Retailers frequently focus on logistical concerns when expanding their ecommerce availability to a new market, but they should also be focused on tailoring their online shopping experience to the local preferences of consumers, according to a new report by Pitney Bowes.

Consumers are becoming more aware and inclined to purchase online from a retailer in another country, making it a missed opportunity if brands do not have a global ecommerce platform. From the ways in which consumers find products to their favored device for completing a transaction, many regional and cultural differences abound that need to be taken into consideration.

“Consumers’ interest in cross-border shopping continues to fuel incredible growth in the ecommerce space during the next few years," said Lila Snyder, president, global ecommerce, Pitney Bowes.

"There is a significant market opportunity for retailers to tap into this growth," she said. "For example, in emerging markets like China, the combination of higher disposable incomes, coupled with a growing appetite for brand-name goods is creating high demand for U.S. and UK brands.

“For many brands, it has been possible over the last several years to create a simple cross-border online shopping experience for consumers in Canada, the U.K. and Australia. However, the market is now at the cusp of a new frontier with more global growth and reach to gain access to more international consumers worldwide.

"U.S. retailers and brands that take a limited country-by-country approach risk missing out on the booming global ecommerce opportunity.”

When we looked at this year’s Black Friday, there was a definite uplift in cross-border shopping. Global shoppers in China were the highest for placing online product orders with U.S. retailers on Black Friday (November 27). Overall, there was a 38 percent increase in orders placed online by Chinese consumers with U.S. retailers on Black Friday compared to last year.”

The 2015 Pitney Bowes Global Online Shopping Study is based on a survey of 12,000 consumers from 12 different countries.

Local approach

An interest in cross-border purchasing is most prevalent in emerging markets. In China only 15 percent of consumers think they are limited to their own country for purchasing online, while a mere 8 percent of Indian consumers think the same.

A consumer’s reasons for looking outside of their country also differs based on where they are located. Globally, shoppers are motivated to shop online elsewhere due to better prices, with 61 percent of respondents saying so.

Over half of Chinese and Indian consumers report that quality persuades them to shop internationally, and about a third of respondents from both nations mentioned authenticity factored into their decision.

Burberry Chinese New Year selection

Just knowing the rationale for buying internationally is not enough. Consumers’ buying habits also need to be studied in order to best cater to them online.

The path consumers take to get to an ecommerce site varies greatly by region.

Globally, 62 percent say they use search engines such as Google, Bing or Baidu to find merchandise online. This is even greater in Japan and the United Kingdom, in which 70 percent expressed that they use search to discover products, but Germans showed the most inclination to actually convert from a search result.

Shoppers from the United States, Canada and India are most apt to navigate directly to a retailer’s site to find merchandise, with about half identifying with that buying behavior. This is more than the global average of 44 percent.

Sixteen percent of consumers around the world use social media to find items, scanning Instagram, Twitter, Facebook, WeChat, Line and other popular platforms. In emerging markets, this practice is even more common, with 38 percent of Indians, 21 percent of Brazilians and 20 percent of Chinese saying they have done so.

Michael Kors WeChat platform

India is also the top market for email, with 30 percent of consumers saying they use branded messaging to discover products. Also greater than the global average of 16 percent using email are Australia and Canada.

Crossing the channel

In addition to discovery channels, the way in which consumers make a purchase differs by country.

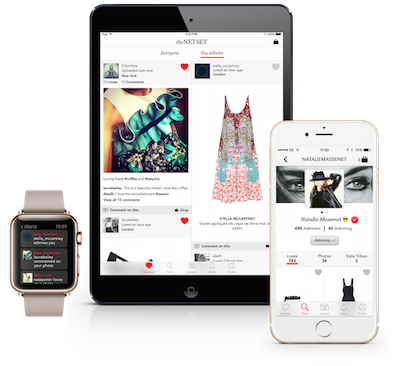

Around the world, 24 percent say they most often use a mobile device to make a purchase. This is especially true for millennials, 33 percent of whom use a device other than a desktop computer to convert, whether that means a phone or a mix of technology.

Net-A-Porter's The Net Set is available across devices

The UK has the highest rate of mobile or mixed device conversions, but a thorough mobile strategy also makes sense for China and India, which are close behind in propensity toward mobile.

Mobile may be less important for France, Japan and Russia, nations in which at least 83 percent said they lean most towards using a laptop or desktop computer when they are making a purchase.

Slightly more consumers said they would buy from a marketplace such as Amazon or Alibaba than a retailer’s own Web site. This was most true in Russia, China and the U.S., showing the importance of being available on multiple channels.

For those who are reluctant to sell on a marketplace for fear of brand dilution, competing with the Amazons by offering more can help convince consumers to buy directly.

As Amazon’s penetration into high-income households becomes increasingly apparent, luxury brands are going to need to find new ways to avoid losing to their online-only competition, according to a new report by Shullman Research Center.

Through pricing, convenience and selection, Amazon has seen its popularity skyrocket over the past two decades, and data in the report shows that its popularity is positively correlated with household income. The report suggests that luxury brands will have to double-down on efforts at providing things that Amazon cannot or will not provide (see story).

Breaking down barriers

Poor localization can keep consumers from making a purchase. Twenty-nine percent say they would be deterred if an ecommerce site was not available in their native language.

Fendi Japan homepage

The most popular reason for not converting internationally is high shipping costs, mentioned by 64 percent of respondents. Along the same line, duties and taxes would prevent 48 percent from making a purchase.

Being able to buy in a preferred currency is key for Australians, Americans, Candians and Germans, while having pricing information viewable in local currency is important for 25 percent of consumers globally.

Global heterogeneity presents many obstacles for brands looking to maximize their share through localization efforts, according to a recent report from L2.

The share of ecommerce sales in the luxury industry has tripled since 2009 and is set to triple again by 2025, but obstacles such as currency, language, selection and payment method may make it difficult for brands to expand and capitalize on their reach. As social media, the Web and the development of BRIC and Asian nations, as well as Sub-Saharan Africa in the future give brands more visibility, it is essential that they monetize global consumers (see story).

While some things, including good service and shipping, are universal, brands need to ensure that they tailor their ecommerce experiences by market.

“As the study illustrates, a 'one-size-fits-all’ approach won’t work for global online retailing," Ms. Snyder said. "To succeed, retailers need to balance between the right product mix, competitive pricing and convenience, as well as the’ technology and infrastructure to support consumer demands in each market.

"For retailers looking to go global, collaboration with the right partner will be critical in helping to deliver the end-to-end consumer experience that is expected by your shoppers," she said. "Working with solutions providers whose platforms are scalable and flexible enough to offer support across the consumer experience will help retailers increase speed-to-market and lower costs for the best online shopping experience.”

Final Take

Sarah Jones, staff reporter on Luxury Daily, New York

{"ct":"jkIcu1NZ4V1Rz3kUu1Q\/TYeCgRVkQBkTY8T4PiVxjFZ2HR98DJlPFWyh+uYkcmIYGFPB8\/RY3LHg2Aitfk+cs5pCeVsicLU+BIq4ej2MkX3s6qwocUbCr31YqtujXSPf22Xf8KUQbdB24KSMKKn8bKkhiiTttZRR9D6Rse0KwVHI2PP34pIU62u2gzGtAZKJghuBLyamgioaemf02spixsxpbL8fxDZdLLinpgA0vBYmVdcQX3FGHTGccZ8ETr7DXLE56yN8RUIp9mxCa6czTKa0ac9ftltUh6q0+ZLgUjMsXnwQ91kOLte97o3HacTB+0gYfJmmpWld95uw+9az0VLFs7I07Jta1dBiuHKoUC2dbLwfMMgA0tG2js4kcPMjSlgzTIYjuzORxDXhhyLaD3VnZEjf2O0hb\/yaMP5tjpT1hTy1JyHhlrkQqCZ3sRwqhF3F7Jf9fJ+AKx9BbRXrfECSL1a4LQ+cN2KBBI+zFVmfqJizafsGd\/mxQzukWgHCDNPQRqaF22nfW+psNvEwJcB2DjIDYjPYVBSLUrLIfXqBddSzH5hRWWQ+jkxL23wSNhfPgETlLWkzOA1\/mn+JXc2sLZ4NHVhG8SUIOl7vz2VD8pNzp6QmIAfdFJCm8ZYEV1p9oHYkHi7+CdC1dGWjZ7jSpcBpk4djIVRS3XnHxl4z828eQkj9eUuaH33+OidxPCSB1lCzjqyhO\/fpzuHlHSM6TbMOzQ6VaFrDWLDzqQq0PYeS1EOKgBMByVjxJ3xqLNF2nOPKyQsUP4G7CI7z615t58EjGQ+xomfxN6zQo2pLeig0WuWn9Ebq5nJjrJhjNwJYGUXh\/ufYNe5srVUEe0r0WB91jokkZICcgjrYQrltKF8o1whFCZi87jkv+20NnYpv0JH97CMr4BfUXP9Ba+SKnxTCO18c+Yn9E0xiLBcDuiwmRAJjgrquRUxze0Sh3aTq7hZlwW0Ho+ebt05hiZhhGM+3TfKZDnfPi7EbCMLowSQtZrYMIRo2pyuPPZ28BPr8fPhCi7xWcMc53nz9sD4XfWVmp1R8KQ6AWvTGNbRin7q5J0rP9TuOjNTiSihg9U3ckjChm4t8Wv9X2zIoQ03eyD4W7fT8NOP7v4nWaETdkXmX\/zxQp28zLsKDs40CRuKZ+Hk5Ibw2Du5AOrSQ4ck5w0QTY+TVsg\/1HfkBrRmrio+4S2+9gd0o1tptwX81WQ\/R0Ztz3nF1X8zTpY4fjs6qewlUL+Atk7LRNfrw7K+rk5oniPdUrIFmvxxQzaFkKmKp0mmJTsY0DEEM5j3XEtf5puEmtcxDMe9fMvM\/W2neb1c9wCInm3W\/nYmyLjc2+IwLSF\/l2YnYYHFhewe4\/9xgW4J4PoDJ3h7Qjzc4H1w3k\/QywfGzLeNQGxMHB21mH6Ha9uzVAoQxmFADBreN3xceKqtFoTLNOzITB7d+jn74T\/y4bVjDHzVLhLp3d\/ab4bfwdvf5VX1uRm3\/Y7YNnhnLyaZmm4plYZeRdc13rwc6Knyu1DlK0dae2wjNMkPP6Nj0x46y2zYvdOPNJW+EkcOMbqH2yh6Um5C6O+FEidYJ0H1GyiYpryW3guT260r\/aCgLHSxcp6E14lVZO6L7Q5zw819OBZ14\/TWWGydSTf8nSxjhO7IZIBG9hmN0TXBuMUWHC0oA6\/T8L7GKTimOk3u\/HC86hcBtGUPihPeO1fxqbVDER6aWQm9tVZUuOdT1vi\/Zf39Vv4Hjb74Icyo4U2XJJ86f9wdErxMyYw+KIV2zemuAsIfqVOgQNJb5Lyaz+r8C9WXaNw6QteuV8p3dtX6t6mCbjVxL+aPiee9r4uK5m4HZJBAWAF80MDrfzfEmAQI5tb5L8hljbNpNBSnBSFe53+WaT9f0cMeTvFbqrG5yuomh6syZdvTMHS3PMW\/Ekb3CnQFG5ktHxYKS+aFPd+fZtEh1Kx\/VaZswO0OIPeq+9I39U5eOux3XIayTOal3WilxBLPtz1xczu3gL2bE6thPdf9rbC1AqlgFOA8IVmUlYzhb0dFhPdU\/jb5Brp9SsYtG72hRJMvBKOP0yL4OxXd29CPHG3Nb8aLMF6yO9In2NaNvtRzcwHRR1d5lzokX06rYtr7akxpF0fgBF0vkjS+XOpUeHMnEX3KtrXVnk7gjaqQSDB8Mq2w\/5ORaL+badgS89Nr\/5I08qBo59RVZXsmH1Er\/0YMuInStyUCcmKWDS7MNfn7c6968B6FLjQb1vbDGL5NEtkr6YBB1lmqrOKqn2ionOKJ0mvDenobu\/5XV7A\/F5OF+EY3cYij0OWA2wDSGxLx3p+reAXxwb3ZhzPZI5nItlXeKHDbX1ed8IzgcIF0S+t0TV5Plel4kSPkUGTJOp2WJscNsHh8Z1nJfH0Be7dcPpYdFkE4jf01N30rSNHKWNR2D5l8WKPzUsMLevMw7Zq\/Q90Db8RsmoetAsZ7O4RW7DrujvYFBL76PiUMyHAOirFp4Hm9vhCSh1oWSDnlWCouwPtWCLceHNK6ebrcJGGehkGomuMofTlIjDNz8Lg8SAAeHBF0nEEYPDEiEMmo4BdqAKsDSjM0Mcud2VXlYNlFrY0QAiwxTkNi20yFqVVaZoccIUI7KiB6PzBHNa1s4UXtBw1WyIYThiVNx6f4UT\/QCbKBuR6v4s6ynYa4osagw0p\/ZR9UZ9Pp8t9zID4a9xZ7MEWAyLT2ONzFrUzS6qde\/0xfkoMlfDh2FTtudxef6dvuQrbNdPQzax1v+H30SU0qVNaYl4Kf4oP1n5JVJMZn2FXDBRQi\/qC0\/vGVhdQNAHgpRZVLTjLbYyXGP93lrME5xowkVSovyI\/g3LGWwce0aBLjSuNMVq8FuQ677J9\/swagydodHwp3w\/DLG8aPGFqCCFA3JmEMrp9pDHwlGfq7vHfMEdq+U07ICcKgrlW4OFokzj1YPzSXct4jVWfxxYT8JYvNiXqYuoDst4YHpuEUaKgYRlK0Mzab+IIsvh7nMXFqs9dtmvWz407ovthfZTO4Y29LP1LkHv1fyTst0orEUojpufqy600w\/q3cvkys+s3QOaCSZr+tQN2h5\/SvFZCkuOfT10QulJIzq0+SjQX6TGJDDEJTiUfm5NcELycx\/hjz4ob+bAz1AXfnqO1YsEUlGizIUQdTemVnIGssb3\/PkdkxiDgbUregb3TGC\/VCdcyhtblxOZT8XPLKwH5ruNrFqtIfbJ7B3NNTKPQ+zdVs\/7mqq90Pf1RGPL8Yk1cVp1Ni9DLuuMvSErD8NgPQOSIg4dM6Ly8RSUBFGjXVFel4iT4wR+f+x+fL9zgE9gpbSAnc2mN7XQiOEIOZPlO2J49\/\/44q7LeqKiazQrqhOGjH7+wEpRH+jyI1+bOXXosLHm1XFMBpy8jyaRv3CZIdhntMx8P5Ek2zk1MJ+OTUemLpfCD0192NEBR6fhbBUNTjQRZPF7X1r1XrdHH54qsvvZFz87DR6Adl0lXa0x4P\/4dMSpL2t3DNrPFBUC2MDmXigWlfpYM49JloSlveh8QnwiHMhfn7oHMADpV3jAMaA4uDA6z+lDtQw3txnK5rIDzxGeONqXIRmUGXk1EpYHf7Td4Z0CRpVdpj7Bg++wmlvcqvGocNSsdVmODoXl80SSpr4UlKNud2PAg3HVVskNngCKjTx23YFG6Xk\/MfGIqXPTEd3WKUSo8sfzDDEBBHrj1t4ANx0HvUnGqvf4kZj+iVSaWCZ6HtH8ufgx7L+xB5fnlXFQtF1zeG64\/dYB3jNsJLsuoIo0hDK+poDICtuZqr6mscG9lBKmW\/q\/9Z1ZIV8XVW+rDL1C9hbae0RbUUbehFXV1cTNmChpwvvrrIs9Kln0hSW8rIkIzZ1u+7IVW\/HgI05tdtLCMiFj9N5KLqQUiQVZ+fBpvnePJOYvPtP\/96z3IWfACZKMYagp1+Ar7RyYUrOF9Om0Stfz2D32yDCwpKhk7y1Vk8efIOQ76hAE6cEHcHAUn4E7qavwK+89XSPOIPG3NW77JIQbFHO4qQ+fTz5N5agqJQxsIh5xIQ\/t8UwjqwJuvVcAMyWH9kSbk7OJey9xetnzOOTyaM10kuFkgktQDtPfQIivrcWzEl2BmdnpKCajanv5GCF\/IexCnEC6LJ0rXs0yf7Z6r0Sjsm8Y+zpyWg8LqJqz3KmKQEy\/slrBSQIvgH\/EeBWdqWNQ2B1vskDXKOJHYDsTqqdVcE33ZrOn1luWFnDjdcTxB\/oRX5LZwGSs5KdgPjLf808\/HBqtattpZKfm0hwrFIoqRsHOL254n808eOferQN7YrDTqReiziuSPAuLan9xFXh69R8Q2BNNyC6RD0OYK\/2+DHOx5Ylbl5tI9SqPMX3w0xZYoFRhrFLofbb\/8y2I2CxeebA3Z\/w7Jasf81qu0i1tXZIRLVvybzB2FJ6bORpofZSF3oAUoMe9VIOXoMp3HoB8GnVnEpcmam2R9vkWEorU\/GUEF+wl3eZGFNFmH\/Y2xf56jIWTuGCqRiDBuG0x8O0Qnog6beEhX5dA+HvfIm6ZkDnHBMfRvgZfRA4ZmFTn3UoUplHIXLAijiA70b41KT7P5SGrnfjt+PAOdpW6Marb7HuWVucAWcBj4ICh6d6rVE80IRU8GUiTrvCURYM8PATdEeSEXxKyvaDxPJOW7o3EmQLq7cxq7zdzWjzc5oDMWGnbmh4rXxRfGNZiAKDPYaHg0l2lzDwOhc5QX4MXorl7elVH14fMjTDgtdjaEH2\/gcUTysGMsYG1QRi\/04P1l35QqNgDtjcGB9QKGCDBE\/25FCMTFMFcrQFlbKIBIebQd84BgdFeATR\/2dKZfiq6h1sOWKHqOB4t9Isbsm7YAHu63OhdK3IT98svxyJf0KGMf\/5z\/lRjlGqXEPBOoMlHiAE+6vSvNfmWisLV86UtUXrc1yL2WPqN9SEnTI3n5tDUUaRUoUzpUxC4bLamoXDT4Jvd3UTZglRB27c18Hao03XEInvqRT+tK5kKurOsXSjKbA0Ef4QDXadAEpe91kuodBmBaTG+Ec5YZQY3t+NlwV6r7A7JMSNan5OBJeTC5d4TDmfqyIKsIkba\/8Vc7peYU13n6Z3WKW9ksKmL6OhY1JFos+6RFI21kDWbzSD2pYOKGf\/3c5Vq8GXLHqspuPJr41RkIX8QrXsVHa165ZBCldvRaGGpaeibOOmc4WW5kIJ8eV0wsez7FNKPSHg9rK3wN7Mo8X12IkUWG5Rx9udoRvc1jub3wEK99U9ESPNY17jIelbGhQUBUqBjk6UNIKeInN2VeuB2f4h5muzcgRsy464JLTOBISJ78kF9NPKrYEJoPrPDsrAFzgQm8sP1pMVG33eceGlPpQpIi34kGCDeG35Sn8RVo94Zxi3BaQN7TMAxS3BHc6h2qNpPvSVW7mH7URAyi4tCnBmLlB9FMVqWeF6APFLfJgUeZFwyg\/yMcMKIWivpFAjJbgrz2xPk3Wf9BYGeUsJ0yJjYpPhJLy1dcn4eUnKzF6q+W\/ebWBDI8r+FWyg3ezR7i0X9aFujAQ\/IwSmH22DN+jasv1TnL4x0CIvGeRZ5AM4N6C234INXavdyuSyfK\/vNb2GbZiYs8DoB6ivOYfDRr+5NOVbzYAJkby7\/BKIJ0adrWEVOqnypwzLq9VrmmXvdW1jRmIps7y5tLjomcpYQt2G9fY3JMfjNS5FYWjT1nOsOzh4bWW7AQBBOarVAE+ygoE79hcEd6YtfIXnFFymghgWTi4nwUftfNuhQj5FmhVHBRjZ5a3JVOdVMjE5tJy+S1hNrhPRyK8VcodV7N1ygz7zRnNMigLUY1SkwyTfJWBdYYI8my+6Yu7B5DEYsSi82Tyo4bqeXm2ZiVlPipb0SOthqwazpeqspK4enbTe0y\/sQBPO6Y6cgV1Xcwn+iIEdgk9ApKj81oGj\/CZYqNDuLkVJq3\/6OOr3rTGNea6qKtrowDCx74SCr\/SKTEdQ+ZXREDyOft3zqqMzrHk5I7F1a8pGVl1FRhSa\/HqAB5\/f8+Wyzp5TstQV9AZDIRt9vbqYO1HeZKdp75svxDoNMQqPCAgKZoDd\/T9ouXNIQjIXjUbi0cMEA16sk\/rWFMyVW7tep9ieSRQ6vKDDK3FTI4cQbbpB2so6uxq2jORd8mMmNyZuf5xxatEb17w16dhHr53q\/SpFsuHfrTBTEqsuaTDnghoZYnnradAIMX3Gjz7zVSQ456QXI\/bCk6Rktj9qr+gXFz0urmVkA8HbNvcyD4\/RiaZQ+EG3nl5LVHbpZcD8x3mBgBTjZ1VIM7Rb2gkxZT7ex6XMn8HElOh9777g3dxP\/D+L0tRDje2D6mzI32\/\/wpUR4mIPorMV8hH3dhX30cbxV+UowXqsqz5Xn+c8zIRX4wpHFXFlAbfiMmicsAXjZSG5h00rjTNoZQJ0ptZ8nH6gIRpPKrE7FLpIbVW8UcKTnaKo8gLGkH3F0lYqBxEZVJHm8GxZjgKRaL3bbsLO86LdwsvB4w\/w4zbk+90PNKlcltjBpEsHXxBXNsSSp8oVIQROChaHXP3kFWK49ovF7xZ5Gg7gICDEFF+2kTNZckoX3Z2y\/\/3c+aOP3ktJbFEeK0cUTKp0BQ\/qqLWlnoDNNK3WK\/ccgjFMTbaOQ6EJIkeRYh+K37OrfI\/TiZKfoj9GzRsoaI0AAneFHfgPqX4n+GGLKV2alozvCyxbczxY4p+f8lJY4xKav838Gl8SzmYoZxnTLoPhtynFtPEnI6Xj+lI8U6wq16MWsZ4NfAILyFk2BpAyTyWUDaOwfF5fpuO9BpjbLXJ3h+kaAHQsNWtO7Ln0ONCQKyWGCMbF2i1kONTMKFnRubD6VyqJdFGMR30P3RlB4CGeXcy+V3Dug+xsd7Fdbrl\/JM8a0c6FEmwJABKrXl2r4pE3A+awG4F7sDi7IGVKe\/pjJvAB5jypWhxXYrFEYcRReOu3CVZyqB4HFf\/8Fm2P078nlWpLeNRb\/u7sHiWH2iTUmBzootrWOB4bqm8QNIoHtE8ESWbRPAjUIMFDdNsbmTgDWVVC68mlBEl2S0Za5UpA4kSOBSCmWXji1p9kpqlIFQrsCw10LF6LQ3LpNrX+Obkup3FIwfISn7HHhwOQ\/kiIGiw3GbKgBJiUMXinTF0OzZ4Vp7XsP2cky2WrJlyC\/P8+Utc6caHNMF2IwjM5ce3+bwhg2iOiF9HTd96moSBkt0Qr9XCc1qJ7\/+lOqkBmp2\/o0H44u9aNovUfPqGWDrCAnuqCvmT5JSMKPF9sOUrFkhANz7SKnkcNJ9EDUJ8\/7XTt9IZTB4EOtvGjZ3op4yaM7HqgJjFi33bHuYIdFYfhwfadRdkBikzF9X6C45gENsWnFOFDGiEYpbcHZCaRsU7kjiNQddW6rbd7\/45ZiN8eP44pEAhGvuxZ9QoVG\/ZcmYT3iktQyLpth3G6qaxEojz2pOg8SA1QEI0cwEIXw6y1IySLcv8bq19XyJ9TEWV+e+7VPXuR2q56kor+SnqCzua+yQKqG6k22NEXdd0lMfVDxW2NVyQB5iigIoBf\/bIKYus1CcI7Z44lsVuFiyMvmQ+jI5m\/rRgZjmci\/VGcnmHDoN8JVEBjiohEVCumzafem5DkirUyiF7qBUYf0Ho9zXgO29NWvguQCXM6WGO+3f31PgsIkoKzExy4IHEx9o2r5C2lezWQV6zBlbhzkCSG7cI+aRmb+NfFg4dr2b2PEqOuHOEXpARkHULeQIiRHfraiN5h0C23deHb+rwmZE3P37JITetOrL6JaDYOlYGBhnkZJbJE8OLhNKzzFWmJTTc9vyGtcR2GL+Ndz9cBh2YZCIMkf07bCjY\/eDopPK47oOrzn080QTdpl2VmgcsvFphtsLYPJOJkXICemoqyvovXX1S9+wLS71Bq8Oi1pvCyBCeedT4sSO20GipybH99AbEDGCgJ9G4avJd3mrDtIWWb9V+IFBVuVgfG9bA9i5D83QMwNz4zjY30ClJTfDA\/Qr3MbfV21brmk5WslehmPdau5l6yQJiLlLarOV4cDKIne64G3dPsNDx9Tu\/Aq\/afg4pEEZzSgYvX7dGY3MKZ3zP5UfrFzKhQw6X6esj\/TxZodxLoKHRO1+9nEZ967XTN\/v3z9HbTPWX2v\/51JtopP1iaLdbjC088h1QGhoD3c3Rdv35WH4vIhBieqcPZTFcCr88nRVP2HGCzps9UD4l+TcZF+3KmS25SwlwimkpBAhUUIGZBPtubzU2ryyrxbSxBvYGJy2TsfGrVLdOnpjMYjKI33iHig4NzI2fuCi26+kycA3JyLtXlKpeSH\/s\/1SBONfqGjjYAyu0Kre4jB7OjkxGa6YcdgFuchzHNF7L0XQNbL857WzkFz2b+EC511pkb\/7xTOIhU4QoBWCFFeuOsJZ\/HTU2w\/QAf4+4po\/nv0Rof6mZgBFR+B3QUyn5a61ku8\/dvhpr1QzMv0jNXYW3UBo\/Uz7okYDiZMVFi1xrUVYkHsv2chJVbuB2AixbidiYXYRJDi+i64TG0QkqJZam8ucEb5f9o8uwY6CqZLBDjRhtYhj\/Xu1S4s2xfXncqxbac9K8AmVfpWw5yFCP2ccrd9CVigICLOr\/ZA+rr1Z12OQeJcXgO7RMZIcZNXPgQ8Ha8arxNW20Nn8BaF+ubI9wRdnVym99CemYG3ZcwIK7ojJKQuzXgO89iNC0MeDCFVrULstr5Igrjs3aa4nHjq+pl8Novp7D7O5oH2ptg8u+DwbN7oPQpRlI7l8qdjfBHL4fFNlp6FZNS\/VfUJmKzGqE1\/4v4jkFdlTAB6MsN31WHpV\/Nws33aI48VU8\/vFVIN+hsce07O17sQ2GzGteEJevMxHICYt+4KFTcVpU7wKF+dpqNa5uwPTu6Ed\/epAI5Hx2zeLen2\/eIZfmlnYnjWxSwkxMmsU4xVcEnyBCNy3H+HC77rkItoBRx0ZQNCDPyr6b5BOS1rBiYfZjofald9Z6qVhwi1d9B\/dZHGIiud78eSfMND80FB9J9jxQPO1SG0VlCJkXJLRerft60Bw1va1B8oDsHDWOBDjJ323xJ5nPDzcm9aQyE\/HBS7g8Qmc4c3zxBxYaEgo8NLNcP1ea+vYybzRvPkESN1kpeFSdLLLIXY3bwkfVglGh7rTAKxKkSJtSHg3uD80oThAKJP8TMbr8OGYy6jw72WfjSxJ+duf\/uMnYsR89B1UIfe0NGKWAT2MWnlnjZ15Ka\/5PykoAJ1qtGX4zsakeifF5CgXuOuvYquHiafm4HINC5Y2wcLrzeKU3V0lU\/tdTy5taIFmnH4uYywLKJ9uwqcJWHahEuW2\/msUQtdIpDZueP2RA8VjPxBwfJSre1d2QUbWHxkgYTl\/HvojXVuvWFDFeNmYAMTY+cef4\/Ti+pnyur38Fe5H7kcy5TkFX0uCETvWD7cg1zf\/yu1f+UNyUemzdg2JR9WytML5jC0pCvXB\/l6PBMDSFmVVELO8itWe4JxOt7nA\/569qreYGY5mvihAFK\/aqVfa\/nAtRzLLNT0q8QLd9bf5Vjqq7UH9c\/vYUnglRQIwXoNDZWcKULwbAH5MCLCDGJ8SJoWrF0shWstuiCLICgrd20PJZTADNYTnAgfOVKwpowsFyDSnDzDgpI6FrdLCp08II3lfw8FdO5BpHZ\/SblsmZVTii38hdAAJFHhhv3MfBDqiCwtJl7cH4YLYOoALjsHrIMcZSLCdBdv5lLkFfpbmZ+btkw02hoeM1k3zJ+aQd2gPRRb1qQkTNhFG6mWjAzg2Csl\/ka6WMTBw+tYF8oZkFhpK01jg+akUSVN2IJc6Nvorpmn0pLAunwCN60FgaLdPOXDF5G4Ca201nCYWZMf9wF437LKD+86RFQtDnlXEYwFRGNwUwH\/NAmY6wnglZomjus6aaz8j6kDjJa5PjLRpEDNOzZVAsYlTAd3RUcgnm8BxIyfOFTsPefNbb2xb1TAx3JPkRR1kACpkKDAPNu8el7Xj\/98vwwe7cqyvdp5DKAbkKj3ZY58WOIDYxtZ4bziHpQfsPkEFmFea51RKS5HWBD9GvvAqBnQZUs0i+o6AtEFjXOBkyDpY2TWTePZPWlXrDFjcM+JTn2D0R6cn0Fw2acQ+1WmHmRmyk8RbkVLFeYexEy6FAmSCCxxxKTtsspBCIXUC32FH6o\/Pa7HeFlZhxDY1kdBHT8kjnEt1EM9Vd1Ki7lGpeKcGdoc8s8e93kkh3HQJxJvmzuCx\/nDGvuTktXUYpE2f\/7dg9YaKfBS6QZDp7zJz9t\/rA8U9KV8yYgdHmqVwfgw3BKQP5kfFkV4OQXr7T2TtSrCG3TqfNeCsAD2+clrhj5k39R6LJZuhKYyUFhDe\/Llc\/0WLVbccOZhXrsgQR4k6Q4lm0XOwcQ\/hQVS6fGC0eZMG2NiFj\/XR02kmvcwRxc7Xl\/4+xMn+8Q5Sk4+eLYTfN\/RvAgBYdjssnjfKTuJiMJ\/bAaKAW9bHby4p4tMuhWrhw34rHqsTBi1hBAEVIJwKzTWmDtc8QinWgc2AJ8MGzgq8JDxT3iOTAOI3qeNeAl98XS\/HXgeBwbt37+3qKBL7ZYs4TlujhyuZtyTDI9qzLR+GtOX3unnT8Pho+Fvj2vFuMHsws\/ZccV0Ed9kuhkfwAEunEYP03jFs7rjbNsyMpB8lUIKfHTdwXelHYyUx9ORGkXQKnqFGrUOclEFY1Mo7d2F4GVu65bYSVze20UoLSayUQ+3vKqFdRXxHDSb1iD\/ekYHNVeZeTnPLasHsHF6K9J4fIt5\/QDBK\/bhlZjTdtTvSzgMx6BgHYPIQi6ro+LATNm5OueAFwqmpMNmFrknhHWICsb8VKG5Xw\/95E35totJJ3XIsGsqh9pzAXXU+vFoMB6VmTdTXlJ3WAMVAA4Bm7MsWpGAlUe7XDHTjNbfvZVTSn0\/unyCptMbpz9VwmS252gIHVjIzJ0NLvhLX\/I7scJvKwrE9xLvcaBTgAwcRanUm0DCKX2yaeMafDVMWLC5CPJDkboMTaFGuSyxlr7dfD2jtnJgJamnYIkDDS0pcS1zOlpScja7c5z0c\/jOQwjTo+bGXY2tjTEB\/UWMo8xcEKK8tNOh8EuKSMmcMu1bH0zbrS1aE8i\/APGupnEqsqa5Ouui7Vi7Sk2TtS5+9zqfDHXB9z+ECq6U666TXcPQUlWaJ+8q6qOHLSfV6qRuPkwQlzInDfsMJSOUHIarbx4nRmCHVAskGeQT3WevJw+Vhtj7SjC0MCg\/03qshFw0AfHn7udzGp9Ns2Yo5sYAylaE0b4kCysjce9wx2ZEcW37vvHxLZaMHiVG3LC51tdZwbF70Wb1cOcLmbyXssRKm8jK4H1icH8sXzW7qwqPLqzVZVQ5+xYabpUjHT\/l77CRjL0lc1oVcAoO0plD6u0SOp3xGt8l4E7RimrljUnGbp6AjH8Fp3ek+e0oqwPP0B3tNfaS3ZTIEWAJUIBueiXl8KeIW8neZ0vCG+1JwaRJihwMhc6mJ6iwfAEamfnPKPYFJCXDOUr8I6eMvf1QXt+HmlnZw55oqxVe499toiVFBYWPPXtz7dpPLXQi2JlQggdIHSW3kAWYI6TScPZSHRubXLX4OCDZxWSTpmF5YffhQsvzSeDI5qYRGXCBaevjGjq1VIWIqoW7HcXqARIE6bsVJrkHYiVX5O\/4O9\/H72ZPuEncQwcKJBGjG59zlmzJsZornFeCaJPzKmRyqP6zLizCbITIsL+S0pQc5zg\/LXZepqGgaP\/r3VvNCbfVc0laW6W31yPDZYd9Tds0yPfenoMWtpPnfKhIK6FQ7KH2QtK2VXVqoh1xbaqnSfmEGikUGsj0oOneBs5zFbtZqz54aleJEuOaySqtkGprZ099GqrJfHd9QvMVgZDW+1OhiDCzqwaqesPosVDqo2XeasvhFIAW+WSGR7tnLsURJYM8SjMyIYROaWjf+kNR5uuhFGzYQMN1XfT054BU\/eLOwuhe+r9rSb6g2WqfahPX1\/fgHGXj0YIjHPmriAVZpzHFFyI+9SIsQwAYj1tLG7XVu10RQ6WCecy7kySxpCbboXV51Ea+543u0XYjgssDIKZqErVgt0j5nvEOfk0XlUT0oC6WeIEQ398PG9FTgTf\/iSgW0azwvSmiqQfBQCowlYXN1rA4Qx8grQhAsON\/zPLm96aSVd180WG7PkRIG+4ECLLiIXsVtlIjvZFvY0X4nrr31Gb663n24GFVAUcyBQNkgZM1x1+Op4jrqZkK9reKuF1o0mRrYG6oj2sxuJt3V7YIBCohKrw0I7LBC\/g3VCyEXrcl5z6lRjloyVdOiGdMNw3VDE\/4kJossq0npo4DrVbV\/Ur4wRC7HvnQFRiszLtIxDPrWcsGX5OzpsXb5raAZgn1Ieryq3ZGFLtMkdFxYv5ccNVPw6Hr4i7D4K4C9ZP6lVHhLgtSTB5ADgNdZn\/t\/WNvIAVO0ZwkCgFuPGqUzWbPrUZXiD0qD5lrbNu\/bIo\/VS1SyvfcDq387dCXfCrHfHnsB1GPlN0PJkMzgm\/Lk2qgVMgHYf6htWWTlojAScOx72yh\/ARRH+VK2T5ahPMtFQWnROZHrocgYXw+CGi5FTU0MNe0XnMq1kRxbrodw0K7+BFjH2jF6NFBTL6qWoRyP+332hEIG5hhJnDiPJo241ppy9KGY3Nc9jGsQKAdmPjZ8cNM8b6iUbZqlY+1GKMz4i7zH5CsfvTT1L0Rgq76EVFgZm10Y\/G8qoeJENNvdJZVitEhSzYWLHMhyjk6Qmz0LSH4uK2FaQOVfTomolXEfza0KH+BZIAsn9qT7TpEXpHaPiTZstlrPa+Aj7JMfR6cYXbuuLYkb7uf8AeB49oRm70pY72XwUWZ03CAEVRNP\/dUYgF95DFpTphI103uWP+tEa0RX0HHoYDLvhaIa6tD+7gwFLShW34bs1Z1SA3V0PBDIlGGQqdMOUbMi1hPRgy9rA0u+0PB+vQ3yz18fAWuz6lVgZxr7xTc3xDS+Cl6kA3jJRh8F2tuugkXbXaM8eKet4oYPHimDzu4K8kxfn5XeGt8aBVxil9k\/mBXumVkMU0sGI0xW71cId6IsZ++fWR+x3WIjFfWHbB61SGqsrDGKWvLNrPplSiWxpHHeiFPm5KSClu2nUYya6x09hfApCP8LBQ6Af6IiPa+gbbUNIbRJFojmb4falqKDYJJkRScJqHReXtv00KGJGbe15qOit0mYYjOiR1gnyIWBSKajgDbqUpmdQOrVkhJ81S5lHdPfQMp+KVZQYrqFcuS2UjlYITjj+ULD85ILzGkXRVrQSqll1YuW994tTF5x8gnMuHctBG2LXEjjJ8K6o66Em61LV0ozl9i5JjhH0vP0zrus5hrr\/17VLK1d65Xx5X0Xtl0UcREds5bWiZHw5zBxq4a6FqoeRzleTjAtTG3GYGDIuHB5tkYQRtw9Zu0kTc88KO4uzDL0+mCVxdXxFj76Ee2+QzUeyKTzmRkx6vptlMTRU\/rKaxqo9uUVVKPjkDG8\/JdGkZR1nowXFQj2uqBds7zkPc0LCWdivY9Pd9JHPXpS\/LwrEv+YKjwV4F5njZ7CJIeqZrLnj3xrY1bbiYlHw0WBqH13efI57EQDIAo+7LH7yL7FpucS3o1zfJwcjUlklX9MuFxZJ8VfG9SPu2b5kMH7UXyIFeDdokusO4PDO2GBt\/xcrNnULk3aqvkivHhEwwIgcVOz2kzPHQcvV7thKiuQZOJtGAt24\/KjM+Bt0OqhCOa1ZSWfjQqm9nVnF6eHZ+1JVnd1KR8M2diI8tsdfAiwl7bv7n3mzckvTBOAE+NqE0wiroQWXtWPIq0NmwfatEsqd2VimapHJGiiTRtac3dh55APmN+xpGJ4fjf3Ep\/Fp\/a1AaJOO+Kq0Ea0tvt67QvgJ8lPXxIZPotx0i\/siuppDkw6UNW7JdN\/Cy7wPd\/\/P2e0cqqu56JKC76UYA2OirNMiYtvKLgNHePYFXAWjGDDdxHd0HO1kvMEaSV2CMuS1dQ7LS52q2nZSAekWowkaX1y8MbWVp3ecuHmoRKKmoxEqrUCoYCSsCvuc7dZlK4J+towJFg4uFASsjXogwQBawSLJR3seTz8jp9qScgVgeHUolbckWkdCAJCxitYZ44YeRGrZ9my7e47AOc4C1qqfaq8i42cxHe+CoHCTZVhK\/4OqWFCKVZyq5YBcI+wvcKC8MmwunHc2n53aN86koVRRxVbxcHuKj7oVqhYgJTLfdv8NnkOYo8zF3hIM=","iv":"729bf6107b5319572eb5e9d92e89e97a","s":"d35fd31be6c2818a"}

Photo courtesy of Bloomingdale's

Photo courtesy of Bloomingdale's