- About

- Subscribe Now

- New York,

July 20, 2011

The number of affluent consumer households in China will increase by 52 million in the next decade, according to a study from the Boston Consulting Group.

Six key trends that brands need to be aware of before they enter the expanding Chinese market place have emerged from the report in the areas of demographics and consumer needs. The study observed the spending habits of consumers ages 14-45 in urban areas throughout 2010.

“China's rapid development in the past couple of decades has instilled a deep sense of upward mobility in most consumers' minds,” said Vincent Lui, one of the authors of the study and the managing director of the Boston Consulting Group's Hong Kong office in China.

“For luxury companies, it will be important to consider the spending power in five to 10 years of current 20-25-year-olds as well as future 20-25-year-olds,” he said.

“They will likely require different marketing approaches and product portfolios.”

The Boston Consulting Group is a global consulting firm with offices in 32 countries that addresses business strategy issues.

Born China

Due to social and economic revolutions, the Chinese fashion market is on track to triple in size in the next 10 years, according to the study.

Therefore, China should be a large focus for all luxury retail brands.

In terms of demographics, there are three major shifts occurring in the Chinese market that brands need to mind when considering when and where to enter.

Location must be taken into account when luxury brands are considering where, geographically, to enter the Chinese market.

The second trend, spending, has primarily occurred in tier 1-3 cities, allowing the early brands to have a successful presence in only 462 cities.

However, tier 4-7 cities are going to account for 60 percent of the overall fashion growth in the next 10 years.

By 2020, brands will need to have a solid presence in 568 cities to reach the optimum potential of Chinese consumers, per the study.

Additionally, spending by women is increasing, and will continue to do so.

Spending on menswear is currently 46 percent of the total spending on fashion among urban consumers, while women’s apparel constitutes 54 percent.

The gap will continue to increase as women gain more independence and higher incomes over the next 10 years.

Most importantly, the majority of spending will be happening among 20- and 30-somethings.

This is because these consumers were born after the 1980s and are generally more optimistic in terms of the economy than the generations before them, per the study.

“We already see the younger generation spending a much higher percentage of their income on fashion and other luxury products,” Mr. Lui said.

“They also have much more international exposure through the Internet and travel," he said. "So, we do expect the trend to continue.”

In terms of Internet shopping, the study expects that the number of online shoppers in China will increase from 145 million in 2010, to 329 million in 2015.

For instance, LVMH’s Benefit Cosmetics has already fully immersed themselves into China’s Internet industry through branded content (see story).

Red book

A brand cannot consider the geographic shifts without also thinking about how they must market themselves differently due to the expanding location of influential Chinese consumers.

In low-tier cities, luxury brands should aim to establish their own stores, but can also find successful homes in premium department stores.

The same does not hold true, however, in high-tier cities. Here, luxury brands should aim to establish their own stores because the department stores and malls tend to be run-down.

The social revolution also changed the way in which people view clothes and the reasons they have for wearing them, per the study.

With greater social and economic freedom, women and younger generations are attending more recreational activities, such as going out to dinner or to karaoke.

Brands should keep in mind that these are the events for which consumers are buying clothes.

This consumer trend also gives companies a chance to shape consumer behavior and preferences, given the relatively new realm of desire, according to the study.

The last major trend is the increasing emotional factor that Chinese consumers are associating with shopping.

Many consumers are looking to clothes that can increase their social status and reputation, which opens a large, eager market for luxury brands in particular.

Brands such as Prada, Dolce & Gabbana and Polo Ralph Lauren have already associated themselves, in the mind of Chinese consumers, as brands that portray a level of success and status, according to the study.

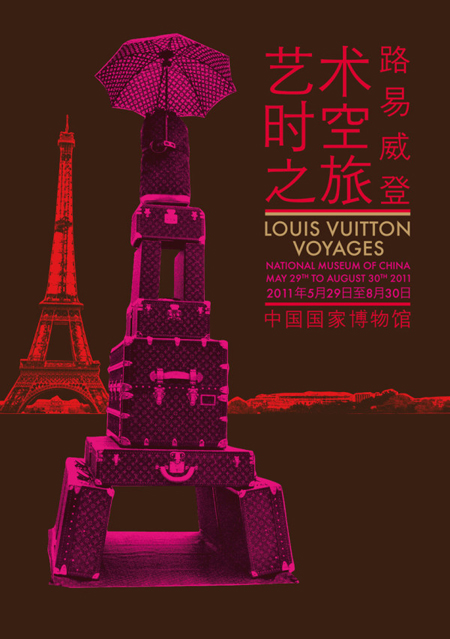

Also, Louis Vuitton seems to understand this as well given the large push surrounding the brand's Voyages exhibition in China, which plays up the longstanding history and tradition surrounding the brand (see story).

“We see a lot of consumers in what we call the develop-myself-consumer space, and they value the pursuit of success and status,” Mr. Lui said.

“They want to be visible and be the life of a party,” he said. “This has significant implications for which brands [and] luxury companies should bring to China as well as marketing and merchandizing decisions.”

Final Take

Kayla Hutzler, editorial assistant on Luxury Daily, New York

Share your thoughts. Click here