- About

- Subscribe Now

- New York,

May 18, 2020

The current economic crisis brought on by the COVID-19 coronavirus outbreak and resultant lockdowns has shaken the faith of affluent consumers in their financial advisors. Image credit: Ipsos

The current economic crisis brought on by the COVID-19 coronavirus outbreak and resultant lockdowns has shaken the faith of affluent consumers in their financial advisors. Image credit: Ipsos

While affluent consumers are generally more insulated from economic downturns and rebound faster than the general population, they also view the current economic situation as challenging.

One piece of evidence is that, while a majority of affluent consumers generally say there will be no change in their investment approach in the coming year, that number has declined 6 percentage points since the first quarter, according to market researcher Ipsos. There has also been a commensurate 40 percent increase in those affluent consumers saying that they will be taking a more conservative approach moving forward.

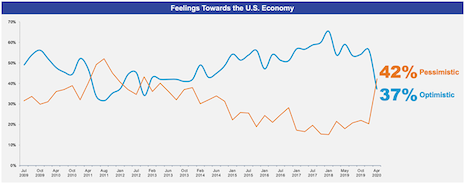

“Affluent consumers have quickly adopted a decidedly pessimistic view of the overall economy,” said Michael Baer, Ipsos Affluent Intelligence senior vice president and head of brand and marketing/IAI and media development, New York, in a research note.

Overall optimism dropped 20 percentage points since January, with pessimism up even a bit more, he said.

Ipsos is one of the leading market researchers covering the affluent market.

Rating decline

Pessimism about the United States economy passed optimism for the first time since 2013.

“The complexity of the economic environment has affluent consumers split on using an advisor or relying on themselves,” Mr. Baer said.

While the number of affluents who say they develop their own strategies has grown 3 percentage points since the first quarter, Ipsos has seen equal growth – +3 percentage points – for those saying they rely mostly on recommendations from their financial professional, he pointed out.

The conditions are driving up the need for help, but negative results are likely driving some the other way, per Ipsos.

“One thing that’s clear is that financial realities and market losses are hurting affluents’ views of their own financial advisors, with their ratings of their financial professionals significantly worse than they were last quarter,” Mr. Baer said.

In the first quarter, 83 percent of affluent consumers gave their advisor a top 3-box overall rating out of 10, per Ipsos data. In April, that went down nearly 20 points to just 65 percent.

Also, ratings for specifics from communication to knowledge to expertise and beyond are all down, as well, with the two steepest declines being for performance and trustworthiness.

Feelings toward the U.S. economy. Source: Ipsos

Feelings toward the U.S. economy. Source: Ipsos

WHAT DO affluent consumers say financial advisers can do better to help them through the current crisis?

“The top ranked option is offering specific advice for buying or selling,” Mr. Baer said.

“Secondly, providing personalized financial implications from the recently passed bills,” he said. “And the third is providing tax implications.

“Interestingly, for households making $500,000-plus, receiving data from past downturns was also tied for No. 1.”

Share your thoughts. Click here