While 47 percent of executives and entrepreneurs identify finding new customers as a key concern, a new report from Unity Marketing argues that the more strategic approach is to invest in client retention.

It costs between four and 10 times more to acquire a new client than it takes to retain an existing customer, making loyalty programs highly cost-effective. However, it is not enough just to have a loyalty program in place, and brands need to consistently deliver to keep their clients coming back.

"Outside of travel and retail, not too many luxury brands have tapped the potential of a program to build brand loyalty among luxury customers," said Pam Danziger, president of Unity Marketing, Lancaster, PA.

"Too many brands view loyalty programs as a strategy for new customer acquisition, which tends to involve heavy loading of rewards at sign up which only encourages customers to acquire those rewards, redeem them then move off to the next program that offers hefty signup rewards," she said. "That is not a true loyalty program. Loyalty programs are designed to reward and encourage brand engagement.

"Luxury brands should look to rewarding behavior that encourages loyalty and repeat purchases. Rather than simply giving points for discounts, luxury brands should think about adding service and experience rewards to their programs, like Neiman Marcus InCircle, American Express Platinum and Nordstrom Notes do."

“Designing Brand Loyalty Programs to Attract Affluents” is based on data from Unity Marketing’s May 2015 Affluent Consumer Tracking Study, which surveyed 1,313 consumers with a household income of at least $100,000. The loyalty study looks across the range of affluents engaged with brand loyalty programs, including airline and hotel rewards, credit card and bank card rewards, retailer rewards and dining rewards, to identify what specifically they value most in such programs.

Reward, repeat

Unity Marketing references a Bain study, which found that just a 5 percent growth in customer retention can boost profitability by 75 percent. This impactful number is partly due to return clients’ tendencies to spend more than first-time buyers.

Knowing that retention is important, it is prudent for retailers to have a loyalty program in place to help engage consumers and incentivize them to keep coming back.

As consumers earn rewards, they feel they need to stay with a brand since they have something to lose. They may also spend more to reach targets and accrue benefits.

Estee Lauder E-List

These can also give brands the opportunity to learn about their most loyal clientele, giving them a better picture of their interests and purchase habits, allowing for more personalized communications.

Affluents are most interested in having added customer service within a loyalty program, but these plans rarely deliver on this and miss an opportunity to make a connection with their consumers. For luxury brands, which may avoid discounting, the focus of a loyalty program could instead focus on added value.

One of the traps that loyalty programs fall into is focusing more on getting people to sign up for a plan than on keeping members happy for the long run.

Part of this is putting more emphasis on rewarding behavior beyond signing up. Very often brands incentivize joining a loyalty program with a large payout of benefits, only to find these new clients disappearing after they have used their initial rewards, which can prove costly.

The key is having a consistent engagement with the clients a brand wants to keep most.

Unity Marketing has identified some of the effective players in this space, including Nordstrom and Neiman Marcus.

Neiman Marcus' InCircle is a tiered program, which lets consumers gain new levels of exclusive services based on the amount they spend in a year. Those who reach $75,000 in annual spend are treated to fitting room experiences, an InCircle concierge and wardrobe consultation.

Neiman Marcus' InCircle

Similarly, Nordstrom consumers unlock more benefits as they spend more, incentivizing them to come back and shop.

Another area where a lot of brands are missing out is in reaching the HENRYs (high earners not rich yet), who have household incomes between $100,000 and $250,000. Not yet affluent but with more discretionary income than the middle class, many HENRYs will see their incomes grow in the future.

While HENRYs may individually have less money than the ultra-affluent, they are greater in number, estimated at 24 million households in the United States. A large portion of HENRYs are millennials with high-paying jobs, a segment that Unity Marketing says should be a key target for loyalty efforts.

Rather than seeking out discounts, these consumers are more keen on spending to belong, giving themselves access they would otherwise not have.

Promotional image for Bloomingdale's Loyallist program

"Young HENRYs on the road to affluence are a real opportunity for brands and a segment that many have failed to prospect effectively," Ms. Danziger said.

"For example, among the young affluents, aged 24-44 years, in this survey, fewer than half (49 percent) belong to a hotel program, as compared with 65 percent of mature affluents aged 45-70 years," she said. "Yet all age groups travel and all age groups stay in hotels. Clearly hotel loyalty programs are missing the mark when it comes to the young HENRYs.

"Create hotel loyalty programs suited to the particular customers’ brand preferences, rather than fitted across the hotel brand collection. Many pundits point to the fact that it isn’t the hotel rewards programs that are not connecting with the young HENRYs. Rather it is the hotel brands themselves."

This may mean an Aloft-specific loyalty program as an alternative to Starwood Preferred Guests or allowing guests to join a Moxy-specific program instead of Marriott Rewards.

High priority

Sixty-two percent of retailers planned to allocate more funds toward their loyalty programs in 2015, according to a report from Boston Retail Partners.

Consumers are becoming more digitally driven, and loyalty programs have to change with them, incorporating mobile, gamification or consumer data to make the reward process more personal. Thinking of a loyalty program as another part of the omnichannel shopping experience enables a brand to reach consumers however they choose to interact (see story).

Having a digitized loyalty program can help ensure that consumers engage with it.

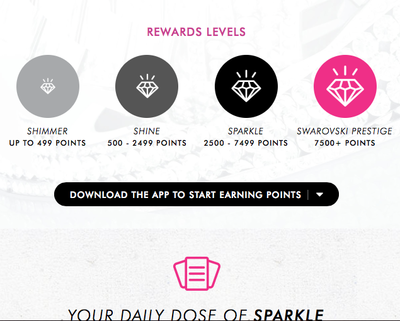

Precision cut-crystal maker Swarovski is elevating the customer experience across channels with a new rewards mobile application launched last year.

Swarovski reward program

Loyalty programs become effective when consumers use them frequently and for a range of purposes. Swarovski is ensuring regular use with “Sparkly” rewards or “Sparklisms” that can be earned for a variety of activities and exchanged for prizes (see story).

Another trend within loyalty is joining with another brand, allowing both members to benefit from incentives.

In 2013, Starwood Hotels & Resorts boosted incentives to join its Starwood Preferred Guest membership by offering a partnership with Delta Air Lines to give members additional benefits while traveling.

Starwood, which has nine brands including the St. Regis and The Luxury Collection, announced the partnership, which will offer exclusive benefits to Delta SkyMiles Medallion members and SPG elite members (see story).

"One of the trends we see in loyalty programs today is crossover programs, where brands partner together to share members and cross over rewards," Ms. Danziger said. "This may be appealing for certain brands to tap the loyalty from other brands, but it can lead to real problems down the road if one brand loses its luster or doesn’t live up to the values of your own.

"This is one failing with various hotel rewards programs where hotel companies–Marriott, Starwood and others–combine their different brands into one big program," she said. "It can be confusing to the luxury customer, and really not meet their expectations or values they associate with their preferred hospitality brand.

"That’s one reason we call out Ritz-Carlton Rewards as being spot on for the luxury traveler. While members get benefits of stays at all Marriott brands, they carry the card and membership of the brand that they know best and means the most to them."

{"ct":"Oa3ODjkjpCGL8bu0wkAagfZjDpfC3EdSqRl2Scw6ulqcTW\/jOyZd\/UWC3KIGyyZRsJsoLJZj5I8mT17CwMHA+TtCyVsBdczdJ6ooJRSKsuMJ4\/K9xndrK4SegBAREzc4Us0Nble8dNlBS360jMW4MxZJA0YALI3Z\/jIqWhUFfRv\/8hwn9tL6pa3pI2F0u1MTvOj3EnsjS3BB+ZZSOb0gzE5sM7vxRUOu3Xw353o\/iRFD3KTe7HHEA\/rNN3GmnhLjFHSD87vZz+gSfijwCXPAusSi4gwSbgMDjaxhaPyhVAgrCxchVkCJrVFzQl2lpP4Pt5rcDbAbPtrb+nH89uWRohvwo6Gj8FIIoi2KoqZ7TVd2BwygoiuDXFoZgPmFqZbm4xko7HQWA1lCXYGqFYUnxSR5Sqv0uHC4w45Z+A1xeQU1\/i7Q7M1QwB4KU2b6YOWb4GdM1oiml9\/TX4CIoRm+9KZ+9\/NQ5PnBMx1SiRCAcGJesFFBtGPI2lJzPLLCM8eLa1K7gRp1ugVfSa8ouIynI9I\/U9i3aUVdoxhMIOXtTZx9MsDBr3vxSu\/pIIcGnz5xgMQIpzgC26yosPA\/YXxbEh979\/lEbLoPU\/7\/a8dG50vmTB0ZtERskOZJm5iD1EecdJCrydPxcUXFgvSlShdDak5m2ddDlWm1\/SdQzoIZgGZc8x\/ZCZtkTsxMK6aCPVF76GKSWqvRwjON\/Mi8U5OTJceIG7rXq+wO\/NymYuT4Tl6SNhkGF3c8N6RL9y9+loKlHn2e9wobZ2kj9XIKOnzXG0Xbc4lVkxcBLAOvbatyK7oO9GUtu1TvAwRgYCrEmGYgb9rhe+ZFZa5LuFzhQRIudrSL0l2nvWbpWEuC8N4VNFiBxgylVOI1IdEBXZnh+7mriLEptM9q5XUfVQDl\/8p3uUeyDNcwBmILBSm5i9y2aGA46gQx0pbN7m9z9DockWfLNpAluTtIgp714H77Erv1hPfUgSscleLfONlqoT7BvEDXt9sjda8GQwQCQzqbZnZBVjJ1cjDtUPF7dHLL1lnKcNwy0lJCK\/ZLZVdUdRVYhtbDykqufSfVB61zS4nZuUgMftlGJAMPIVmIJWWYNDlzaZorvJh7OT7R3oWM2oXc92VP5XQh7liKAuZOGZ\/y67TqGBfg3fEBJ5Io\/ICkffUZRfjphGCFXx5VA06esAI+3bL36mEXQvH55arxVmraGwEdOi4QVLSZLT\/KnNsAJKm7OCa1\/JTmL8DefpLA2EF+Lj7839pqxieeOnwkTYTqs326U2tIDihVn3jLb9OiTEaQ0m\/9bPbqaENg+Y4AznlcEhzS2oYF+nPK7Mur9C6Sk4+F8ypVzp0+01SIkrIUVtfw3VgrgFU72eOVtNOtGI8AuXLrGMmX\/2wdCRbXUf0vmdPTowhVh0SXtwNdIUEeCb3zvzAauQS4c6BftSMLU+M7vJbbUwvpJe\/SFccRwd2vhuCd7Ub1pwkFD9MaDNvGDAo8e9lVIhBJZpp8K\/xAOixw+1499eWgp9CEMAyqdUhgWicJArlncPzyVKrFUoc0JV1kJjsqhPS\/DWOk7HX6jhnvclRzkaFDNqfW7iZk7VJUBHAE+3\/gtDEovUEgK9Ji6ZBxUh96qY8TBaSA8Xq1f+jUv8Vv+NREom5yyHHYbnGTJvgisiDA+ExsdOoYjoWMokU2PrXojJYApgCYdcKALU8H87sg5YyvsNqbHsTLoIHsMNIPI9y4oei1Xd+vZpKFBUiuZAEgfSfJcwli7KvAuK0dOPeFNQgDa2uk4ThaZAq9X4oAojoh0Ap0zJ1\/xk5LThe8coWsvc6zib+LAmPm8g6NDyr987nGAkjRGvq7sXE8YcGtqEjzU9Tpq\/RU2G3RJyrpYzugrXAlEmpIwDq5AFDH4uidE7O\/0UTWZB+EMQvLm22V7\/B2r8Bj4ND8woV6ZNPdldW6z69lg9zWsigpDg8ig+vJCuTi6Z38iNh57DWCn43kSE4GhAFxogeVbcN73j02ddEAcA2lhFF8ZHe1xBk8mG61w+TKryB98DTFiq9YRv3B3KpfeiUD4t\/kZ4J2pgBq\/8oA06\/syanM63IIyM+gGPyC9ibK0kctkGhA65XYVFe8VcDNUhQIFis9Cl9LnFb1\/QuwRXRFRjYWTClHvbixkOUe+JPm7CV5xsTk9gf+m0mwAwMSMKotUf2xO2gINyZs4OvezNGwLnU8C1dmjSBj1IfJbeQoUYOM5PvkiNY4lZZgCja9ewaZagzZXs5kERwerBFE\/xdEiyduuyZOrSTYWWr4BvLbA82txJuaREb6w6NBtZ4jT3RD0RrOJ8XebhN3RKQoWATxdSSunNNDzd+0hNBHK5BItiKUtqCLAnC2wVpvFPW6l8\/6bawknMnUqPHyZf13rhAVs2eQzjDFoAsKf1QnnNXUOZ60CpEq6cGnP3lJQKNTycGxTWxnuFdgRot3HEL2vntenPLnvBhZ80Tc\/WRqUHNvsnZgJWDHU2voj+tejbe7Eg0XDxUwRFcYd6DMjcsVtG7dk0VtsWIF79+MpgNrsEkfr9rv9xeTA0gzr6PLC0Dt5ZIYni4cDRq9vKyZY5pxHGxQc1QslUGrL3s88NdULgScGpUzkkHSySD4Tbi9MfL5mhzn6eJxg0Ptg7jbpla8V6NIEnhzGLpafV6bqu5AoRLYQd6w+R6dS7oF+F1yXu4I0hK9xz\/+QjUgsy4Z9fLjK51M\/befG4aTjVjZSz7OrRP0lmSigwbC\/ElIPzk9Q\/pVW1V979IPoHuk1k0E2mlU+iZ38UilyhvIc\/DkdxiTT4G+4xbQ8lm6PFKDkyxVhLHEry9Yrl0LZJlLp4RWB64kcQke02Mgje52FnqOts137LPHL\/akGLtSMn0TMCMjx01gaFIAJJ88p2Nnu4yRAvTaOqx2pXNOAKJkGmNFLnObt98a9RaQSOBYZbhHGOmuqmKCqoBEEo4rosDDeqhHe9psdaJy0jINq1hrKwxRMNpipEITYtloUXAbAF\/TgsNSqFjvVIX+MgyfUuRcmo3vqraISl2aB8ixOEwR+4GfaKG8\/U72cbMaRV22Uvap1idwArzmvn41AF2\/z1x69tonZXUU4Hv1mbD+ScWSgFBw\/VylOyd2TmOvSqJfie09JxCK2mCzkqAEmRVRiB\/JDdG7mR65D+Gt90q9pnNoRsdpNrh6fiKiWC2MXXm5Js40oJrRnPpbJitWOdNhAfxpxe6o3HNgBHOb1tfc0Gpq7QFeQnV+B9M47CGY20rxpw87EccNd7kKNEM+SD9Kzv5L1fTlTMSSgcAOhdJ3KJulpFe8rzpVW8UMVRlK4R49tHPSEV2AoKfbqrw1bgT0KgjhrTIFRuc1rTwAznfoWUxfi\/5ObRXAr1Iz8T4lebKHmJRCyxPXSrDhUc9GVJ8LV81xCVZYJyifwR9XpkWKXS5dH61sDH90O4BYfGCJfqybGcKpv92BrLDwchS2HOFChDinJFsEnu8IimYlzgAdh9\/DG65lK2NHn0nrrrDJ\/lQLwTrNpOLZysUhuKtTGZh3zmtP\/3UKKWntKAty0cc1Wy8XVDdRDIqV4fBw+uKrVryLrfnvSmJCnAT8tGirttk2NP7d7UKviWfSbgCrGc6cPG\/Db\/1CpejTmxFv9Lzyn8OtGg62kJBWDTO1QiFC3g40igqYWs\/C2P56qb93yNhSjliPTt0YpwhRwY+U8mEGEM91GVLYZWerhfnaoAMggZclLgUpktz3EpGOSYp3eCgQo\/LAJBmFJpNzKqTSnfWpT9N1WngqTzppPXGxqSh5+6JtppuKsI+Nzht4OgBc\/Ob3WifJsMcVGnlVUMrcKuQImObIIVC3EPD\/Bx2jDWuUCYcxyeybxhUxo3ePtxU3QHgi3sz0lrcLvqMmqtYjurnAZNZFKeW1M3qcc8N5AtVX3oNnAMFpzpGvRqpRzvr9jg6b2fwnZgPV7j+PHI\/jqg3H7dqEMzD+x1b39mngB2YmwtdqJqqx1GPG7i8SnEEybLBPRlrX2URLShdI4KD0QiOD4n0Y0LrKbK8ldE1FCW5RCx7CJxpIRLcPABr8bMF9Qs4eKWNzFJah3H6bviXwmBgfabNYTDk+VL\/1GGGNnEKwEY3VZIzmcsZbtte6d5PNOHhbQPGvyDbwD8LckBPN6s9lZ9yb44UASSq7HqG9yLPmXL8kdZ2OeuLCWrsNWQ3\/lgbJUZFnzetldSkq5WpaHgD4gcGQQgw36hkQDbvQf0EHdOg0J0XG\/i70stMVIhZgbOGVb041k+vNdf25sVV4FdZo30C\/hFZC1SG716JYXyhY9PmhByI1IoSUCW\/QxcgDj566uLlTtS1S67NOV\/1TJMCcUW7K+88jN4j8Zvy1IZIKzTZmrv\/2QEINyw9p4ieTGvwDtL1TSKJtX7cuwfY80X8PHWYjzTwYETXXWULc5tlBOoLAuhh3g3c2HD2O2dgTEK7vBehkRS+rx54AMxy4VUAmlRJUC06x7SADRd7w2BCWx\/D+Ua12SSz27RtEPuJsDV915+UGqGZYoRtPtNk4OwztiHFrTbISba7KstJ2agmcR2sk+VTT8XMBK4yh3qOzjbAQhJAk1EUKU5vjlhBP3ttPnvGQHnw7qQrS9QCSOF+MZ+HjCAn6Xjeixbrt85mrKZeUAp0Gq2w1aGz07kGPFGhpRhWm23+xOQm7W5QRrxhc2+r8uoAA2wMGQsrp3CorXFZrecXPos\/C+BRUg9xeSNxd9SUF2XoJFG2q4aYuUOEonmRihv5Pa+ZftmyGy8oMdZLCzTeZXrV8fknsolZ9hBJPmqjVwBwjJn3rWNTQBlMVBBT8zSMUXZy\/ar+u2dyRLD8popyhkfsMvZx5BgLdH8IrbdlmmUBUNpJO4PLsXN6n9ht\/+pahfKUJtRgcnTmtBdqIxCA3\/MLSrrNt8G44+0LTqn783ko+h+KXRP1HYDrQ+m7yPYEZb5j1e8ElobJJcFae5K3GBmuPG3O8zB23gtP3sZzi7jfMTDFqcU+XMpCqrmZqvi6wMS82p0n3AWCYb32zEJTRcGSYrLApxXIOQi8MtznCT0U4tz2D8w93UHMfLyNpGEjh4cHrE3DdA+t7ZeB5KVhx3leS0rrJHyUZI3We0fF8IVk03RUkphiRjrf9Jv0jPxtCXJaFvWYtfYAD3XzhRF6Yng\/v5W9y6MCOf2pQ9a76TOtfnBXzMzXiwickRaC444WxesK5VOF7AmkhQhzVX+I6bUjexoAVAeZlnNo3VUCOZ3gnh6BMQp+dZYcqjjh2QUqDMJlwKPJ\/LZvEjoMCEF76mnCsUEcpvd7ajt69CHxWbp\/NJCep0ysmondgPtt6f1y9J\/M1oYnmvxNyd4yj9s1lEOXYypH4t1xnZG22hbc1JPEvb4iG0U1PWb7JDs6+YclpeYVaesL819pgY91IVDhU5UQ1cVWia98O+NGSV22n6iMtBx56Afj2XxLT0JE5xZgKNiQqCE3D918Z9AYRLvLSS2j9LvTuBvdE9+eWCMwohIC7IVNbI7AiD\/QxaLZxiO4ZmGBgfEO3\/B0yFzvhbk2QAzGOt4wmj0KfKBZ66OV0qJFVYHfzoOPpMEfR+1m73vALJqKiPmhknVh+sYQEdOQ+lhikwaJtMNXmpmeP9+nK\/0ZxrLtzCRz6UBpRU4tuXSywO\/S491JInYv\/JEjuAkQeKNEOdPVvMWSZguVRW1GKaUSe7hYKnyXuRkghptqEHorvKAVuvaVNtdvVYlpERfotaPCcsXja+LnnCWxOwhV6nR8EWRq9RfykBcVY9d6Y7pzJOqvBpIoCcohySgW8V6gCYJ+wUmJ5kE582SqhK+jJ9y3V\/umK2aQ5MpaIbR+ixLz3v647Nhjul1EcY92tzhy7OXM89XttLvawFM+ss0TNoy1118qAYy9N47P\/OY5jhffpXtrBF9MaDyGow4aLSKGZhnnhUG5V1Q3fjakggnyiHFy1yG0NkekQ1L1nejXaKqjifV+Ai7gzjFpNr2ppveROzc5ugVMBmLZ3Mx3rTvotgCBoouvSsGx8x4j\/jyuiI76k\/GMA8xPn1\/xhVvJam5FUJQTVTVUuTVoTzqtwY51vzOU77R6bBz3srFguRB5BNXuzhU45PNSb7w3Q3CvHoyoSJUcM5JSdu\/KfEwoPtVZmk4MM7bLoJwRbz4Jbdskxau2UsdhhRitm8SCjxEy3y8ajdpH3Zw\/6PVJsE+JKNPZ6TrjnZwOKNMFmMElJfMk+6lbX6T06arxDi\/YTCuJ+hLnawOf4Dbo36FzpTcAv4mTB9NDtroXhNFlpY5OXAlFpW4RY32zF6AES2abjiN4IpKePG72Ff12fFLW0EO7u\/AG4wffhkztCxDWbm\/8cnFXMuZ9+z\/xAGRg5fX6SdSnWhotGZlNy2VSaCxtvTFpgKJUw6uuky5E2IFWpD+SjJxja4VlI9xR8whpJBMEUBvvpTkdSbnbYQhuIWhTA1NXoQGS\/MkxzUbr2y6cbiVutaMAvw5LGDhrE7a\/yS3T6gQJjsIdr\/a79pibIINwVqqOC9PwIG4SgwgFoSg3iW0CUuTmfJnMzNu7uK1RjfaMKjLl5pfG9GEuao8YcGqdUi0udy6BxbAPJ7KQCfoQu+lNihtOIfhYC3+TifTbhbut1heNGiyjK\/tuLUjro0GoUg2VdndRLk9gIvrgtCO3vMoTjX45NKhuQVI7tGUE+yu6VZuW2TjtQFg1VyT83svD+qpb6B1Nhsp2AKBx1FGa7ox4BMIAqePq324msoXjDCk0ZHJRuDmXSKq0wSfnIyCOBU11lCtxYm1lIAHZlAkmDiuIyf5LXEpyixuvEwBxhfy5M1ZtHXIBVJYBz7JDwK2Faf+oJuiJzgYkLJHecQELAubf4DdyiIn4diOHigW3RJPfn78dIGUsNkxbG5cKcurOuKLInR8Ld+C\/WemqBEAqJqftLLde2jB4YM1KYe6I+JrKB8o9rVJ5KEnIHQH3O4Mpg3YXqadVh7Npv5opU1zTN+PmJemDpiP+rEsGZ48hTYJh1cO3vsVrU1uSzo+ShutnMaaHdmUJrQDUdfw\/ugBeC6Wnumczp5MQaP5nkscgdoGxO26lBYFMFfh3qfOstlvxvx5NGtCiVkVX86q0YeUx7nPILkY6f5Ce9dlXCBY\/wFS4i15Kpnd1S9Qa\/k1hELcoGhcy3fY9yFhNysqhXdGustNnlULB9XNw3YnFCS5pd6mguf1VO1NDlsMcDW1eIH+xmm4FMB8DzZRblkqMQI9HwI78oLxR9GTMARJvvswps\/ViJqqRaTE5jPiVx5jxxVrGpzQ9Cs8rKRPHP4POZs28ZjE4Q9ppAtq4DHGMs3gI+wrihMnV4lOXvAP+GersWXchCEyEcHfenp67Y1aXGz\/J\/ZvcREVEUZJwoQ6cVGd7GwFuBScC6n10oS5O9pMJANTbCOPpxeTCQTWsguTgRfzabH9N7GXwcShVbokiV1elWDhpzbeO9p62Sra40TlimhDzLsm66nX+QM\/591XrjpiAX\/nykFYKPWUKQ2Kavwm\/vAwBBqf27m3w0NvnvRh7LIS4DuleQ3FpPxDEGTr3rYXs8OC8Je+3iE3ByjcjVdJOG5WlGG7Qxk2WFpEox\/dlnZQft9YM8YevHTT213Oi6wY\/b4R3ibpQOcMOPd9djZxYMjwgl9pmsifgl9GgMPaOWGvo7tKKw9ru+IVvxVwllSuFNwUM1kSJuC89XlRu1cc759MnOoqJNWU7\/w+rFZkrHrAMMfsgDtxodEy1SajBKvhBxLE87Op1k5jB67OOKF4k4B\/UOOzo\/pK4hIsq2UZkSBJ6lcsUImwqyQ3M3YQbvQiVurPhzB4O9bii4v4iictWcot4mSJj3krXP4bdE8YuCaRJadIi\/Jonytc78DqbYUHBfcgZ0OHzJe5sIr2goZ6ks39tnDw\/3uCIb5ytOzHbsE1zth3XRWdQ1NGu4ODODwSbUJRI+9G+h7CYf6lSlYVYG36sH0vl0sAOTF7jZ4U5MYjEztAOX2cvIxdBsF8cNX+ehKUEqZUQ2SpyneRtLLT1F1AyDsBvXvi74jj6XbMjNO88fCI2Cg7iqwUYYJ+H6q5tI7EL\/AW20c6RdJRR6NZfOPCapp3l7ClcHXwFwkI\/7kWtIRTBHUqip3n1iv4nnxHv7RBN8dWZSkJD46V27bX2kpUvLX6nzWD33ylfInV2+BFld3wkNUF1RHTzLyRn+XreYAs0JsZJsVoiEGZySFEnHlM86CSLTwIoCOhYcJvjkoStt5qvG9EQ76UySqEivHs7A6kteJMx8MKn0w9DuxOmSLqc+iZNhiQO001gz3Kp2U0vMdypq7eTwqeDXbo\/MNrxVan6fxj8D4C3hQSbHy+3wN6g9OioGHOet6MbJe5mi5j\/qDUYWrw4+f9gQEK1+m74Rvi2FnqbXqYe5hNHP7tMwiC6M45VDZ4HNPKzEArRrgpEDrYgRzv1UkBRcY4cftLN4bUZXsJ2v0xVleyCSchlGFx+Krzca3SmuXX4ebDHZRBRy8IUFL4B3aHKAM0uZ8Gy9+RQFdE9FGTQ5zW2blsm\/oONhfPXb8URKd2kOkj6GZHXZK1fEw\/nrZmdKZBWKyYK9nQFjadV4lov6CuvxNhFYpkJZbV6v5rKcsQzjpQTbra6zbVJBFyw8rYoTHhFgNpbZag9S3trRrnkMXQhSUyand5wZvJH1VMEBC\/jBR4Ieg8HVHM5Q0x15TSowZpkNtVAxxZN8YYtWKZ6w363V7AZQMmQvIbbLDuKVdvoKQWKTJ3Z+66pBcPTtcxA1P04Je1K9u\/LM1p96P1pKQGc7WOhkHLJitJIeFyh3Zl4g0n6jT2dSTihngAZ1fxKthGksk2\/FCrvbbpBEQQXvbCrF2s4r07OR9CTEvpvwGgzCV\/AfIBysjLl15GoPrpqdoCRw\/M\/DnMw6TucQiOQ1fXEaVKQ6TMiAruQRbdidWOTN1PE5fYLUE\/dhcgz2+LcpW0smJhymuVP350iYM1M94M\/PaSkfuhDvIZPuLPbrbHDDM21WFXFpv7OxKyNvj1LqTPJCu68gjlmjMNilkHcqzR6VWOyUXU5+rw1nKnrzJ8fYso1wyiwuj\/9ReT3rc0bAoNLfeoBCqpgMsBcbTSe6+HMtS\/TcwbzponjqFFA4lmfcYUsO6bZiNI9LPI919C2qexLa+fpyDPut7SO\/ojUbQxoN18PgvJGFRMLUDsIi2WY6n+Y9mALpDIcONJRDhrXYb6u51IvM3egb+5Kb2HSnkuHrix7TMCtIMN2OTpHvwOzYuXFFYwf4vtnNyJfeNEHE6cqMSkFvfulKbGGNt4xc53BFc0meVnfU1tUHOm3ZvQKbjs68Mr3uEa5zxoXjHs2+qh25Fon7uNohrTcW6yeTBLWIlbLKw2P+DaaUDQd1xYhihOVbJmhREdWnGoDmEowXEq2BJxBqbQbShVckTNn1R1jlVC3EWMKERQOYT1uL7tW10YrsBmHC9WcRPC9KnypHesxm8FidrckUZhH2okOCXbJ6+KNi6t62xWQhP1iOrvH6iKh0lcAsA+iCP1Du92w+n3U\/yVCT+\/DgJTv3qQEMalhi7ywxPuFVnzAxxMfo1dh1ioj4voqqKIf7Vevvqs4BZtVzhy5jy24vOqkAO4V6Hq0d+uKf7WYE03skSAzoKlZcwEQb78JpY2lQSiXD4MVblg4wv9n6z3PFqoeJh759Im8Jdxd+v9xu3BsmTv8NT\/hbnoerIA3s78fE4MMEk8PblB8EPsBAKvjJpn40cDOlhEtHbJlPuMw9SdZZQ8W2bWWt8OdHMSXT97vHwnFAPqJPnyKiA2aVgdVpZ5aEE5Ts+qu6hYryKx3KkQZz53FQojNT2Wu7otKBDhJwTFITm1IoWMrGrrRc0Ko5JeATuCel7tCLdpOtozhomaimrKmpRaayD2ZG2zYeXGzk2HDrUqPXMUkQb2wSB9j18nKuy1nb7RT4wsOaG6bZZmr09QmgKr4gS6gDMtvv0PM31tW\/8Vy4wa7+x0EQl2nHTChrnUswrpKbUQW6npc\/\/j7jsDFgrTudp+bCxdDMIi0RHQEuc8R2P4U4Gvd5kieHfdU35P\/jwwTZF5EzHir4oiHYu+TisBRW9P4Q8YrlxY7yKtR4ySC6HseIwLcT7hKmGcye4oHAQyJXm\/yr07StSu3GoFqd71IMTKko\/Ii2Ls0+ICE70q50iUvaPpdfYikU8qcNlkxfbYBuOzNOK9qcPotzaP0n8IeADcrYsYbfAUhiqYc+TpFG09xF9CQ1+zgYlAujLG8joPeAJ7hH1G0jYyauT5OxSyOVbJGiIJJlxXmGhyCAA+ts4xjC3xz38K4pDAK6hjdNNQQCBOeZisbqzA7PO8kpOC2dr4IePv0qKWzUo+BzIaTiZ8gFNf6ZR6LIW0gw9F97Coo7lzAMufXO\/7GpI665wEepLAZ6YbpBh3Qu5sK01LNYkSPrvR5RBF90iv3WBhqpYY68Z+YvMSA1\/o8POwNCfEjUhIiBGQRtsVpEhh\/i6oF5c1HOT16SNXaP0qVbDKJHl4WSZ7XSMs7DvLLgNSXUVbHL+Cw+DQAOdn5lnbj9bPYfbSSpIFQAkBSfPg1MPq6f2WiyY3\/mzLXlNC9gCTHcC8zOoSegSj4MMEp6en9CNn7sZtMGWtnA+EWMny4y2uS+WbKqAaM8jI8el+sMgsDsmp06lIbw2rD3GFc1E90I98lqdnA90\/yB8DYuzPU1Pfs0i++m0NVXAvKZTvN+qVc1lBUkEVjuYoMI8BwNZHKrLMkNiRdAbajP+28fumGbp3TCMkOrniYYHRqFlIcI6PgsccrDOmNgMtfdVZSj7A2DQ\/SMg6qIUQlo2xDRGA3OLyDJmoTTmfpDwiIAbz8Vx88\/7fyOrDZuZCGyPfWFZmcTWAuHxsgqLZ+KXbcd7OrPt\/h6gqgkK9jrFzCoNv1DyAaPii+i4k7NAUjNjNSX+416TLqzOHseu+a487ukM+nf+K498USriPwf\/ANVRkHvIJ6xn1kNXul2dvw\/meOBa+CaFk5ytSU5hBziU95E3jNhW2N5\/aSFdj2jjMyNPLNfauWZcZo\/xAqiTKs\/OqG+wounWSrFscbcrAXXBph1FYRKNrqxb72w1\/ohq0EnuvmZyFIzJ65SX\/v5gQs0CrmbS\/\/2JrX3\/5g2x0Y8Q92JkVezPoPb7JQevItFD5d2LF62l1aqpUbKBBJwsoSjN5qBfLx4ACjh62E33o8hIZey90tQ\/NIoXU91F37ntpqhBk+8XBRPSJvW84Wj8NoqhHVQvvr+QoHS5PGMWObHgFkBZ9DtYwuIf\/YYcslqlaYq2z8WowjYOREMSs3HmzXeN5CJCv7Gz6gEspI8U81DqFEWg\/P3\/fc0WG4l6tpc9WAiyYKAS5oeWjGgpKb61+a91vPot3B2977k+Y5DLAUD\/QwzVkD5\/oo0VkQiCW23fSdM+6Or3UtwMPLH\/azM4PEPxRYTdCw1rNm0fqOI1kH1JN4YHaTw2ncouSgyiJ80\/cuu9iMgGLIOKD41HjDSFcGcpcOvwRElLk1feOyfTaRxm60+jdMkr55YL6OsXT8BzgisY791w+gWuTMb1749Hx6l\/+fUWHkYZ1OO+Rz23sgttP9jlzMWXeqhUuc5ayKbUeqGBWUiIS\/mM+VDpGcyFAA2clPkKb\/29VdaaOYrSd021Wdt1a\/KKX1JfGjeB3wpkKh1hvWYzdscF9\/8UdMGxzubllvskvvinDd4LGTKjPYo7aXgBycRsFByIo7MOl02vIZHljPEvg+mSF9BoWLo\/5P9AsXt+tRZsuSOlw6XJNpj34eMAvrNy9LTXIrsDJPF\/xAtgGOZQ+8YSf+7sWQssbbUuXzwZXVHRYqshGW1xS\/XXw1F917oXjli4GhA2ryGgbJR2XNE+14EMwzJVZeg9lfgCEFubLmFfGoOEsl5H3VQQPWRabzWMYZfie6uoimUA56RZ3U9bb6JvwO9HZftvrBVGpgJUUR9dzGee5ElYtaXaUs11VNBxrxbL+Are3mMZ2+aYuMkefs02g7U0BSikytPow6UV1\/s3jhmUgPrfGYN2e5nu2EB2uJjdetkPYzOheE5Z+ctv7rZ06uLE\/Mqya1ClBRjtcdWgxhFFdaUH0nfqBKYmzAgiAiy4BPnAnMXgX\/LNCOKSzrvr2+3MjvZYefwOO5Wb33TWfatE0kM4CYChXQlGpER8M61mfRVJdpsJdAWN+BHAbjsL4kk2SImCww5fw3SeuhnWiPMsDSCd9SMjJyfV2Pyy74pa460KSyuUSLQiFtfIdA968mcS3guxA5AlaMV5rT4bp4TOz3tnydMsgxFmTbTMk38MX9xcg2eF7pXlkF9m2ko0cOWfaUFz1UMEk7k5\/JJMA8ySA9R+WCX1snu8UVNHBpoGwv65K3ugIo\/kI1LwYZ2i5qZEYrypKQIm5iSLa4b8EKr1Td50edQRzkX8yPuTdrPi5EKno72op8Cuo7x7rFnSm8ccip8P2TPSnMm\/BZ4Lwrf9Dy4hH0LVf7cKOGJsm+YbmXr5YkpivO\/m\/p4wRJ+RIuzmqgg0IXZx7DQ2xmsab4oUwILQwL9LtT2e\/SWFkQ3Me0zCUU3LjDxgdCST4\/re0sgP0\/hc8tNGcb8BzQ+6A8M4EqEDyqhPpLMkd\/VyDhVUybvgZs1ljbawFN4zw2u2jVK\/J0D32oQLAkCI9MsRsWNIuzrHiRthr3TfEqqqnNB9IzzEMNo4hj\/cYsO1a+7lNA0tSkxY6kwAnZuNdfsS\/tcsLZoe1+3Ae1B5846O5t4hly69w7C3s8BQYUXXGpnVon3HgVcCBCYMsexStHbrorT9mZWVssCcz25VOVOJyeez6pe25x6H0sfOPYbiLFm292fZneHZpA47xXjftbCKeZ0FS3SHcut+pERNCJN9PuIWzVHkiyJFclISEyyV+0IhiKOWakUdIUcxpvOr+4HS3ncenDtRbQHRKFBdDMS7DlbYRogsHYWT8zd7HLWziLhNC6zeyScv0uiCNdtZ10Zbaq0xRkW2TWPj7LAzCt751hinLUPnkNyGVmxfTD55jQHRatPTGDLkptnJDTcwwhCm5x73+vHs89cTOK\/Igk1GAUfpop8PuLx5PpEZrThVIgk5Ygxd3hadU1u15RgC8NxDh1e3+zKD0BUfunnW5lHdNfz84FcehKP8bRFbiznPd8XPYrxVtqynOUxXSv+OM73ka8ruqC3eq1VOvfVrxn2Q4axiE++Y5VnSOdtQgJ4cVh57Ix+6BN8haGFh9LBeO2ktBAh3Gb8yf5FSq1eJMilYxshnOimituhUO1EZiqeqAZC3q0izo9IsH1ONK8UrsGIaNjrdm5FTPiRtZjARD0bg+dpWcoKWqpfKMrB43v2kzU1eXsB2C9Z\/gKpmhNToQAsiNJLbqhSo8fX7RvqanHCSMGkFoNSc\/+S+qxEKiTXiieeEVFGrgRSTL94oq\/znD\/86Goj52OIMJauwlGA2ggWSElqA86yq6APRzmLwY8kmoSTJxXjFXySTB\/SrnMRizkl2f2F2KYI99BnQ\/z2f1lXHsEzbpo4AgZECUIAmo9tdruDvZaC6fKxijld49M8zoyrDFr17UujA04V1oAJERypZDPPTbdEEPNHLcE1RxwqX8XdgDsFHr9A8nPNuTiradrVBirZ+fNzAvgxS9AOVKxOx39kp32236eyBEJyWIT8FL6wvo+GBeTVob4MeCEac8\/hfjx9XXA9v5xuqQ8mZ0zZM24rtXnxhmhfxPbDPDDZkBY5IM6Zmf4Eqktgx+uhBLh0QoY\/aKilA64QxsOVJSfi1szuHsZYb2VPr5VoB3rMRREVQ\/M2ZK9W3uCoMcNQ+ylWkCBTop9hsKUSsMPVh35f7qEJSNW6aNW3QE0oOoPTBe7Bj3zp7RRq5tNFcglNh8yt46ZOwLkM7s3\/jSxs1UZyEg4yFuhzLVAJK\/E01L+7NeBSDTV4ldouhKYvsVS\/6I5O4pEK1o9Pk8exK8NzWOV+CE\/ihH7xg0QpYJSMeJf1CSoN6BqnNxXgtuYveT5x+XKQbE33aaxZusq043IsxOvo3SlTBd5KPyKySIWHgAEOKobmqH5HlU\/gdlxTULOTkuR93QL4m58HagdgezocpgmmN\/CShZS7RxUSVpRjAZtFAl6GS3aENd32UM+7Krr7nRZHlHGTVCJji0a5wUQTUAwpJ5Ck7Z2zX\/WPq6s8AFsAiUH2yWf7rnwaYnB8eIwzS7szv0156rzVjNwygF1SyMCIh4XSREh5+3BmyoE3EtE7nrZHm2eRcaAuHy8gBk0aRXy1l9aNEth0TuO\/oVcLZJSlJZjWSzQbMy61lNTttu\/739GpAaFH1kJZjbX4nMz1GLWiIX\/EVwcszaPeituRIlC+JGXI+\/wr6m\/jKJveoRDKSy9lnKVIN4ZiWhkSen1nza2IRvUZrOFafWIYS18CZXxsdheS95fM7RVxdkZ9HupohU6wcp\/z9OgaGzCWa4vTdYyp+Qmq2CyM9R6XYMlcVbCQcyYZpa1++iR1jD9SrEn7E\/k0LbioW0Z4RRTDMoVqVuQuPAzjMMQdUL3rotBCl8DGHebUKrlZYjEvInxHoK9L5twOgEUoBHlIbvobQMgqf0VzBEdpo2vy\/ESbfEkDSh3T2d3h+ZSeREdK4oEJAJxEGo0WNsohmpm6KOOdgwCCj78qZon8dE\/jxq5RqAfyQNzDB959lS+bApnsB18ZjRRzwO0fRYdr9jwjSRkhWBx6KqE4birM4L0GT+4LdkRO0NeamKUlO6iDLx9IgtHbcN7sq5QfsXJsarxs+\/vxX93Hg2QaOgoUCkK6KgmXxwep6w0+6ZyuVHLPkaFxI6GWuvlng75iTo\/G8Rq+gzy1xhQjPI\/zsG+G3ei5nDylRZYesdIwG8DKuu1Wzl7tGGKw7ZCDd0JDGEEP8otXPYZ5tvtrLc3RGTpv\/3BKz\/uzijL2OgceiX08KG+WFv1UC+UsrQVIPrt6sXxOtYbj58nYqZ5kqQVeooUYvPiHXMJxpCjY9aHqNMisciY7Nmp6A44Uh4QgmPU2C25nL1EHsZI2uRkcRV5qW58NULeS84224XUBCX+NFVBkbnjTrDooty8PfinICBGqrqb9OjCJD\/E9lFLmh1P3RZnuAxJglGkvDEutNiH1uX2I8gAiVgi1uI3ShHLekas2dkWRZos=","iv":"798402f5bd9a0565736d2afffeb2f36f","s":"37d4b9ab12ba5e0c"}

Nordstrom Rewards promotional image

Nordstrom Rewards promotional image