- About

- Subscribe Now

- New York,

April 21, 2020

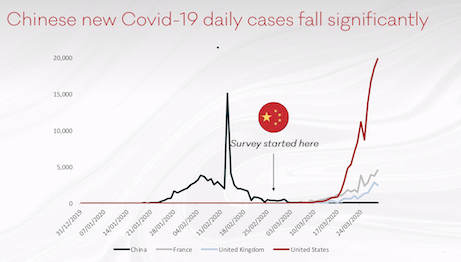

Altiant's latest report tracks consumer behavior after COVID-19 cases began to fall in China. Source: Altiant

Altiant's latest report tracks consumer behavior after COVID-19 cases began to fall in China. Source: Altiant

The majority of wealthy consumers in China have said that the worst is behind them, signaling a positive outlook for the post-coronavirus economy for luxury brands worldwide.

While each country is experiencing its own pandemic curves and associated recoveries are expected to differ, Altiant’s latest “Luxury Consumer Sentiment in the Age of Covid-19” report suggests what the outlook could be for luxury consumers in other parts of the world.

"We really need to be careful extrapolating the Chinese Covid experience to Western markets," said Lars Long, founder/CEO of Altiant, Stockholm, Sweden. “With that critical caveat in place, if the curves and recoveries are similar, then it would seem that there are several more weeks of fear to be overcome in the West before people start to regain confidence in their national economies.”

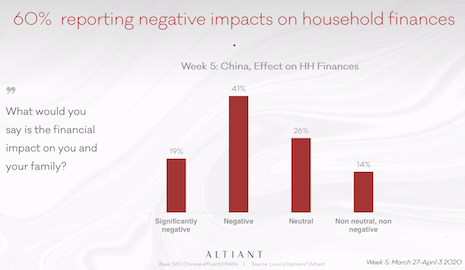

Altiant's latest report reveals that 60 percent of households in China have seen a negative impact on household finances during the crisis. Source: Altiant

Altiant's latest report reveals that 60 percent of households in China have seen a negative impact on household finances during the crisis. Source: Altiant

Wealth and spending

While massive amounts of wealth and disposable income have evaporated in the current crisis, history has shown that high-net-worth individuals and, to a certain extent, affluent consumers have rebounded much faster and stronger than other segments of the population.

Still, luxury brands are not recession proof. While heritage brands will outperform, some sectors might suffer more than others, according to the study.

In Altiant’s quarterly monitor, the research firm has identified a decrease in purchase intentions for the next 12 months.

Automotive, for instance, looks likely to be the worst hit in Asia, where the impact of COVID-19 first began to show signs in the first quarter.

Affluent consumers in Asia are also cut spending on jewelry and watches.

Interestingly, wealth management is the only category which has seen an uptick in spending intention during first and second quarters, up 2.6 percent year-over-year.

“This could be due to the rebalancing of portfolios or it could be evidence of a shift for affluent individuals diverting more of their finances towards investments in the immediate future instead of spending on luxury products and services,” Mr. Long said.

The report found that 40 percent of wealthy households in China said they are not worse off financially than before the crisis and 14 percent even said they were better off than before the crisis began.

Still, 60 percent of those people surveyed said finances were worse.

“Regions will likely re-emerge in different quarters, so the outlook in the short term is certainly better off in APAC than elsewhere,” Mr. Long said.

“Affluent Chinese consumers will drive the initial recovery from the consumption side and then likely in Q3 we start to see similar aggressive rebounds in the U.S. and Europe,” he said.

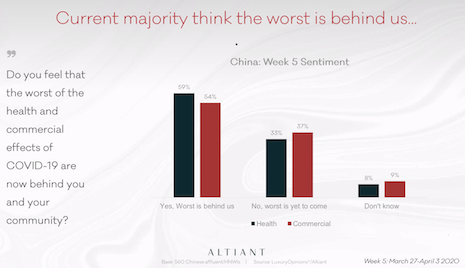

82 percent of affluent consumers in China think that it will take 1-3 months for things to return to normal. Source: Altiant

82 percent of affluent consumers in China think that it will take 1-3 months for things to return to normal. Source: Altiant

Economic outlook

As luxury brands and consumers in the West try to imagine the future, China offers a hopeful vision.

Eighty-two percent of affluent consumers in China believe that things will return to normal in as little as one to three months, per the report.

The majority of those surveyed think that the worst is behind them.

The new normal could even look like the pre-COVID-19 days, Mr. Long said.

“Obviously, consumption behaviors are likely to change, the easiest illustration is an increase in online ordering, a throwback to social distancing,” he said. “There will likely be a sustained recession as HH finances pick back up and lost wealth is replenished.”

Most affluent consumers in China think that the worst of the coronavirus pandemic is behind them. Image courtesy of Altiant

Most affluent consumers in China think that the worst of the coronavirus pandemic is behind them. Image courtesy of Altiant

While it could be a slow turnaround, luxury brands should use the shutdowns as a time to focus on their digital programs and nurture loyal customers so that when people are ready to spend, the brand is top of mind and the experience is current.

“Brands should accelerate their digital transformation and stay close to their client base by showing their most compassionate and personal response to this unprecedented situation,” Mr. Long said.

“We see that the brands that are cited by the wealthy at the moment are those associated with basic humanity, such as those companies making donations and using their infrastructure to build health services including ventilators, masks and hydroalcoholic gel production,” he said.

Share your thoughts. Click here