7P3Y+lEIAQ2QyuELgdbNRXtIBPtfXhPHlS6+JJAWZKoEl5x6gWI6bj3+WZcy3RypGr9lKfA9mb\/M2IBOuj1HLJ\/g195aXTnVoV3ZTRkZLfM12Fw0bJ0Ppz10+tvmxeBSzHnjUcVXH1FizO+XAI+gcgqnc4cU5J3o7K9ViJYg0jrLbH\/2XXtbFnAcO3Myouukez4gxOBKcYhGlHH6IheqAytHiu\/ms\/3\/woh2Dc9fVxK1xQZuFlAc0H65vxz5lHDa+7nZqCnlNNfp5PebqCdcD77s6GO0f6RhbCArJ64g2y3FTqVppDlnxj3A0E5aKKLSRxiSl20np3AslAXJWPW7sVw3VbvzPbsepfvxedEsZOzLkQHLmg3zSNrngE0Vlw6YpcRKSyvpD0d9MJuvhnkfNaQAFw8y6RkPt1505EyIC\/DA8Naj+YmdKVwHav61XA6AN0pqpikiN2NNqBAt0tHdU0pIeftlgY22tJhtNlVAQAA3Pruu4MvAedfLgrU31J+smqTLzRWHYqVo0ltlkHFGlnDvKF3DBhA9wbHVwoT\/QawBNvdT0bckjeLPVZbT6X6zgNED1QpcQRY5Qp9MJqjwc7reTVAMlyu+87PGbayQv7XylQx4qRh2Ta8sBIi5lRY0Ua+3tofAaNEsech+wolqcUxtw0QtBomMsPlahU9sE0bYGATj7ZO\/WEa728bkk5s98oCas4njYYHeBHura0MiPu7NNBmpJ0ebnchOjncYI3u5PF2zSMICDwJ3XBmEUbiUzjOMzEa5yu7h\/kuHusP4D7SMuAFONoeCmTM7pvCitVNF+x6XcXm3TzDfL9HtxPM7iiNjpcS\/73yNtCVVmEmRtXMzFOfQrqHKfaQKPI3ezIRQeoAMjPNSUxZK0PmKAuq7wzD80S9XcDVyvAkXYjJmPBixm0AlT8EO0yYnzHljtQ+6GoYkfaIiSLcP\/gFk2YQj9BNcsWNwp1AVnQKYpg9aHnR2DysThb56t6FPuOPEJUpoQrtGknxbIsClUZJz7Vr0u3fCOD\/3PQk79ps31JDxsErydBoTDPSvdc0T\/CkJz0VB8g+fP04Es7YkiEkPFFE2y5ewpajaUHZqvgC77qQXaadAkpwEtgrb\/bMJ4EfpGGwyeoasnb1rTkqi5FpCrL25KJGieYlRzRsHSjVCZJ0FuojF7XU515BecRjRNkACbrjk3nPsOfjaYU8O8svy+5U75NWpS88sEFCe2w1S6h3vny+YdpHFCih\/vOw9NCEyrjyETEw\/ntYu8mouEmZUmXnudPnD41XI8AmxRkUTkBglMp5BcN8y0n4ASmdfS1j4fM3VsrcsG4AR\/gEuR9oR6Uc2fPRq6rhMPMYk4XuhX1aiIOP51Dz7tUwqhrGl2Eyus+PMJuDhHoual+DMyOXuVNWAi9FYi\/j9Q26WNXQ2KYebWVngZ0fEt4nNb9nnVLsg8\/cOuXksfpM7Dty1BhTrgcp1fsJkuLy9tDscebyZugUHbDVH6l0kabc7u2\/5H4Akb2Kyy0rNp5CJdr4W0D6DW7cSXx4wgppG2gpDYWEh6vghHIdn7eOlc1CuRTHvAdZCGSGyDum28ovDfV23WSNRodFa861EyZMpHzw3cw9IYdQwp2BRLDiNnf8qpESD\/52TH3WJYUIBncJwePi\/msqto0K96\/uzsiCXigY7z59eKg42AKdXsbw2ew3OpYmE3JjLHK1QA5ZoCi0tyhRW3S979WLl8+levo\/Jf+hnhQoKV9P4uFB8U62Z73v5jg8wXaM8gs1wTLcMmre2x4Xrxz2peoTD0o5oc5Igo+5SUquYz31wgE0XhEzGcWslhhxrIa7rS7tQ3TdSQ\/rRVEB4+pTJnIObLzlUo\/81agKP\/KiIsx0Y38TwaUbbN\/gmrWwNY3dbcjw0ORXwx7L1QMXLjCEwtZ5l5TWIzVvjyhdSv\/1KJD98I4DUO++jkhZFw2THhU9b6eEGSGGOwbgDr6fRzkRlItgCR5NYc2yvqDbh0DZjjwGFNyabHB47yj305+SDA4hIRr310dn8qSrFBf3+5Wr+3G9+qSEehdubSYmx51rjgp2cjR4D2jMqfZ+2wAPO9\/v3cx\/iPRPuZwkxNSuMlotehLhvP3AaB0RdTZohG22nqdVA\/Agzv3nc8HNmYiRUwigFcafaBWrtEr4y5DCBXoBVisfZQoxdN11Jb29m4eTakq0ZD42U5PGNfELAFH1rkHv+kjh\/NpEt++nVVItNTmdLNRDflRYzRLe6KW1jr1OHrT51f9nJKddT\/z0ZFkzVu6Yj5lZ6k6mEbFY2w0hwMzdBPqF4Ml5RmFl0RVqICRrxxTtqsCpcxDbnWPUzt\/rBp3S+LxVx9F5DagG5GxV\/vnyd07n66RVV2SKCEG0UBChMUBOgQzVeDDFoELvpynGPrB1WB8ZZ8mTxKLrM+PoaBqhbCZOfDhXZkC6tquhQvMydPpdifvH4jQNO1SyXSU4PkYjpXFCpQrodjk86lFDiWZQMHj\/pzwy1rGwjgR9raXaZArA9Rn+3ajtz9lRc4PEHxY7ajcqGRKbzhfrV9VfV9nqplx\/qyT9J9CuMUZcfK9TUkViUhJvUGKFOq60iV2LPJDJSosKtmLlRApH9ueKsl5kLSZixxpY0VysO01PyI7Vvf20K7wejxy6OCoPNe3B4VNI0pXtzBq6MxxJmUx8wi3jxngEYSdLX8RgzEuDFmlL1nnqzHVLqV4kHvofZB+ZO89zS55rYm7EiEJ0TPvG2tpOZA0Qvh8l8xKUEhpAdEdw5wv5gy4t3GTjIlI9YF6IDTygyVrsaPDZaqx9zmGFqBwv4xRl5VtjvTz9sKsJXkxTP4de6oAEhMtdlkxJ\/Caqjwaba4tEFHf8euJqtfQ5hpfpSr5vcRPg6HCCkgXmx\/wu+djxADpU8Ic2g2pOidRzxXI6Lhl4foEqrfSZGKaxQGtxKDxlxY9PKg+WK+s\/8+dF1qBcuJhdOzlbonoDYjbTyC8VR50Rg+ObDQxh3Bx0e+SC9oAwg5oaa+NXRb45Ksfu1TrXDsWdweaUE8jM8OSRQlquu7m6bL6feO5zD1rTzp2LXRIDTIXePtgpAbWnVoxKB9Tps0SKAJ68rW4zs5FecIAgXBL2vjo2cCJuCviUP+1hLJrlMEoZEuy1upn9+wRi38jPDjcuFxuUTMq7xOuzF37HF5XcV2QD\/Ldis+GE9J9+ScsYUL72NFHgvQUdb75+idxF8yN9OCqUQsvb4eC+VURslAuY4O08upwy\/K6wWj0bxYQ7H\/1Zs2GHwrJmZVkmXg9oHDzCeyKUE95VufOo2higgnZRGUYcgGm3tnZ7rw7Tf1TPM2ujOvac3p00dG0iKj2lR4cgeMEbSPl6+WiCGQRJyq2DPeBeDuTRvUJMBi89z0nbrjriL6uBVU8a2c+2NRj1o4iFq1poVqcUJhGQj5KPEqoMEwPLolvXWHChq2J5+dg4NYndMk9T423YJqhg+KyfS6s7dErR+kdybwZwqX4Kii83POge0HBYkNV\/xS6v4Kn482TVe1PfxE+nYtEc8OfrStqJObnzOHQ78qh66J\/xpomqL6j2yHF9oMifkdZK6QXtxR8OAoK5NERi1RxqfrOrroqYlcsV04ThHJghjWBSuY8meh7xYLFtLnpkX5IE\/32Jw6WwapmtWK\/h6POWm9PULNq+9CqmCyxoCefq5N4vuGazHLSOHlCc+Ol\/JXaI81AI9B\/YByM0Qxhrud6pAJia0M+S\/UPYXLKnKj7QNLGU+1UA4esaFKjBflSuXEZVxHggG1BuSm1FgxRy4wEO3IWBvd7W8S9OXE7rukxL+LFyNKAb3iSCyYbSkLWjEDeIZ4gh\/7sEUcEok2OJsd8EUvbfTW+kgd+RGmmOTdTJSI\/43IagkXu\/rmZiBMyTAGS2cn6A6tnQtWVHg4Y47aEUNKza0PLfzuLL9VbCPdIwUR3fhsXob+IvnXngVPR8MROlik9i5KxS1FqR\/JxEUsTeJEJwjZIyfKsJwMi+rbRpCrckTVlWIMhPxeMwIqu9TFZ2H3yrro3ZYRj7enIbUYPZzPt9tgTF3FLfgdhtb7c3+Yfa+gzF3OZ1JpxlVpbk2gOgOtERbLwXOv+AjHR2AP2h7jCnOMvjrKxY8K6J0ZSL0A\/heV42VV+UL4qrl7IjfzuewkyKRy+LKJ2b7cHHENiLathIk0LRab5lTc2jbCBDNNKpmv7tgDzHj7p89oH4TYxm7pdaCX2qQya\/oAbOQRA4XF6RdsfqhdLOiiVDNsIdtAOog0Gtu0+Dxrzp+QDF47z0ftx+mwF63wXPcpkSw45dKNfjtvgyAHV3pP25mkWGEAlFxi46Bx6eCUP+I+S4Oqknq0SazoSTQ\/nG3rp+SE8mAc+RCMACmOoCO4btsQ6hDFq7B8XqATU2hgn1OVtcA6OFerJIOmxu9p9moiGYs8dLBx7gMykpiC7gncEr20\/DWohP6GhY5AirAlqhmIBtZGXLe91YI3hNd9OOP6wfOu2T4mD+26zCbYrDhNI97XacUgTaivGuwie8cac4B4Zc+7TLzQMdGhJF9w2r1y0+pCI9kxNRxtSyT6C8isvsv2vAXTBj14JvnyRR2avxy+bjOaaA3vznARKPgazY4GxCIwUgPnrRU88OHCe9LW2lzQ1Jd+XyjhEnOXVBESoGfBL8Qq7b+Zb7ImqmkU+pCoaLi7ISKIBPpNsilyCQkpu4JeGNXc+tjSG95Hq5YboLpHpZZZYwStWGfVNg0oHAEnP2VD04kNvA9ymT\/X9qGe00dXBMwlFGAWX2W4vXJKCmwGVGdzn20ej4rV\/wIpHIpgtADJN+jpOmCG7wBvPJiOJmYNucmUOXqMCt28GZVNvcAi62LYJ1HfEaZWnJTX5ekNi\/V4hWK\/HX3i8kEXoAfxth95dMgUKH7GVQxcvIZAJeV\/1F3QC2sIgGgarBETwphjSS9CZRwPDDIMK3mq6LbkcrJt+LJ6L4dJ4E+ajMCZSRioX5f82Ym4fB5+70zeti2qu0QpJ+cehZN8or9LkvdesavccsH95pQVoP+KS0RwSWJ7xU+4+Q3wSprnQo6eLtJyOHMe5OTSGnoXINbhkripIPoMlmhPsB6+coCkO75XgytknjQ\/o+F9W2lk5PxxuU8ht8caCfQEl\/t76J8QzzSTz0eBQ+jO4UtRy\/NB\/8MCUBnf0LEk3dR7Y8ELp0PPPhdCy7A7ztc8OVFowOIxCvsCA0KZ7VoiEGXZH\/LO+n9NBfr81UyLdnuBXSI3KwUI\/Og2qA0V4QNVBZjCXEsBiH5ShaWJsOdR8ITBLsEHxzdWAETbVLxtUeknU55cXmcZYFSkf3\/lGrI+rOrMAjf2g+wzYtbNU6GFpAfPtwf2QiDW9LJ7uC2tc4Tyw14uyO77XVp2Qkno0xiKxk4120cbPN6Wr8xZNi8\/7I+lD4ADQ\/6DRvubRG0TTDpZYbDkLpnN6mrgPyOlUY402\/bOJb+IsJGaGAC\/5WD0ww4RzEq5AxsRUUvX8Nvb9YbEfpYdm6jykoRS4+kggXZ8we7wplg7\/NUnxZhQi6UxdO2aQ2fZDjs10jnWde6Gc8fdoj32k84gsOJxVr6Aof4kZdOpkGdNN5YyGupDpYRRNAG1\/vQoGc6","iv":"86b0c217f3805d14a3e03f30780bb0ab","s":"a5c2770eacf90d6b"}

The wealthiest Americans have had the greatest gains this past year

The wealthiest Americans have had the greatest gains this past year