Ecommerce is becoming an increasingly significant portion of the luxury fashion business and it is driving much of the category’s growth, as consumers seek out better selection and simplified shopping.

Fashionbi’s Fashion Ecommerce Market report notes that the number of ecommerce shoppers in the fashion category is projected to climb to 1.2 billion by 2020. Much of the new customer base is comprised of millennials and Gen Zers, making online a key channel for reaching luxury’s up-and-coming buyers.

“Those companies that are not present at any online store – owned or via a retailer – are missing the customer,” said Yana Bushmeleva, chief operating officer at Fashionbi, Milan. "It's true that around 90 percent of transactions are still happening at the brick-and-mortar stores, but the online store is a crucial touchpoint of the customer journey.

"One-third of the purchases is influenced by digital channels, including the online store," she said.

Fashionbi’s report looks at the biggest players in fashion ecommerce, including Asos, Farfetch, Revolve, Yoox Net-A-Porter Group, Boohoo, Global Fashion Group, Tmall and Zalando.

Growth trends

Pure-play etailer Farfetch saw the strongest growth of the companies studied for Fashionbi’s report, with its revenues increasing 56 percent year-over-year in 2018.

Founded in 2007, the retailer has 2.8 million customers around the globe.

Farfetch’s average basket value was $618.60 last year, the highest of the retailers featured in the report.

Yoox Net-A-Porter Group, which is now a part of Richemont, has about 3.5 million active customers in 180 markets. Last fiscal year, the company’s revenues totaled about $2.3 billion.

YNAP’s revenues are greater than Farfetch’s, with the latter seeing $602.3 million last year. However, YNAP’s growth was fairly flat in the fiscal year, with a 0.7 percent rise in revenues.

Net-A-Porter has launched try before you buy services. Image courtesy of Net-A-Porter

However, while YNAP and Farfetch are some of the leaders in luxury ecommerce, they are far smaller than China’s online retailers.

Alibaba’s Tmall and Taobao dwarf Western fashion retailers, with $36.9 billion in revenues in the year ended March 2019 and 654 million customers.

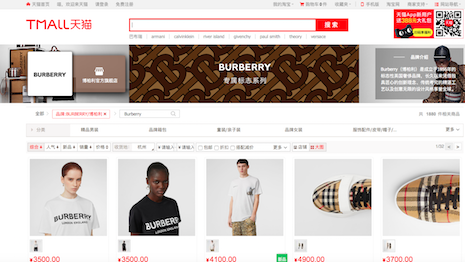

While Tmall and Taobao have more than just fashion, Tmall in particular has worked to boost its presence as a luxury retailer.

Alibaba has given luxury houses a new retail format within its Tmall Luxury Pavilion, which is designed to more thoroughly connect the online and offline shopping experience.

A select group of heritage brands is being invited to build Maison storefronts, which enable them to have even more control over their presence on Luxury Pavilion. Bottega Veneta, Valentino, Burberry, Tod’s and Ermenegildo Zegna were among the first brands to launch Maison stores, allowing them to reach valuable Chinese shoppers in a more exclusive environment (see story).

Burberry's presence on Tmall. Image credit: Tmall

"In China the ecommerce companies are trying to blur the line between online and offline," Ms. Bushmeleva said. "In 2018, Tmall has launched a consumer services center in Hangzhou.

"A one-stop shop for everyday consumer needs includes smartphone and watch repairs, high-end cleaning for luxury goods, footwear and jewelry and clothing alterations," she said. "Users can check rates and pre-book the services online using Alibaba’s Tmall or mobile Taobao app and track the status of their order until it is ready for pickup. Or adopting the social media channels for mcommerce, there are many examples of how luxury and premium brands are selling special collections and limited-edition products on WeChat."

In general, pure-play etailers are growing at a faster rate than mass-market retailers such as Inditex and H&M.

Online opportunity

By 2022, fashion ecommerce is projected to reach $713 billion.

In 2018, ecommerce was only 12 percent of total fashion sales, but it is increasing considerably. McKinsey estimates that fashion ecommerce could grow three times over in the next decade.

Consumers are spending more on luxury apparel, footwear and accessories online, helping to drive a 50 percent increase in dollar sales in recent years.

According to data from NPD Group, while consumers have not upped the frequency of their apparel and accessories purchases, the average spend per shopper has grown. Meanwhile, shoppers are buying footwear more often than before, and the category sees the highest average spend (see story).

While not covered in the report, traditional luxury retailers are also seeing growth in the online channel.

At both Neiman Marcus Group and Nordstrom, online sales now represent about 30 percent of their businesses.

With consumers showing a willingness to buy big-ticket fashion online, luxury brands are rolling out services to for the affluent shopper.

YNAP is catering to its top luxury customers with plans to add more than 100 employees to its personal shopping and client relationship management teams.

The new hires will work with Net-A-Porter’s and Mr Porter’s loyal customers, who are referred to as EIPs, or “extremely important people.” In addition to the hiring drive, YNAP’s Luxury Division is expanding the footprint of its client relations staff by building hubs in key affluent markets such as San Francisco and Dallas (see story).

“I see that the online market is becoming more luxurious," Ms. Bushmeleva said. "It's not about a plain Web site and colorful images anymore, it's about experience and content marketing.

"Good examples are Tmall Luxury Pavilion, Extremely Important Person by Net-A-Porter, luxury white glove delivery service by JD.com," she said. "The future of ecommerce is definitely about omnichannel business, full integration of data between online and offline sales and behavior analysis."

{"ct":"cstykWmM3MyJjukAb9MKMUae6TjL7tXDOLA4vCfNV3vkKTBC95uelFGM3rIe6YSaS51umikeTIQ1gHNOGa+u\/NZv8eG4qKeS2nf+NaJLMSaswPvPQbOin5QKoxz59n5LazUlX7GjZc0x4bb9YFlqL00fxd7l2LGIt6a\/OPCmwDy+XnFrCXDCUjoXsULg35fmBMeQkuBd7K41c3txIG83dtbbPTEzxHvOWkCTnDFxhbn9L\/bibXs2SwMxLAV3H6I2wlPLbKLknPtjifvgmgaJFvjXoE5EVfZS0kVfoW4RsFQcwnI7y4LcnVtSINCoA6iRwbt\/ASQPPg+BXWY8L3gKn+pREH5oB3WBx96TSak4vbFDKOOpNEy+1q7rC2wk5HTxzUyzH+wswYHXIFlK0aoRiUTTNDGlfIS3hLiVzirooM5bGKDVv0HVsHBt+0tLQynx5nMvSDQ29O+TOUiAY0rlnU4A4Yq1SSOz8JT3jTwHf3c6mlczposIOb1HxUlMMe\/vxGrxvvuWM6Zfd0nxwOneqVG2yGxswTF8TkrcudejiNxUNTzOEvmmCHlND6KwBLzQ13W7MakDJnJH9VCpx66D5x2afGN+XXVbvRCRTjFb+hO7d3Qv91m3S+vmBTon0SDq3HPr+JDFGJSgd9WWJNthsF0d1UKz6zSwMdX2xBAVzPbod64Fk+M2qVeRHm7\/pyG1ZjI\/0s7\/05xnKGUiv3gtLlIf\/QM+lR6QWSyNJ8YyzyLmAv+Z8G+l2dbfxJ3NqlX6FAf2o6\/blCYebvRhh5WeiB\/Mi5lU\/6dG5Voucc\/77vjE3YGgQXDUJbL7n56q2Ll\/6lAHYEU6Nu562ltkg48xr1fNSDUQXQIt2wq5Z9Z9OMySeANTT12oG4JtSNk91llbYk1dptlF7v56iOmzUTTQ4+QA6D5wW13Ktpa2IDKDF1Y0LCxkkIfaTMVepR+hp\/hTSlmud49ajFsV98IDJuvv6J2\/RTjk4apZYwFNSNH9FOJPGzRl6PgQJgSPCVRF4378mJhgWnsZOmDq1\/uJ1qxDVPePoIIznnMhaxM2pQsADX0rM5MkuEcSfgcw4uBvMyYifNLj9\/wc8Ov+hrtg7NkMpVsPilxc5vnbxxx30PV162lqK6ep0CYJp+bMD\/Sz7Z7HpSDhzyyuU4AyJEAQHrZtDIjUGXjPGZA59Gn41RSN0ArWpZWx4m9cRQWrn1v3lnbWCMm2vpy0EoqQh\/lCbgDoPK5vHek7ZF2AbOfeK7ZBbGBU\/BTEUgH7dFicqdD6ShB8\/ZHlDAb1BtqM2r5wxBY5niDd2lj8fMiou0xWpm5RbjO5JoeAvIGDmpxqwICETFepiSXZ7XvMJokEnZ4mHVD\/z\/edP45gnljK5KMpqyCdEg95eNNNizjZQMr\/g3bfbmUwHTLMkgopdaJNuSLay7OPOMwk430EnZYIvEnSyl76XmBef2je70drpsnaD8n1cqBjMYPAHY2wT7Bgaz0Lqx2MEHEHi+pUWs65wMGy3Sp65JO4+7tFPwWsltzUBL0B8xNSF59GATUyfuri+A19v9E5qo4wJ5ZJ5r8SCAtpE6LrGDRp3CzTIlxKkvXk6r6uzchlaKmhTjYA4+6z\/66czzu9vDNw5lF9BsSEQA3hOoH8XnDkKmunV4Oxi82mHbuamwZ2y3QHHX\/PWxpL9m7m6+CpqJqD0beiyArsQhg42Ml7QgUbNEouf0c35D0bhOu+4PQVOoOrABwXxJKEhNG6v4r8laxw1e\/k5N6tQZLvmle6ebv94x\/GAXf44KyxMjDIDqWnPCzV6q\/JsZgAhVGVIRnSzFL3cKchrwPCQRy13OLFqnVU\/uutaC00A8X7qz3knCX2VSZ9BAc660r+8G9m75XYBpwZ6tATUuRtXW8o23oeSGZ0WG9ICjZlSz5k4bgQbbOvbheiaz1fzXuyC13uymHd537FuK0DOx+jA1vkCmETmF\/ivllGbmq\/zbwhpeALA91HynqzU\/dL1qeLUnVPjPO1z4QAuAw4VsaShJ2Y83zl6npYuJQT+K6TjW1we0sEGouaezqfH94LfxcCSVAoAnF60Yb9kOBqdgh+PmcpoFMDceIgnBAPx70lY4YTppeG271zdAdoav5D+DJs4GM2W\/PK0f+\/OhzEO1wAHgwP8GhsE1Drz9Bj2KTGTjXqUkdkhmDzvMjRsl2xt7+a8fMRphKH4JV4g5seUDP+Rg2RLUW4ZPR5MP756fNgJ5QvwanXbVnSkkx45NkNeYWMbp5YkAS7exHuqKwlrDS0zJ0Bg\/VCjrATs4b6jzIC9PIrpgWjORZCw9UkEvGHfX2bNcR7jyzT336jb6dXosyGnogu6YbT0bVpXUpvN6ggspkpZuUgMbmb4IDm5udsvntb++ibW2EQwDihwEefwJawNmyFWPinGpXescCMPSwV3N+5iq3Hz62YdEM4VUVCZQhVmoa7KKPc\/uud6PD6Msv4+kDzdbPcySeh0pBuggFK21hHQu3LFfe\/O\/9c5Ahz2TU7wmztKnmZg1VsMEOQLXUVo31tHu0zPXxvkye+T9In1E7ahJnAEw7mxhfHK\/1PZyfmVQ7KxHVFK75B8rHulHMx+VzcY+SP5PWAYG2AQzGcIJsAWdi1NLhhjp92TTXsNd60x1oPQiPgKW406ZrWua27IkXR9gxi\/XssHCWwltoZWzZkmoTBEBI6yjPqFMp0XWvET5ECfamxWAIfesMOK78hIsCi4\/XC346W0PsDX2RfA6UPVb\/zMg7VRZus1SrON3JCYkrxWGVu+iVkRQBKewiF1JgbEKkrRbGidPlgaCsOqxiHNcD3pm4Uv5MFTEswtWUNFzKWzc\/FxbNel14NyGVuVJWT3of\/Wmof8LBuNqdFtOS13JlNfXzh8AK97b8zuELzCPuayzTILc0thUpOcbrGwImyH9Po6jf1Fe1pYdcp9vUprTzFCRj9R1Oyea7vHgdMvMiDiqQ7Ru4mkyQfwJGocD6m96RG7fKTFDsmUUpRAUrJIdZtY38FM3sAt9C+To2tP6pBz8\/GHbMA6a0l9rvtaZPTkDRbpRcNB8tyMowsboRb877pXY0aJUPl6\/5mDqQt1HZrGRB2eMxtnHwq1qPd7xznG1wRm\/X0yRzK09BSZ1+Sxs0fBrAo4I7EuBA1jSvf12RRn1IWUkB0ojnsH3WcJkNKSrh79Up4ygvTY6F7e\/IcsCCMYnA3IsGkYY8jpLP6Ixfmekn3a8vbIfT\/v+CZ9AtVMBORtx29CSUs6d2c9Qii3j0gWE7gPSoO2sLhKQZD6pnd+qnM7oc1a64Gh7UJ4UvjuF62Y1E7JQUfM9DQPBmlSFHnb+Hqvs86dYVNiLky7kQsw9JeaN\/8E2sPYuWz+VAQzDIiwsG4HE1ENKKzuyrcjAcmVnMKezw1H9KomsSEr0xnzE9IbnTCgSEyVEnsO7iBw5EefIGqIM\/z1tDrFcJh5WsQpnMD3MUO63geeALZu2Vml8hSYuTM3WsqMbc7aGyxDpyJIab8B\/wTyRFx5UpjSYj+T8xccE4F+8abOZ14f34Es6LyI8zrV5E6IjZJ2FS2raiiYVvx8zCrul92nr5OSOxhAja3KTXOomCqURln7GLnnwkF3Ya8xaPSytE4JZDeo7tqd+yZj63puPnEsyeC+BpdmZYl3EVb9yYM6yG0sIKSLJfv3EHAmpQb3BfjHBuKN1\/H0uLFonozizFyZRwxeARxva5YW+ExKaN5hhB1A5kl5JlzDlLwlHKmJEQyq7oTyxCTCOs+eLnG3aJoCgpuXvcs6I\/FFPq+wIi1pF7LvWB3FlI6dVzEg6y2PURWKBHKPclmvp\/MGtsj9cTQP+3pwqGngcj7z43jCS9mUmnNHnyrc5v43WGS2pgg1eTKBnntynsmEZYLXDTUEaUsDqa4hjZ8jHJZ6EvN3QLzQZnaoIRGQ5YVs4RFJc7\/XPpP9KfJekAWIOXCJDMzs3NlDOHCl3hOzjxzptR42oX+4k\/JuF6STWUMVS03bXOjYPd+4lFqe3m0XnH9Dz+e3fNgnc4+c2Fu9TtwxGebv9wfi5G3mb6kJ2gnj2soNiarfsuok4F4fsf3iUMgKzkpJtNJBjbgJ6VoJovQlmKdIG9RK1ADYptpMH9SJ8s2vPElNQ8Y6nc0giPGHhCfffLj5CRhWz1aza2eSPsmhdcndw04Cj3d9WirTTOkbVwiw2zKyi+UrDIdhKR0NWLSKM0yECG\/GO4muCQIQyt8BuloCX+lkVecAWMMooAB0\/XMZ0tsalWd37TU2qdWcR626sntnhIfYY\/jeTdXNDuSHvUAOwuzfqbr+2OBLqZHttL2cVANRJVgYj1f4R+WT0DRKOqNqLwrkxde7xMmC1EN5L4TQOK8oNHyb8lv2Za0sZUlYqYNh\/DYlAXRQDa83q98u9qHRKdVUKBrW2XZFMPtg6EbrNbjd7a0F0OsL1yQUKbapK+EnVEoFmryJpbVhyoDNEjakS0r3BE5zXzb4wFgAnK\/cAH3fNeqhS6Je4VsNZ4txRZ1PLJEiHM+psE1cI\/H5TEudv6hXJ6eXAKWeOMzfupX4G0+Bc6rToHINbbT0RhpZ4Jqeb3M1pgRo32a1f2uWj3IUXRL7TzMXJMrSxMTA4g9QwkaN0kV89csoLWO0rKZJF4nEilq9HLo+Ryi4z3YKwvZsgz3R9KsubUT4Qs2asJvTKNKPAvKlT\/yYiBmgmr2zIUOv0Cn+FmXuQ\/R\/6+O\/tQVOgZ0lJZRMbqzEnGUF3tCmnNnVSR5yAGjdVVgfcAdY7j\/vAcvzfKBQG0u3kE2753WdGi6V61zQvkbeBcKqcnI\/S+OSbao13fKxhfyPKdppvA6lDaKleiAKxoQ116h9GiKJ\/82JPppOyFoNdPTEgSYLD5ZTBcIgq06vfkwkd8NKKCRjhs8akuQVpRzPXjkz+KJhU8266lVf9x1KwMHZMCAkwf+OKSEEfTLECUucwq0o4t71MleTV3oj8Aw94Hc0F0cQLO5QzitirxC6WouifAMHSOvNlk6Cj3WxJnq13wUZIbN5\/rMExU5OwsIvqvUVsBBqHQTA0rsOlFM2PSbvEphoocHYjfL8+nBIz+KBfWSYh1mz\/lJfcGhO0ZrKKDpdWzhhwdEsWiJC8CkKH02tKpos3BJFPzAZHmw9yzWlVxbWCL5JXMFI2dLzkkd9iOwxHWH9XGJ37cvHiOftFmkd5Jw3OLJPNBN3laY3sV6XqnBWZ66syt+ni7JKTbZN\/g\/ypGR2p5rSLESWhCs5Aoykfj\/iaZ74QrcfkvWxPdcyQVyPb5pVVo2ixVEHh8sSqrps4CzCUGly7nlgyCdVEcdDQZXIa8FVYZLc7NQ6hAba5COMX\/mr6x9+0Rhswstsj2Jg8YVAAFST4WIrVEJsSLY75aKp070+qj4MHDXqBWK0wmTS+GSOTY3lp3DL0CeAgE+AnfpChZnZbISKh8NR7DebV+zwdiqA+++7ZRjCq+IsCqYgGKD\/xhoMcHJYxtvXs\/QdgsYvoJJmtTyzahfMh6\/\/p3EYW\/19pc6aGDYRf\/kRXiZrFq0Vro5DjjDXQgfDl9Mg7kepf\/+jCzURcgY4B08mMK9Z3uSr2yztZZdwWtUBa\/E+vSbM8FCUGMbn\/J6naHxubm7U7Y0ZGiFnF7kZZ4g0zomV7Y1tMNsWSwkJsrnZwt9JCwe+LXs+\/v7aYotC1Yz9Ej3fWVLu+pfwFiqY3Q9i7xFZkex325nYGcFpMyFGxhBm4ibiMoyYPctb4qpWE2bG96rANqTjJ+5t0yLSjbYFpw8KpeJIkbcimDMMHwvJ7wqRv2E6RtvxRhH6r\/532gSnrIObIdx5AaHEfR8h5oznwvb+2fiMJ7dT8UkpQyyNGDPSS8nSo8gR+S0TfK9rV0Cygpig4Vn3vicGea\/Lg8DMKhzv0OXUjnejfOleO1+YarKdGXmolEidBFyhaGki5QtyOzX4TKAc\/T7nV0h9+CjVR2\/+vQxBFSFV8d9NX+dSbMyQwwmJH0McQmImXxnM40VRqWULYIS\/j+TftqNGSrp4+XgD92WtGNZaYZjzGfa7Ypi7KmIzckVnqbA4zQLISOkq8kWwuhiLMs4PNeGQxg\/1iazBQGPXpvSit\/oJFagtyrGJg9dVmu7vGl3yXLRWIHo2NCvLkji++lyELAh+dXA62jaq37XeZig0p4Iqx0Lbg8PO5QloTf2veI5oUSstTOYOwkHpd92CM639GRO2vBMy+93eOnGkU59xwk9pzfsncUWtlg1I3l06z+te6mSQGJ0Mre4ymrhMj6UAdag1dfFMb7f3TGr6iodznc5Bsi0ZyzKlyJ85OMaQ0aC38KOJfy3e1QQ2Xcqi0+l4e7bAkn\/vGs0wQV8\/dJ8oZ7HPKDQ1Z7e3gIAGy7k1EQsT6JhkZNRw8c7S3JxDuQQSZ+ralbYE732TWoShni0\/K1iMYBckQr610v45dUv2fGUcde5wIMl06XHwyu3Rzd6gnSHX7\/aBRLU3yOZYycLBBjkfhhXQnnMK5KlPwNQc4g\/a0lLJQD+X4nhOKdGcDqFXB\/AyaEyI+A33HA1tXdaymSIxHu0ypK9JANCGEeDMNfaib7bLaYyrPGQZBsOzkFWp4aIghAEgmSlM53Gv3twrR0Yu9JfOGCvwvXw4IOVbMIA4hajybsLHdK3x\/wEbiCTZwy8RKcl6Z5RYrqoROND+UGZOEH88m2v+Rueth2A3lkbtOT\/Ic9vgbNtR9H984z28R6Fl3niN1JC3p9PGnCJAq5WQ6bZtx6mUQ3bd3EfxKeuZj06o4CpAyWI5qInrxv9Qhkqw5WugbgH42o2EcH\/Ytjr3T5gJOPuuRvA5jLfn\/HQHWo1Qqa32XNW+jfYb6v7I5CoJAxt2GCzH2EGFdbq\/biG89MFQM4Ey28o4WLV0E9+fmWnLTTYuKY5pRbguLVI4VtShVhRKuk4V8HR5objkJ9zH2X\/siyPb5ECwQ2HqkMv1kqydsbki+VotSEfemXZo9uGGvv8o5xk3tR8ooHDjrDgB7cD+RRqAY3IX+dmebdIUBbZEtnGwu0HUfS4Va18ZkTKc8kN7QVJlFLZA\/QEUFP4X\/hIHf7BlBCALK15Ry3P5GGt8ls6JACySGimkQtdUfjf+FqugAcjOh5pqctLIfTHladLEOqWdD00clhHtuqVC23bMjz2UTfmg8v7dSI7Qi\/CWX7CTbNL95PYhDOwgFnDbqlQTyPYspnaSIEeoEtbJPIAAWnw3cJBwN4WLTF5gD6e9ryLrIP2iNn0EhceYl19eJ8s+HVkhwLBPG4HItTxcuji3T8WXi\/4azFTuPHGrKREkzKPwHFQSosveLthsdN002ByygHMbRxaIobifiSgyH45AOJXooTMb5Ubkq8MZe1As81slo4VpiyU2HRThZPxOzJr0SMGFiygQpDceHl+hGG5wrSreH+vGvC3fRVxP2c3U+ys38QLHdX\/O5zW1Vvtvu4gKzaEgqlRdUhSpVEl94NhIVeTjmqW7g57+Xg\/7n3F101mpjiUA4xMhiXOBVke+xLdi8dfhQ5zQrUW9jBs5MvmygI4LahHBDHrSC8BrvS7h6qIw+M+fEMUMlnAHOaVYUVJfYUO5B\/pYgAy3er2UybIAKRVa+PcBcG0oFiBIp97eUHEwUIxwvCvlFHMZt0LLKdXvlGJMPpXs0ihkMDdAbIA5s5Nx60RvohcOzzWsQD1PNZVYtf+alf3\/CsEe8MW4nxN\/PdpwZdndDt10kx6oXzITLxWigSWlfyQNcLUH0U83\/R8MPCkzJepTRqfy3VQj0O02LjMTbKPzRNiWbGBoSw+R6wEuEVZL80HPnfIHDiKwYHY8pJj8LjwzTcD+rdwrzyom3cxf0W\/cGFn7K1kNBKthokeQJVVHB8\/QNIvJVFmkqyYisKQPyfovW9v2CSI6KdxwhXsrghu2yhZnv6q7BtaeaKxcIw5\/sq+KLghW95qD1\/ulDWfmU3EwLwzwp37So49tc0FS2ILJFLjgH8DMMhtrti52LpIIA25YeAUPpLNMEWiLJCXdwMhYrGB6csB\/4ZZ5LjpcbEkiqm8KT+E\/th8eGRYHVeJ3FZJfPLgmc37aMrJHkS5F\/QRZE9DWo6NeE4bjSryI0GQdbS8bJdBya\/jItsNcoUd05X6KkAvvGMImxww6ZCKntFlw7q5+UXIMOfLC63M+b0Rj7lrCRQ\/WJCC8VWoUrTCA+3PjVb3HXfrShTDAfvhUEHIBEXPFF+zu5Ikyj+2zqQuWwWkxctHbHRVkij4tfAQbVEi\/GhV6HfVdG2420who0qw38DJxZ7kO+tYDZ98UM2TV9ljYI1e21GoHtU6KHxwkOvAMLCikyxmyTaXq\/VqsmiU7dejYLWNViLsNzaGq3+lYm3TFPxjdqf6xldcD+r6kb+cnS2G391JidUyqNHQsqWmdRKx80r8HoWJKeXZ9zr\/XWROn83sLxFuOxUrym\/cuOuNYvQd3aqWk1drSXAw0HeV6o2FWUf\/YzeqPz9lgqInfvM86MIAXx\/gPwbvXbkGQWDUHG5w+l0qBafxWg3OB8VjpBwZNz1o+5u1BFKxa\/xYg4VgGO7UUSoXgW\/wJG3xRLKM+t3U+AeeJ4tUA9RFU9edTpDydzqMUagOAWMR52zAnO07xXLxdmFJc852u9bSZzTtQZqRD2XaSjY8htFZZkLKVV23w9+Yc69Lt92IQDo1Z+0e3AZ+ySxGv2KV+l41We\/Dn5WyxGyUdP51tq55aC0FC3apSX+s2JNwHuuc0FwsjwsrDOpsllgiPFWNC0OxkAcztXepsdoYul7fNkWQWSeB\/2xshKXhDHuULJFmmwhCdjszDw6a+jSdzIjx8BLUcHBzKr3Qt24ANWhqFv0QIqtRzPK0MXGBI0HCUAy0DK33PDAo08gj1IY3rkvNpzfpi6mbH0dqeibFr7wls7m3xNzGLp2oiYObSsDmP1ZwPMze4en1MnhCRPg2Oe2s70847f30\/KqMIakogO7ytSOGbKp7M67e3+D\/dGowgFBxwR2Cb\/KGfS6ya6ZoRG\/mEdBX\/Vi4kTB6V3LkcgXBP\/yi1qPtcxNiFMknanKNvXFh5NpjRaO7w6tgw5RtdeHueMJIzUyB4LfX38yF\/I3UPwGESHb2MbA2jW8O5mcWWKzFEhJP2Kc4Hob5vH1VVosaEFndeT\/\/Qg4w7cpjEGkFN4WZYEQt7IvINIFT7JcYE42VF4zpGk\/o0cAX4f8Rho37bUSeh7w1JWnUzt4KL6W7K7tKuZlf9j50SkrIKwegXnBEIEGJNTcYDKzenfyRQxzesTTkyz0nHmcxH+R3J9KoLuU6vcB6P8Q1lijRSmGTzmRDDevFNReggX82iZaaLk3v4Q134Iv7hWJkQrVdO5k5Dvdd622lwhyXYqhYx+M7RrDtJ8KGPErL5nTaogx5jTHAqXfPMGqMQHj8gzoktGs2wARThT1KD9jfCUqpqfOHsBSaam2ZirwRJ2mGVLAu3z5Xfauhndxly9T\/q312V8c4ZCd2QsRZ2ARSII5vTY6ukGVGEy14NdFOu67lcxgTsgaMA4uLgY08xkK+ExuTIQUYe4AWUGijuPN4Ri16wK0I5ml36eLLeBTTgWn9Ckp1dqkDa8lsjoz3x1tPltmLpPH6W+BQtTnb9V9S5R58tQLl7eJk2CNHOw23nNd3GNHX23iNkZRH80\/M8iUd0coFz4TOzBturVt23sOGgjjAghPSz8u2aCAm7EL02tMb2TgHhEfPtruuWkKouPYRT7aJKa\/kudwIIH0je65WiCfaDYu3LTSLCiOZmjzvmEvXwro0ZviDvcoSgpbnkUHryYoJ9Twduux4EsxtGTSze5k6aI727sTwrlcsZ4+po9pUN8U4UZcudBTHI+uPL6rTWlgT87F8zP88tdppvm0QFvUtP90PmJdF8NJymCcxmwaajjzG6Olwb5kdraIZPjGmhjvu+WmNwPqRChsBW4gPHCZ7Zr7p72yowkOuzjHdT34XAru13QZd72mInq1xUq986iM0tN41B79QTvpKvGF7IFs8MStK0T72W\/lr1M8jwiuYECOCIevjDCVM\/8vdWuPzp+eulH\/5IA6QR5x6apt2021fYdDPmO\/pde\/lcBdoaXj1J8NnXklZ+1J1i4o4RRZMUag26Y6DS5e82PDEZu5boyWnpO7x5fm9CNr6XXSgoOmwRot9rF9vnAUy+EOHJ0Qp\/UXhscTRK6KXpYf9b7GqXUzyNewypQ==","iv":"a267987e6ab13a6f9640f68eec917031","s":"3025c19e9f9e7482"}

Farfetch saw growth last year and launched its IPO. Image credit: Farfetch

Farfetch saw growth last year and launched its IPO. Image credit: Farfetch