While the beauty industry, including luxury players, is usually among the first to embrace digital trends, this has only been accelerated by the coronavirus pandemic.

According to digital marketing agency Tinuiti’s “Beauty Industry Trends Report 2020,” the sector remains resilient as both purchase frequency and spending are up year-over-year. A quarter of shoppers have also increased their online spending during the pandemic, but high-priority purchases have changed.

“2020 is the year of the “Super Spenders”; we saw a 45 percent jump in shoppers who spend over $50 a month on beauty products,” said Dalton Dorné, chief marketing officer at Tinuiti. “It may surprise people that men make up nearly 40 percent of this group. As this audience becomes increasingly diverse and valuable, beauty brands have an opportunity to evolve and connect with this audience in more meaningful ways.”

Tinuiti’s report is based on a survey of more than 2,000 consumers in late April 2020.

Changing the beauty game

More than one in five shoppers, 23 percent, report spending $50 or more a month on beauty and personal care products, an increase of 45 percent since 2019. This includes 8 percent of shoppers spending $100 or more a month, up from 5 percent in 2019.

The majority of these “super spenders” are women but men are reliable beauty buyers as well, making up 39 percent of consumers spending at least $50 monthly. Six percent of men buy beauty products online weekly, more than double the number of women who do so.

Subscription services are a key driver of e-commerce growth in the beauty industry, with a third of respondents having tried subscription boxes.

These services seem to resonate especially with Generation Z consumers as they become more financially independent. This year, 41 percent of Gen Z beauty shoppers have used a subscription service, compared to 29 percent in 2019.

Shoppers still prefer to buy beauty products in-store, but 54.3 percent prefer to do at least some of their beauty buying online. More than 60 percent of consumers also turn to online resources for at least part of their discovery processes.

Almost half of respondents prefer to use mobile devices when browsing and buying beauty products online, while 37 percent prefer desktop or laptop computers.

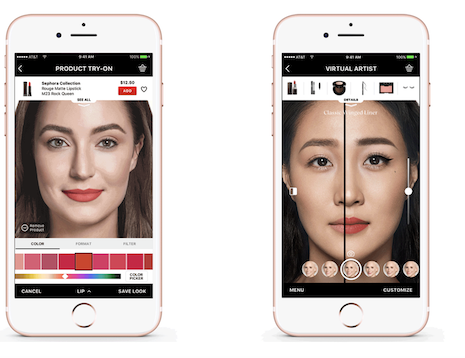

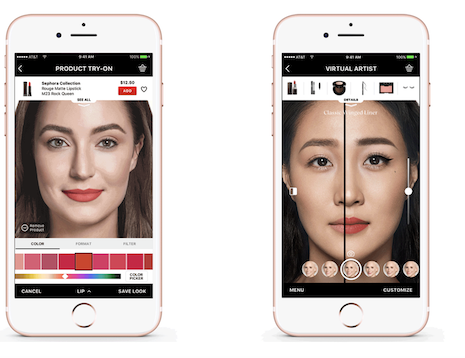

Sephora's Product Try On and Virtual Artist apps. Image credit: Sephora

Sephora's Product Try On and Virtual Artist apps. Image credit: Sephora

Meanwhile, voice technology such as Amazon’s Alexa is the primary shopping device for less than 2 percent of consumers, a drop of 51 percent compared to 2019. It remains more popular with super spenders and Gen Z, making voice technology a worthwhile investment for luxury brands but not a priority.

For instance, personal care group Coty Inc. provides beauty tutorials and services through Alexa (see story).

Beauty retailers, including LVMH-owned Sephora, trail mass market players including Amazon, Walmart and Target when it comes to consumers’ preferred online destinations for beauty shopping. Ten percent of beauty shoppers prefer Sephora and 4 percent opt for brand sites in 2020, both up from 2019 figures.

High-spend beauty shoppers are more likely to prefer Sephora or Ulta than Amazon, at a rate of 38 percent to 20 percent. However, Amazon is able to attract more male beauty consumers than beauty retailers — indicating that there is an opportunity for those specialty brands to attract men through more inclusive advertising and selections.

Though 49 percent of respondents have not cut back on using beauty products during the pandemic, the coronavirus has quickened a shift towards skincare spending and away from makeup purchases. Thirty-one percent of beauty shoppers have reduced makeup use while only 13 percent have cut back on facial skincare.

With the onset of the pandemic, a quarter of shoppers have increased their online beauty spending. This includes consumers who did preferred in-store or omnichannel shopping prior to the pandemic.

Free shipping and product samples remain some of the most popular features among all online beauty shoppers, while women are more likely to prefer loyalty programs and men are more likely to favor wider product selections.

More than three-quarters of shoppers who have made online beauty purchases during the pandemic have consulted a social media network — 25 percent higher than average. Instagram, Facebook and YouTube were the most popular platforms, but overall, social media preferences vary based on age and gender.

With beauty retailers reopened, many cosmetics companies face a brave new world of how to sell products that once relied so heavily on close-up personal interactions.

Makeup counters and close-up product demos will have to be reformed using digital tools. This shift in strategy should include a hybrid model in which live and digital components of beauty sales complement each other (see story).

Diversifying beauty

Diversity and inclusivity will also remain important as beauty brands and retailers look to continue engaging consumers beyond the pandemic.

Sixty-three percent of respondents also believe that beauty brands should be more proactive about diversity and inclusion, including 75 percent of Gen Z and 68 percent of millennials.

Better representation of women of color was cited by 38 percent of women. Understandably, men were most concerned about gender diversification and gender neutrality in beauty products and promotions.

Luxury brands are also beginning to pay more attention to more diverse beauty shoppers, including men.

LVMH’s Kendo worked with pop star Rihanna to launch Fenty Beauty, which retails online and at retailers including Sephora.

Inspired by her own difficulty to find foundation that matched her complexion, Fenty Beauty set out on a mission to provide beauty for all with a line featuring 40 shades. Fenty Beauty’s entry into the cosmetics arena shed light on beauty power players’ lack of merchandise diversity for complexion products (see story).

Boy de Chanel cosmetics includes four products: a sheer coverage foundation, an eyebrow pencil and a matte lip balm (see story). Chanel is also marketing gender-neutral skincare products on its Boy de Chanel landing page, including cleansing cream, serum and sunscreen. The line's midnight blue packaging is minimalistic without being overtly masculine (see story).

{"ct":"EeoyTzKdpQ6M8hKh+QOtyvnFhU8sOSaj\/p9acgWOnv6TdtYXnftC7uROSMD\/ywxXPpq4dEUEO3u\/UCoufUOnztyHXx3SaIp497QRROQDFuMi2UK8FF6r78UgPYobIeACYHhsZvlzNcbdGKvBnRzvqS2iSEeHXOXHe3NHX+q3ETW1FI0jnQSRn\/19ybiHXS6VDz5r4Wz2CkPSf9aHRuTWpp0Fk+SCNZEuQiBqlnm7qmUTJgJzzIOT4vDYuEwZiaTLMzAAcb\/qJLf1UiJBCbqa+m1\/bmRizgESOJlRt5bDq75p1bouoq8VYLUoZ+9yhgwxGtW43DdZ2bYyN1Xh6TriOPTnWtN4t3JohSbdh\/KfGfK7lN\/wqDj\/cKNlVfgn0TC4YfbmY7eKev104d\/TxVVX417cOcMZYE19epSX5U7R\/qTSZaJMOKqicMz\/ixCrbWFWJ4KnOvLTjVkyjYPwaXqiSAY8rm\/o8wioDq6ETtPHls75TWsFW8MDos7+kHIpl7BNt2elhhWIE6WPOFY1MMcdpY+cf1hmlDWRHhvlON3M+FxjRFjQi+xjwuoAzrGN4Qg+WAlw6MOvwTZwYg6a2px9KTnxZfPz\/kOCGlwt4FLJM+XkzpCxwMuMVqvooszQECmpIBZy6BogGS8vueGEmNV7vxev7SMZqgBhrCfpNc07xENFthzKjy+r6dvBS\/Ae\/M2rkuIE8ueTZzbUcHbpUKj9gQ3eqj374Z4xdtks0vT4lVm312vZ4US9mTdkqDbIkdydPR73qOp1t9BOrYLHd3ImgLdpD4Fy6Mvs865k8cNHMuw6m18xgkPlsU46x4X7s74WMw5Hb97oyDvTEwKCzPb670bMOJRsdmvPxkJOZbGCz9NgnqTFUusFGl0TezK4+anjjh0Vz61Pl30bAGEq6C1rEj+YFWPACgGd5c0U+wWRI9o8Xr3A1PPTUXFEf7zZskHjxdu7xpAAosVU6WBv\/6ud1nyki\/8TWVX4bC8Nj\/AUp7733ptJrC2CKs2C4UKdFxjSkZxQdc3TKJnpzLjlti3N6+Gzte9D19mSFdOfiSS\/pckR4IrECF\/RCkKErik8ZXIUvj7P1WJdgdaD9\/z8olAVcBmUTlw0dC68ax\/0K\/3FBw2pRNlu+oG6G9y08YswovkBT+W35oIYONUZrwxfkhDPuX2v49GqQNQpIjHlM+8khUDxLqKACZrpl3tusMwyl5sWdyvycB4Si0mqbgvC2FvmPUAtCMQmwlLIQWFLKAZXUG6OgREfqfgXeraVo\/vyiyroKCa5blCHuITgERjmKYYAAk9yingxzSQ\/HPek9XdT7X\/I4SCMaD8dQkaptRjsgAhUBUVa\/zimpM9urk4q5v2lzCho4u\/gYPefF4AU3IlKoW1nUy10Z10X8WDYeZNOpkhHz0QBqnWZpRpdGmuAQZPWTOmvu\/Coh1c1if2PyJyrSOCmDsBckJLrrzG0XvNwW3m1yrgRDs4OgryYGIDrW39ipLr5+aJpsPZ6DJgtGJCRGp0fHq7rmCdh5x0b2JJrmR5nJc+soT\/TrjSl3d3NZksf1P3lyk\/D8I+Oq54uCOBvHdhMIYaG64gg+\/aextAIB+FufNX7\/TMsFZ8rMy5YAr0f8WPNj3rupf7JweXeicofPj0r9BIFWSH8Xs3xkhgjyAKMkrpTNsE5MlxQ\/GhuZzyl74D1TmgzQ06j\/utGOXUKrNjOs0EoghnMW5wyeqYETZXIKWNrCRMc1iXqfuJLyVBtlvseL6TVmlp04B70\/O6XsfWAa8M9Bozjp2HM0iu57KpUgDaaC8LZL2gu8SEVZdpvJRm8Mnb2blBEkUApTojydizsBurKa1MD1fkQy0ugJDjPkxU3I3QRytagctLLrbttdBkpbrM8nvL+4glsmNc8kafVYD+7JU4g736iLaWRxjGovbNQbMxtLyr3HeD5WVntYwWH4aKzB2Tj5eEQZwySeacdaQ6sa23aG2xZfPoVNTKxQEpgchdsWMNjnE\/V5GmpqWj5iDOs4aLXOO6ENjICPzPDszFnFAdN2AyHq5xVVta3tnfm2akreE9sHtPL\/gLIamQdmLGihSNbiHM9YsU0X7ANRgrgk6ARY3OFwYc+5iSxb9Haj4AKjnsWJu+NBd27O+IOF2Uu8FANar37b7SX\/BK2CWFPoNC5UqbJ3uGh4fq8f5c\/xDXeTbkSvOHyLG60NRVDSwrhBzy50e\/wk7YXQYUcopyoGhtyJiAc\/wIB4EzXo54w1A+51ymufrBB4J10JvdN6PcYkXTuSdTb3TzoC0oBVLSFweKh\/fA4MKWmBBXZLrYVgfD+FcgeNWUXCdNGpSbcsiR\/sZLdwGYMOBXj5BkuFPT1q96vN8bfyp7BR29TaFegQ+JUmrRjsxxQqMqqWt4LXhL6m5FHxrfWSdSQ+2Kff3HwDEeXuv2yAhelpBeAH2zZgi6FgRnMo4rmKZg8haYyDVxN2mQfTxfdlOTS4+B6JI5bo7\/tjcPiLKUz\/ObJvmttQfhajHSJrQ4n231idEUnQc+Od9DAUHV7ldt+zWGK+3ee9Q4+YovTNmg+c1ieju42EevQvQJBKwEhU6JVUC0JkY1vZw3DiE8d8VecjJo7cmqJub\/CQUJXAYdcLGCwnGeLAYvx1QuhmSi+OzG2HChU77P4OWJXG0HdKGHpCAVMpDRuQnT4sOEoPJ69Yhce4aJs3xkTaBwxaJebcLw3yz8yHjDNmKx3ESM\/vo8ecJ0Y8vXF0hh0S8YyhEwGzugsrcAOIa1fNGfa0+\/Cm\/xtyc6O9COho\/nnOTG0YyMgTJ1rJXrWZMdeAkXKzecRvtxmsUPcs0hL7bvl30rHwxXzkJyTcrJH40kzs5zqBGnsB2XAjEMibH\/AFSxa5jBBdDMLr6lfvcxur2iW5dXI2zxRE2XV9UfdurWXHTCItYK3sT4H7C1DsN6sVFu7plM3kKsPOhnC5FfDWjOl1lX9fvDe8+7V84MwAju7vOuSSOBIBn9H1mcuczPSHhCA4hoC0G63+bZyufD1r3lSx5UHP6mA+IV3TpNsvtzyQTOr2NsNWNW06uk\/ybGVDLWClXsXiUU1xOp8RPfs7IXmyNrHN7w+rScXMRvDSRua9Y\/KXyMi160O6oafoFzcXghDIx\/zTFIsxq2J4CIGmqlJHROyGl+Ako8mMN+KxLR2wzqMJi\/niPi7BB0aDIt1RSXLwuYk9Gjrkfz2GQ3Pinhug7wYgc1wqhSmjc4UKovYQ66SiWAvoJj3+vmY6aWAxY4MB058TchLtVvZobw\/7xLkLsEsIQj1ZWP6E9cDTvG911lb4XfvG\/tG6kI0zP7omq544AUATtMwVqndp6y7ANfSTBe9+I28rbVzZ0Et32N+Rv52jQO5Ouxbs3+5Po6yx\/pC\/MwbJCjmTgoX13d8dSJyGA2Pxri8j+MSr1C+0YOF2F6tbHswFLMPdiuLBYWjCevjmmGVxk7LKIOC889KxBGTaLI7gmQl\/YYCNOjjzHitufdTpma6b6MBj9qC2GnbspyOnNrD7xLT5UOSXrh99yjOlPbPdYiqmPfgvQvE57PIildxzK2JR0RGPFA\/BexU6j8oNg6xT6Xt+XcXUmH4Bm6WFEOuPb+bg2B1S0kwnCdCROh0XhOFeBtwtNttvvJb8qcsZ9JRulSUr7UvHaJ\/MZSABK3pKfyL6CvGw1Jbhro+QCdKZkTxurhKaq8PxSObhIuuYn4qSYoWVVoODKLuFjVkyvGES38ytZ7ZPlZsym\/GXG\/ZTRra22gbX2fcHg70TtZaCc5mHFQ4gFbiXfqgNRSKl9+MagSfzjnH4krOcDvdF\/CxNNvu\/3jmZzqMy6czc+5f5dCJ2+dJmTP3YRb5baYQSELriNjOQSzaQICXkjTdRijYTAN5pDeTqFFLfLo\/Zw\/hwi5cwS+sorVEfujG65597+lboXYYlgTm8b83izJ43nQJ7g8PshapPQsussilt24MOEgREqJgW9vuOnyqoiYoAfG5w5NFwM4pw6zRyKUxjKhA0\/E6eQkRdKZ5rQAB2\/LPcjdqyqjmGg1o4Q7EmQ+4UQHL2eh3aI+Si5EtuO0X+dNLfe0RBGGAf0u6XOQ\/+NJRIRbxpCJ1wfbVVS7Zl7Nd84gxkl8R08jvIDvQSBOtqRZKTlxDD\/92aAyhi2+4HdRT4VINFkYOghaFSOhDvLwcOhA26Lj\/HpOcUcmt8lF4+nj\/3Hl6fovFXbUL1pWgGfq2IEJWz6QJl7BcwZAH4wUp0UM7zzxSh3s1U0TEwvdTiiKCHl\/eJ65iHWWn+mFV++U\/6fnIweXup4WeO1+PskN+znz01yWiUDY5exCoeVpUiZ\/XSWrzeIX03pGWh13nnaKjKYtBjbnfixvPLGdpA2torIMvNPyTAULDI\/yTlSvE7SFcwJt1w7TWYtOxBoJA1TbrtxozmWOogI+Yw9lx3hlHNAgGyr2ev1VT\/LqIMDQtxEcZyAvnt8RCxShke5rAm0Y+3nFzsdupCX\/hPiSiK\/aw0YoQeCp6qqj098FowqniS5DPiIrlLzxhKziSr2C6+1nxvqtGBWPXa3M0xKCJqV1PiC+fTTuBAm6hwoqYF+FU4IUo1Ylj2IHM1ETxvXHq5KOIYtqSLJIYNkfET2+naeWiBUz2008fnDKLKwHk91GC4glmA64SkppVa\/hB9f+3I5+keaedNYrWWYJA4LG1QySjl4EVERyGO3iJTBqCA2P9XJ\/RE2PlOZ946JbbJ7+mrWPhxeJ89q6KKO\/zkdGbbO45lc3hUBFqbGBSYdHwcubCdLbnAcnQEUbcqNl0E9a9eHN15yG8zUfCDUqpgtu\/wZYG\/7TVIHF3g9kqvNowqCZegwCU6C+g+Z3jSxPUOcZhvu3gbi74zcHMoA5aSrw9GdsqxAxCq+5wXzE7aPouDwDa7dZjB0NkwOW0x82ThkhVSxuRg1DTcitNs3iTdGX7UEJIv0qwWdExL2qQGsYI9Ow3QV4m3kbCbKVtjp9t8s9SH3lKqxjelZ\/QxCzKTjA+jamJPVeTB3GbDH8JNkzazpKbjWRF5WOlDy8V9Hb1QhcxFvCVQH4yA\/2htR4opaHRDI9wJdV67b46ICJQDaZhaINbaRYv8g\/Bz7Arf0AeUITPg7jtAuWRIlceaoJSIGd36CH5cXz6Nx\/LaUeHYy80V5Pe7ec+slgE+hmMhRbJ6FkeVr3XLVaOVZmWVEiD5JbkoOIC9\/7ipyON63L61SM\/3KTxswScpmJaGF010H2oh\/fYYiNS7K0acSmphkyI9RrGY267l5LdCPbdAWSDgbqIVa4mss5rP12zhO5umYtyUqhLkDoQZ46Gh\/Ivb5If\/OA0Q4KyvKPVxpevhC8wKyPuDR7jt0PHHPgbt9cdQPakfRBqQb3MNKQ2lIB4YEyxp8FhBOJ+VlZpqT15SbSn8zmiR5SSBXedFAT2TuUBuQzEz83lloOEraIMk3nsIC5546r8Sy8XsmXpGWJRsIrJgPGzdbroRO71ST36yEbOShh9\/DQOh4MpTAEtAhgZssZ7V7qx+fyGY+2MACu4StjkHCcjs+PVCqCoNWs8EksUZ0O\/ZgJd9owQg+F8huWIaeE7hMxwBIH37KGUN9o933gl1632CgMkW777vgKFiaSIHtzejPJcjMkAZyDcNsF4lnNTnUF1wFmqXVhjZvjFRjkpT2Gc8w5hPsXwQV7W0NViCi+ddWjFKwKAwZ6Ub+FroYd77nLkXYKklTE\/Z2YNTHBw2sVjMFC8G8tt8wL0T5+PZqZVk6l9ZonT6j4R0NxnfE9kLZFwXqgSnI9IfnrEPkxnlO3xZmB5NdllsleZLbDcqTGvuBZQqnfExRsSSzTh1QDm3jnq42U99JaPEJ\/fmNUTG13Z\/q4ZzT6FnzEbBuNyznfKz\/4LsaAUITkX9nZ2qDVBECVvWu5rGm1rVu+NeQKmRQDNN0uW16wSkklDU0BCrvtBy249OeAwL3v85rMaVrmEYkJwYvOTpFv4T1XpiZ78TLSJ1m+mYF1XjPJVRi92r0EGm5rQDeOxMMBoUVs1HDSBkxAmUX5fbyg07bKf848L4RrZuQlyiY1XzN\/Tk2iqQDSk0jArDbFzSuOsVcR8P2F6c6T4\/fwC1FBkYrb7fm6VYE9plbNcWoOo\/53G\/MQtOlhFcmUcIS99qB5TJM2MbEaADMD9ICadlmezGUXqS6wyDp11Dfw46gpuxfRGvL2P4sgKALSnnSm7PcIdOlu0lWVFAU2oGC2XpMt670bvjKE23cVTYo1MfBa9PBkDlcTkRJXwsTbRQ2vhFOuiIEHRQBwlNbS65u61dk9vC\/s3G7Cf4qRJ\/tAFoQVA9vwSCFEIfxGrrGHjRkcACgNlYGK7tmnAF5EWE296mBELku2rLPFz2AL3jArvBnRCZokrwdczkiaqfTRKE+Dj0RPq7cUmmfFw2+VFqmBZT+ZC5gS+Q+t0gDR0Fjyw7\/etorYRrxmfahRzY8vDdc\/BkAp7syc0fiYHZGPEK1sGNiHVh\/wsoDfdzRho4Ti+Pbfmwhfhhia5n7YKiIpVsn+QxHEtYbvOfneqboJrvq\/OFbX+8wFRaGA1jSl+GcibAqb7NERn82Fp21uQQhMrJwUfJOxnQBeA7D0SQoj3pEPntOeRrn6NgmT9BsN4tsceT9lz6kXuI392TpMGL4MfRYtM4ZP\/RqUQMZqJraydDweAWihZuvwtEteDiP9zGiyE5W9KEcsMzRirZUaGCSYQz8AN\/H+xdQ\/FRixVhRFUw4Z4z45bMablpEnSoU7fmfEyFNFHGTl5MMcm3oJBAhgtr8lGokyo43qltTMr3w7tbMIg5B1TiqVFjWuuLC+mz5mil7boQLMmn+L\/iPSpS+cFeci8Xt5\/C\/mLG8Gzh43ZcZYA+53u3Q9VphhRnA3AzMJDRapZMoIwFo7b+\/FYbftvaJKtczpkMX4\/96z3mDvXzzt+cxZm3biK4dz56X9Y2MDDvEWoqV\/sHQK3FYVoO+S9CEQ2UwIshRuzq4PUGLKgyQ+gEhYjPHbs5ZSgXLMBc+DRchIGpU2oMmxlI4Uwx6NX2nb\/FmKTMZl7fZ+A0yG9K+RS0ifuVQRUyaHQMB\/dBWEdh\/V0xyBcWVt5Yg07d5gfcSFrZ\/goazZ3azuCQCbaD\/N+B8Axv4Fwmp9uzk2BSql92B6NqFb\/1B6+X1DgSggeFG4U01OOp71KZ9zJXS32KEJMT7RM78Igz5sCScI5PLbQE7RpPYrQv2OTDrRJ5hZbwOaN4zOR6aGIF+7IuKyAK9qIqMyydCqblSoDHVywjTwetiVVABdKHynC9TL2hSWaydZzh3S5yH2Wf2P4iWEMnpR2B\/QewYhwiqv5La9za\/9BFgsbwlGzO2PbLZL\/SX40OiGlbH9sOKAKI9aFEGtSM8HzGnDKknvs\/xvnXB3zmaPTVrTzx8no+so7XlU1+uAXuzaJvCk5S2h1EBMoeQZYkItZUd1xN3jlZY2YnETA7RHVp0WyMnB7cKEqfPZ\/irICCBC7\/pQUxH+j3CZGZawlrnwoOQzl++\/2FZsrTk5V+SH4TVQEfPgOQiHng\/eGERu4qoP\/mXQ8+w2WESWasIGhSK1ZVWW\/NCwHAC\/RZcbVFrW4fh8dXYQC87t60MnqSjpXswQt4k+RBGF8\/2YGnvR7AznRRnI4O3Zjjtdxjp+8FaRwB44I\/SuMAejP4Nh4cXPpOn+6rwALhfdbIyOIR2nLp2UjL7dvZHPNmFFJmrOpDFbphH4ZsBlYWzN2mYwa7\/8Toz1AqKUoR6jOPFpqhCEj+hluu6tvY9Ha0QBCtMLMEVhoLr9VC1TQl1pFG4R6GkMgCSXUskpXd5AgK5Q1Mn1Z09RdPiIf7cJBFkBWAQbsngzNObbSIeFGyFcUGoqDtB6+EAwVgUZJDUoqCG+op4xGM3qecWoHF994+Kc2IoWEq7sydfLO66PIQUSEoQF6gf7w5SErPBh2MAE\/aG1eN7\/cbBtQJcDK2rSR1UuukRaMoGk3Bt35RErjIGR7eSk4JOSTiZz\/tVYFo\/0GExtaYih7FURg2N52yxPZXYqeHgGqSJgNJCLqOtQS9dwNDAMaGCvPlLi0I31fjWMkXGQjccElsCZhxxybn7QVN16Kutu46Re7b19SXXBO0U2zcraHmD9iYE2Ga1ilHB4Ki3T\/hN+BSmQ+ZrrM2\/9zZssEbzCGAArbvSjKX2gNNfOIWJ9Nk3mMHsNd0IZAHdZBtyjn41iGP16LGjrNnmQYE+tGddBK\/1SSjb1DKB5IPCdKcVIWpKA28Ds6d7VWYLfJKzaJJXCkir9psz3UgKXTez58ATsI2oZioCcLKJOab75+8GI1y24wx+76bNpsc6fYNoYp1P7sxGpQvhswvnZ+i\/xSwRcXpDnwEIOE5My4W5B7tTbKJ5zFMoQcaC7Er7Lxtje305L82z8UYqkiMzC6yBDoQYgwyI2AepZRuDzOAIt4c9Ph8xz1w9cksjZeX+kXFGOIXHVaYvc+I1Ju4rhEC4hhqHyogjL+JhTE9Lms2Mgv6KU4Y9+l6lpGYo0kEfIv5dfTsyqq\/M7ynnj+WUuox9cj2oOUMbB5va1Y0w5nDF1Y\/pes3FnXvZmtaXm7Nf8A+nly5cEYjIfJz2lbV86BwBuLWtSIYOjU8XpMzTvTUGj0wYsCEDmHGnIn3NCo\/USsJWqvko66lhUrZvb7aG8OKXl9ezrgtxNrISjwPg3X9+EtnYKrJNLltwG0gKbPGaH2EwTNSWqnMljyqez4tzpn98aCrD+qCpU4jrX1EuYy1Iaac6Qcmiy57s6hwF8XWjhfc5cLgMSrqlU7PuKwK40twsXZqL+Ket03WW4ZoN+45aZDyycA9wDC4XG\/m86kWjSjIl7Tzpz\/GUwovl7xp22A6h3\/9IBxU0ulBURZSiNj9EhKmlogYEIz1y9qrh5aiLctq25TWDPD2u5KeOxty6g1sV5xr6zOfWpbFFa0WiRg1NV8PNRbrvJWN9kdFPas8ReZNhWE0AftHKlNmy+Gic+6SOqhWq9kQag3yK7b2H5a8BjNA8szhzN6SW\/AHdTspSn74NXBSTQUIrg7Ohz68Mc5WFivTjFHUBmXDxMGaWo7TukTF56yEd78xXfAjbtCX5soQMJ2MK8Ql3sH5a13Ju2Hf4NA00oXDCdlBaj0WVygqsCOV0e1AfX4ExsPtmHahgsJnTDsHUrz5Jd2wjKAe5pokPmiU16wObiWxpYQ862iVWYKon3DVTjoA2uzgr7dm3Y8z2FaT7W6YzJLJPj5ERWhZy+nRi9vPgJeSFwXmY0Hh462U+Ix\/Kxjq24Mcv1kWvsNdY0xFIq6bzHJ3LJnyoM2WqTF32U5B\/Rf436SSQp7M+VlT2Y3ra9gw6vko94Rqy5Q9GSPKQ1rHsbP74eQobDCB5Yhnxr876R3Q+QyRdttfI5Be08F\/L07LZzYZ6Va20MfzH7bbD2suwTo\/9j9xjPGR56USS68gkN2+oLHwTbxL\/JRVFJW+VChsEsei4VRsFhLmGcJjNdOJNAfOcQKwXPztJSTPHa\/eNXFtAevhcZqMnouuPbrbrrsjTcPAV\/DSw2NK7HwbPqZPurDBOcCD9FzBPvhFGcKhFZ2iljWFMDn4mRH\/U+G+dEPKy+RId4dAxRls381A2aufuIDpoCvM5fOdlAf9GXVOET7hKHQPwWpTExU7QQHttw+MegJTg9knlH0DdrbzxqBg9Xua7+iEynRVXfPVfxYfXYoBTT+zldSnG+7ua9QM+XmYKVjRmQmN8\/voqdyMZKB4p98ao0+iAZ5ROcNVqQ+q+D9HCyS0pKxcIO4irmD3+4Gxx4rSCCuVb4oZuUyIkFItxXzMDYE2R3TuvsGWhb40VO1bJYiBS39NUA9mcBlSVOcRQHYg374beYsDtKz8t57qELF0BRkgzqMKP11ka5sNvN3DvSx1V2kkwx+o\/YtXbA9m6ZMlJs41IOb2wwbXxNZSd1Ign8yO\/a1e\/l8uXXPW3xM5Kknw2ON48zg\/\/miZXt4gaPcHjPLNQClwhgrW2x8loTNJte6ZJKgF+\/9qpYPkv5mv\/kFO21d5P7e6r2E1u97itZIbnQFBqaC4o2KDCcjBNalW6Hqdza9eN9SYqI3YAKAJ9Bsqq1rGY0hM\/O7F7IGDDQOWrfj1bPIwwe6gEkY4fgNo2MIggdM7dYu8tWBWY\/zlzWacByDeDY774IXbY0PKZGLhx3uMJD90lIPlP1kusA42j3gIjVIuoy0U7\/+DZREs1B7Z2MJbsN7+mfk6fcmYX8Ifz6jUyKF6N3F7dJVUH759rQLTrWdU60OAzrP1rRn4mIZdOEiyJfLvl\/s\/gELrpDQU3gRhR7F6ri7CuMry4Zw52zgUonb9AVeqMq2pPTfIpcSnMOMCGIoz0DCnUiQgwEhmUg64S3LfXNFuELLWHmezRFad6kJxHGIjB\/5V1XURSmLdb1cc5KkY7LDx7ipq9kiFi909wdf1ukBD7XimfhfzM\/ymk42kPVIsQWl5hhqeziM1O+E786+w1XHD8LV5JWLNRL6nUK5","iv":"69bfb3a910ea52de5f158ebe50a601f1","s":"7be6502ce65ff9e1"}

High-spend beauty shoppers are more likely to prefer beauty retailers than Amazon. Image credit: Sephora

High-spend beauty shoppers are more likely to prefer beauty retailers than Amazon. Image credit: Sephora

Sephora's Product Try On and Virtual Artist apps. Image credit: Sephora

Sephora's Product Try On and Virtual Artist apps. Image credit: Sephora