- About

- Subscribe Now

- New York,

September 11, 2018

Automotive is one of the top categories where consumers want guided selling. Image credit: BMW

Automotive is one of the top categories where consumers want guided selling. Image credit: BMW

As luxury buyers grow more accustomed to online shopping, even automakers must prepare to meet customers' new digital-led expectations.

New research from Boston Consulting Group finds that today's car buyers are relying on more online resources before ever stepping foot at a dealership. While offline, onsite car purchases will not be disappearing anytime soon, consumer preferences are changing fast enough that auto retail already needs to adapt.

BCG surveyed 3,000 car shoppers around the world for the report.

Sales track

When it comes to car buying, consumers are devoting more time to online research than in the past.

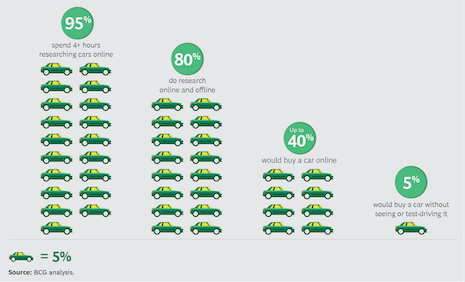

While 80 percent of car shoppers do online and offline research, an astounding 95 percent spend more than four hours researching cars online.

Image credit: BCG

Armed with more information, drivers are spending less time at dealerships, and total dealer visits per sale have dropped from about four to 1.4 in the last 10 years.

With prospective car buyers spending more time online, automakers have a valuable opportunity to learn more information, such as the make, models and features that each potential buyer prefers. This data can help automakers strengthen relationships with consumers, for instance, by better tailoring vehicle recommendations.

Improved ecommerce strategies could better track drivers' preferences. Image credit: Audi

Although only 5 percent of those surveyed would be willing to purchase a car without test driving, 40 percent would consider buying a car online.

Automakers and their associated dealer partners should work to better integrate their online and offline marketing and sales. Already in existence — and with room to grow — are online platforms that allow buyers to search for vehicles before picking up at a dealership.

By being aware of changing consumer habits, automakers have time to develop and experiment with new technologies and ecommerce strategies to see what connects to buyers best.

Merging trends

Ecommerce has already been widely-used for used car sales, as even an Audi RS6 Avant owned by Prince Harry was sold online.

The car was listed through Auto Trader and was originally listed at 71,000 pounds, or $92,480 at current exchange. The sale of Prince Harry’s Audi gives online car sales a notable boost as a viable way to purchase high-end vehicles (see story).

Online car sales are not the only development impacting auto retail.

As the sharing economy continues to make an impact on the luxury market, affluent consumers are growing more accustomed to sharing goods, including personal vehicles.

Since early 2017, automakers including Cadillac, Porsche, BMW and Mercedes-Benz have introduced their own subscription ownership models in limited markets. Unlike traditional purchasing, financing or leasing options, subscription models typically consist of one all-inclusive cost that covers renting vehicles, as well as insurance, taxes and maintenance (see story).

Share your thoughts. Click here