As the luxury goods business pivots to incorporate digital into many brands' strategies, ecommerce is proving to be a significant growth driver.

In the second quarter of this year, increases in online sales of luxury goods outpaced the overall luxury growth, according to research from First Data. Jewelry, women’s accessories and specialty apparel were the biggest contributors to overall luxury growth throughout the quarter, with the categories combined accounting for 61 percent of luxury goods.

“The biggest takeaway from our analysis is that the economy sustained its impressive growth across the board in the second quarter, with spending up across a variety of merchant types, sizes and regions,” said Glenn Fodor, senior vice president and head of information and analytics solutions at First Data. “Further, as non-retail growth continues to outpace that of retail, we’re seeing continued evidence that consumers now favor experiences and services over ‘stuff.’”

First Data looked at transactions occurring through its solutions between the months of April 2017 to June 2018.

Retail performance

The second quarter of this year saw a 12.1 percent year-over-year growth in ecommerce for luxury goods, while bricks-and-mortar saw only a 2.5 percent growth.

Sotheby's has even embraced ecommerce. Image credit: Sotheby's

Sotheby's has even embraced ecommerce. Image credit: Sotheby's

However, bricks-and-mortar as a whole, not just within luxury, saw growth almost everywhere in the United States during the second quarter. The West was the only exception.

Luxury overall saw year-over-year growth of 4.7 percent in the second quarter of 2018 and more than a 3 percent growth in the first quarter. In the third quarter of 2017, the luxury sector actually saw a decrease of almost 4 percent.

Footwear retailers are doing very well with an 8.1 percent jump, followed by specialty retail at 7.6 percent.

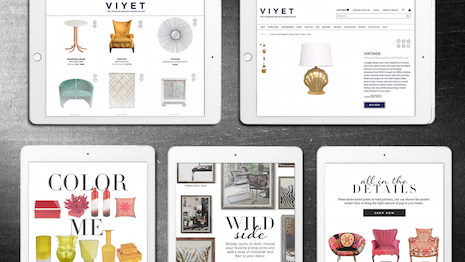

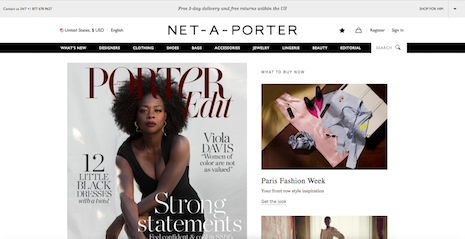

Net-A-Porter is one of the many platforms pushing luxury into ecommerce. Image credit: Net-A-Porter

Net-A-Porter is one of the many platforms pushing luxury into ecommerce. Image credit: Net-A-Porter

Non-retail is also a growing sector, reaching beyond shopping as consumers prefer experiences rather than goods. Reflective of this experiential focus, restaurants also saw year-over-year growth of 3.6 percent, which is more than the grocery segment.

While non-retail wins out, new retail spending still grew 2.2 percent, which was the category's largest increase over the past four quarters.

Additional insight

Retailers are looking to bridge the gap between physical and digital, as even tech-savvy consumers continue to prefer shopping at bricks-and-mortar stores.

According to Fashionbi’s “Phygital Stores: How New Age Stores Are Changing The Way We Shop” report, shoppers are looking for more customized experiences in-store. A growing number of retailers are incorporating technology to improve customer service and harness more information about their customers (see story).

While digital influences up to 75 percent of all in-store visits, retailers have not been keeping pace with shoppers’ preferences, according to a new Boston Retail Partners report.

The consultancy's "Retail’s Digital Crossroads" report examines how retailers who are quick to adjust to today’s non-linear, multichannel shopping journeys will attract more customers. Although retailers have been investing in the digital shopping experience, not all of these investments reflect consumers’ preferences (see story).

“One surprising success story from the second quarter was brick-and-mortar, which saw momentum everywhere across the U.S. with the exception of the West,” Mr. Fodor said. “Bucking the conventional wisdom that it’s a casualty of the rise of ecommerce, brick-and-mortar showed a very solid 4 percent year-over-year rise in spending.

“Within luxury, however, it's ecommerce we see taking first place with 12.1 percent growth,” he said.

{"ct":"t3QCx0rgyC7JMcDLIf7++VfqnQ9+giJHJLIxhV9Di52JHgEFPtCKLUWN7gxJlO5AC8myuLlCbE0oxmsTNS1+wFtBlz7uWalYN7UqmPmJHZcOp6ovUXNXPtaqvJ7o5Ah88yVtXl5E+ZhHpmfwkkMyu1GeqcbGlymZNQ6yL+SEOd7685x0e6cDr0avX75SrWcKjHcIfqeEXnGG7ZBkju6FP3rpoehhv8gpvj\/IUBSl\/Sfdu\/b8Nn3ucoVquS5O499pyhu2nUAoyXoEaQS3tosZTHCt7oYnxlLBWi\/NE1YRGUWn5I5Lp40hxk7cx8yA36f7Dqba7qNoJQjmPlsj+lqcHy2bpj9QUSitzo3N+ec7iA8F+OKQPG9u1xIJGr9DkJ7Rjp6CkbIVI+ej8Ezl0abSzV+z6wV\/b7UuwREdJW\/FDcHAcXILmVJ3NtnKFYK3lyuCMwxfsZJZHgJqYVRZmVdcXp9Mp\/dtN5Iqtu7kChGvSzXUcGgGhcXbGtmTY6dFCkddUYG5HWx5bf84NR14c2WM63hwKftt8rDr3kHifYRAdM6lqN2523VF8s4IkqY7ZyneRf3zUjR0vJ002zFX1Pi8UCc4\/jIWmBb3+w0nDKCVBCjxz5ekUEkxv+rqFIhKSPzhqPnWixY88DHPudkc3XtoyYfPeIsqXFSynUZYncCs8IBP6P7K1VEHn5qvffGP1HUL0wBX3fdtJlSrQb60wYDtuttBrpAoSvGxYn0hnXC46fwq\/WjuBA5GxGamXeH6919gwgtBsG6dFlpPPRzwKfQQOHpMfRn4oP82Ji3LDMemLEL+4RMJ0e3z72o1bgbid5aMIy3pt1TCzMl9MQj1iId3eKWPT+Vs\/ap\/HT5+F31oGHo4nDJkvY3aiYDatuVSxTFwvDTWcwgO+FbRjVDiAZbI0YbcSh0ItrFlEwJN85l43da8eqoVVeeXd73fUBME2IykF2PXVvbLwQqkVGqGzcVaLBToMG58UahxAFX6p0wA4eljiIhONxapWLPZzIhcc5DncuTi\/tRS6RSZdjDw5PYAKgA437dMKSZ+GZGUfl+Oxvdq5j8DuKk9iJs7sZd4YYincuyAV1KtP3TxCaqEmrUHWLRGDrc6WWQtbXJDZhCYKMdr5t8bkg4mXsn7Ck6z5Hk0YtDv9jbge1s8Ntb7NpZphTbaLN8jag3cvZnw+n72iuMQ9XNenobOaaN6xOtwvtfkcf5NyAdplF8mbRxbyz4vYaZZXwgosg4Min5mS+\/uGR2BXU6kfYhfqE2sSa0tVFNbSBuoFhkEAI\/oNbC7zwYMF4UIKeueEDJmUuLFg0q+wJey5AOk99eKLEAhZX+kpOYRLEJ+CUvD8Y+uW57MKEnSzAEZ7T40dWJj70Lzx6hG4sTliBLej20kTAUt2ep4oF12+dOK9NSBSfBQh\/WTwjuHDsRoi6TXkOr4vFU\/9ZI1yPGxMyuNhuyx18ocG4dvrOm3jmC3r3Y0u3VTJy7iYvkQMb+yL3sqy9\/bD51eeHn3SA66QwauKfT9iV9g5pWCFEpI4Di+ecIfSvroironn1eBBhrMay4qoRD5Atg0UATx9p\/O0fcY+g9pFDiFvet2+4CAMpl3N5y0xWob39wcWbo2h\/VbRRMOTeBCIT5K02dcHil5PqY4pmh+gR36LZNyJFUgur2AVTtkg5DEantuf\/1MHV1NtWKRaiXWqPX1tUtgYafd+5R95hEMuMLC6B\/YOUhXleQztUzHuiL9QZ7Wdu5hD+aLCbMXwHc3mmE2DsPPeUKTy9sFA9DmNQyCe2rAyG71KQSE2gnY6W5Cn\/kPccQW64nPTqLLsSyL72TcnfODL8ab9MEI5Wfp8233nWIStBnywuMGUmqfWtttMmAxfDJ47ASSCxO3hg16eaznywYz5rbrdOTbNBlt1Ljk1TyyAF57k27nxWdNyFWJuIuC4iQtTrp6Sm1q0rz5aOomh769lcQrn7Hn5UHvVyNqKS6SKrZQGG7LP11UW83GHJCyoeKrw4XEPsyR0m2nVooqbt3Yu2FbK6r0VhO+LEhJT7iC0wbs5dMBEIotsswpE0UsfRAcT5xBpK0n09iUQo0AGpekJbK59kiGxp49NAntwJkN\/5Qf7cTUuw7fVUyGATKsaTIu7W22JzC8XJbnJelzHgmeEgWkQ5W+XPJ18NGv2CTgh97BHPdFLcN\/iF5V7F\/0iVkgJlVH47XVE\/B1FwPYYZyPkz8nxw1itpwJgwM1nj+VS8F51HEEcBtwLDqVREfYqEdfw0SL5y4hvKMKoAq9dmTyLjEI3ux2qhMIDgCW5JqGGjRIxQln6aEWzkJuvnPII5HHlRFYXu6tE5Ws1xdx7wuNVs5O5XSnkwaP70+3xxsT2vPw8BZ7QnXqInT2irmcAdSBbZCiXbxJKeehCmA+JP5Pb9TdUEdhHouDrfbPmnjwEsAr0xojKwdg6JNLieKpa8Tt0AQoOZu4luiMu+MO8UwX5krZuI17PmEr+xsVDB398+618vAVyDzMiPDMSDDZ8xvgsdyZqM9d8yxCfDIVQnypZZI36qan2HCGnynZBFvYWRwZY4XBQPmgjua8H5mL+r6ffznY8FZkEQJmqRLd0LnAzSJHbCk+AgrtaxO0hhq3dgZSx7ds1pbCygUXHH6bZGlVgbaBBurYjFotURyZxEpqCBTUeeGxeTFmjIkzeXFksRmt5unV2C4Iy6Yt+x9pOUl2Y1hSK3x+7IP7G4apWf1b6pAsBacwYQIBYqWCC4r7xN+kUKhWbLbyWUzoY8Qi1O6SwoylX8A9lIAQCmgkA0FEwcpCK2D\/vsCZgHHm9EqtrTIYeWepvi8K\/mmUe7\/hfMvyB9HochAwE2SXpAH7Sbv1wM6j9xavTlNZgSZ5CEvXn3jCNz8bQP1+4YkA\/nNtf0JM6dvvJPy1DAHv4mi\/39HCbnVV7A5LsDS\/zoQttUfse9RwgUYne9Ql9E9ry7SABgjvSBRcQACErpAbpX8i8ZBzLcDjQxXMv3UqjzdeuFIgnyrXVf9yYE5DeM\/8t8SpLCb+2cNdh\/mtGLl0OCbGAjrn0j02escarux4GsL5hFv8+cTHH\/MQpUbckS2uzAGS7dQDUSmgqJqEuW6VgrFPFFqIUKcRu+6Mzp2VgSPbsf5kBrrn1VTPcZEVBaPEFHrbHTzEsjblmeb\/+E7BVcSka3nGmkXD6Bt4bqVzXHWq+EG\/ysOM3a+2aqzmvgv84lvaIGl35aqdZo7eFSlQqyBFu\/QTyQubykNvuuJvBMxfpQ\/RqFpymmAMSLP+0y1BKcEgBMl4DmXTuoef9V7iltrlxEydVABeOAremq++01kqOSL3ruEwLOYxeKN6jDuku11GwLxdrbD2vqrFIUoyE7YX+NB0EL7oITyOLKlN4o1s43IiwUyNrhsJKQiIIlh83CrEZjddNWmjBZdAwcXMznD42RHQEzI4mUrO0jonLRm0cP48z099fBf\/AtNKaA3lC2\/1gajDLxP9apVWy+tr3U3z7DD\/PXFI5tVZy4y2PjzQ5R3z2aPcHtwTiEPWpQBPwxsaepz1G+m5631N2y84bECAX3s\/1fg69unTHXPUrsNMoXzAlBtTN3wcGU5UNwWjn5PWzvW4kxZEMUu1YNronEFBSGkdPm5yyigoPByXAQzjIxWOfSCFUDHJ7PU7qANCBZ9CXAwMTrRiV5P+Mf8TJXolEqeH\/yBs7EhaysuzDf39cfiR\/vDBbxWeFaJCr8o63QgTua\/SovidymmWjiH7Tfot4I3L+Et1UdpStve\/g7JqcA4In01lTp8tRPv3L2E9PzEDJSkXm6qz3rROonnBNraFA0z4ZP4hyZx8D9F+08yCk51JDcZ\/18Jr3q\/FL5r7MqvZp8vuEzFcEbNkpZms0NqWVCvL+Y10DYUV0MxSWLdx3pNESPB9SAjivU23y+piTBPxrW0mPjQi7gc\/vxofGOQu2kJdo+mxr0HWqM0Vi3nJC9U9L8GhKl7Kv\/xtzvkmhlui1v\/jP8zVXte0FeroEBdab5\/lquTzYf0i7u8k15Dp9FUHLTD3qovpq2Bw2R3UXdzJmkng8vFiJtXPePWSPGn4CbbKHwf4a+zxXSZwJiulaA0uT85zbEtXt102davVyRP2mFsVr1mlxJ39qEd7HDTlqVdTT0GbAa54oluVAGB8NVx+IKirjWDyV1ng1AuOGmQT3K44LApqXYr4lC2yh8p6dqgfqThHaqVDl1RzjJMKNLyintWQi2J7NUXEnN80tsfTd6Nv6eDUcEK+8m8Y+7iw3ytQpOB6WCE9dASI6ELcdB1b+iA5Fgj+StobuqUSqWbzz3RdtsMlOXj++iGkE0qDiqmfH8JAszuhxkMcnqktcxBZTa\/C8m9hZFveVIjxxQbsfyHHkoR5G6opd67OYjxEaCNfreRCc0zNIFO5AyCMuMFV\/B\/ht9uNbMpTiIMkJENpw2XKEXVBEfAUOSaevQU78z6YeopFip2UnWf\/hNc+ql4RZVcSb5Yehi6WxwAWcWuJ+l4EkB0s0ps9yW56uor9NG1CyK8yqLjCddJUK7RZX\/cWb6w3nqvfALFW4OHq0HrRvXuuMrnPzZ1dI0GGjn7yVGBx4D1Pe6FZBJ5qPXaKcjgfj3+zGt1HaQwspf6P5uxWHUqTxXfxJHmTDPsMdbDxiHVMrqoI9tHaJp\/ZNVlqUPAVzke5cN1m2Qa2o4+cPlGYM8aQ8FPu1RthG3iOKDrTACJSJXY9aP0hUSGtkjG5WhJZ7MHG4nTshGQ3nW1k0wUaDHmK4XhWqj2hcbegP2sRQ7XBZCc6OdCUKG63WBLk9rRK\/Te08M11zYQm74Af\/51EAEfvxT9pDYOoWd+883xg85M56Fw0QFGsn8gCKkJp1YIAAIgGKD+9nGeL8Gi7OVyAbPm69EyyNmutBpgNdTzx1HYK77ybYuK2c48y2NlpzbA95p5FsLF3QPnY1CcNLFoN++VIWcErwV8Xg4Z783UQr6otyULDSvVwxHVSsnEgFfeWVtd91ZoTaPJZp1cJcubAkuz2sRs6G\/mIVN\/w7mQgAqfbIz6OVm337iEJnYro47hgx9uXikUDIaywltfF2oYQzmHsVxygYop+0JVBfwZB6dLGBcWmFCmbyx0Dv4JAJ\/jvjjyZTgKvrHa1VktX+KMoMFJLPpJNgVLdhzvNAXDDRC7jnwxR+mmiA8Sq3NtLcYDjll5CPWs1I9bDihM7DaO5VitT7M8u8af5o4uk3Gm2XtQ\/Bc8JZaUPO\/TZEFgwIsoRzCvgxGSRlLvUlJ4vIbmpySxWvGoWQH+\/qnOfxHiZb2uNnrFtrFviHfca8rf+tKge1XTAfaZSM8QUoTWNJOzOFtwHrwnYkl3wpXN+QxITpmAYWUPc0N30YmZvdg7eqa1SsXmaEB2F60ZpXt8OIlYL6IbqHUd8bQpd\/\/rPKa1h2s1HDFiZWYqp02Vx9sznfjS1eHA+eXuvrtap7yICsQnTKAebA8rMocVBkED8iIBtz0SgeLqcquSwUS8W0\/J1AFkWFZ2+n6j8lzX\/18E3iCXRBvSYr2YLBCk3Cccz7WeLuxPexMtv9bZhLooN0BV+A2uaSNENMW0QDxBsedP\/uQQGsYx\/PIUDyYyOtYdjvcbJK1PqRdNHIbthZMs1K2Bv+jyWKhAlVSaOFwIZn8rAe5yaBMfcaaoWKncMKD\/qmfu6PjqkAETobIbbgmBy4iiKlfGOqSR3F9lLK8GWMEfcyEo04vcIT7aaU+70395FqwUVDGVgbQJQYNAcedabe22XlRZSIHimolcM+pjp7IcbrJL4JLIob0ZwUIpM8zzQQnz2z+5iNPSoSpl5yNSMB\/B\/dK2BQEkc7YxszLHtqlM1FM6MUYFUygdGUo1iBWU7yfmWVxyFJiLLPzAQv60k9q2qWGuhgbmggFC9jA\/t5z6jVSm7XWQwVfinBOuJXHAzgj5ckTjS1xQAn02jV\/hFGXqKZmFXSGiz31S4h0JglvZvKFoS0zzf56m4lBD7DXJj0MKXXqi\/FsoiKLywkrTk69AHo5eNgpLWGHxAvoQ5Tvxdco6IhyxnsMMaq3LJbdmMToZwHj5AhqSeYxOLoWZGSzzGMN4nfzd4iXms3e1978ZSFWtdqtWjdU5g\/vz2VTrJFg9B3nlXmiK+ArnlyLkxnpChXADDFdzcccP9iuFaSg+huFWXY1KprEjXrmVnopSCNyYBHm\/LC0Z0aCszpEdSpKUjv35YGzIoveGu3cbZ9rBRhij30q7D\/QrDJbXZoohQ0Kb\/XNkS1ZaffMeOHUiH3um6z5t96+fAGlNVNVoK+Sti1EQck5ZKrl4hWmbQFfEyEEr0DCYOa0aAnoOXjwQh9nBkLJUBig\/2qkgIcZg7CawfW7oiStWffNOnBSjTnffEBUf5Mwtb8ir5PixJBJVxg1\/aCgI\/rcjU+9FJLqW1cUUKjOZb3b3U6ifTcm5Bddae6JDQV9XteTHcMLWzSQ9QEDOM1l1qQvgsSoggImzrr2zNuM+XrzR04SzfZo3AujER9c0Ek+VN6tYwcfCM5CkIPh36kyaSG\/qyb0y+WbBf3OUmc3HdSYvQfRpTHR3AUrRNwgyAZq2PYhAG0rOb83REtKtQQjP1MyT6Y9DKcvwAbddLqe9hm2zoZ\/OQQwkoLqcJFKVGBOZEhtTQS\/AjScpEoneeR\/M4Osgs9dQj55KI7pj0uufpPVc\/5\/+Xe9IQqAlDSDND2wzFqQUeYNJJn98jMq4HvJg\/MStS5+ijYE1yfuv97JDIsRvBpojRZLoKZXKFzZJAGYErJHh\/edb7TQ\/zcyIhsykcmeRasYbrqpp\/PHTvtNQNu4xVK4eC0RI+hs66VkFncbgM\/GzQplyn3qHkrtVGBmbhMDIsEOyVOYmklLKHN9ytgkslIolzcdUWNtzUvCaXGUqaE\/qELWiM1YkhZ0\/Xvp8QcT6Ep\/57a3zPCxgwyPt25qmjp1Xp7uFGH2aCTjqtssaVkBykWulLBlWHBP\/tkBi7gaKH7MRFUVk+jhYRQTMrZ1EUo+GMVE5QDPRQ8GlVTzYOIJ8=","iv":"63f98a2d955c0f10ce54d88dc5018395","s":"02a95d9e8ad73a24"}

Even heritage brands such as Givenchy have now embraced online presences. Image credit: Givenchy

Even heritage brands such as Givenchy have now embraced online presences. Image credit: Givenchy

Sotheby's has even embraced ecommerce. Image credit: Sotheby's

Sotheby's has even embraced ecommerce. Image credit: Sotheby's Net-A-Porter is one of the many platforms pushing luxury into ecommerce. Image credit: Net-A-Porter

Net-A-Porter is one of the many platforms pushing luxury into ecommerce. Image credit: Net-A-Porter