- About

- Subscribe Now

- New York,

March 24, 2020

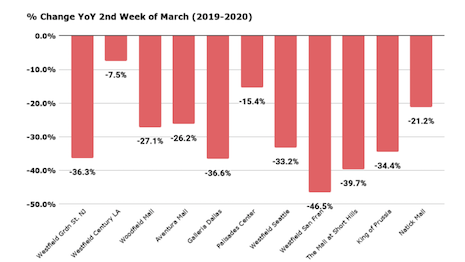

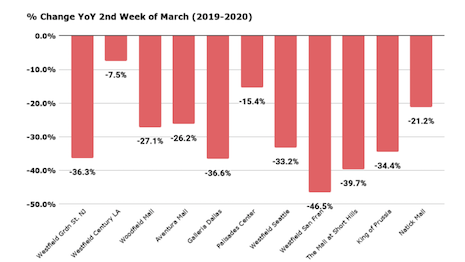

Footfall to shopping malls during the second week of March 2020 as compared March 2019. Source: Placer.ai

Footfall to shopping malls during the second week of March 2020 as compared March 2019. Source: Placer.ai

Foot traffic to shopping malls was dropping as early as the first week of March, signifying a major slowdown for luxury retailers even before the coronavirus shutdowns were being felt across the United States.

Shoppers were not going to malls even before orders to social distance and shelter in place went into effect in many places, per a new report from Placer.ai. Instead, U.S. consumers were stocking up on toilet paper.

“At the moment, apart from a handful of specific industries, there aren't many offline retailers that aren't going to feel the impact,” said Ethan Chernofsky, vice president of marketing at Placer.ai.

“The question now is, how can this time be best utilized to prepare for the inevitable rebound,” he said. “Everything from better understanding their core audiences to thinking through how to engage those audiences during a period of economic difficulty will help smooth the process once these stores re-open.

“There has been a growing shift by major apparel retailers to move to outdoor shopping centers, and a situation like this could push that trend forward.”

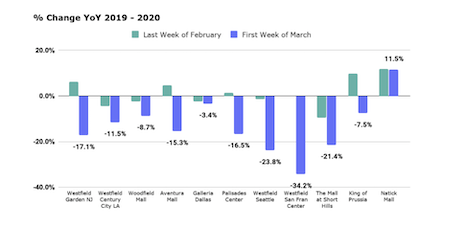

Footfall to shopping malls in the last week of February as compared to the first week of March. Source: Placer.ai

Footfall to shopping malls in the last week of February as compared to the first week of March. Source: Placer.ai

Drop in traffic

Westfield Garden St. Plaza in New Jersey, which features Gucci, Louis Vuitton and Burberry stores, as well as a Nordstrom and a Neiman Marcus, saw its weekly traffic rise for the last week of February as compared to the same week in 2019, according to the report.

However, during the first week of March traffic was down 17.1 percent year-over-year.

The King of Prussia Mall in the Philadelphia suburbs, which is anchored by Nordstrom and Neiman Marcus, also saw year-over-year growth in the last week of February.

The situation changed quickly in the first week of March when footfall dropped by 7.5 percent as compared to the same timeframe in 2019.

The Westfield San Francisco Center, home to Nordstrom, Louis Vuitton, Rolex, Tiffany & Co. and Sephora, saw the biggest year-over-year decline, with footfall down 34.2 percent during the first week of March. In the second week of March, traffic was down 46.5 percent as compared to the prior year.

During the first week of March, Westfield Southcenter Seattle, home to Nordstrom, Sephora and Swarowski, saw traffic go down by 23.8 percent year-over-year.

Natick Mall in Massachusetts, which showed year-over-year growth for the end of February and early March, recorded a significant 21.2 percent decline in visits.

The Mall at Short Hills in New Jersey, which houses luxury brands such as Cartier, Chanel and Bulgari, saw footfall drop by 40 percent in the second week of March.

Galleria Mall in Dallas, Texas, and home to Gucci, Louis Vuitton, Nordstrom and Sephora, saw traffic drop by 36.6 percent during the second week of March.

“The retail economy proved itself incredibly resilient in the early days of coronavirus concerns,” Mr. Chernofsky said.

“As these brands emerge on the other side, the key factor will be how effectively they engage with their core audiences,” he said.

Ethan Chernofsky is vice president of marketing at Placer.ai

Ethan Chernofsky is vice president of marketing at Placer.ai

Reopenings

While most of these shopping malls are in areas in which non-essential stores have been closed, these malls should be preparing for the recovery and imagining how to win customers back when shops reopen.

The top malls already understand that they are providing more than just a shopping trip, but a more holistic retail experience that includes entertainment and food, Mr. Chernofsky said.

“These are going to be welcome when the situation eventually comes to a close and leveraging the ability to provide this full experience is going to be key,” he said. “Additionally, there is a high likelihood that even as certain areas return to normalcy, travel restrictions could remain.

“Understanding each store and each location will empower them to better drive value for customers and, in turn, complete a much faster turnaround.”

THE ABILITY to better understand and focus on the needs of a mall's core audience is going to be critical in driving a quick revival.

“These are all steps that these retailers and malls could be preparing for now, to help ensure the most effective relaunch,”Mr. Chernofsky said.

“Even looking at the changes in audiences and visits in the early days of the virus could prove invaluable in better understanding of how to maximize reopening,” he said.

Share your thoughts. Click here