Consumers are focused on buying essentials right now and most purchases are being made online as people around the globe respect lockdown orders amid the coronavirus pandemic.

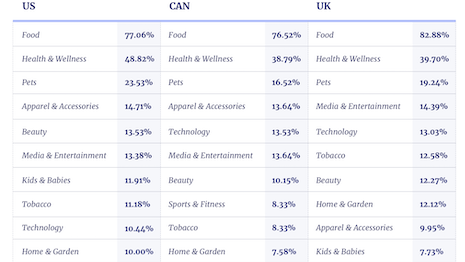

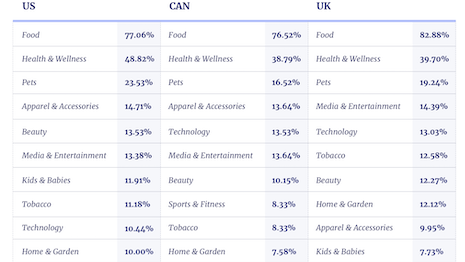

A new report from Yotpo found that 78.8 percent of consumers are buying food, 42.5 percent are buying health and wellness products, and 34.95 are purchasing household cleaning supplies.

“What this means for luxury marketers and brands is that they are in a position where luxury items are just that, luxuries,” said Raj Nijjer, vice president of brand marketing at Yotpo, New York.

“The shift in the focus to buying the essential items for survival could easily result in the big-ticket luxury purchases consumers might normally make, especially with money received from tax returns, being put on hold.

“For the short term, new luxury items may be small cosmetic items to wear on a Zoom Happy Hour or Date Night, home workout gear, bath products, essential oils or health supplements to help with mood and relaxation, and takeout or gourmet food items that are ordered online to have a special meal.”

How people are shopping in different regions. Image courtesy of Yotpo

How people are shopping in different regions. Image courtesy of Yotpo

Digital buying

The report found that 88.15 percent of people are practicing social distancing, with 45.75 percent going out less often and 42.4 percent staying home completely.

As non-essential stores have closed down, consumers are increasingly making purchases online. People are even ordering food online in order to avoid coming into contact with other people.

Some 43.2 percent of people said they plan to do more of their shopping online, and 31.7 percent are only making online purchases, foregoing physical stores completely.

“It’s difficult to tell how long people will remain shopping online, as it depends on how long stay-at-home orders remain in place, something that currently varies from country to country and state to state,” Mr. Nijjer said.

“A lesson for omnichannel retailers is to make a meaningful investment in their online channel and marketing technology, inclusive of having a continuity plan that shifts retail workers to support online, like local fulfillment and online customer service, should the need arise," he said.

“The longer we are home, it’s likely that consumers will adapt to the convenience of online shopping outweighing having to head out with traffic and crowds. We will see a new market of consumers that will increasingly work from home, and serving this segment could be a new opportunity for ecommerce brands.”

These new opportunities for luxury brands are to promote upscale work-from-home clothes that are more comfortable than traditional suits, designer office furniture and high-end audio and video equipment to help people deck out their home offices.

“Brands like M.M. LaFleur are offering virtual styling appointments, but are also leaning into the new normal lifestyle of working from home and touting the importance of self-care with lots of content ranging from recipes to uplifting reads, happy viral content, and even fashion tips for Zoom meetings,” Mr. Nijjer said.

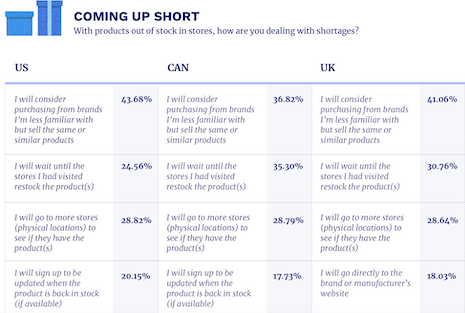

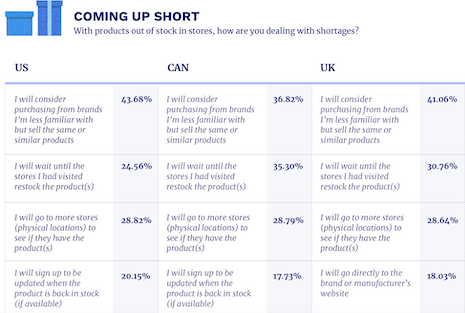

Consumers will buy from others when their favorites are sold out. Image courtesy of Yotpo

Consumers will buy from others when their favorites are sold out. Image courtesy of Yotpo

Loyalty among empty shelves

The report found that brand loyalty is weakening as consumers scramble to buy goods.

Some 40.55 percent of consumers said that they would purchase an item from a less familiar brand if the brands they love are out of stock.

Because shelter-in-place orders are different across various regions, brands likely have their hands tied when it comes to producing more products or making their products more available.

“If brands are no longer in a position to make products available, we encourage them to keep the lines of communication open with their customer community by offering a signup for in-stock notification on the product pages,” Mr. Nijjer said.

“Offering products when they are in-stock to these loyal customers first helps strengthen the relationship and also encourages them to sign up for the brands’ loyalty program,” he said.

“Due to the captive nature of the consumer, brands can also use this time to build and strengthen their relationship with them with helpful, supportive, and tastefully entertaining content.”

While digital remains core, brands should still remember that retail is not completely obsolete.

When the virus finally subsides, consumers who enjoy going out shopping will likely resume this behavior after the pandemic has died off.

“People that consider shopping a social activity will likely be the first people back in the stores once it is safe to shop,” he said.

{"ct":"Zwbr9xC0sH58A09BdxqLynx5rj7EjT1zv\/2GjqZBasl+gB4flX0Iw0POhKNV\/uYtHAnQkNEjRsIY7P+jaRU2Ocf54cmKIfkIxP+q3AeFSue23FuAhQ0qaweR+dcMN3ZCjwXR46P0+45xUWgyAWn9H0yvlL7q\/hs0h\/ZQ07i3hpFr9hS62AMsoYywumPL325wlOCfQK+TZbnHDSFoA5+PIDQuB0KscPc9TIyd3ht\/n0RDNgoN5hRE4WGjli9udNELLuPPlMUecQz\/TsIexyMIbPl\/TxqH9cmgV0KegJUEOf92Ws74ZCnreCUSmKIJtAkBU0AyQMeC8Q8cytjK1hHM2tTQQsG2rI2GA8W5DQItdEo5uFLE87SVtZe3QtBAGPDWMQBUDmjE6qRAbs\/6Fc1icAOzmMquI15SQqjhZKEYvQmpB4xK4SgktAUr1ZcLCarlBdzIiViftZoYKx0Fc71I8ddWF7mXIloooJgrKfHy8x\/k08BeNWnZFJGSVXzfEH2ZV\/p2wwKSaTE8rVhHfA6vrMlQn6fWImsb6HiLyK7hKsQ7G9hjg7qEbq3hqgyj\/yacDbNYpOTk\/taMHGqLhpoQSyEH51r5bnNftpWOBtPUKDuZ08cH4TbKUA9SpkjQFCL5WS9R+FrsMuWX2xqfMWI7CC7cVtIQ\/ljjHzD7Ca3UdLxQHCn8zG05IzaxxMo+2zwZsoW16MpXvoBv8onlywLls9tGlFSQgkMT4HIiZBbDFcawmHQRTKhonKEDsV77dpHaI7xoWgKyXA2JSWh5tcSQexQfyufbM9MZOo1Axhn0rjkN\/kdP\/L6neCJgUllW2+9CaAdVjntcWf9Dxy+ISP+BT23oOpyL9ihu5PLIGSpR9UJ2ch9FyZRyqug7qsvHoKU8AZomzXexbBQbekXLYqqvbX\/RBWiNx4wAb\/WMhXUhxRAT+WDoM+2VNh9W70DKq+WqhcVSM63tt7Ke\/qcDUKh0qqJvAlkTGd\/rJwbpPHuOfMYx9k5FqYAm5q+Rz06Q\/YBrVIK17HhgSrN9YG98ZAzb1PM\/qX5v6TkQTNO32qEMw2wEwYDTNu1XT6jlRbZwRW7Sds1\/QSQgVCe9Aekudc9jRNATfOWbsZPEIyl2fni++Yz\/PDT7Zr\/TT2QimihKe8vbtMlY4lmCV9l32sqrzbL0OzKuwqsksqVDVv9wgZJ+lE1pwUXygCeBi4QemhqWGTUuNy6QLcGxpZ5BKo+8fElhxEYWeOud0BkEbqYsuww\/yE8eLC+MbaUiI1+axzH1ZvTvBHO6yQAUiqMBw4HReCWnbyHPEHlXTlIZfHEj1MxeJZJsL1cuq9PrssDi0THnHtBNQ\/ZiFjYZnpb9o\/NHL5zZa2NE4vvm4LOQzV53hSAyDomlgx32kvLY4YQiAd8Bnz3+Rs4\/pWjGDDxr\/PhDvlUTiBSyNG65jUQuaY4IMMywD7LzUyIsATg0acFbb1zTSoZ2QDAi4UcFEgDvYcMrhGBVHdqU1vwSF89prT1Lj5\/IxkHSf9+B\/g6Ti7RzaYg1zQ2b05V46I1yb1jB\/mdEHMM8c+sYVRnUzu2I\/6jSNZRaoVzdgn\/H\/lSK\/PbC\/oqxRHll9jVW7apXz3Tiqm5cDt7pvKHbbjI6iPvgRfbB3VVkxn9kymn6S5pSF1FQPgXcKt5v+rv4rUhGwHSrV2ZdkXn+ptNjrN1r\/UPDK9nZZ1Eum4MJ878dzPrTUQ7SyX44n68AoLREv1e7aiBtoE0u1h9bawp1qL4p\/1OGWHkW45vb1EXWC0CJhFp+SuJVcux7cQ6JJ0GgyknmeQoswNIXlUrk1HGK+6CltFke8YzKTJxg4rwypf6xFRC2NGMgmHG54d5rGdUp\/YVaoefr3t2p\/eASnGxYK28qXQ3fel25z8UrWadVMd7D8unFIpM+v\/UZORpm\/8ZqHAqMtX5vIzphapUwTWRwGVW\/zAntDEqvG4eNgcnijmBSqKusBMrL7yzwd1c\/NqPdk9qpyBh+zhEcNeQ0QazINSMQwdxTFLxz2g4eRhIgnhvcRc+QdA2DaouJvw+TI859m5tjrlcat3InB3djYhPaHiE1nLAzLSdlMsSW21SbKRHTDvTSR1EHYYhP1BIMZOAVcdhLjYQuTq3A4tqjjOIGEwzJvi7b5zXZsxtRU4h3Z5fuWHyVyka4J2g3CZZE\/luBdzJQcrvrCuO2mEx\/r8IILxBs3745Oy7EWqxs8pwZ3Uw\/aXnj0nQui6a2WV2rBrjDaB8CMukoOL8G2nZrhOXeafGWapQMm\/P0\/WUNUfZTov+o4ZI7q2nGbVyQFQOvD5jIu2vikaAUDBhcUgIEhj9XXxmRrL1mx0YaZUzpbSXyDmziqCyr3AyJfygd438FnnjeeUH7OSzbF522rLuE7YS2pANfvVRohTVFmmTsS3xVdIDrny\/2j9zgt4OJpPNxpkuZ8x3WAxdjg04YQNiGTC6isXDmaZ6Sdj8r2Yay3WRWsmMp4WDIf3C4zHRwlcrvQcZjTpY6o+mXRXIJZCziwrNNhP\/PKUKmMIwi4zUEjqDhkfFJBmJLBwpVgY6JhVORLUooZ4Y1NjgYV0Txgeos+QZTZNpHMq\/JZQPMN\/bSWxcK3V1xgOs06O23X+SRPOVMqF4n2qUMVkGzws2KcQVNl\/DnYkF9jB1gc\/F8bGAqlrRIrSTE1\/E6fvHUFIHNr3EsaPlBPoRvVcIVfrMkZjI3acIUDIFwYi3k8LQl\/EW84NANZzIObEbnjraO3Kl8qQ4vcg\/D9FZMjdAsmTz8AyBJ3I3U09kw8UqzPR3S2zVNaZ7196k28Gn6V6bdhxbZBir4m9ocNE3mRN4Xo2koIO\/y0PxCQQvJswC1U++69XMV24dNPfr\/FG\/+TKWwkAaW6aSAvrSHIShvAumfV+HFN5ovf4qrwKomFQVT93Ozdmwh4jKSbQsMXbz7bplSDqU10rMV7FkFon22VfkmmrDSuEImb5jXXQADyaTmnpd8z2KeTNh99cNF43OvlClzTIKi7QNOSrp35V9RkY7+NcReKXfQPw8fkJCQo8xj9rV\/tDq0ArLMoR1D5XNMdTKxXdDcuS0y1nzMP6HQQ\/AKpUkCtcG+L0uRKP\/t4Z34NBFUwPSQm5E9rdlqP7dJrDQRIWLivCJgZKqlFJ3pOY+qQA5qcvK2XNN1UF\/Bb0Foi\/d\/qCwan\/DqDlm+a5oTeCALL6ZO+\/gm+VKSCaOXK\/ff6U3r8hEw6jwXjX4fZp3LoVUDm7VzlcuAyzFBsQyN75R9gCjcG3CmgCEPdrvV2p299\/1qSuN077cT97AWGttKZdjW6zpvrbIJVCflhNMtYZk8tge5zJ6k3QU\/9L9FP1j9pOgYHXUlmIQYdnO3nRLVdN572ZjXT5FoC9G9lCgNQKqhw5rlVEQLHn0tIkbutSfui4OYgUw\/ih1BaThixPKeqXp0LquPgvK1XSbXPK0\/KDbJPU4ANtPDdEtywnpEeU9ERfIn+1QL7TXWYNaR32E5NlCnDvxHD36W\/2+czxJFBroLCGLFh3YUXT9VSd6pOfhkOH1rM6LbCVY\/nJShhp9tU\/AHmAl5oYOtqhDgVO6Ywy7ntgzM2kuwBJ8+0oOSeN4uKINJuqZMDbglpJ3Sy5DLumKsoV1kQIxHZmrH7FDElrxhmN7AzMJ1pYI8ALquc9iSluGDs0YZsQbBomtP+2pNjRXNVHMffJV9z5MmlpGsqwe1AJfvaPFBTG7YCSEyt7zPpwbG6QdrcKmnyr8tIqNvuLp1w8VBLJMJHWv3pHhUwca3s605nYx4QMj3l0XE+tsuP38Vpl29jw9C+bc4pgMusmMlGpRA0Zhy5ACAANalH5El\/b7Ro3CVvZ2HbMaLZOZya\/tQ1ySxmSJ+G\/zN+V7A7pVCH6Nd84XpYNa3Dl6O18wwCskcPWpgdtb\/NLmpspM2mN5OLZxMUG+2KKGMEAlt0I0hU6mZIILNHBIpq\/dmylbtpoEnm+lo1FJPZougUCzIry7Npbr1JdPCP1\/yw462nrHP38I\/S\/gkTqzgbiB9ftFwsrxkScB8VnCgEw9BooRMhUuwmr5XVxBDZqJRbdA6B48VQ4FXWtlbq\/wWm49EWOkXJQaUvjM6cUGlaiQHgEaM2piTCwb0P35usrpg4UCD4N6xXar5da4QfYCSQC+dhu6oP9Q08h3TZQBr35jHgPCoSCZtgLPhPhHO7l3BRh1G+IhjPtXm+noFDlkQ1+tFsFjHWaDCiY2DCxs6HXzKW+oQQavoai\/RXLk\/Z9jPBG9mgIXUYnynWYS9sF3sZkiWxKdQIpHEMWmqmXYVvJKr2aPKeOXZR6+kCtgfSss\/8IMaklGdQkOZKKN7fS\/0U3uIK3KrZhehSQYCgfSNnfgBTJPqbZoIX2eFoabqZ6\/NynFcaWvYGGBKmzTOLsaBrZrdE0G6y1FG4X6eXm0dC78uDGqBCesFZBebvcQ4H2RC2JqfvC+OpWoGk+I4x6EZ4zgb120y9SYXMFiKJk09vdQ8pH+1kDxfOXtOY5ScYtINDdUviLjP\/v6\/r3V\/Wwt6EzPNzxtX09KuqDN5SrCpTc8XEyA\/t1XQR9JMX8lOBmq+gv3cyWaECROZws\/RTJuezzDvDrc96szLXAvZDDiVTf85KMkD+mc6uDNSUJtH9waEqpLJSXRQAkPTTNWhmq4McOuIv1K8Vlc+k8pD2211yV+obkNodJ+4PMjqdB+MiTGfKHej2FySr2TVVi25KPZ3ldg\/g6GRo143D502U7qtMwFQFZ8jsQDJ60iGmkkfbWyg\/0ZzFnQDizyvXs26NOV2bQbCFa3aRGxJpymWXOkm+K8Xi\/tiLxxrVILPjuVENFyr7c8459flvBL10tKc4gjr9RmRgqcTx41yFBphABlQZXsiaKSdZHIPx3EFVnWlbB1kyg7FKbDJJCN8CsGPvB\/baaWL+3+h28Slaj4MA1wlNa3xnbZQHYpPBPPfmXrdOIUC1kI1c+p6FaGgo5b0VdxAKVfRxcf+HHJCR4wmwgp3rPLySDux08N\/pakqxen3RzpS2mJrUK4UL9DgV6RF3NvfW7wCLZoGICVE4Ay7FESZDQuT5jQRugdee6xqICSMWM74tqaV1MXLRChhZcBI9Fp4AsuSAwsou4Hbp\/o5a9f6gx0ssHcYiiYCrkWH9hYPc3n8oI3ifYwSjVtSmkl6iNgbh3PQyJKP5b70oU7zodoK6CX4Qvp5pTEXmEVv+VfQnFtpZmvTXCs1iloUyU1Rc7gSFNpeyLXOjNm7fTF69KTGVSik0ggZJPv9MZPQ91HI6s\/AaiBaYjONyHTrlVq3JwjuAxheuuJw2JuLf+sbrbRK3XRJ6LvUqy28aBUr1zTiUJANoNOwDjEEf0psuv4yeBUC3Fl1KIMZ\/yJ+obCiUrCwDuQOvo7T9K0te8c5YhrPlG7N3YrDa3stgjTgo1Kk0ZVyx+gVj3HEZRy87YCvG98RkHaeQH6dasxtoGtF0quRSEC8kA6Ou+xbN5qj96pyFohK3KUyMlj4thUfc1uLlz5Rl+O1SVtVO8bw8H6a8hZdBIU5jWKM2QmpS81kErYCK8a0UXEZA9IoMkcxYWLPeqXMgXRhr4XBFop2FqTPbh2jGo44mAj3tIkZqgpnoGVzy8Go0lQOWU5S40LmkxQJpA0yYVpokEb5+N5e6FgvBMUS76OapzC0rYw02dKP1oT1qLI+gk01M1XD+d2VyeZoXV\/EY8DuFKSvmM5YXAceiiQijK1TGE0ejkssnewreSaCUfw\/sw61LLZEbHZ1mHnZ8V8lsyG3qcHZAUR5lth+t+7pStj\/SWQH4vEtTzek2UWpX7Fdq5K7ul7wPmwLeFbj3Fp+lMcG6JLSPi1G4L2T224AwNMRJgbzvkdKJp1cOvz1fOLtfA604E\/titlBGzTrFS4kECwOMEWioE0Vo+WIGSXU2JcFh3wYthz\/KmqrTXX6FGJcTc8jcaDsm64t8TsJq\/RJq4qMZYFocmHQa+2ENWCYsjPrUJjnMJPT49oRPPCki6+5HvTAXhPfRvIpafRTeppbbXljLZTG5yJnCmoXp0DFo166pmFApCT7pgf4KR7D1lDcmD4D0QdviNdYX0\/J68sq8wKN8tk\/kuEhNhu623Mhie9M\/EC4Z8yPEXM1NS9jvo0jGgCjU7iEUE3K3Eu8Quw8\/pM2PgT3R\/caH1mb8T1SYbJUkpjoPfR8Njg6ZpRdwBROUdHnLNX1iFIIrpH8YSjMgJSnm0ZUq9kK2kpIo\/0NrmIci0SREhJR2yVDOE1qXMxsqn3a3Pln3OFEkZ5eqERq0KvetBj\/sYOZqkNkKdpT6HtsKq\/Ualh73RD8dGmnOph8wJsnmcAaaOKXZxTnbo4Ko0kUjEtzqRsxg0sm4AmBnEJqAsk1BRw7Rbq7fvcygirBamQe6p5Y1gCQ3I6t\/UxYJVsyF\/5S1a83BffzVxvkyeNjerE83PdJTNFzjvMUK7ZoySgv8qgeY+yW0tBBjZRJ7g6gLpCo2CD0QstHXXXtBROCqLfkbebq9PTCzD1mZcTG3sFdfx2bmbTvfvVkwv2aXeanCK\/OGOhDT870pD2uD89pE4sf+FZHH33llO+VdRuPc2TbOL7HkYwIsBZpEa78bfDkEvkSmwTnPiTbNPYO4\/DaLfxV9sCXwNvrY5cZH2L6V9M\/5vra\/6eN+wpqUilNbf8J\/o5TQ09MXj4bXgrVbQrU7yUcqh7AaDHRKw5lhrav0PMrGY9+FmKccQbSgXUF5rdQ9rO\/3mf0paqV4mx\/fl7ppnDzk6h0H0AdTZJTJtKnpaknv1JduUu41FodMwXvTZ5WHfvRk7Elo7w45Uo6N\/qcEyIZLgkc38UVuoXRJop\/vbRKcBMdc4aZH0oZORZxQJ8taB2Sx3X6r3XlPpwiyOKgNiZFu8Nsb0kF9GYGkiAU+qNmqZQ1kdE4EOwKVMpKxluDjOHRx89IVS3MGLV3EG3yemu6UqHp644r+O4l8MOA+OX6WkZTsR+WaTFPvgmOrEVThU0xFp49ONkYM2WQQ1oFOYMsJe23u5xYeFX5KlQdN1s9J7TkehDHMPFoIZ8p7Fw0i2cb956v9WNIodFQ9xyBVtbVg3WogRk9QFQyVmlWEE3HMVxxpLtcl6\/ZFVNfsLQBjjDxJpdCRmof2KosaIJYm9qhHYpBhjvIjfqh+fUbp21qbzRFmXpj62k6XIoa4i0CiK0P0UtwbA4GJGmfJVNCLw9mtqDDUx+WK0gTBK\/7rlaTI1Z5O7gFhRJK3Y+JDaxtvYzHFiAjGRPxHb0yQbtx9niqLnlQPC78zbl8bAuQDE7RM92ONTNETmtxjslAqrp\/+E\/Cy1IOHf4MRY4mrA\/PSA\/fw9qEU7E\/0gWIuAXwGMQ+XWr5DIU1mgbfun6gVlWNjoAjsr6wHd1mOJpwqZ3i\/nbX4\/oQ+StJXmfEokz\/2oYI59Z4GWu3pZtqqwgimLR9Z4npSMV5PkLc3UNYOYiXMlxw4+XEkGA6hwb2qfunXeWNrM40wSbZb\/HCFNlAc1gCbB6KpFNB\/hawD8FgIKudFgy0JbGg8GjIhVNrkPwbaAACD+zPOrgCgRiHIATEptc7qzebAL7uMh0AtzOGlOk1XyS9SccWJzNBbliX457s3f+IN1US54eEb2mJflWXy\/0Jv7S\/T+iHGbasHWMFLiauabYgiUx+oGg9BRcE+1nvLmxiRCKa+5MqnXEP5rIGFqXRIItMZcGyDP2cXR6vyvJ3d2BODIlzs35L15Ia7zV4\/ehd3JAdkB+WcgM0dzNfOMAUtXRxDb\/ylzzms\/n5MTNvDKX54pvU6p9cRDuZaBgee0x6MBc3HLLL6DZroxSBZCLXcjfghx2UmUY8sjUsopJ+1hxxcVlSl00X++IHVaafg6C4ejAuV6yAgLvhEw0K5CKYwYXEn42a9dylRHVEJI1ocfb0rdrGXp6TMFyJPWJfESh0xcIVC81jJIsOQtX5bEhiXW7inVZA14M4IFWNi8AXRaZWquWnnwZkj+sDUaEuZCEm2Xn\/\/U+\/oomWjdsIDwfU7gq91WHCm0e4jfJ8e5KwpGKbmEHga1mYq0Nj7i2pVgQDn8v+sZsFpdECbgA\/A1wSAuaEbHiDXNngmZxS3rTtJnoE17Y5RamxbcnatGKkaE2pp\/b6dTRPrIxJaFJaL1lrgXIZC2wzbtbE3g==","iv":"85927fd2ef34e23b0a3ad0068a222433","s":"a41c840add2bebd4"}

COVID-19: Consumer Trends by Generation & Geography from Yotpo explores consumer behavior during the pandemic. Image courtesy of Yotpo

COVID-19: Consumer Trends by Generation & Geography from Yotpo explores consumer behavior during the pandemic. Image courtesy of Yotpo

How people are shopping in different regions. Image courtesy of Yotpo

How people are shopping in different regions. Image courtesy of Yotpo Consumers will buy from others when their favorites are sold out. Image courtesy of Yotpo

Consumers will buy from others when their favorites are sold out. Image courtesy of Yotpo