- About

- Subscribe Now

- New York,

July 27, 2011

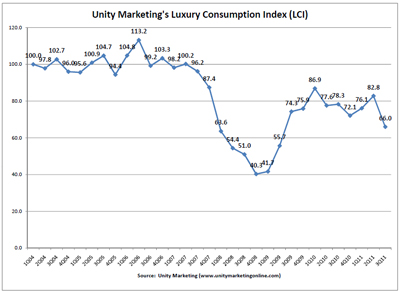

Consumer confidence amongst the wealthy has dropped 18 percent, reaching rates that have not been this low since the middle of the recession in 2007 and 2008, according to a study from Unity Marketing.

The luxury consumer index nosedived 16.8 percent year-over-year. The findings should be of concern to brands and marketers as they enter the third and fourth quarters.

“I am extremely concerned about the sharp decline in the luxury consumer index,” said Pam Danziger, president of Unity Marketing, Stephens, PA. “The last time it fell so far so fast was between the fourth quarter 07 and the first quarter of 08 as the economy was sinking into the recession.”

“I am [mostly] concerned about the deep decline in confidence as there has been nothing like it since '07-'08,” she said. “This is worrisome and it could signal a double-dip recession.”

Double dipping

The study was conducted July 6-13 and surveyed 1,272 affluent luxury consumers who had an average income of $301,8oo and a net wealth of $856,ooo.

“The sample is made up of movers and shakers in industry and business and these are people with high educational levels who read The Wall Street Journal and pay attention to national issues, so all those things factor into our LCI,” Ms. Danziger said.

The luxury consumer index was 66 points, a huge drop from the previous year’s 88.2 points.

In the second quarter, 51 percent of consumers felt that they were financially equal compared to the last two months.

However, 17 percent of respondents reported they felt worse off than they had been the last 12 months.

Relating to the decline in luxury consumer confidence, the average amount spent by affluent consumers on luxury goods and services dropped 8.4 percent in the second quarter compared to the first quarter.

Looking towards the future, 38 percent of respondents said they will likely feel financially equal in the next twelve months.

Comparatively, 18 percent believe that they will be worse off in the upcoming twelve months.

In terms of spending, 47 percent of respondents said they will probably spend the same amounts on luxury goods and services in the next twelve months as they have in the past.

Unfortunately, 27 percent of consumers said that they plan to spend less on luxury goods and services in the upcoming 12 months.

Taking stock

Looking at the findings, one needs to remember that the respondents were most likely influenced by events happening around the world.

“The debt ceiling debates at an impasse in Congress certainly impacts the affluent consumer’s feelings about the economy,” Ms. Danziger said. “As does the recent news about the housing market still in the tank and unemployment still holding out over 9 percent."

However, this does not mean that the findings can be disregarded by brands and marketers.

Brands need to use caution when planning their fall and winter campaigns, and possibly keep inventory on the light side, per Ms. Danziger.

“They [brands and marketers] should keep thinking the glass is half empty rather than that the glass is half full,” Ms. Danziger said.

“That way they might be pleasantly surprised if confidence turns up, which is much better than to have high hopes shot down this holiday season like they were back in 2008,” she said.

Final Take

Kayla Hutzler, editorial assistant on Luxury Daily, New York

Share your thoughts. Click here