- About

- Subscribe Now

- New York,

April 21, 2020

Drunk Elephant: Internet-born, with a strong Instagram community and quick customer feedback. No wonder Japan's Shiseido last year snapped up the 2012-founded brand. Image credit: Drunk Elephant

Drunk Elephant: Internet-born, with a strong Instagram community and quick customer feedback. No wonder Japan's Shiseido last year snapped up the 2012-founded brand. Image credit: Drunk Elephant

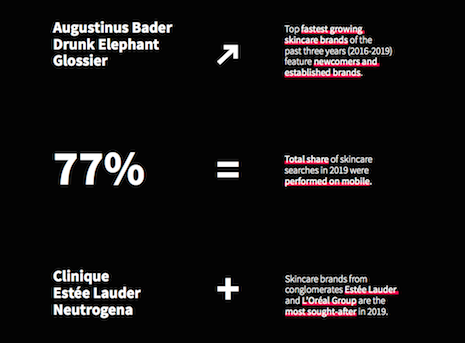

Seventy-seven percent of skincare searches last year were conducted on mobile devices, a 26 percent jump from 2016 and indicative of the seismic change in how consumers undertake product discovery in the beauty category.

Per a new study from DLG (Digital Luxury Group) titled “The Online State of Skincare Brands,” the beauty category is going through rapid changes with the rise of direct-to-consumer marketers whose marketing is based on building a sense of community around brand, product and experience.

“Beauty brands must be more empathetic towards their consumers, by showing them that they understand their needs,” said Benjamin Dubuc, DLG head of search and performance media and author of the study. “And their needs are always present throughout the year, and not only when brands launch big advertising campaigns for Christmas or Valentine’s Day.

“This is why it is important for brands to adopt an always-on strategy when it comes to investing online,” he said.

DLG, a Geneva-based digital agency with offices in Shanghai and New York, analyzed 28 brands with skincare as their main product, including Glossier, La Mer, Clarins, La Roche-Posay, La Prairie, Estée Lauder and L’Occitane.

Dino Auciello, head of marketing and client development, and Andrea Silva, marketing and communications manager, also contributed to the 92-page DLG report.

According to the study, Augustinus Bader, Drunk Elephant and Glossier were the fastest-growing brands in the past three years. But the most sought-after names last year were established brands Clinique and Estée Lauder from Estée Lauder Cos. and L’Oréal Group’s Neutrogena.

Based on DLG’s analysis, transparency, auto-reordering, personalized chat services and innovative payment means are key features that brands should include in their ecommerce platforms.

Clarins, Drunk Elephant, Lancôme and La Mer are among the brands that offer a best-in-class ecommerce experience, per the DLG report.

Beauty brands with skin in the game. Source: “The Online State of Skincare Brands,” a report from DLG (Digital Luxury Group)

Beauty brands with skin in the game. Source: “The Online State of Skincare Brands,” a report from DLG (Digital Luxury Group)

In this interview, Mr. Dubuc discusses industry trends, role of search and performance marketing online, the lockdown’s impact on beauty purchases, behavior on PCs versus mobile devices, brands that have cracked digital marketing and ecommerce, and challenges and opportunities ahead. Please read on:

What is the chief finding of the report?

The global beauty market is undergoing radical changes.

Over the past five years, the market has dramatically shifted focus, thanks largely in part to digital and the rise of direct-to-consumer whose marketing strategies are centered on building a sense of community around its brand, product and experience.

By exploring the skincare search interest on Google and analyzing brands’ ecommerce environment, we found out that there were significant opportunities for skincare brands to create meaningful one-on-one communication streams with customers, personalize advertising plans based on user search intent, and increase customer retention.

What are the implications for beauty brands?

Beauty brands must be more empathetic towards their consumers by showing them that they understand their needs. And their needs are always present throughout the year, and not only when brands launch big advertising campaigns for Christmas or Valentine’s Day.

This is why it is important for brands to adopt an “always-on” strategy when it comes to investing online.

Migration of beauty searches and performance marketing online: will that accelerate with the social distancing going on around the world because of the COVID-19 coronavirus outbreak?

One of the main barriers that ecommerce was facing over the last few years was a lack of trust from older generations.

I think that the current crisis has strongly encouraged, even forced, many consumers to buy online – even the ones that were not convinced. And now, these consumers realize that it works well.

Consumption behaviors in Western markets are definitely changing.

What works online in terms of marketing for skincare brands?

The most important thing is to communicate the right message to the right audience, whatever the platform.

It is about being customer-centric rather than channel-centric. Data management platforms and CRM must be at the center of the strategy.

In terms of online, are searches and marketing more effective on PCs versus smartphones and tablets?

There is no big difference for the most part. However, on mobile, a lot of queries that are made are related to the ROPO [research online, purchase offline] behavior.

Consumers have become more educated: before buying, they search online, read brand recommendations, check reviews and compare prices, and look up social media content.

It is becoming common for consumers to search on mobile while they are in-store. This is why creating a personalized and frictionless experience has become the new normal for every shopping experience.

Which brands are exceling online in marketing and ecommerce?

Newcomers Augustinus Bader, Drunk Elephant and Glossier are the top fastest-growing skincare brands of the past three years, 2016–19, according to our report.

Those digitally born brands have conquered the heart of consumers by putting their needs at the center of their strategy. They don’t have to deal with old infrastructures and organizational challenges. They provide strong consumer support through social media and leverage consumer engagement with personalized conversations.

Overall, their agility and flexible business models allow them to listen to consumer opinions, and rapidly adapt the product, from packaging to ingredients, according to the consumers’ needs.

However, historic brands such as Neutrogena, SkinCeuticals and La Roche-Posay, some of the most sought-after in 2019, are keeping pace. They have been very good at building a great ecommerce environment for their consumers.

Among the best practices we found out: product recommendation based on user searches, personalized chat services, transparency in ratings and reviews to guide the consumers and frictionless check-out experience.

How will online and mobile behavior change after this COVID-19 pandemic subsides?

Lately we have observed via Google Trends data that consumers nowadays have less appetite for beauty products while they are under lockdown. We assume that this is a systemic effect of the crisis.

As people don’t go to work, and don’t go out, they don’t take care of themselves as much as before. Basic behavioral economics.

We expect that beauty will take off as soon as consumers will not be confined anymore.

Hermès entered the market recently with its line of beauty products including lipsticks. Does that change the equation for the brands examined in the report?

Every new competitor entering the market is a threat to other brands from a market share standpoint.

Regarding our report, only brands that have skincare as their core product have been included. This is why brands like Hermès, Chanel and Dior don’t appear in our report.

What are consumers looking for in the online and mobile experience?

Consumers expect a frictionless and personalized experience. And this is true whether it's to buy a product, to find information or to be entertained.

It will become even more predominant for Gen Y, a generation that has been shaped by Netflix and Uber.

If you want to watch a movie, you click and you watch it. If you want your favorite Poke bowl, you click, and you have it delivered at your door in a matter of minutes.

We are living in an on-demand era. This behavior is anchored in people. They don't like to wait. They want to act on their terms.

We also see that younger generations are demanding more transparency and a sense of community that is highly developed.

What is the challenge ahead for skincare brands? And the opportunity?

The main challenge for skincare brands is that the cost to acquire a customer will increase every year. This is why they need to optimize their data-driven marketing activities, invest in search experience optimization, and double down on their customer retention efforts.

Marketing teams need to be aligned to business KPIs. They need to focus on CLV [customer lifetime value], and stop looking at the basic digital marketing KPIs such as bounce rate and average time on site, which are now outdated.

I always like to give this example to anyone that talks to me about improving the time on site.

Let's say you are Lancôme: is it better to have a user visiting the Web site, browsing the product feed for 20 minutes and leave, or to have a user coming on the Web site for 1 minute, making a purchase and then leave?

The user that has spent 20 minutes might be really frustrated not to have found what she or he was after. As they don't want to frustrate consumers, brands should reduce friction.

It’s a frame that is not easy to put in place as it requires a complex data ecosystem. However, it pays off on the long run.

Brands that focus on their consumers, have a clear positioning and play the infinite game will always be successful.

Share your thoughts. Click here