- No categories

- About

- Subscribe Now

- New York,

New numbers from analytics provider RetailNext estimate that, overall, digital sales will climb to 16 percent of total retail sales this year. This will also impact an 11 percent decline in bricks-and-mortar store traffic in November and 5 percent in December as compared to 2015.

I need you to indulge me on an extremely circuitous – although hopefully informative – illustration of why the technology pancaking of services with a healthy portion of human-cantered design are essential to drive market adoption.

NEW YORK – Acquisition of new ultra-high-net-worth (UHNW) consumers will be key to building sales for luxury brands as they adapt to the new normal of annual growth in the 3-5 percent range, down from 8-10 percent during the halcyon days of the past.

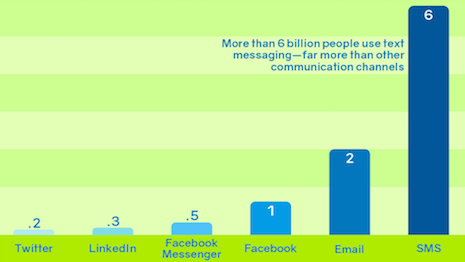

Which other communication technology is able to provide instantaneous feedback and almost guaranteed open rates?

While customer experience is hardly a new concept in the marketing world, recent mobile developments underscore the extent to which experience matters more than technology.

These days, push commerce is the default setting for marketers. Do you want customers? Assemble a gargantuan email list, blast out notifications with dozens of deals multiple times a day, and hope it will nudge someone toward a buy.

If wealth and upper-class stations are evaporating as lifestyle markers, old-guard luxury brands are in a tough position.

Some estimates say that by 2017, more than 30 percent of online travel bookings will be made on a smartphone.

Lowering prices on luxury items has become a go-to marketing strategy for high-end retailers.

Performance used to be synonymous with BMW, convenience was a personal shopper at Bergdorf Goodman, and on-demand meant Jeeves bringing up a bottle from the cellar.

Recent studies suggest that recommendations from social influencers hold as much weight as those made by family and friends.

As the holidays approach, mobile has the ability to make or break retailers’ peak shopping season.

It is natural to compare SMS to email marketing. Both types of marketing involve sending messages to recipients who have opted in. This comparison, however, should not be carried too far.

It is no secret that luxury brands have struggled to make the online leap to ecommerce. The biggest hurdle? The fact that the luxury in-store experience – of personalized service, insider knowledge, exclusive access – is so strong. It is luxury’s biggest selling point. But it is also the most difficult aspect to replicate online, where everyone – and anyone – can access it.

These shoppers who make purchases on smartphones account for 63 percent of fashion shoppers under 35, and will only continue to grow to represent the bulk of all fashion shoppers in the near future.

A striking 34 percent of marketers list mobile marketing as their most difficult tactic to execute. Fewer than 30 percent say they have an “excellent” grasp of mobile advertising, and 22 percent described their understanding as “poor.”

If luxury retailers do not get on board, they will soon be eclipsed by mainstream retailers – and that is not good for appearances or the bottom line.

Proximity without affinity produces a flood of false positives.

Digital technology has become our answer to almost any question, a siren voice offering the global luxury sector undreamt of levels of engagement with whole new audiences.

For luxury brands, the very art that motivates designers to create clothing is threatened when a 9-12 month planning period simply will not cut it against brands such as Zara or H&M that can churn out off-the-runway looks in mere weeks.

As advertising strategies continue to adjust to the digital age, many marketers fear that an obsessive focus on data is having unintended consequences.